When I ran my scans today, most of them were pretty empty as far as the number of results. However, as usual, I look for a theme among the results that I do get. Gold and Gold Miners had a very good day. I watch the Gold Miners (GDX) chart frequently as we write about it in the DP Alert every market day. The chart is available to you in the DPA ChartList which is available on the left hand side of our Blogs and Links page.

Below is the chart. Notice the new bullish bias that has arrived with participation spiking higher than the Silver Cross Index (SCI).

The "old favorite" I was referring to in the title was Natural Gas (UNG). A subscriber wrote to me and asked if it was time for UNG to take off again. I believe so. Actually, I have been watching UNG for awhile and yesterday I noted the breakout and bullish rounded price bottom. I'll talk about it more below.

Today's "Diamonds in the Rough": GFI, NEM, PAX and UNG.

"Stocks to Review": LCID, FYBR, AUY and ZIP.

RECORDING LINK (1/7/2022):

Topic: DecisionPoint Diamond Mine (1/7/2022) LIVE Trading Room

Start Time: Jan 7, 2022 09:00 AM

Meeting Recording Link.

Access Passcode: January@7

REGISTRATION FOR 1/14 Diamond Mine:

When: Jan 14, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (1/14/2022) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (1/3) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Jan 3, 2022 09:00 AM

Meeting Recording Link.

Access Passcode: January#3

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Predefined Scan Results are taken from the StockCharts.com Scan List.

Gold Fields Ltd. (GFI)

EARNINGS: 2/17/2022 (BMO)

Gold Fields Ltd. is a gold mining company, which engages in the production of gold and operation of mines. Its operating mines are located in Australia, Ghana, Peru, and South Africa. The company was founded on May 03, 1968 and is headquartered in Johannesburg, South Africa.

Predefined Scans Triggered: Elder Bar Turned Green and Stocks in a New Uptrend (Aroon).

GFI is up +0.75% in after hours trading. I owned this one on the last Gold Miner run and will likely pop into it tomorrow or Thursday. I covered GFI in the October 6th 2021 report. The position is still open and is up 26.2%. The timing was excellent. The RSI is now positive and the PMO has turned up. Stochastics have turned up and are rising strongly. Relative strength does suggest the group is ready to outperform again. GFI hasn't been the best relative performer within the group, but it is holding up against the SPY. The stop is set below last week's low.

The weekly PMO is on a BUY signal and the weekly RSI is positive. I expect it to reach all-time highs.

Newmont Corporation (NEM)

EARNINGS: 2/17/2022 (BMO)

Newmont Corp. is a gold producer, which engages in the production of gold. It operates through the following geographical segments: North America, South America, Nevada, Australia, and Africa. The North America segment consists primarily of carlin, phoenix, twin creeks and long canyon in the state of Nevada and Cripple Creek and Victor in the state of Colorado, in the United States. The South America segment consists primarily of Yanacocha in Peru and Merian in Suriname. The Australia segment consists primarily of Boddington, Tanami and Kalgoorlie in Australia. The Africa segment consists primarily of Ahafo and Akyem in Ghana. The company was founded by William Boyce Thompson on May 2, 1921 and is headquartered in Greenwood Village, CO.

Predefined Scans Triggered: P&F High Pole.

NEM is up +0.15% in after hours trading. I've covered NEM twice before, June 22nd 2020 (position is still open and up +4.6%) and November 9th 2021 (position is still open and up +7.3%). The RSI is positive and the PMO has turned up above its signal line. Stochastics have just turned higher and relative strength is strong across the board. The stop can be set thinly at 5.4%.

I like that the weekly PMO has now reached positive territory and is on a BUY signal. The RSI is positive. I am looking for NEM to set new all-time highs.

Patria Investments Ltd. (PAX)

EARNINGS: 3/17/2022 (BMO)

PBF Logistics LP owns, leases, operates, develops and acquires crude oil and refined petroleum products terminals, pipelines, storage facilities, and similar logistics assets. It operates through two operating segments: Transportation and Terminaling Segment, and Storage Segment. The Storage segment consists of 30 tanks for storing crude oil, refined products and intermediates. The firm's initial assets consist of a light crude oil rail unloading terminal at the Delaware city refinery that also services the Paulsboro refinery and a crude oil truck unloading terminal at the Toledo refinery that are integral components of the crude oil delivery operations at all three of PBF Energy, Inc.'s refineries. The company was founded on February 25, 2013 and is headquartered in Parsippany, NJ.

Predefined Scans Triggered: New CCI Buy Signals, P&F High Pole and Parabolic SAR Buy Signals.

PAX is unchanged in after hours trading. I like that the RSI is now positive and today a PMO crossover BUY signal was triggered. There is a positive OBV divergence. Price closed above the 50-day EMA for the first time since November. Stochastics are rising strongly. Relative strength studies are very bullish. The stop is set below the last price low at 8%.

Not much to see on the weekly chart, but we do have a rising weekly RSI that has just reentered positive territory.

United States Natural Gas Fund (UNG)

EARNINGS: N/A

UNG holds near-month futures contracts in natural gas, as well as swap contracts.

Predefined Scans Triggered: None.

UNG is down -0.36% in after hours trading. I've covered UNG numerous times. The most recent was on September 28th 2021 (stop was hit). I presented it on April 14th 2021 the stop was never hit so that position is up +46.1%. All other positions that were made in 2020 were stopped out. It is lined up nicely again with a breakout yesterday. Price does have overhead resistance to deal with, but this is the first PMO BUY signal we've had since it began its decline in October. The RSI just hit positive territory and Stochastics are rising and above 80. Volume is coming in and it is starting to outperform the SPY again. The stop is set below the 20-day EMA and support at the December tops.

The weekly chart is shaping up. The weekly RSI is rising and the PMO has decelerated and appears ready to bottom. If price can reach the October high, that would be a 57% gain.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to shoot me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

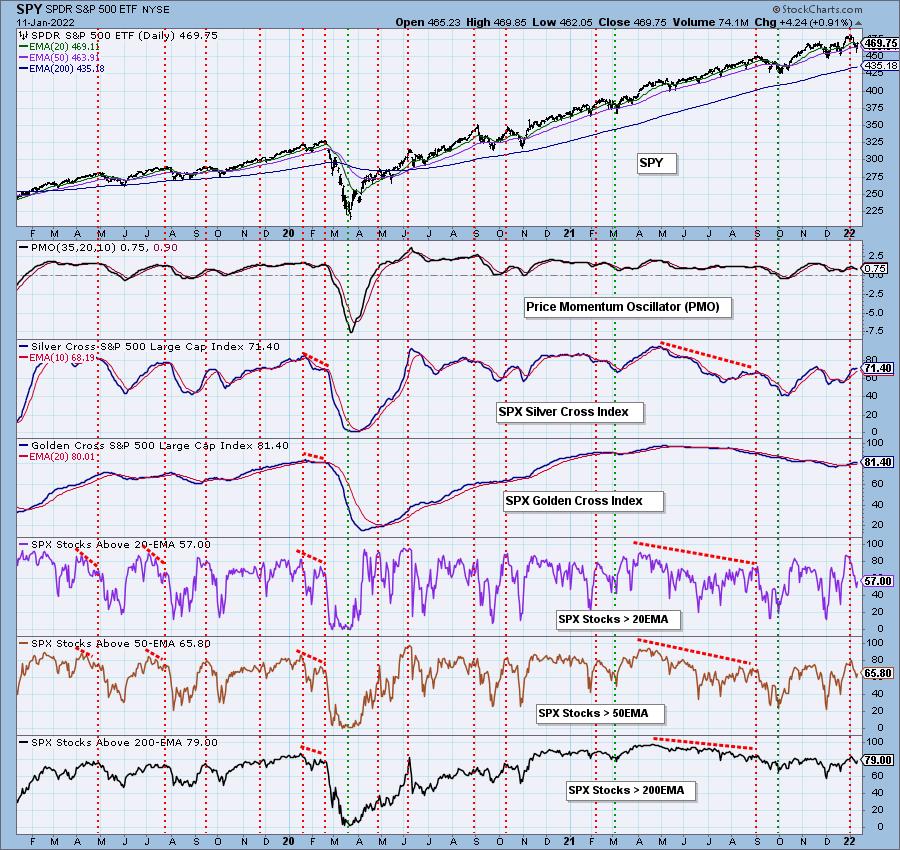

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 15% invested and 85% is in 'cash', meaning in money markets and readily available to trade with. There is a high likelihood that I will add both GFI and UNG to my portfolio in the next day or two.

I'm required to disclose if I currently own a stock and/or may buy it within the next 72 hours.

Happy Charting!

- Erin

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com