Crazy day in the market with the big sell-off that was somewhat unexpected. However, selling usually offers interesting opportunities. I found some charts for you to consider simply from my Diamond PMO Scan. I looked at scan results from yesterday and today. I figured if it was a candidate yesterday that it should still have merit today. In most cases that was true.

Be very careful if you are going to expand your exposure. Today we had a downside initiation climax and that means more downside to endure at worst, churn at best. The Energy sector is very strong so I believe you'll be okay there.

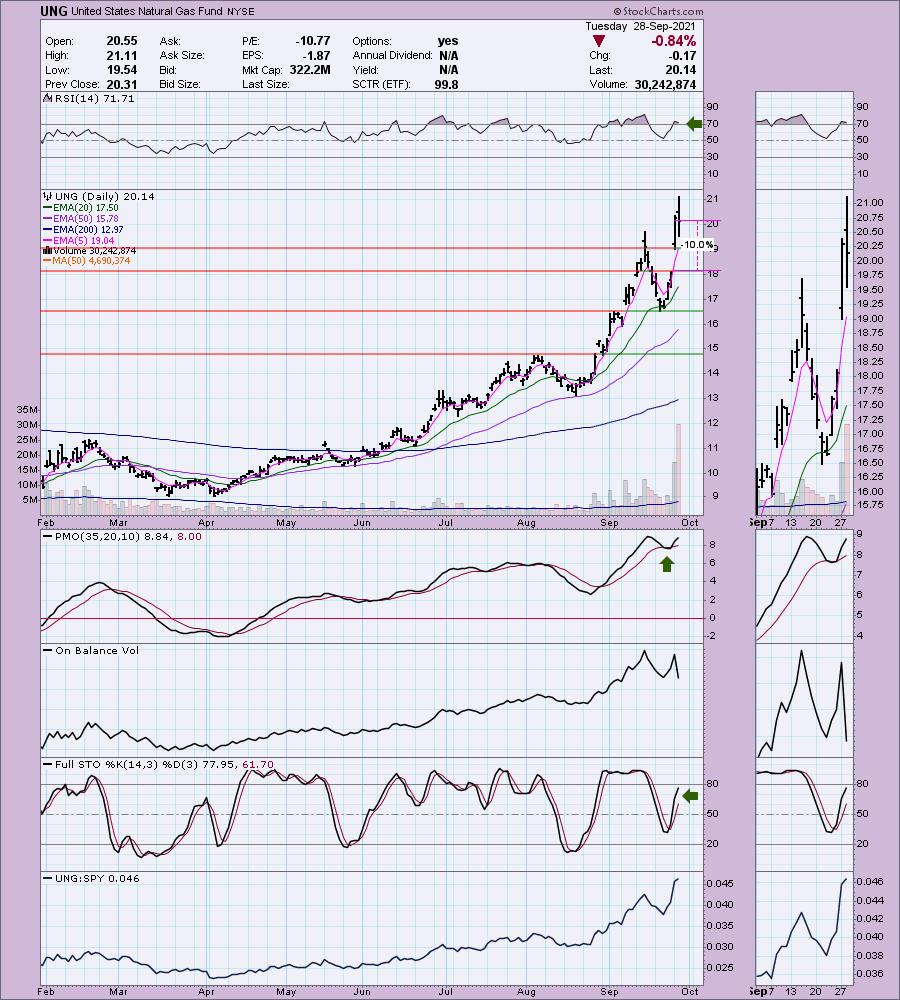

I am finally presenting Natural Gas (UNG) again. We definitely missed out on the parabolic advance but fundamentally and technically it's bullish. It pulled back slightly (-0.86%) but it still offers a chance to get in. I mentioned on yesterday's DecisionPoint Show that you could consider using the "juiced" Natural Gas ETF (BOIL) to catch up on the gains already posted by UNG. Just be extraordinarily careful when you are in a "juiced" 2x or 3x ETF investment. While the gains can be tremendous, so can the losses. Position size appropriately.

Today's "Diamonds in the Rough" are: DISH, INMB, TXT and UNG.

"Short List" (no order): EGLE, MOV, PBH, COP (I think it still has room to run) and RGP.

RECORDING LINK Friday (9/24):

Topic: DecisionPoint Diamond Mine (9/24/2021) LIVE Trading Room

Start Time : Sep 24, 2021 09:00 AM

Meeting RecordingLINK.

Access Passcode: Sept-24th

REGISTRATION FOR FRIDAY 10/1 Diamond Mine:

When: Oct 1, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (10/1/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (9/13) RECORDING LINK:

Free DP Trading Room (9/20) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Sep 20, 2021 09:00 AM

Meeting Recording LINK.

Access Passcode: Sept-20th

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "Diamonds in the Rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

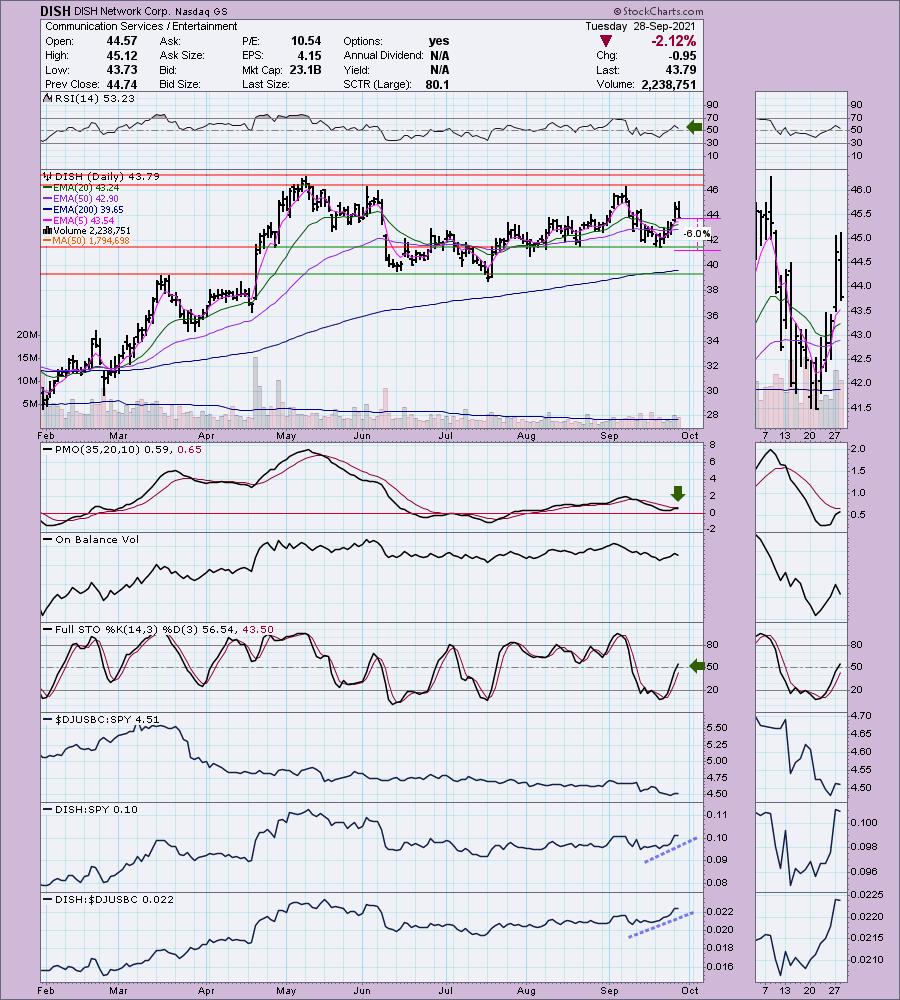

DISH Network Corp. (DISH)

EARNINGS: 11/4/2021 (BMO)

DISH Network Corp. is a holding company, which engages in the provision of pay-tv services. It operates through Pay-TV and Wireless segments. The Pay-TV segment operates under the DISH brand and Sling brand. The Wireless segment refers to the wireless spectrum licenses and related assets. The company was founded by Charles W. Ergen, Cantey W. Ergen and James DeFranco in 1980 and is headquartered in Englewood, CO.

Predefined Scans Triggered: Ichimoku Cloud Turned Green

DISH is unchanged in after hours trading. It pulled back today, but it didn't compromise the short-term rising trend. The PMO saw some damage and the RSI did turn down; however, both are still positive and not overbought. Stochastics are very strong as they have now thrust above net neutral (50). This sector and group aren't outperforming, but DISH is doing well against the SPY and consequently is outperforming its industry group. The stop is set below support at 6%.

DISH failed to overcome resistance and we do see a weekly PMO on a SELL signal. The weekly RSI is positive. If it breaks out, we can look for at least a 20% gain.

INmune Bio Inc. (INMB)

EARNINGS: 11/4/2021 (AMC)

INmune Bio, Inc. focuses on controlling components of the immune system to activate an immune response against cancer and Alzheimer's disease. Its product pipeline INKMUNE-Cancer, INB03-Cancer, XPRO1595-Alzheimer, and LIVNATE. The company was founded by Mark Lowdell in September 2015 and is headquartered in La Jolla, CA.

Predefined Scans Triggered: Hollow Red Candles.

INMB is up +0.20% in after hours trading. While the pullback today wasn't that severe, we did see the PMO flatten and the RSI is positive but declining somewhat. The rising trend is still intact and I really loved the set up on Stochastics. The Biotechs in general are underperforming, but this one is bucking the trend and outperforming the SPY and the group. I've set a stop beneath the 50-EMA. This one is volatile so it could be a roller coaster ride and the 8% stop could very well hit quickly.

The weekly chart was the kicker for me. The weekly RSI is positive and the weekly PMO is on a BUY signal and appears to be bottoming above its signal line. It's hard not to get excited when you can see the upside potential on this one. But, remember, it is volatile and could create a ton of heartburn.

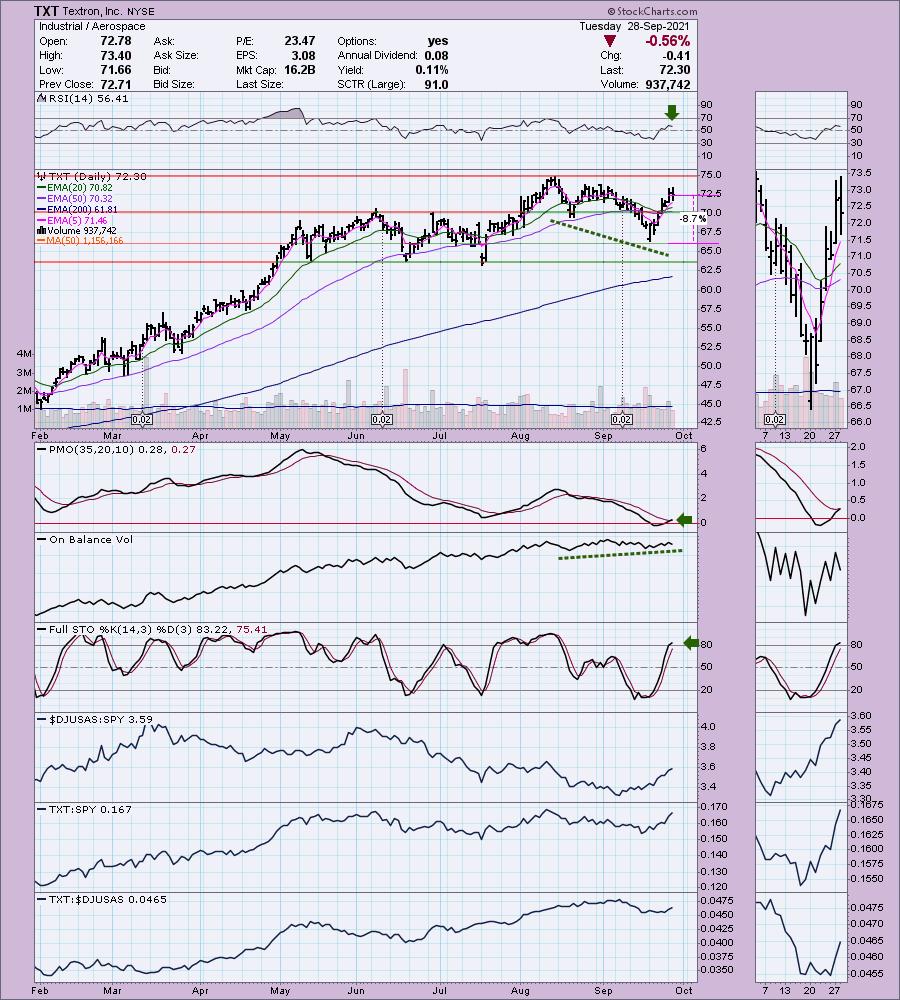

Textron, Inc. (TXT)

EARNINGS: 10/28/2021 (BMO)

Textron, Inc. is a multi-industry company, which leverages global network of aircraft, defense, industrial, and finance businesses to provide customers innovative solutions and services. The company operates its business through the following segments: Textron Aviation, Bell, Textron Systems, Industrial, and Finance. The Textron Aviation segment manufactures sells, and services Beechcraft and Cessna aircraft. The Bell segment supplies military and commercial helicopters, tiltrotor aircraft, and related spare parts. The Textron Systems segment product lines consist of unmanned aircraft systems, land and marine systems, weapons and sensors, and a variety of defense and aviation mission support products and services. The Industrial segment designs and manufactures a variety of products under the Golf, Turf Care and Light Transportation Vehicles, Fuel Systems and Functional Components and Powered Tools, and Testing and Measurement Equipment product lines. The Finance segment provides finances primarily to purchasers of new Cessna aircraft and Bell helicopters. The company founded by Royal Little in 1923 and is headquartered in Providence, RI.

Predefined Scans Triggered: P&F Low Pole.

TXT is unchanged in after hours trading. Another one where today's pullback didn't upset the apple cart. The RSI remains positive and the PMO triggered a crossover BUY signal today. There is a nice positive OBV divergence that led into the current rally which suggests it will continue higher. Stochastics are a bit overbought and turning over somewhat, so keep an eye on that. In this case, relative performance of the group is rising. TXT is outperforming the SPY and is beginning to outperform its already hot group. The stop is deeper than I'd prefer, especially given the bearish bias of the market right now. You could tighten it to align with the 50-EMA and the mid-August low.

The weekly chart is somewhat positive. The weekly RSI is positive and the PMO may be decelerating, but it is still on a crossover SELL signal. New all-time highs are likely on the way.

United States Natural Gas Fund (UNG)

EARNINGS: N/A

UNG holds near-month futures contracts in natural gas, as well as swap contracts.

Predefined Scans Triggered: New 52-week Highs, Strong Volume Decliners, P&F Ascending Triple Top Breakout and P&F Double Top Breakout.

UNG is already up +0.79% in after hours trading. I've covered UNG a number of times. I will point you to the last few times I covered it. There I have links to prior times I've covered it. I presented it last on April 14th 2021 with a 7.1% stop. That stop was never hit so that position is up +109%! The time before was on January 12th 2021. That stop was hit so that position is closed.

I believe this is the best pullback we're gonna get on UNG for awhile. I am contemplating it for an addition to my portfolio. I'm pretty much furious with myself that I didn't get on this earlier or at least taken my advice on 4/14/21. I also am kicking myself on not taking advantage of the pullback last week to the 20-EMA. Well, like Uranium (URA), I'm going to get on board late, but I do expect the investment to still pay off. The RSI is somewhat oversold right now, but we know that can persist... just look at the first part of September. We have a very positive PMO reversal. There is a negative divergence between OBV tops and price tops, but I'll forgive that. Why? Look at Stochastics. Very very positive for an ETF that is so overbought. You really need to set a deep stop on this one. I believe that gap support will hold, but if it doesn't that would be a good sell point. Of course if it begins closing the gap, you could bail then or add to the position.

Carl and I talked about possible resistance ahead for UNG and he really doesn't think the two levels I've marked are likely to hold back the rally here. It could certainly move back to test the 2018 highs. A conservative upside target is at 37%.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

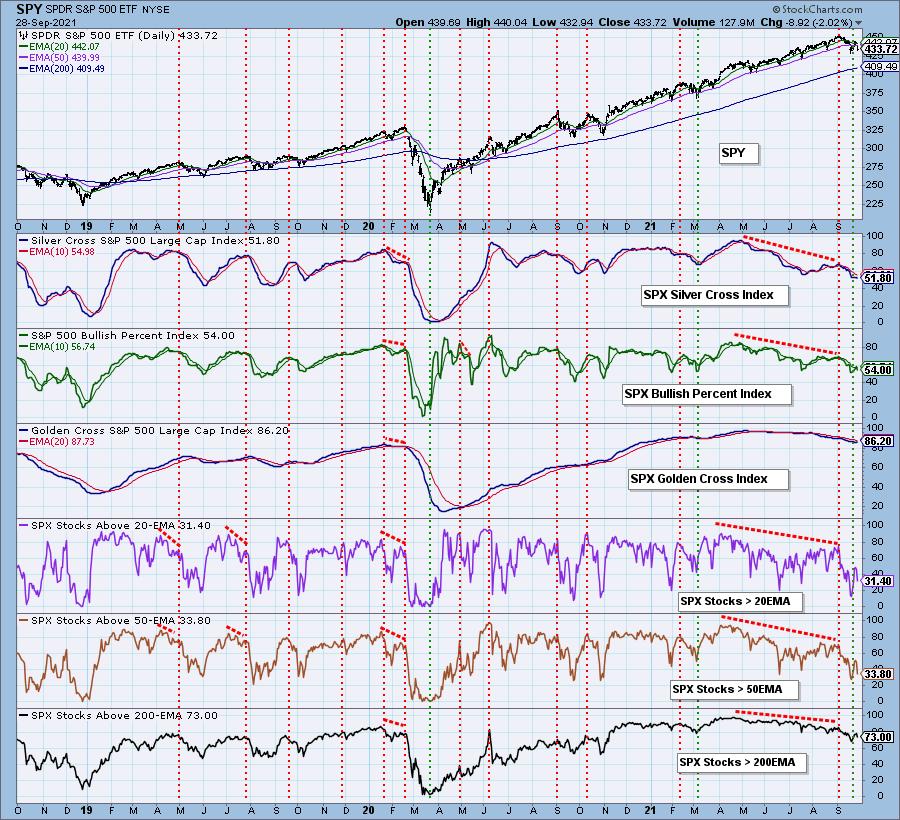

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm about 70% invested and 30% is in 'cash', meaning in money markets and readily available to trade with. Stops are set on nearly every position. I will probably add Natural Gas to my portfolio tomorrow.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com