I run many different scans to prepare for the Diamonds Report and one of my favorites is "Momentum Sleepers" scan. It hasn't had that much in the way of results lately, but today I found a bunch that I liked, including a bottom fishing opportunity. I am bullish Gold Miners right now and was pleasantly surprised to see one on the "sleepers" scan. Healthcare continues to dominate my scan results so it shouldn't be a surprise to see three "diamonds in the rough" coming from that sector.

** Announcements **

I will be traveling July 1 - July 15. I will be writing on the road, but broadcasting will be suspended during that time. It's going to be an adventurous road trip for me and my husband. We will be taking a train from Los Angeles to New Orleans, visiting family, checking out retirement areas and then renting a car and making our way back to California with various stops along the way. I'll be sure to post a picture or two and I'm sure I'll have funny stories to share along the way. It'll be interesting to see the various stages of the reopening of America.

A heads up to Bundle subscribers, the LIVE Trading Room will be going on hiatus as Mary Ellen will also be out of pocket in the upcoming month. We hope to reopen in late-July. Please direct questions to erin@decisionpoint.com.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

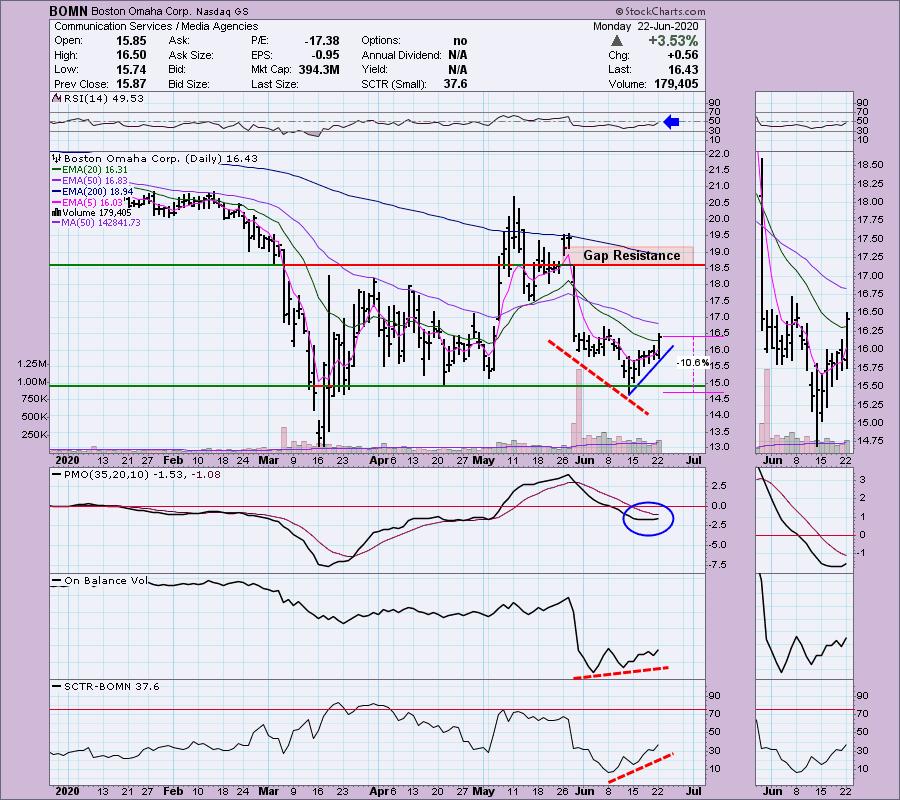

Boston Omaha Corp (BOMN) - Earnings: 8/7/2020 (AMC)

Boston Omaha Corp. is a holding company, which engages in the provision of billboards, surety insurance, and insurance brokerage activities. It operates through the Insurance and Billboards segments. The Insurance segment refers to commissions from the firm's surety brokerage businesses. The Billboards segment includes billboard acquisition and rentals.

This one has begun to rally nicely off a positive OBV divergence. The SCTR is improving and the RSI is just about above 50. Today's sizable rally had price closing above the 20-EMA. The bounce came right off support at about $15. If it can't hold that support I wouldn't want it. I am looking for a move to test gap resistance.

If price can get to that gap resistance level that would be a gain over 18%. The weekly PMO has turned up.

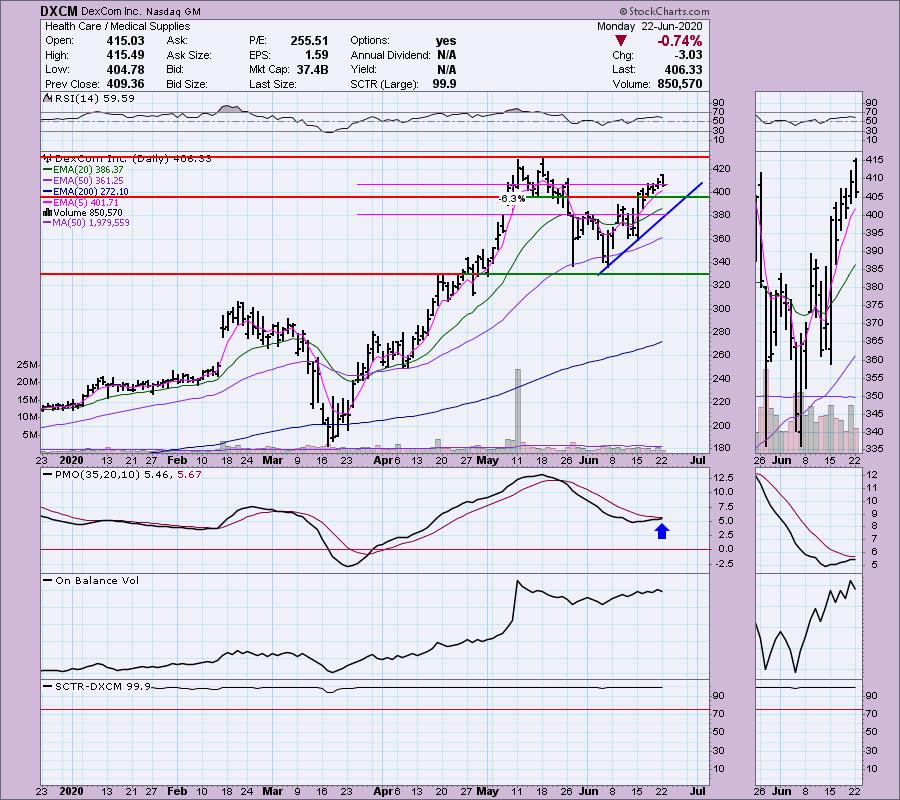

DexCom Inc (DXCM) - Earnings: 7/29/2020 (AMC)

DexCom, Inc. is a medical device manufacturing company. The firm engages in the design, development and commercialization of glucose monitoring systems for ambulatory use by people with diabetes. Its products include Dexcom G4 PLATINUM System, DexCom G5 Mobil, DexCom Share and Mobile apps.

I like to find quality stocks that have pulled back. DXCM pulled back somewhat today but hasn't compromised its rising trend which is good. The RSI is in positive territory and not overbought. The PMO is coming in for a crossover BUY signal. OBV bottoms are rising with price which is bullish. I wouldn't want to own this one much past the 20-EMA as a stop.

The weekly PMO has turned up. Granted this looks rather parabolic, but many of the Healthcare sector stocks do.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

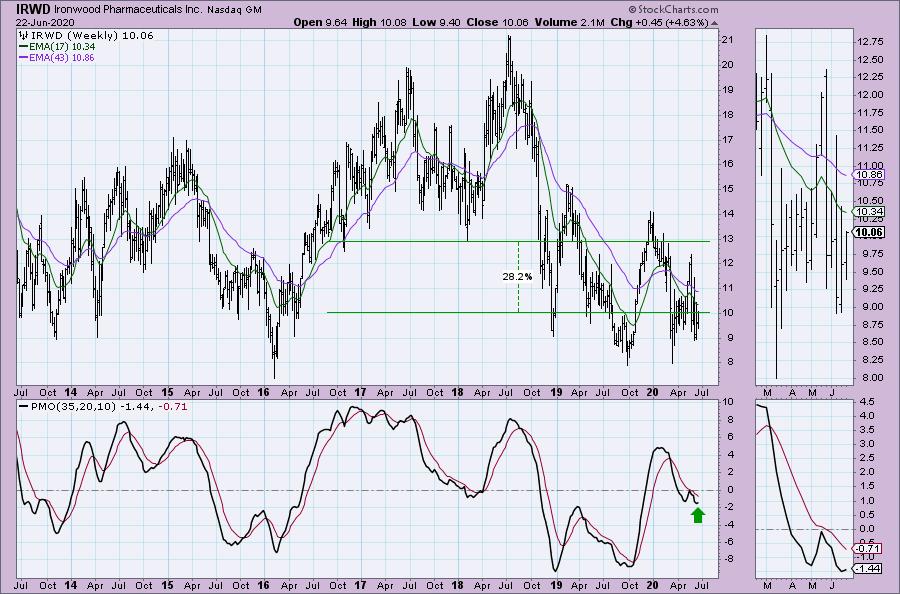

Ironwood Pharmaceuticals Inc (IRWD) - Earnings: 7/30/2020 (AMC)

Ironwood Pharmaceuticals, Inc. is a commercial biotechnology company, which engages in the discovery, commercialization, and development of medicines. Its products include linaclotide, a guanylate cyclase type-C agonists which treats patients irritable bowel syndrome with constipation and chronic constipation.

This one has been moving mostly sideways, but I think we can take advantage of a move that could pop price out of that range. The PMO has nearly given us a crossover BUY signal and I would say that a sideways OBV v. declining bottoms on price is somewhat bullish. The SCTR is improving and the RSI has nearly reached above 50.

Upside potential is sizable if price can get back up to the 2018 low.

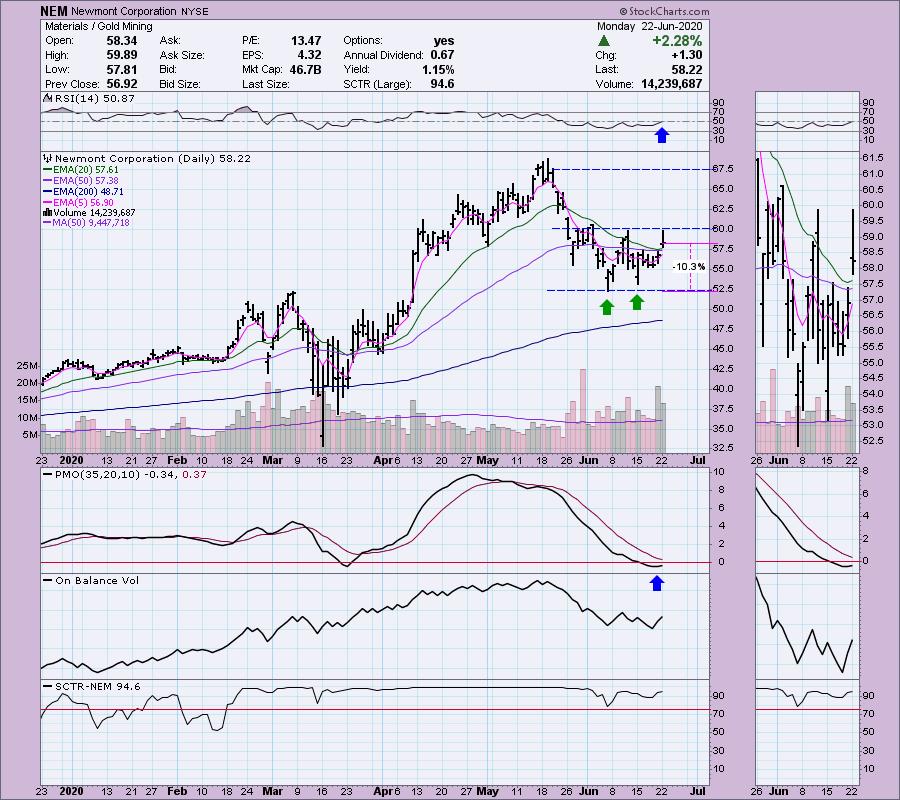

Newmont Corp (NEM) - Earnings: 7/23/2020 (BMO)

Newmont Corp. is a gold producer, which engages in the production of gold. It operates through the following geographical segments: North America, South America, Australia, and Africa. The North America segment consists primarily of carlin, phoenix, twin creeks and long canyon in the state of Nevada and Cripple Creek and Victor in the state of Colorado, in the United States. The South America segment consists primarily of Yanacocha in Peru and Merian in Suriname. The Australia segment consists primarily of Boddington, Tanami and Kalgoorlie in Australia. The Africa segment consists primarily of Ahafo and Akyem in Ghana.

This is one of my favorite Miners, not because it performs that much better than others, mainly because it is a large-cap company that has a decent yield. Miners have been pulling back in general but NEM has managed to use that time to consolidate and form a bullish double-bottom formation. Price hasn't activated the double-bottom as it needs to breakout above the confirmation line. The upside target of the pattern should it execute would be right around the May top. The RSI has just moved positive. I'm not thrilled with the OBV, but I do note a nice amount of volume coming in on the rally.

If NEM can get back to its 2020 high, that would be an over 18% gain. The weekly PMO is declining though so I would keep a close eye on this one.

NextCure Inc (NXTC) - Earnings: 8/12/2020 (AMC)

NextCure, Inc. is a clinical-stage biopharmaceutical company, which engages in discovering and developing immunomedicines to treat cancer and other immune-related diseases. Its novel FIND-IO discovery technology identifies targets based on immunomodulatory function and on which the company is building a proprietary pipeline of immunomedicines.

Here's a bottom fishing opportunity on a small-cap Biotech stock. This one has been very beatdown, but it does appear to be finding support and rounding up for a rally. The PMO is gently rising in very oversold territory. The RSI is rising but is still negative. I wouldn't be in this investment for the long haul mainly because it hasn't performed particularly well since the bear market low.

There's a bullish falling wedge on the weekly chart, but there really isn't much more information than that. $25 is an important support area. If we can see price get to resistance at $32.50 it's a nice gain.

Current Market Outlook:

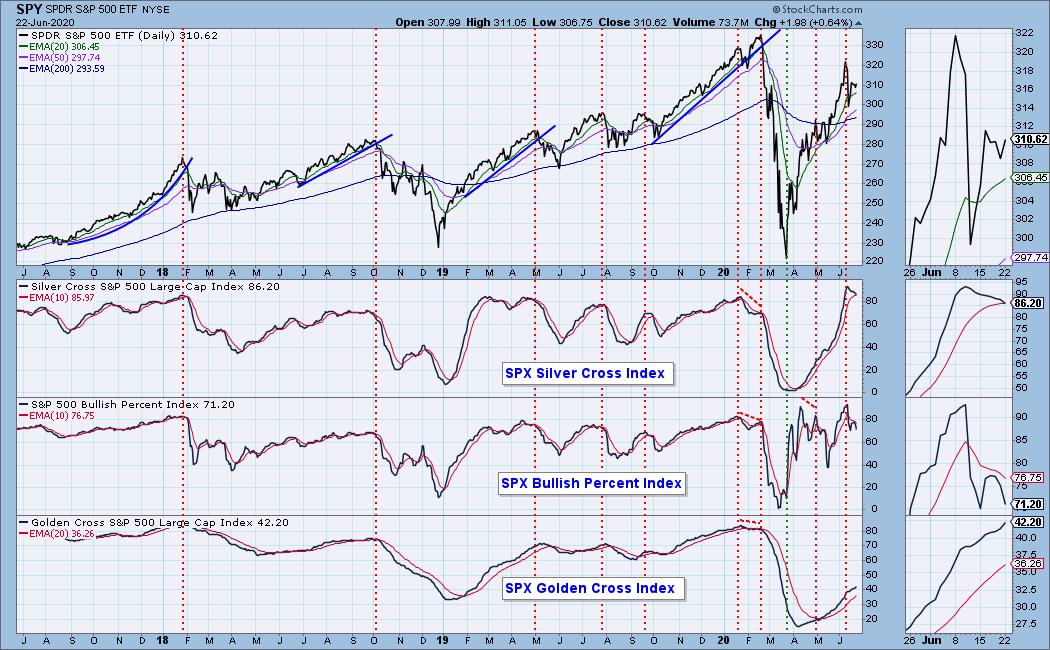

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 18

- Diamond Dog Scan Results: 29

- Diamond Bull/Bear Ratio: 0.62

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: I have been trading with tight stops so I have been pleasantly surprised by the upturn in the market. I'm probably going to move the hard stops to trailing stops to take advantage of any more upside while protecting myself from a swift market downturn. I am currently about 45% in cash.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!f