Today's reader requests have potential! I am impressed by the selection of stocks that are sent in each week. From the group, I pick my favorites and then I add a few of my own to round out the report. The market itself is precarious but as I noted in today's WealthWise Women show with Mary Ellen McGonagle (MEMInvestmentResearch.com) that my market view in the short term is neutral. I suspect we are in for some sideways consolidation so we likely won't have the wind at our backs on stock selections right now, there may be a few headwinds to deal with. These stock picks do look as though they can weather through a neutral environment. Most stocks will not be able to hold off the gravity of a declining market, but these stocks likely could.

** Announcements **

I will be traveling July 1 - July 15. I will be writing on the road, but broadcasting will be suspended during that time. It's going to be an adventurous road trip for me and my husband. We will be taking a train from Los Angeles to New Orleans, visiting family, checking out retirement areas and then renting a car and making our way back to California with various stops along the way. I'll be sure to post a picture or two and I'm sure I'll have funny stories to share along the way. It'll be interesting to see the various stages of the reopening of America.

A heads up to Bundle subscribers, the LIVE Trading Room will be going on hiatus as Mary Ellen will also be out of pocket in the upcoming month. We hope to reopen in late-July. Please direct questions to erin@decisionpoint.com.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

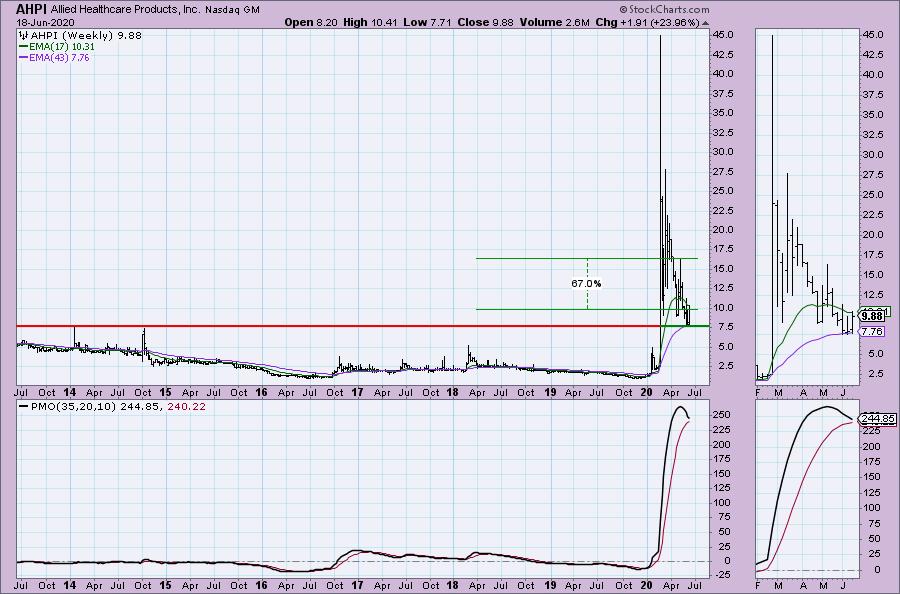

Allied Healthcare Products Inc (AHPI) - Earnings: 9/25/2020

Allied Healthcare Products, Inc. manufactures, markets, and distributes a variety of respiratory products used in the health care industry to hospitals, hospital equipment dealers, hospital construction contractors, home health care dealers, and emergency medical product dealers. Its products include respiratory care products, medical gas equipment, and emergency medical products.

This stock came up on both my "Bottom Fishing" scan and "Carl's Scan" which search for beat down stocks that are showing improvement in momentum. This is a very enticing low priced stock that I might try a small position in. Currently it is trading around $10, before the bear market decline, it was in the $40's. This is the first time the PMO is turning up in a meaningful way. The RSI is now above net neutral. Notice how this stock held the 200-EMA perfectly. It is now breaking out of a bullish falling wedge. Notice the positive divergence with the OBV and the nice 'cup' shape of this bottom. The scan must be on to something because currently this one is up 13.7% in after hours trading.

The thumbnail is the most helpful here. There is the problem of a possible PMO SELL signal. We can see that support at $7.75 is crucial, if it can't hold that, this one could resume being a penny stock. Granted it is up 24% this week so far, but I think it has much higher to go. Just carefully position size, if this one goes south, it could be painful.

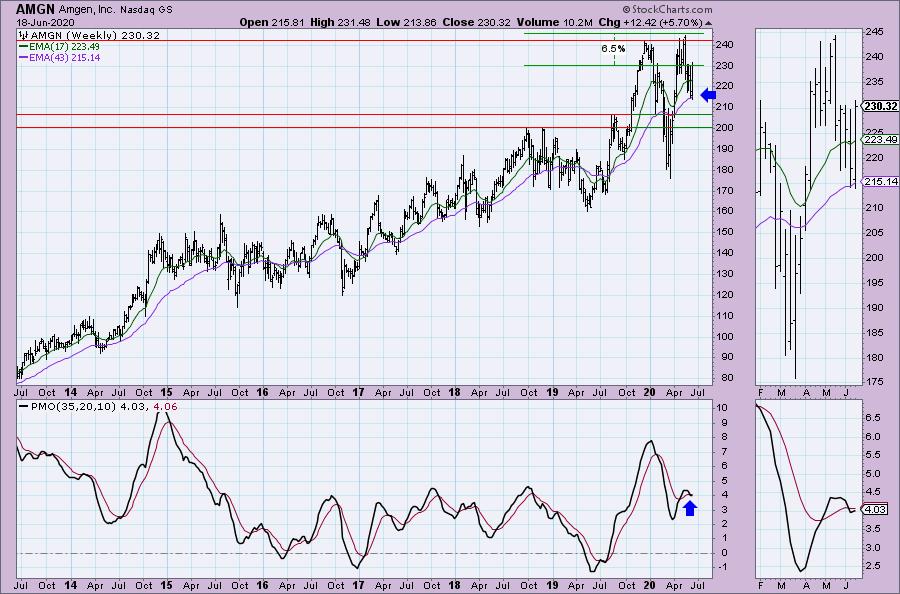

Paul: Amgen Inc (AMGN) - Earnings: 7/28/2020 (AMC)

Amgen, Inc. is a biotechnology company, which engages in the discovery, development, manufacture and marketing of human therapeutics. Its products include the following brands: Aranesp, BLINCYTO, Corlanor, ENBREL, EPOGEN, IMLYGIC, KYPROLIS, Neulasta, NEUPOGEN, Nplate, Parsabiv, Prolia, Repatha, Sensipar, Vectibix, and XGEVA.

I liked the set up on this one, Paul. The PMO has turned up just above the zero line and the RSI is now above net neutral (50). It broke out above resistance today but didn't quite close above it. There is a very positive OBV divergence and the SCTR is improving nicely. You can set a reasonable stop below support at the June low.

The weekly PMO triggered a SELL signal last week, but it has already turned back up. Upside potential to the recent all-time high would be 6.5%, but I suspect it will outperform and create new all-time highs along the way.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

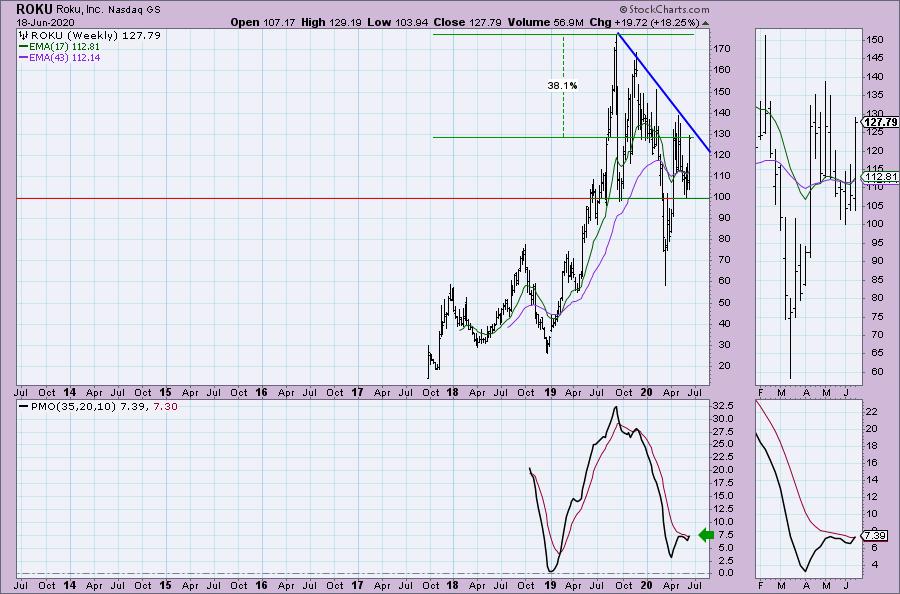

Mark: Roku Inc (ROKU) - Earnings: 8/5/2020 (AMC)

Roku, Inc. engages in the provision of a streaming platform for television. It operates through the following business segments: Player and Platform. The Player segment consists of net sales of streaming media players and accessories through retailers and distributors, as well as directly to customers through the company's website. Its Roku platform allows users to personalize their content selection with cable television replacement offerings and other streaming services that suit their budget and needs. Its product categories include advertising, Roku TVs and Streaming Players.

This is a familiar name! Today ROKU had an amazing breakout which may need to be worked out with a pullback toward the breakout point. Interestingly, it is down slightly in after hours trading (-0.07%). The RSI is not overbought and is above net neutral. The rounded bottom makes a strong basing pattern. The PMO generated a new BUY signal today. The OBV is confirming this rally and the SCTR just reached the "hot zone" above 75. I likely wouldn't buy right here, I'd want to see that pullback, but if you did get in here, I would have a mental stop at the EMAs as I wouldn't want to drop past that.

The weekly PMO should trigger a BUY signal tomorrow after the close when the chart goes "final". I don't count signals on weekly charts until the week is closed out. Similarly, I don't consider monthly signals final until the close on the last day of the month. The fight ahead for ROKU is to get past the longer-term declining tops trendline. If it can reach its 2019 high, that would be a 38% gain.

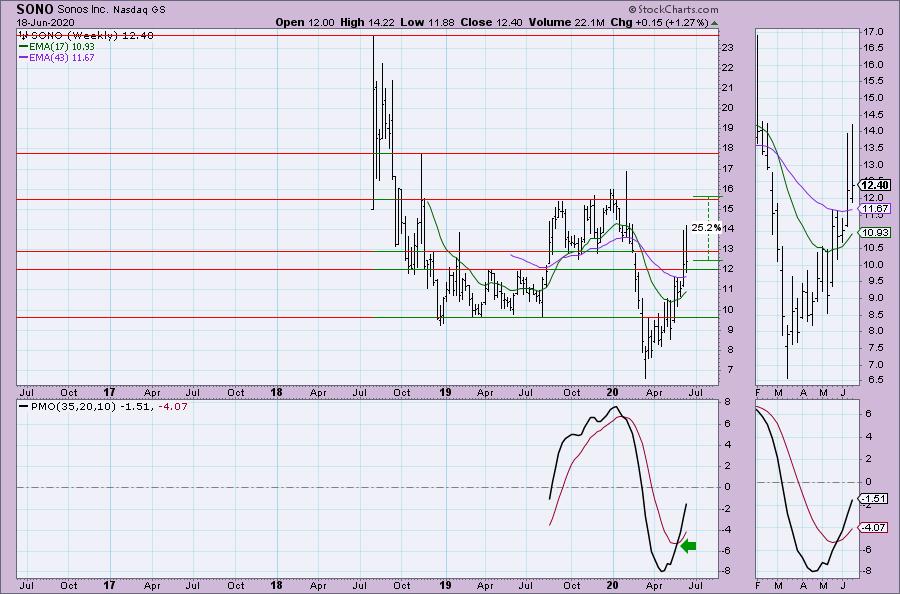

Olivia: Sonos Inc (SONO) - Earnings: 8/5/2020 (AMC)

Sonos, Inc. provides multi-room wireless smart home sound systems. It supports streaming services around the world, providing customers with access to music, Internet radio, podcasts, and audiobooks, with control from Android smartphones, iPhone, or iPad.

I adore this company and its products which were definitely ahead of their time 18 years ago when the company was formed. "Smart Home" companies began installing these systems and I had a family member recommend trying their speakers. I was beyond impressed and now have their products all over my home. Today's 11.5% decline is an opportunity. Price has just about reached the bottom of a solid rising trend channel. Despite that decline, the PMO only "ticked" lower. I've set a stop below the 20-EMA. A serious break of that EMA will mean a breakdown from the rising trend. The SCTR is pulling back but is healthy just below 75. The OBV is confirming the rising trend. It's currently up +0.89% in after hours trading.

The weekly PMO is fantastic. If price can challenge the late 2019 tops, that would be a 25% gain.

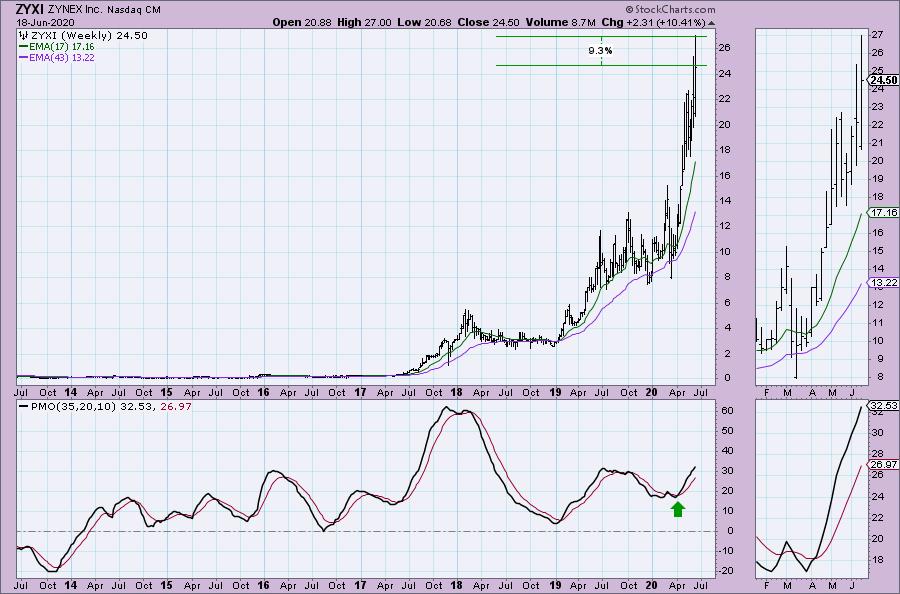

George: ZYNEX Inc (ZYXI) - Earnings: 7/29/2020 (AMC)

Zynex, Inc. engages in the design, manufacture, and marketing of medical devices. It sells electrotherapy medical devices used for pain management and rehabilitation. The company also develops a new blood volume monitor for use in hospitals and surgery centers.

This stock has been outperforming the Healthcare sector, Medical Equipment industry group and the SPX. It is in a strong rising trend. The RSI is in 'positive' territory above net neutral (50). The OBV is telling us that volume is supporting this rising trend. The PMO is on a BUY signal. It had a big pullback Wednesday which makes it more attractive now. That pullback would be the reason the PMO decelerated, but it is rising nicely.

The weekly PMO is very positive and on a BUY signal. It isn't overbought. Upside potential back to its all-time high would be a gain of 9.3%, but I suspect given that positive PMO, it will leap over that resistance level.

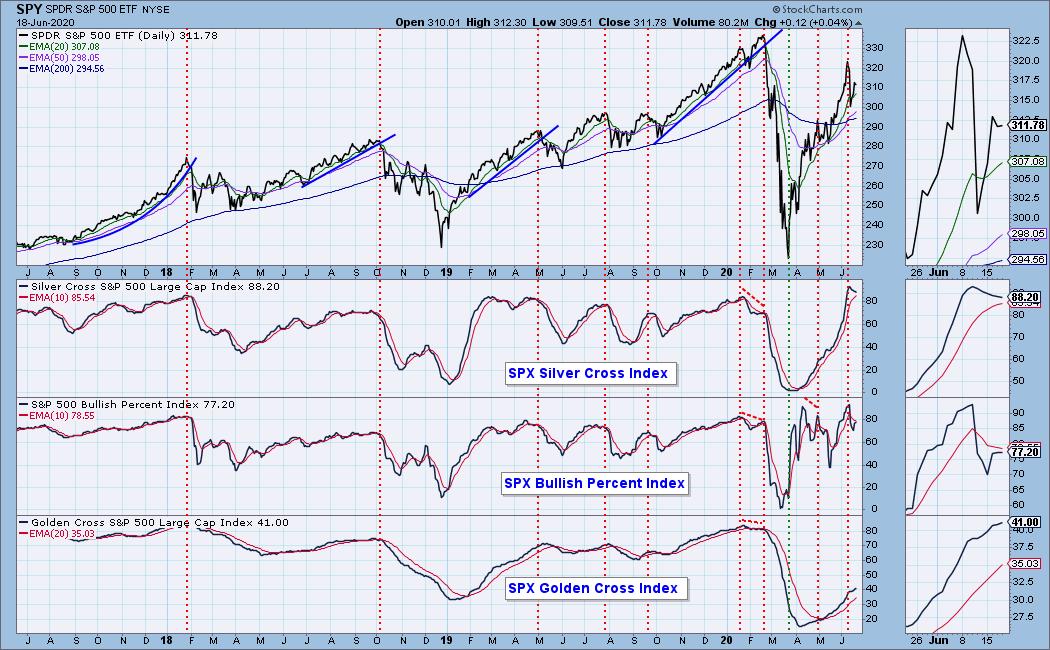

Current Market Outlook:

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 29

- Diamond Dog Scan Results: 61

- Diamond Bull/Bear Ratio: 0.48

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: I have been trading with tight stops so I have been pleasantly surprised by the upturn in the market. I'm probably going to move the hard stops to trailing stops to take advantage of any more upside while protecting myself from a swift market downturn. I am currently about 45% in cash.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!f