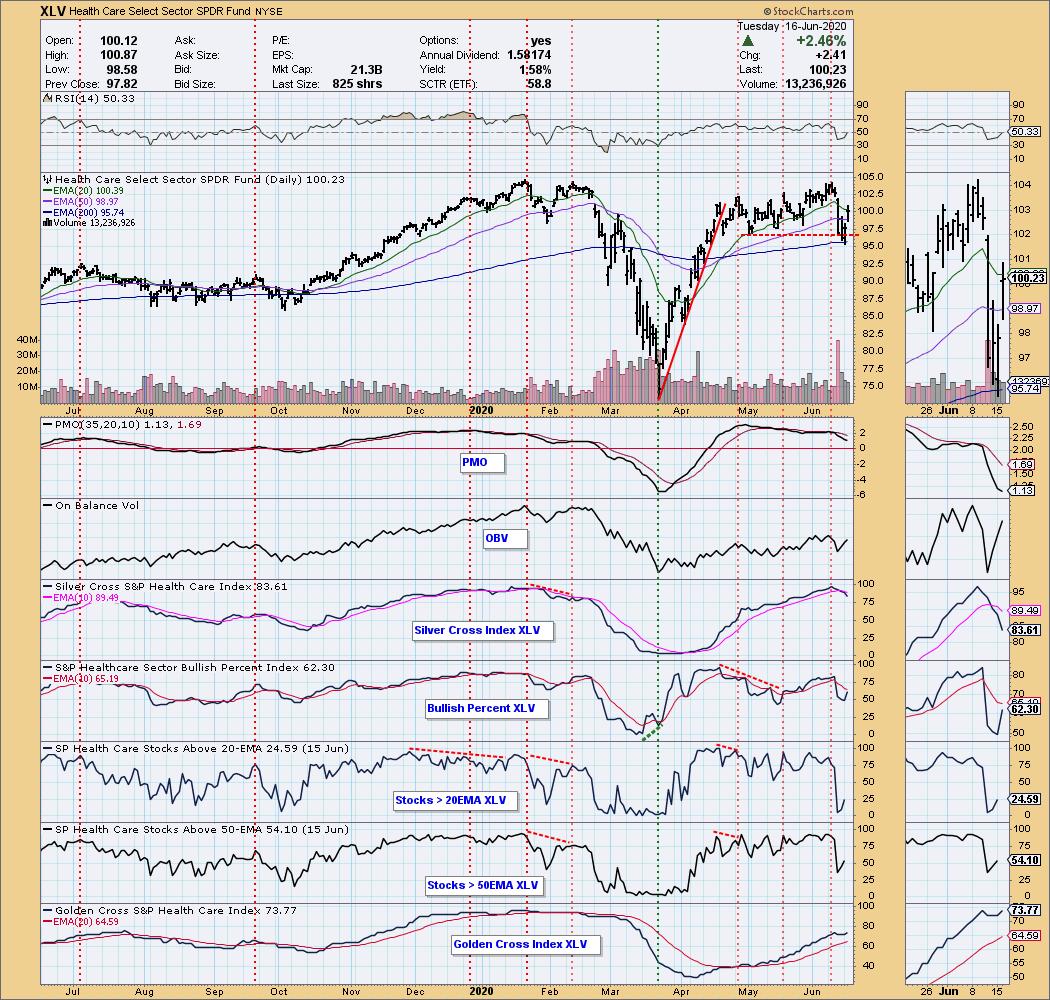

Unlike yesterday, I had more choices for today's Diamonds. Healthcare stocks dominated my Bottom Fishing and Momentum Sleeper scans today which isn't surprising when you look at the XLV chart. Notice that some of the internals are beginning to improve in that sector. The BPI has turned up along with the number of stocks above their 20- and 50-EMAs. Notice also that the Golden Cross Index turned back up. The PMO and Silver Cross Index are moving lower, but both had gotten quite overbought so I find it comforting to see them decompress somewhat. They do suggest caution in the intermediate term so we should keep any of our choices on a short leash.

**I do want to note that yesterday's Diamond, ALRM executed its large bull flag with gusto today.

** Announcements **

I will be traveling July 1 - July 15. I will be writing on the road, but broadcasting will be suspended during that time. It's going to be an adventurous road trip for me and my husband. We will be taking a train from Los Angeles to New Orleans, visiting family, checking out retirement areas and then renting a car and making our way back to California with various stops along the way. I'll be sure to post a picture or two and I'm sure I'll have funny stories to share along the way. It'll be interesting to see the various stages of the reopening of America.

A heads up to Bundle subscribers, the LIVE Trading Room will be going on hiatus as Mary Ellen will also be out of pocket in the upcoming month. We hope to reopen in late-July. Please direct questions to erin@decisionpoint.com.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Crinetics Pharmaceuticals Inc (CRNX) - Earnings: 8/7/2020 (BMO)

Crinetics Pharmaceuticals, Inc. operates as a clinical stage pharmaceutical company focused on the discovery, development, and commercialization of novel therapeutics for rare endocrine diseases and endocrine-related tumors. Its product candidate, CRN00808, is an oral nonpeptide somatostatin agonist for the treatment of acromegaly. The firm is also developing other oral nonpeptide somatostatin agonists for neuroendocrine tumors and hyperinsulinism, as well as an oral nonpeptide ACTH antagonist for the treatment of Cushing's disease.

I'm expecting this one to execute a double-bottom pattern soon as it has just about broken out of the short-term declining trend. If it breaks above the confirmation line at $18, the minimum upside target would be right at $21 and what you can see is strong overhead resistance. The RSI has just moved above net neutral. The OBV shows a beautiful positive divergence that suggests we should see more rally. The PMO has turned up and is nearly back into positive territory. The SCTR is not great but it is trending up.

If price can get to the upside target of the double-bottom, that would be a gain of more than 23%. The PMO is turning up this week. I've also annotated a large bullish declining wedge.

Karyopharm Therapeutics Inc (KPTI) - Earnings: 8/4/2020 (BMO)

Karyopharm Therapeutics, Inc. is an oncology-focused pharmaceutical company dedicated to the discovery, development, and commercialization of novel first-in-class drugs directed against nuclear export and related targets for the treatment of cancer and other major diseases. Its SINE compounds function by binding with and inhibiting the nuclear export protein XPO1 (or CRM1). Karyopharm's lead compound, XPOVIOTM (selinexor), received accelerated approval from the FDA in combination with dexamethasone as a treatment for patients with heavily pretreated multiple myeloma. A Marketing Authorization Application for selinexor is also currently under review by the European Medicines Agency (EMA). In addition to single-agent and combination activity against a variety of human cancers, SINE compounds have also shown biological activity in models of neurodegeneration, inflammation, autoimmune disease, certain viruses and wound-healing. Karyopharm has several investigational programs in clinical or preclinical development.

This one was a Diamond on April 15th. I was in it for awhile but when the PMO began to turn over in late April, I sold it. Since then a bullish falling wedge has formed. The PMO is bottoming in oversold territory. The RSI is almost above net neutral. The SCTR is improving. The OBV isn't telling us much, but we can see accumulation currently taking place.

The weekly chart isn't that great with the PMO falling from overbought territory. There is a bullish cup and handle that formed. At this point it isn't really executing as we'd like. I would just like to see the overhead resistance at the 2018 top challenged as that would be a 20%+ gain.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

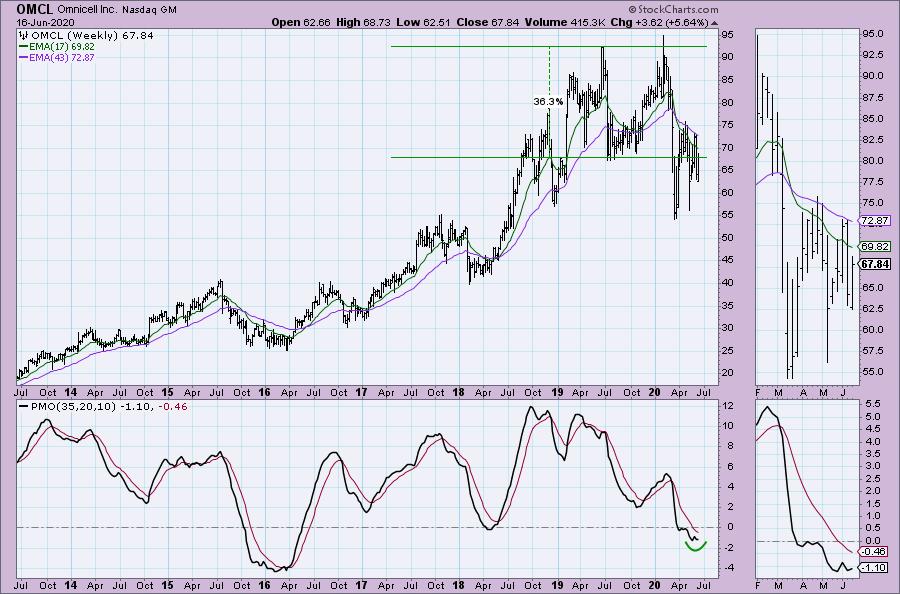

Omnicell Inc (OMCL) - Earnings: 7/23/2020 (AMC)

Omnicell, Inc. engages in the provision of medication management automation solutions and adherence tools for healthcare systems and pharmacies. Its solutions include intelligence; platform and interoperability; central pharmacy dispensing; medication adherence; population health; and point of care automation.

OMCL had a healthy gain today which helped it break out strongly from the short-term declining trend. The PMO has whipsawed back into a BUY signal and the RSI is just now above 50. Last week's gap was covered today and generally when a gap is covered, you will see a continuation. If price can get back to resistance at the April top, that would be an 11%+ gain.

The weekly PMO is trying to bottom in oversold territory. If price can challenge the 2019 high, that would be a 36%+ gain.

Insulet Corp (PODD) - Earnings: 8/3/2020 (AMC)

Insulet Corp. is a medical device company. The firm engages in the development, manufacture and marketing of an insulin infusion system for people with insulin-dependent diabetes. It specializes in diabetes supplies, including the OmniPod System as well as other diabetes related products and supplies such as blood glucose testing supplies, traditional insulin pumps, pump supplies, and pharmaceuticals.

I like this company and I know many of you out there do too. It had a healthy pullback last month and is now basing. It is forming an ascending triangle pattern which is bullish. Price was stopped intraday at resistance that lines up with the April/May lows as well as the top of the triangle pattern. The RSI isn't quite above net neutral, but I liked this pick as a bottom fishing opportunity on a popular company.

If price can challenge its 2020 high, that would be a 24%+ gain. The weekly PMO isn't so optimistic about that being hit just yet so consider this one very short-term to start.

Tricida Inc (TCDA) - Earnings: 8/6/2020 (AMC)

Tricida, Inc. is a pharmaceutical company. It focuses on the development and commercialization of its product, TRC101, a non-absorbed, orally-administered polymer drug designed to treat metabolic acidosis in patients with chronic kidney disease.

TCDA has a great looking positive divergence between the OBV and price lows. These divergences generally precede strong rallies. The RSI is above net neutral but not overbought. Price broke out from a declining trend channel and closed above the 20-EMA for the second day in a row. The SCTR is rising albeit not a great reading at 25.0.

The weekly PMO is turning back up. If price can get to its April top, that would be a 20%+ gain.

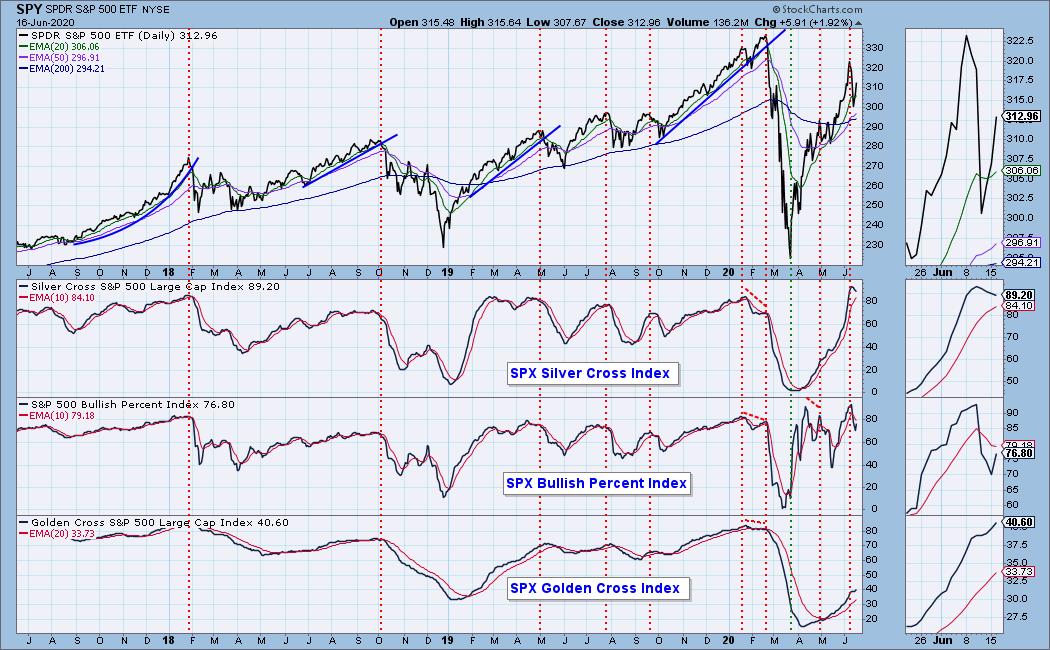

Current Market Outlook:

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 1

- Diamond Dog Scan Results: 59

- Diamond Bull/Bear Ratio: 0.02

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: I have been trading with tight stops so I have been pleasantly surprised by the upturn in the market. I'm probably going to move the hard stops to trailing stops to take advantage of any more upside while protecting myself from a swift market downturn. I am currently about 45% in cash.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!f