* * * * * * * * * * * * * *

Carl has decided to retire, and Erin will be joining him in retirement. We will continue publication until June 27th, and we will be contacting you soon via email as to how this will affect your subscriptions.

* * * * * * * * * * * * * *

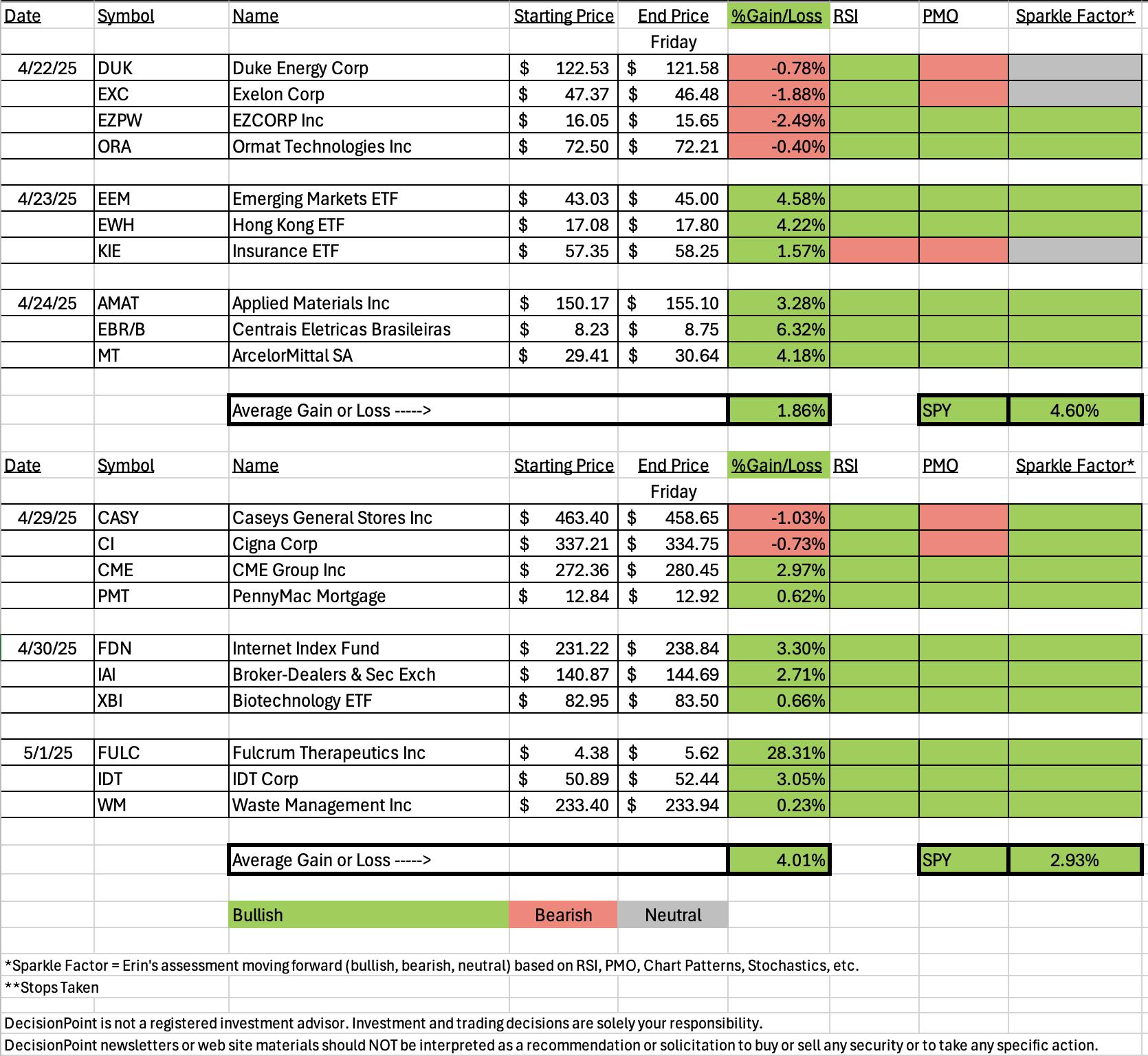

We can tell that the market has been on a winning streak as "Diamonds in the Rough" performed very well this week. The average was better than the SPY as you'll see on the spreadsheet.

The main reason the average is so high is that I picked Fulcrum Therapeutics (FULC) after their earnings announcement yesterday. It was up 13%+ yesterday and today saw excellent follow-through with a 28%+ gain. It was up about 11% this morning so it made a great move into the close.

The Dud this week was Caseys General Stores (CASY) which was down slightly this week. More than likely this is due to its defensive nature. I'll talk more about it below.

The Sector to Watch was actually difficult today as many of the sectors look very healthy moving forward. Ultimately I picked Industrials (XLI) which is off to the races right now.

The Industry Group to Watch is Heavy Construction. This group is making great strides higher and is showing excellent relative strength. I found a number of symbols that I really liked and are on my radar for next week: AGX, STRL, IESC and ROAD.

We didn't have time to run a scan at the end of the trading room as we had more symbol requests than normal.

Have a terrific weekend! Monday trading rooms are no longer occurring so I'll see in next Friday's Diamond Mine.

Good Luck & Good Trading,

Erin

Diamond Mine Trading Room:

RECORDING & DOWNLOAD LINK (5/2/2025):

Topic: DecisionPoint Diamond Mine (5/2/2025) LIVE Trading Room

Download & Recording Link

Passcode: May##2nd

REGISTRATION for 5/9/2025:

When: May 9, 2025 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the last free DecisionPoint Trading Room recording from 4/28/2025.

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Fulcrum Therapeutics Inc. (FULC)

EARNINGS: 2025-05-01 (BMO) ** Reported Yesterday **

Fulcrum Therapeutics, Inc. is a clinical stage biopharmaceutical company, which develops new medicines and focuses on unlocking gene control mechanisms to develop small molecule therapies. Its product candidate includes Losmapimod and FTX-HbF. The company was founded by Michael R. Green, Danny Reinberg, Rudolf Jaenisch, Jeannie T. Lee, and Bradley E. Bernstein on August 18, 2015, and is headquartered in Cambridge, MA.

Predefined Scans Triggered: Moved Above Upper Bollinger Band, Moved Above Ichimoku Cloud and Moved Above Upper Price Channel.

Below are the commentary and chart from Thursday, 5/1:

"FULC is down -0.01% in after hours trading. I hesitated on this one given its explosive move today on earnings, but ultimately strong earnings do lead to higher prices. We just may have to deal with a pullback first given the RSI is now overbought. At the same time, this could see strong follow-through as we did have a bull flag that led into this rally. There is a new Silver Cross of the 20/50-day EMAs. The PMO is accelerating higher above the zero line on a Crossover BUY Signal. Stochastics are above 80. Relative strength for the group hasn't really kicked in, but this one is outperforming both the SPY and the group. The stop was tricky given today's big rally, but ultimately I did it at 7.5% or $4.05. Be careful with this one as it is low-priced."

Here is today's chart:

I expected to see some follow-through here but I didn't expect to see this type of follow-through. The RSI is entirely too overbought, but I suspect that will persist as there is likely even more upside ahead for this one. It is overbought enough that I don't think I'd be entering at this point. If I owned it I might consider taking these incredible profits.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Caseys General Stores, Inc. (CASY)

EARNINGS: 2025-06-10 (AMC)

Casey's General Stores, Inc. engages in the provision of management and operation of convenience stores and gasoline stations. It provides self-service gasoline, a wide selection of grocery items, and an array of freshly prepared food items. The firm offers food, beverages, tobacco products, health and beauty aids, automotive products, and other non-food items. The company was founded by Donald F. Lamberti in 1968 and is headquartered in Ankeny, IA.

Predefined Scans Triggered: Elder Bar Turned Green.

Below are the commentary and chart from Tuesday, 4/29:

"CASY is unchanged in after hours trading. I spotted a bull flag on this one. It also has a nice rising trend and breakout from a longer-term trading range. The RSI is positive and not overbought. The PMO has surged above the signal line. It is well above the zero line as well. Stochastics had been falling but have now reversed in positive territory. Relative strength studies are excellent with the group and CASY outperforming the SPY. CASY is also holding a leadership role as it is seeing rising relative strength against the group. The stop is set at the 50-day EMA at 7% or $430.96."

Here is today's chart:

This one still has merit. The flag is still in the process of activating. I just think it will be slow going given the rally in the more aggressive areas of Tech and Comm Services. There is a filled black candlestick so we could see a small decline before things get going again. Stochastics did top and relative strength near-term is suspect so while I see upside ahead here, it may be limited or as mentioned above, slow going.

THIS WEEK's Performance:

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Friday signal changes are outlined in purple.

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Industrials (XLI)

Other than defensive sectors and Energy, it is really not hard to go wrong with the remaining sectors. I just happened to pick Industrials, but under the hood the other sectors look pretty good too. What really impressed me was today's gap up rally and the Silver Cross Index rising above its signal line. The reading is pretty good at 36% and participation numbers are seeing expansion. Stochastics are above 80 and relative strength is gaining. The PMO just hit the zero line which implies strength. I'd be looking toward all-time highs at this point.

Industry Group to Watch: Heavy Construction ($DJUSHV)

Most of the industry groups within Industrials looked very bullish so I could've picked any number of them. This one did catch my eye. I note what looks like a reverse head and shoulders bottom. We have breakout above resistance. The RSI is getting close to overbought, but it could hold that condition a bit longer based on history. The PMO looks very bullish rising above the zero line. Stochastics are also positive staying above 80. We should get more upside from this group. Here are some excellent choices within: AGX, STRL, IESC and ROAD.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 10% long, 0% short. Time for expansion if the market opens higher on Monday.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin HERE!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2025 DecisionPoint.com