It wasn't a great week for Diamonds in the Rough mainly due to the recent downturn in price. It took many of our positive positions from last week and moved them into the loss column. On the minimal bright side, Diamonds in the Rough did outperform the benchmark SPY this week.

The Sector to Watch was Materials (XLB). I was close to picking Utilities (XLU), but ultimately XLB had better participation so I went with it. I'm counting on the Dollar to sputter and that should help this area out.

The Industry Group to Watch was Miners, but I must say that Gold Miners looked excellent as well so I pulled some stock symbols from both groups for your review. From Miners: ARMN, NGLOY, IE, LUGDF and LYSDY. From Gold Miners: ORLA, AU, SSRM, GFI and HMY. These areas should stay strong through an upcoming market decline.

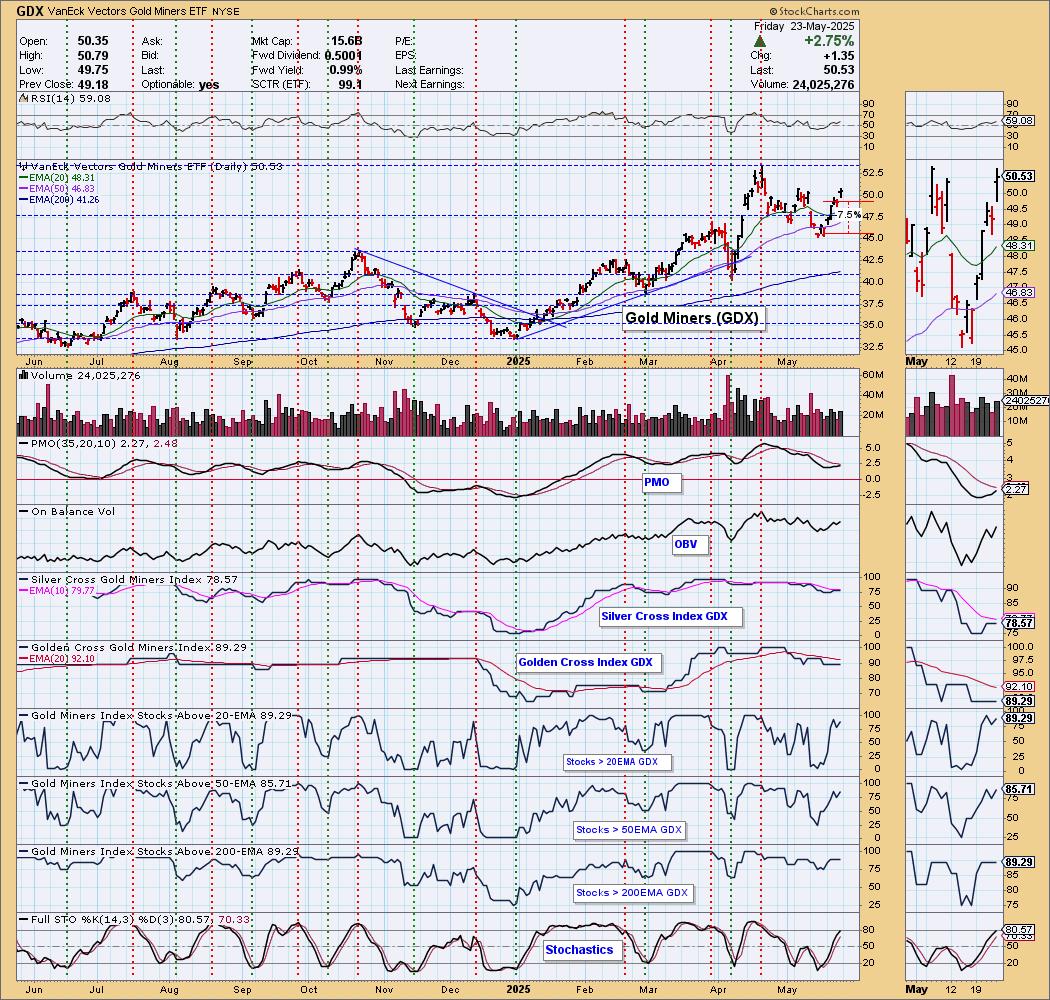

This week's Darling was Gold Miners ETF (GDX). Not a surprise at all with Gold making its way higher right now. Obviously I like the group as it was an alternate Industry Group to Watch.

This week's Dud was Thrive Holdings (THRY) which hit its stop today. Overall Tuesdays picks didn't work out well and that can mainly be blamed on this market decline.

I ran all of my bullish scans to finish up the trading room. I ran them all because I didn't have many results. (BTW, today we saw 200 shorts on the Diamond Dog Scan again so we should expect the decline to continue.) I was able to find some candidates that looked quite good despite the market downturn. Those symbols were: PM, PBI, SANM, UVV, NEM and CCEP.

I did change my exposure from 70% to 65% as I shuffled some positions around. I particularly wanted to be exposed to Gold Miners. I'm also giving Nuclear a try given today's executive order to expand nuclear energy for data centers.

I hope you all have a very nice three day weekend! We remember those who died for our freedoms and are so thankful for their ultimate sacrifice.

Good Luck & Good Trading,

Erin

Diamond Mine Trading Room:

RECORDING & DOWNLOAD LINK (5/23/2025):

Topic: DecisionPoint Diamond Mine (5/23/2025) LIVE Trading Room

Download and Recording Link

Passcode: May#23rd

REGISTRATION for 5/30/2025:

When: May 30, 2025 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

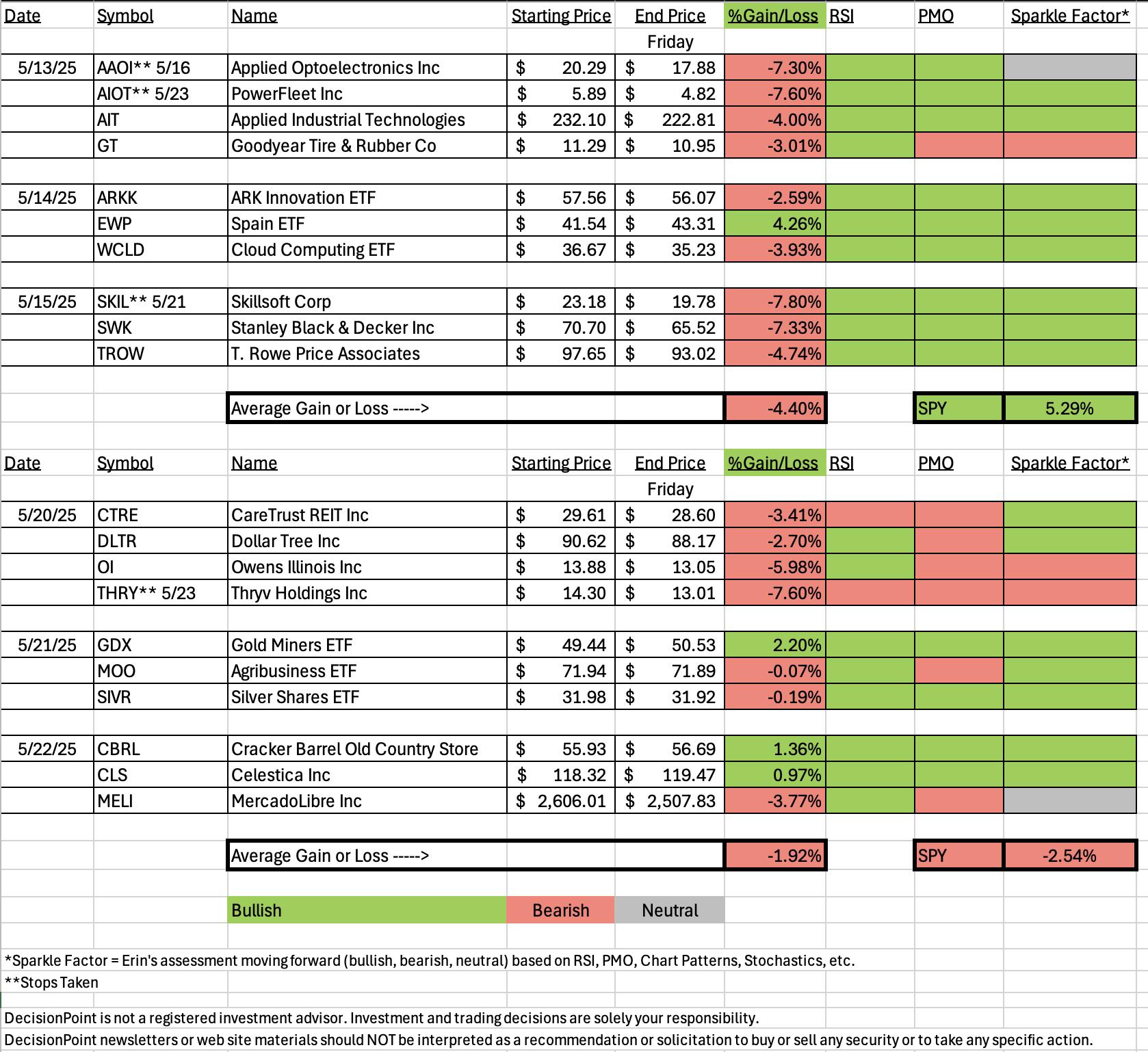

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

VanEck Vectors Gold Miners ETF (GDX)

EARNINGS: N/A

GDX tracks a market-cap-weighted index of global gold-mining firms. Click HERE for more information.

Predefined Scans Triggered: None.

Below are the commentary and chart from Wednesday, 5/21:

"GDX is down -0.06% in after-hours trading. It is still in a declining trend, but the Dollar is wavering and that will mean good things for Gold and Miners. This also looks very much like a flag formation. The RSI is positive and the PMO has turned back up above the zero line. Participation has healed and should support more upside. The Silver Cross Index is back to rising again. Stochastics look very bullish. The stop needs to be a bit deep as these guys are volatile. I've opted to set it beneath the 50-day EMA at 7.5% or $45.73."

Here is today's chart:

The chart is getting better and better. We now have a breakout from a bull flag formation and that implies far more upside ahead. Gold looks bullish so we should see this group continue to outperform. The PMO is rising and the RSI is not overbought yet. Participation is very strong with Stochastics rising strongly. The market may struggle next week but I think that will only increase demand for Gold and Gold Miners will benefit.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Thryv Holdings Inc. (THRY)

EARNINGS: 2025-08-07 (BMO)

Thryv Holdings, Inc. engages in providing marketing solutions and cloud-based tools. It operates through the following business segments: Thryv Marketing Services and Thryv SaaS. The Thryv Marketing Services segment includes the print and digital solutions business. Thryv SaaS segment includes the SaaS flagship all-in-one small business management platform. The company was founded on August 17, 2012 and is headquartered in Dallas, TX.

Predefined Scans Triggered: Elder Bar Turned Blue and Bullish Engulfing.

Below are the commentary and chart from Tuesday, 5/20:

"THRY is up +3.43% in after-hours trading so there is something up with this stock. I could've annotated a flag formation, but it isn't textbook. We do have a solid rising trend and the 20-day EMA is about to cross above the 50-day EMA for a Silver Cross. The RSI is positive and not at all overbought. This is another Surge Scan winner so we have a PMO bottom above the signal line. Stochastics have turned back up in positive territory. The group near-term isn't performing that great, but it is still in a rising trend for relative strength. I was unhappy that this one is not outperforming the industry group, but it is starting to outperform the SPY. The stop is set beneath support at 7.6% or $13.21."

Here is today's chart:

I decided to give this one a bearish Sparkle Factor, but it is setting up a nice bull flag right now. Where did this one go wrong? I suppose we could blame the relative strength line of THRY to its industry group. It was beginning to see a price decline. I see why I picked it on the thrust higher, but it turned out to be a fake out. You could watch list this one based on the bull flag.

THIS WEEK's Performance:

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Friday signal changes are outlined in purple.

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Materials (XLB)

All of the sectors have falling PMOs so it was tricky picking this week's Sector to Watch. I wasn't all that impressed with the price pattern here as it is struggling to get above the 200-day EMA and we could have a very small double top developing, but ultimately it had much higher participation than Utilities (XLU). Participation is taking a hit, but is essentially in rising trends. The Silver Cross Index and Golden Cross Index are above their signal lines so the IT and LT Bias is BULLISH. It is seeing slight outperformance even with this most recent decline.

Industry Group to Watch: Miners ($DJUSMG)

This is almost an identical chart to Gold Miners (GDX). We have a large bull flag that has been confirmed with today's breakout. The RSI is positive and not at all overbought which is great given we've already seen so much rally. The PMO is turning back up and Stochastics are rising strongly. We can even see some outperformance against the SPY. The symbols I found from this group were: ARMN, NGLOY, IE, LUGDF and LYSDY.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 65% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin HERE!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2025 DecisionPoint.com