Today the Surge Scan went crazy! I had over 200 results on the Surge Scan today. It turned up some excellent candidates whereas the other scans were mostly mediocre with their results. Consequently I decided to only pick from the Surge Scan today.

As a reminder, the Surge Scan finds PMOs that have just bottomed above the signal line. It could mean that a very strong stock had a pause or pullback and now it is time for the rally to resume. In this vein, it shouldn't surprise any of us that the resulting charts nearly all had bull flags on them. Definitely a much easier day to select, although with so many to look at, it was a bit tedious.

Good Luck & Good Trading,

Erin

Today's "Diamonds in the Rough": APP, NVRI, NVT and ORCL.

Runner-ups: AVAV, CNXC, NGVT, ETN, SHOP, BKNG, MSA and NMIH.

Diamond Mine Trading Room:

RECORDING & DOWNLOAD LINK (5/23/2025):

Topic: DecisionPoint Diamond Mine (5/23/2025) LIVE Trading Room

Download and Recording Link

Passcode: May#23rd

REGISTRATION for 5/30/2025:

When: May 30, 2025 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Welcome to DecisionPoint Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Stop levels are all rounded down.

Applovin Corp. (APP)

EARNINGS: 2025-08-06 (AMC)

AppLovin Corp. engages in the development and operation of a mobile marketing platform. It offers AppDiscovery, MAX, Adjust, and SparkLabs. Its software-based platform caters to mobile application developers to improve the marketing and monetization of applications. The company was founded by Andrew Karam, John Krystynak, and Adam Foroughi in 2011 and is headquartered in Palo Alto, CA.

Predefined Scans Triggered: Moved Above Ichimoku Cloud, Elder Bar Turned Green, Moved Above Upper Price Channel, Parabolic SAR Buy Signals and P&F Double Top Breakout.

APP is down -0.04% in after-hours trading. As you'll note on all of today's charts, we have a bull flag. I didn't annotate it, but we also have a large bullish double bottom on the chart as well. It was quite a thrust upward today so we could see a small pullback that would offer a better entry. The RSI is positive and not overbought. The PMO has bottomed above the signal line. Stochastics have reversed higher and relative strength lines are all rising right now. The stop is set as close to support as possible at 7.8% or $351.19.

The weekly chart shows a nice rising trend, almost vertical right now coming out of the April low. The weekly RSI is positive and the weekly PMO is turning back up. The StockCharts Technical Rank (SCTR) is at the very top of the hot zone*. Upside potential to the next line of resistance is about a 19% gain.

*If a stock is in the "hot zone" above 70, it implies that it is stronger than 70% of its universe (large-, mid-, small-caps and ETFs) primarily in the intermediate to long terms.

Enviri Corporation (NVRI)

EARNINGS: 2025-07-31 (BMO)

Enviri Corp. engages in the provision of industrial services and engineered products. It operates through the following segments: Harsco Environmental, Clean Earth, and Harsco Rail. The Harsco Environmental segment offers on-site services, under long-term contracts which may contain multiple performance obligations. The Clean Earth segment refers to specialty waste processing and beneficial reuse solutions for hazardous wastes, and soil and dredged materials. The Harsco Rail segment sells railway track maintenance equipment, after-market parts and safety and diagnostic equipment. The company was founded in 1853 and is headquartered in Philadelphia, PA.

Predefined Scans Triggered: Elder Bar Turned Green, New CCI Buy Signals, Moved Above Upper Price Channel, Parabolic SAR Buy Signals and P&F Low Pole.

NVRI is unchanged in after-hours trading. Here we have another flag with a long flagpole. These patterns tell us to expect a move that is the height of the flagpole. That's a lot of upside potential on this low-priced stock. The RSI is not overbought despite today's giant rally. The PMO has surged above the signal line. Stochastics have turned up in positive territory. Relative strength lines are all rising. The stop is set as close to support as possible at 7.7% or $7.44.

This is a trading range kind of stock which I generally avoid, but this looks like a solid rebound off the bottom of the range that tells us to expect a test of the top of the range. The weekly RSI is just now getting positive. The weekly PMO is rising on a Crossover BUY Signal. The SCTR is in the hot zone above 70.

nVent Electric plc. (NVT)

EARNINGS: 2025-08-05 (BMO)

nVent Electric Plc engages in the provision of electrical connection and protection solutions. Their solutions support data centers, industrial automation, commercial buildings, power utilities, renewable energy, infrastructure, and energy storage applications globally. It operates through the following segments: Systems Protection and Electrical Connections. The Systems Protection Business segment includes enclosures, power distribution units, cooling solutions, both liquid and air, and control buildings and provide customers with products and solutions that protect electronics, systems, and data. The Electrical Connections Business segment includes power connections, cable management and electrical solutions. The company was founded on May 30, 2017 and is headquartered in London, the United Kingdom.

Predefined Scans Triggered: None.

NVT is down -0.46% in after-hours trading. Here we have yet another bull flag formation that has been confirmed with a breakout. The RSI is positive and not quite overbought yet. The OBV is rising strongly. Stochastics have turned back up in positive territory. Of course we have a PMO Surge above the signal line. Relative strength looks very positive with rising trend lines across the board. The stop is set beneath support at 7.8% or $61.70.

We still have a declining trend out of the all-time high, but this rally looks convincing, setting up a bullish "V" Bottom formation. The weekly RSI is positive and not at all overbought. The weekly PMO is rising strongly on a Crossover BUY Signal. The SCTR isn't in the hot zone, but it is getting very close.

Oracle Corp. (ORCL)

EARNINGS: 2025-06-09 (AMC)

Oracle Corp. engages in the provision of products and services that address aspects of corporate information technology environments, including applications and infrastructure technologies. It operates through the following business segments: Cloud and License, Hardware, and Services. The Cloud and License segment markets, sells, and delivers enterprise applications and infrastructure technologies through cloud and on-premise deployment models including cloud services and license support offerings. The Hardware segment provides infrastructure technologies including Oracle Engineered Systems, servers, storage, industry-specific hardware, operating systems, virtualization, management, and other hardware-related software. The Services segment offers consulting, advanced support, and education services. The company was founded by Lawrence Joseph Ellison, Robert Nimrod Miner, and Edward A. Oates on June 16, 1977 and is headquartered in Austin, TX.

Predefined Scans Triggered: Elder Bar Turned Green and Parabolic SAR Buy Signals.

ORCL is up +0.06% in after-hours trading. Here is another bull flag coming out of a double bottom formation. The decline took price to support where it promptly reversed. The RSI is positive and rising. The PMO is surging above the signal line. Stochastics have turned back up in positive territory. The group is performing fairly well right now. ORCL is edging higher in relative strength against the SPY and the group. The stop is set beneath support at 7.5% or $149.76.

The declining trend is still intact on the weekly chart but it is about to break from it. Price has formed a bullish "V" Bottom that implies a break to new all-time highs. The weekly RSI is in positive territory and the weekly PMO is rising toward a Crossover BUY Signal above the zero line.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

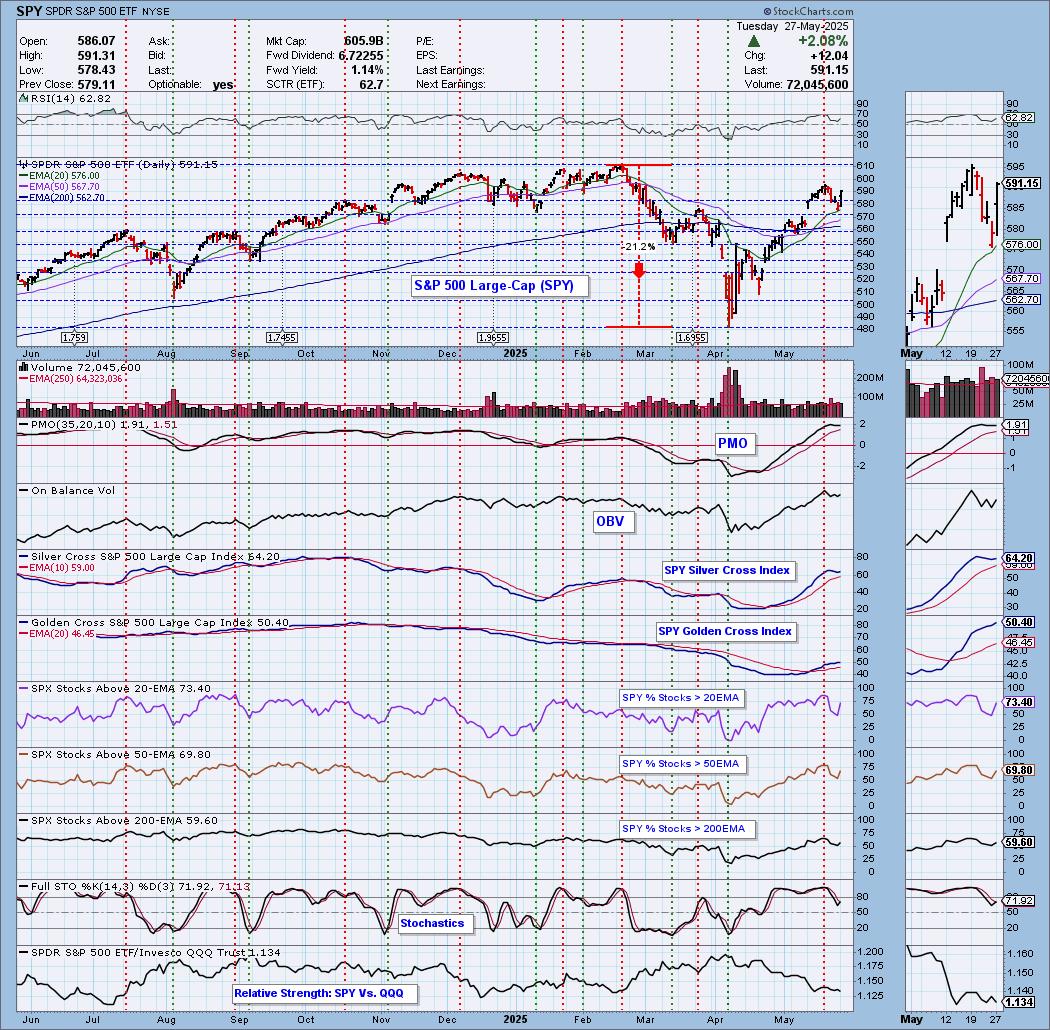

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our "Under the Hood" curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 65% long, 0% short.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2025 DecisionPoint.com

Watch the latest episode of DecisionPoint Trading Room with Carl Swenlin & Erin Swenlin Mondays on the DecisionPoint YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com