The market did end up seeing a positive close to finish the week. I still think the market is vulnerable to decline next week. Today's final up thrust came on President Trump saying that there would be "flexibility" on tariffs. I'm not sure this is helpful overall, but certainly the market needed to hear something somewhat positive.

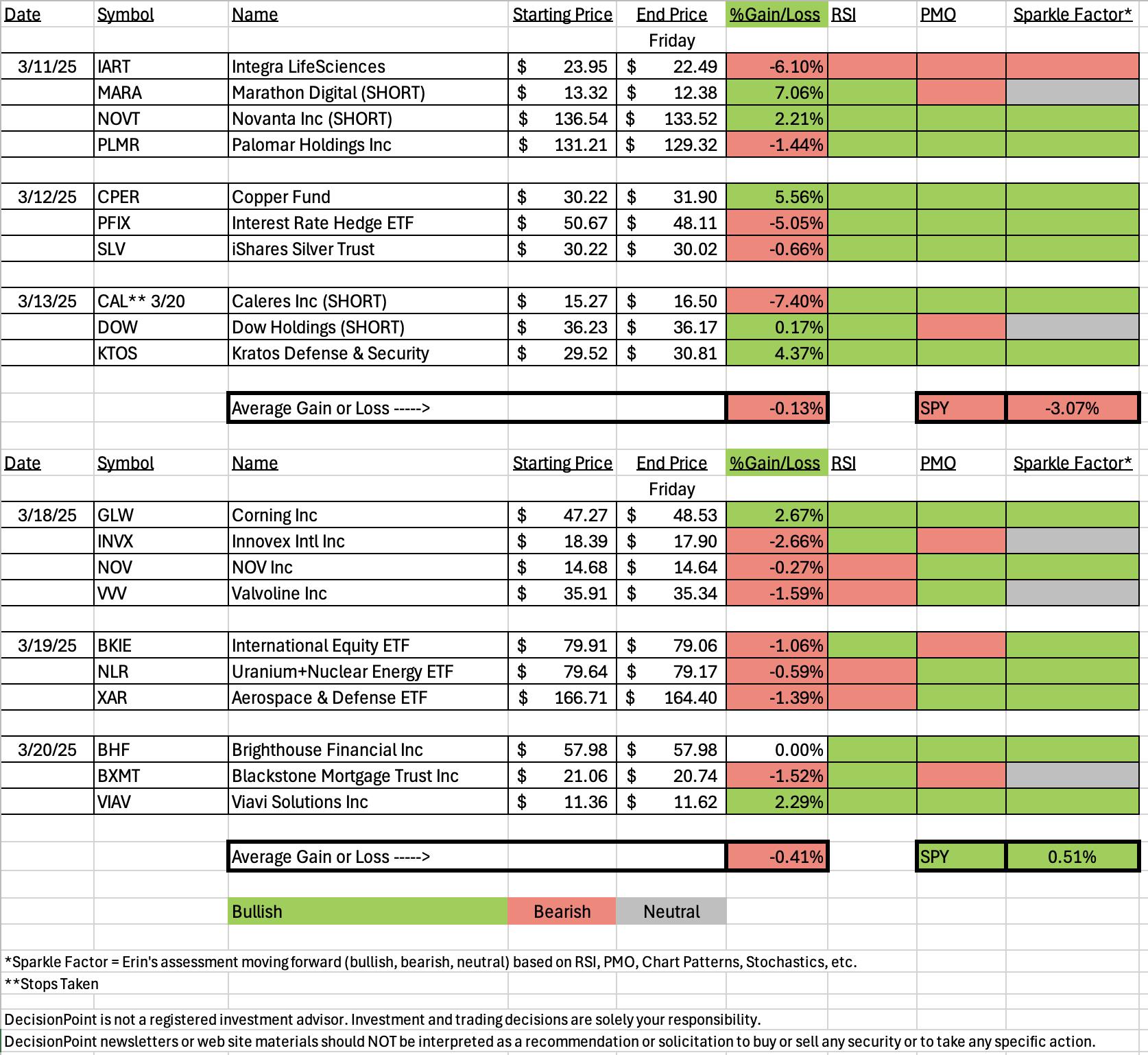

"Diamonds in the Rough" have admittedly struggled as the market tries to find its way. Last week's Diamonds are looking pretty good overall, this week will need some help.

This week's Darling was Corning (GLW) and this week's Dud was Innovex (INVX). Both were picked on Tuesday. We did have one stop hit last week on a short position.

The Sector to Watch is going to be Utilities (XLU), but I have to say the runner-up Communication Services (XLC) does look good, particularly if today's end of day rally can translate to more rally next week. For now I like the idea of staying in a defensive sector that already has strong participation.

The Industry Group to Watch was Conventional Electricity. The stocks that I found in this area for your review are: TXNM, PAM, VST, NRG and DTE. All are worth a look going into next week.

I did have time to run the Diamond PMO Scan at the end of the program and we found a nice handful of stocks to watch: ICE, CCEP, PEN, DASH, TDY and NFLX.

Have a wonderful weekend!

Good Luck & Good Trading,

Erin

Diamond Mine Trading Room:

RECORDING & DOWNLOAD LINK (3/21/2025):

Topic: DecisionPoint Diamond Mine (3/21/2025) LIVE Trading Room

Download & Recording Link

Passcode: March#21

REGISTRATION for 3/28/2025:

When: March 28, 2025 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording from 3/17. You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscribe HERE.

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Corning, Inc. (GLW)

EARNINGS: 2025-04-29 (BMO)

Corning, Inc. engages in the provision of glass for notebook computers, flat panel desktop monitors, display televisions, and other information display applications, carrier network and enterprise network products for the telecommunications industry, ceramic substrates for gasoline and diesel engines in automotive and heavy-duty vehicle markets, laboratory products for the scientific community and polymer products for biotechnology applications, optical materials for the semiconductor industry and the scientific community, and polycrystalline silicon products and other technologies. It operates through the following segments: Optical Communications, Display Technologies, Specialty Materials, Environmental Technologies, and Life Sciences. The Optical Communications segment is classified into two main product groupings: carrier and enterprise network. The carrier network group consists of products and solutions for optical-based communications infrastructure for services such as video, data, and voice communications. The enterprise network group consists primarily of optical-based communication networks sold to businesses, governments, and individuals for their own use. The Display Technologies segment manufactures glass substrates for flat panel displays, including organic light-emitting diodes and liquid crystal displays that are used primarily in televisions, notebook computer, desktop monitors, tablets, and handheld devices. The Specialty Materials segment is involved in the manufacture of products that provide material formulations for glass, glass ceramics and crystals, and precision metrology instruments and software. The Environmental Technologies segment focuses on manufacturing ceramic substrates and filter products for emissions control in mobile applications. The Life Sciences segment develops, manufactures, and supplies laboratory products. The company was founded by Amory Houghton Sr. in 1851 and is headquartered in Corning, NY.

Predefined Scans Triggered: Elder Bar Turned Green.

Below are the commentary and chart from Tuesday, 3/18:

"GLW is up +0.15% in after hours trading. I liked this one visually based on the reversal off strong support at the September high and 200-day EMA. This looks like a solid rally. The RSI is negative, but at least that means it isn't overbought. It's also fairly close to net neutral (50). The PMO has turned up and is headed for a Crossover BUY Signal. Notice all the volume coming in on the rally. Stochastics are rising strongly. Relative strength is positive for GLW against both the group and SPY. The group itself isn't really outperforming though. It isn't a perfect chart, but it is hopefully getting us in early enough on this new rally. The stop is set beneath support at 7.3% or $43.81."

Here is today's chart:

It has had two days of dealing, but the rising trend hasn't really been compromised. Overhead resistance is nearing so we could get another stumble at that level, but ultimately the indicators are getting better (the RSI is now positive) and this suggests we'll see some followthrough. It is in Technology so it is somewhat dependent on the market's health next week.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Innovex International, Inc. (INVX)

EARNINGS: 2025-05-01 (AMC)

Innovex International, Inc. engages in the provision of solutions for both onshore and offshore applications within the oil and gas industry. The company was founded on September 15, 2016 and is headquartered in Humble, TX.

Predefined Scans Triggered: Filled Black Candles.

Below are the commentary and chart from Tuesday, 3/18:

"INVX is unchanged in after hours trading. I liked the symmetrical triangle on the chart with a small breakout (unfortunately it is a filled black candlestick which implies a decline tomorrow). These are continuation patterns so the expectation is a breakout move given the prior trend was up. We have a positive RSI that isn't overbought. The PMO is on a new Crossover BUY Signal well above the zero line. Stochastics are rising in positive territory. Relative strength is very positive as all relative strength lines are rising. I also note that it is close to having a Golden Cross of the 50/200-day EMAs. The stop is set beneath the 200-day EMA at 7.9% or $16.93."

Here is today's chart:

This one isn't all bad. Support is still holding and think we could redraw the upper declining trend line to take the recent top into account. That would put it back in a symmetrical triangle. It's a continuation pattern so we still could see some upside here. The PMO is in decline, but ultimately it is flat well above the zero line indicating there is still strength. We would read the PMO as showing diminishing strength, not new weakness. This one just needs a little more time. If Crude turns down however, this wouldn't be something to hold onto.

THIS WEEK's Performance:

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Friday signal changes are outlined in purple.

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Utilities (XLU)

Admittedly price is technically in a sideways trading range, but there is upside potential should it get to the top of the range. I picked it primarily because participation was more healthy than on XLC. The indicators look good with both the Silver and Golden Cross Indexes above their signal lines and participation above 70% across the board. Stochastics have gotten above 80 and the PMO is on a new Crossover BUY Signal. It does seem ripe for more upside and if the market doesn't cooperate next week, this defensive area should see some action.

Industry Group to Watch: Conventional Electricity ($DJUSVE)

I liked the rising trend on this group as well as the new PMO Crossover BUY Signal. The RSI isn't positive yet, but that at least means it's not overbought. It is in a sideways trading range, but there is plenty of upside available before it reaches that level. The stocks you might want to look at from this area are: TXNM, PAM, VST, NRG and DTE.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 20% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin HERE!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2025 DecisionPoint.com