Last week's hedges came in a bit too early, but one of them, the Small-Cap Bear 3x ETF stayed open and is now up over 8% on Friday's decline. The market looks exceedingly weak right now and this tells me we shouldn't be expanding our exposure. If anything, we need to honor stops and/or clean up any weak positions. Even strong ones will be vulnerable if this decline really gets going next week.

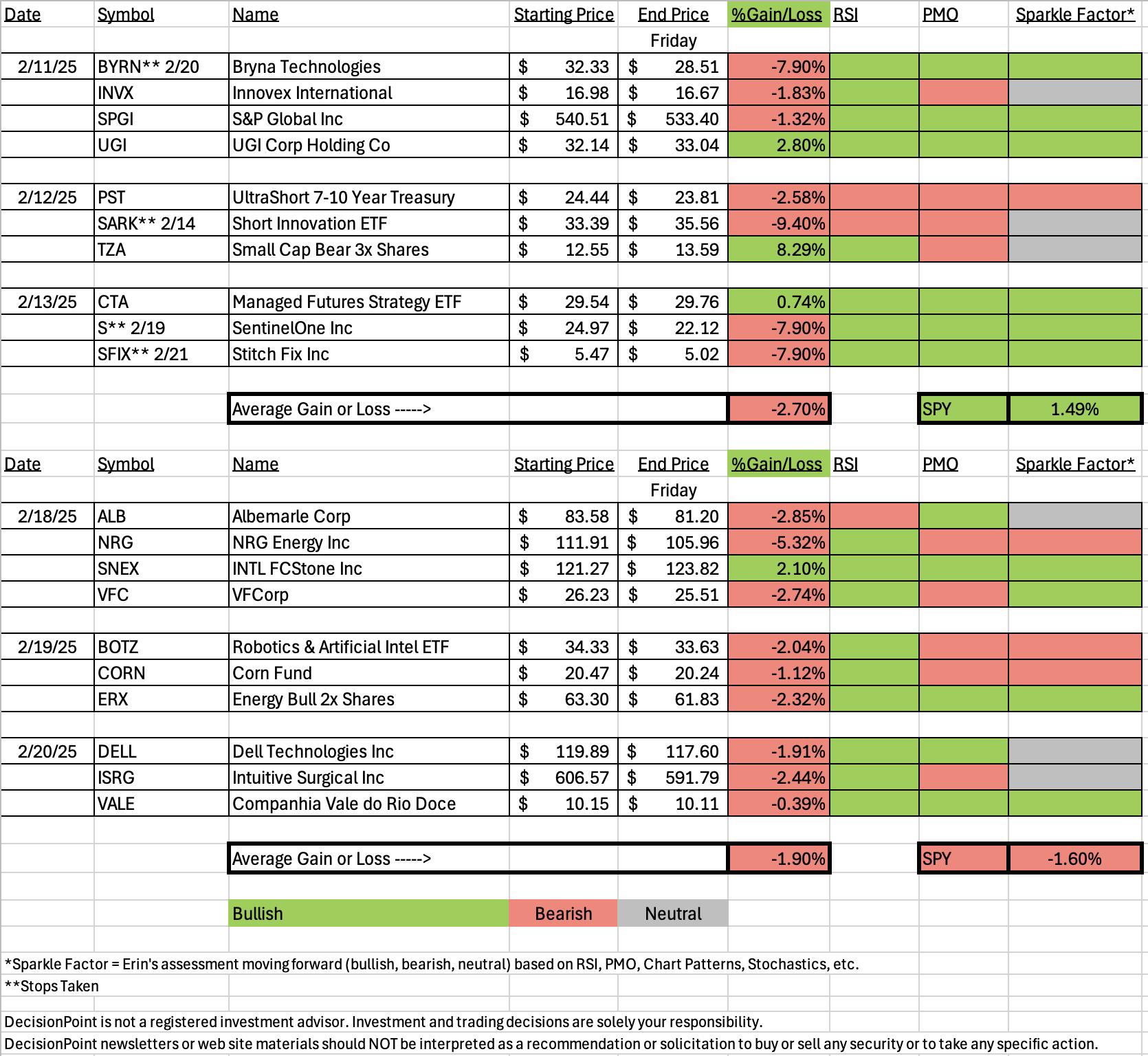

The decline was very unkind to the spreadsheet. Only one position was up this week and I have to say nearly all look questionable moving forward. I kept some green Sparkle Factors but ultimately I don't have high hopes for picks given the likelihood of a continued decline going into next week. It was a good thing we contemplated and selected a few shorts at the end of the trading room. Those shorts were FL, NHS and ASTH, all of which should continue to lose ground in a weak market.

The Sector to Watch was Energy, but upon further review I decided going with Consumer Staples was a better idea. Utilities still look interesting as well. Energy lost a lot of participation on today's decline so I think it is safer to go with Consumer Staples going into next week.

I'm the Industry Group to Watch as Pipelines. They are starting to see a bottom and could do well if production begins to ramp up as we've been told by the new administration. Still adding longs in general may not be a good idea. I did find the following symbols of interest from this area: WMB, PAA, CAPL, PAGP and GEL.

The Darling this week is the only position that finished higher, INTL FCStone Inc (SNEX). The Dud this week was NRG Energy (NRG) which is a Utility. I like this area but this stock is not set up well anymore.

I ran some scans to finish the trading room as always and as mentioned above I found some shorts for your consideration (mentioned above) and there were a few longs that are worth looking at: PUMP and DHR.

It is setting up for a rough week ahead. Shore up your portfolios and think defensive and possibly short.

Have a wonderful weekend!

Good Luck & Good Trading,

Erin

Diamond Mine Trading Room:

RECORDING & DOWNLOAD LINK (2/21/2025):

Topic: DecisionPoint Diamond Mine (2/21/2025) LIVE Trading Room

Download & Recording Link

Passcode: February#21

REGISTRATION for 2/28/2025:

When: February 28, 2025 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording from 2/10 (No recording 2/17). You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscribe HERE.

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

INTL FCStone Inc. (SNEX)

EARNINGS: 2025-05-07 (AMC)

StoneX Group, Inc. engages in the provision of brokerage and financial services. It operates through the following segments: Commercial Hedging, Global Payments, Securities, Physical Commodities, and Clearing and Execution Services. The Commercial Hedging segment offers risk management consulting services. The Global Payments segment includes global payment solutions for banks, commercial businesses, charities, non-governmental, and government organizations. The Securities segment consists of corporate finance advisory services and capital market solutions for middle market clients. The Physical Commodities segment consists of physical precious metals trading and the physical agricultural and energy commodity businesses. The Clearing and Execution Services segment refers to exchange-traded futures and options, foreign exchange prime brokerage, correspondent clearing, independent wealth management, and derivative voice brokerage. The company was founded by Diego J. Veitia in October 1987 and is headquartered in New York, NY.

Predefined Scans Triggered: Elder Bar Turned Green, P&F Ascending Triple Top Breakout, New CCI Buy Signals, P&F Double Top Breakout and Moved Above Upper Keltner Channel.

Below are the commentary and chart from Tuesday, 2/18:

"SNEX is up +0.03% in after hours trading. I like how this one is stair stepping up on a nice rising trend. The only issue here is that we have an island formation so it is vulnerable to a possible gap down. However, given the set up of the indicators I think that is unlikely to happen. The RSI is positive although getting overbought. The PMO shows a Surge above the signal line. Stochastics have turned back up in positive territory. Relative strength is rising for the group and SNEX against the SPY and SNEX is showing leadership among the group. I've set the stop below gap support at 7.9% or $111.68."

Here is today's chart:

It was a difficult decline today and it did set up a bearish engulfing candlestick. I believe it still has some merit moving forward as the rising trend is still intact. The indicators are still positive as well. Today's decline took the RSI out of overbought territory which is positive. Stochastics did top, but remain above 80. It could be interesting as a pick up on the decline, but as noted in the opening, I'm not a fan of expanding exposure right now.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

NRG Energy Inc. (NRG)

EARNINGS: 2025-02-26 (BMO)

NRG Energy, Inc. engages in the production, sale, and distribution of energy and energy services. It operates through the following segments: Generation, Retail, and Corporate. The Generation segment includes all power plant activities, domestic and international, as well as renewables. The Retail segment includes mass customers and business solutions, and other distributed and reliability products. The Corporate segment includes residential solar and electric vehicle services. The company was founded in 1989 and is headquartered in Houston, TX.

Predefined Scans Triggered: Parabolic SAR Buy Signals, New CCI Buy Signals and P&F double Top Breakout.

Below are the commentary and chart from Tuesday, 2/18:

"NRG is down -0.48% in after hours trading. I like the recuperation of price after its bad gap down. We are seeing an acceleration in the rally now. The RSI is positive and not overbought. There is a new PMO Crossover BUY Signal and Stochastics are headed higher while above 80. I like Utilities and the Conventional Electricity group is outperforming overall. NRG is showing leadership within the group and against the SPY. I've set the stop beneath the 20-day EMA at 7.5% or $103.51."

Here is today's chart:

The chart went completely south and I really can't point to anything in the technicals that would have indicated that this one could have problems. It didn't look that bad yesterday, but today the complexion of the chart changed significantly. The RSI is still positive but is likely to hit negative territory next week. The PMO has topped and Stochastics left territory above 80. The rising trend is still technically intact, but given such a deep decline today I would have to look for downside followthrough with a high likelihood that rising trend will be broken.

THIS WEEK's Performance:

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Friday signal changes are outlined in purple.

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Consumer Staples (XLP)

XLP was one of the few winners on the day. Utilities managed to see a barely positive close, but that was pretty much it. Considering the market had a bad day, XLP really outperformed. We can see that participation is rising and getting more bullish as more stocks climb above their 20/50/200-day EMAs. The PMO is rising strongly and Stochastics are comfortably above 80. This sector could still get bumpy if the market as a whole continues to weaken, but for now this looks like a pretty good hideout.

Industry Group to Watch: Pipelines ($DJUSPL)

It was the rounded bottom that convinced me to go with this area. The chart isn't the best, it looked a bit better this morning in the trading room, but it has merit as an area to keep an eye on. The RSI is negative right now after today's decline, but it is close to neutral. The PMO is rising toward a Crossover BUY Signal. Stochastics have tipped over but overall are trending toward 80. It may be early so more sideways type movement could continue, but take a look at the following symbols as they do have bullish configurations (at least they did this morning!): WMB, PAA, CAPL, PAGP and GEL.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 15% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin HERE!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2025 DecisionPoint.com