It was a productive week for "Diamonds in the Rough" with eight out of ten moving higher. We did have a reader request hit its stop on its first day after being picked and that did unfortunately take the spreadsheet down this week. It was a Boom or Bust kind of stock and it busted with today's trading.

The only other decline was Lantheus Holdings, but it actually does look good moving forward despite this week's decline.

The Darling this week was United Natural Foods Inc (UNFI) which was up +5.51%. It is a Consumer Staple and with the recent market weakness has been finding favor.

The Sector to Watch this week is Industrials (XLI) which is breaking out and making new all-time highs. We'll dive in under the hood later.

The Industry Group to Watch is Diversified Industrials. We found a few symbols of interest within: FIP, CSL, SWK and LXFR (I own it).

I ran numerous scans at the end of the program today and found some interesting prospects: GEV, SOLV (I own it), ARMK, SFM, VRTX and ARI.

Have a great holiday weekend! There will be no trading room on Monday due to Labor Day.

Good Luck & Good Trading,

Erin

Diamond Mine Trading Room:

RECORDING & DOWNLOAD LINK (8/30/2024):

Topic: DecisionPoint Diamond Mine (8/30/2024) LIVE Trading Room

Recording and Download LINK

Passcode: August#30

REGISTRATION for 9/6/2024:

When: September 6, 2024 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording from 8/26. You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscribe HERE.

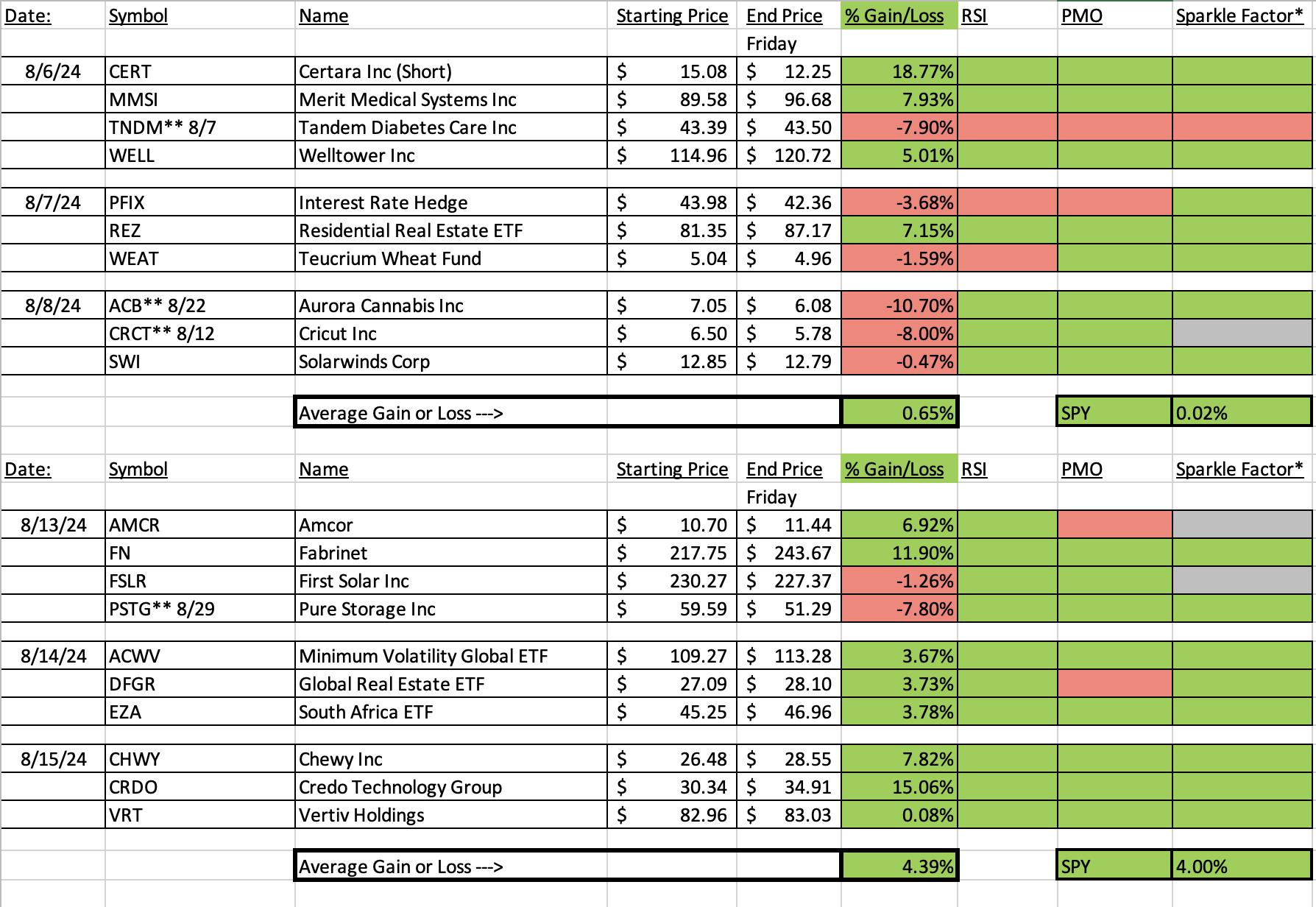

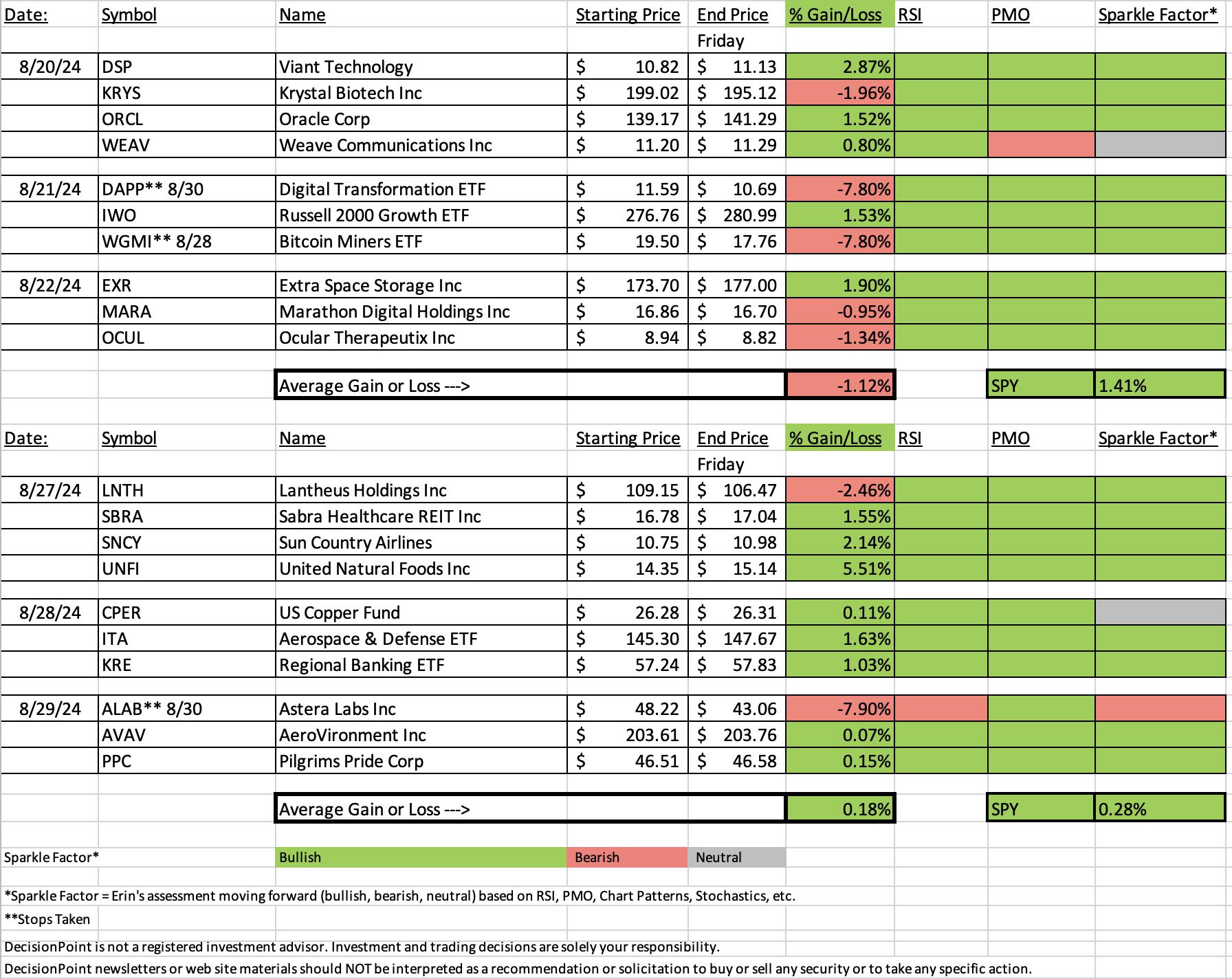

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

United Natural Foods, Inc. (UNFI)

EARNINGS: 2024-09-24 (BMO)

United Natural Foods, Inc. engages in the distribution of natural, organic, and specialty foods and non-food products. The firm operates through the Wholesale and Retail segments. The Wholesale segment is engaged in the national distribution of natural, organic, specialty, produce, and conventional grocery and non-food products, and providing retail services in the United States and Canada. The Retail segment derives revenues from the sale of groceries and other products at retail locations operated by company. It offers food and non food, frozen, perishables, bulk, body care products, and supplements. The company was founded by Michael S. Funk and Norman A. Cloutier in July 1976 and is headquartered in Providence, RI.

Predefined Scans Triggered: Bullish 50/200-day SMA Crossovers.

Below are the commentary and chart from Tuesday, 8/27:

"UNFI is down -1.74% in after hours trading so it is giving back much of today's gain so far. We'll see if it progresses into tomorrow. I like this rally off support that is about to take out the bearish double top pattern. Price does have a big test ahead at the 200-day EMA so it may stumble a bit first before breaking out. The RSI is positive and not overbought. The PMO is on a new Crossover BUY Signal and the OBV is rising. Stochastics are above 80 and rising. Relative strength is okay for the industry group, but UNFI is seeing outperformance of both the group and SPY. I like this area of the market given weak price action currently. The stop is set beneath the 50-day EMA at 7.9% or $13.21."

Here is today's chart:

The rally marches on and isn't getting parabolic. We do have to concern ourselves with upcoming resistance where it is likely to run into some trouble with some consolidation at the very least. It isn't overbought yet so there should be more upside to come. The indicators are maturing nicely.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Astera Labs Inc. (ALAB)

EARNINGS: None Listed.

Astera Labs, Inc. manufactures semiconductors. It offers smart retimers, riser cards, and GPU booster cards. The company products include: Aries PCIe CXLSmart DSP Retimers, Taurus Ethernet Smart Cable Modules and Leo CXL Memory Connectivity Controllers. Astera Labs is founded by Jitendra Mohan, Casey Morrison and Sanjay Gajendra in October 2017 and headquartered in Santa Clara, CA.

Predefined Scans Triggered: Moved Above Upper Bollinger Band, Stocks in a New Uptrend (Aroon), Moved Above Upper Price Channel, P&F Double Top Breakout and P&F Triple Top Breakout.

Below are the commentary and chart from Thursday, 8/29:

"ALAB is up +0.04% in after hours trading. Today it ran very hot so a day or two of pause may be in order. I really liked the rounded bottom and the 5-day EMA crossing above the 20-day EMA for a Short-Term Trend Model BUY Signal. It looks primed for higher prices. The RSI is not yet overbought even with an over 10% rally today. The PMO is on a Crossover BUY Signal. It is beneath the zero line so I wouldn't label it pure strength at this point in time. Stochastics are above 80. The group is holding its own against the SPY and ALAB is outperforming both the group and the SPY. The stop was difficult to set given today's big rally, so I set it about as deeply as I could at 7.9% or $44.41."

Here is today's chart:

It was a terrible day for ALAB particularly given its 10% up move yesterday. It is a boom or bust kind of stock and it busted. The PMO is still rising, but the short-term rising trend was compromised somewhat today so I'd likely avoid it at this point. Stochastics are also moving down. What went wrong? It is a reversal candidate and carried a lot of downside risk as a boom or bust type of stock will do.

THIS WEEK's Performance:

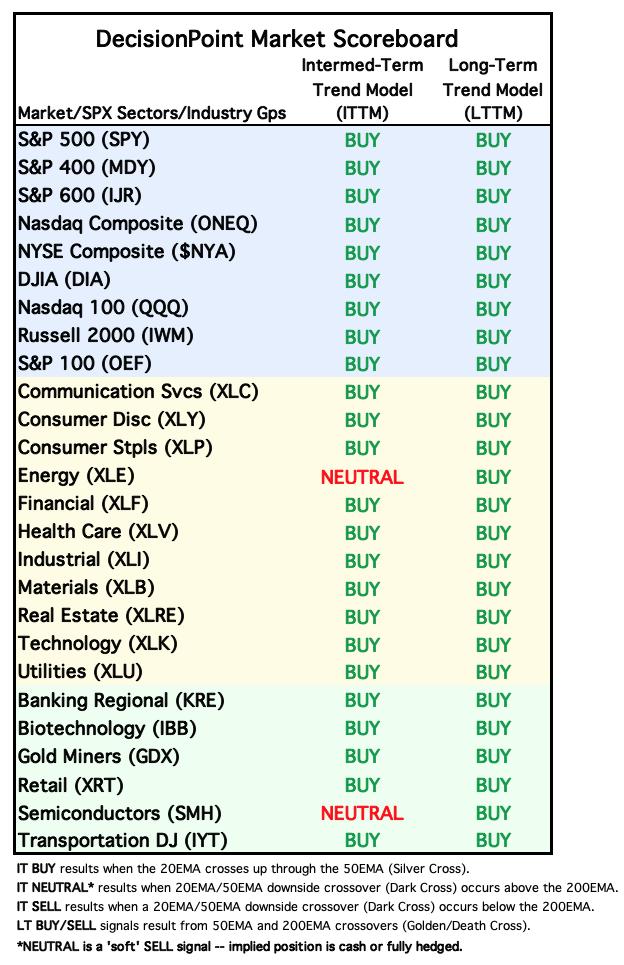

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Friday signal changes are outlined in purple.

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Industrials (XLI)

The only issue with XLI is that it is overbought according to the RSI and participation numbers which are running hot. Still this looks like a winner that should keep on winning. With strong participation and a rising not overbought Silver Cross Index, it has a strong foundation. Stochastics have turned up above 80 and we can excellent outperformance against the SPY.

Industry Group to Watch: Diversified Industrials ($DJUSID)

There were a number of industry groups that we could've selected today. This is just one of some very good industry groups in XLI. You may want to take a walk through those industry groups yourself on StockCharts.com's Industry Summary. This group has been winning and is on a nice rising trend. It is getting overbought right now, but the PMO is rising so strongly above the zero line which tells me there is more upside to be had. Stochastics are also holding court above 80. We found some interesting symbols here: FIP, CSL, SWK and LXFR (I own it).

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 45% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin HERE!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2024 DecisionPoint.com