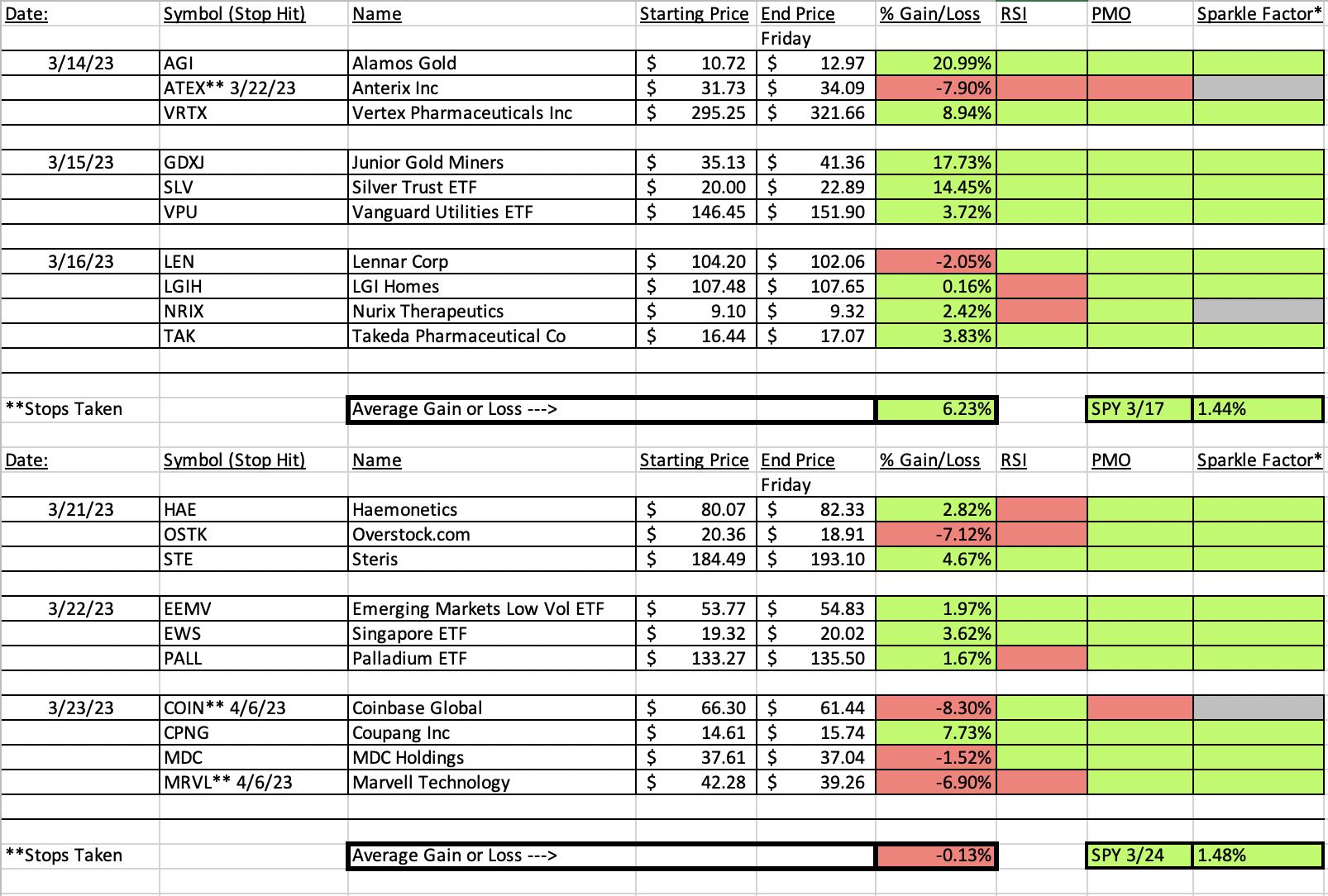

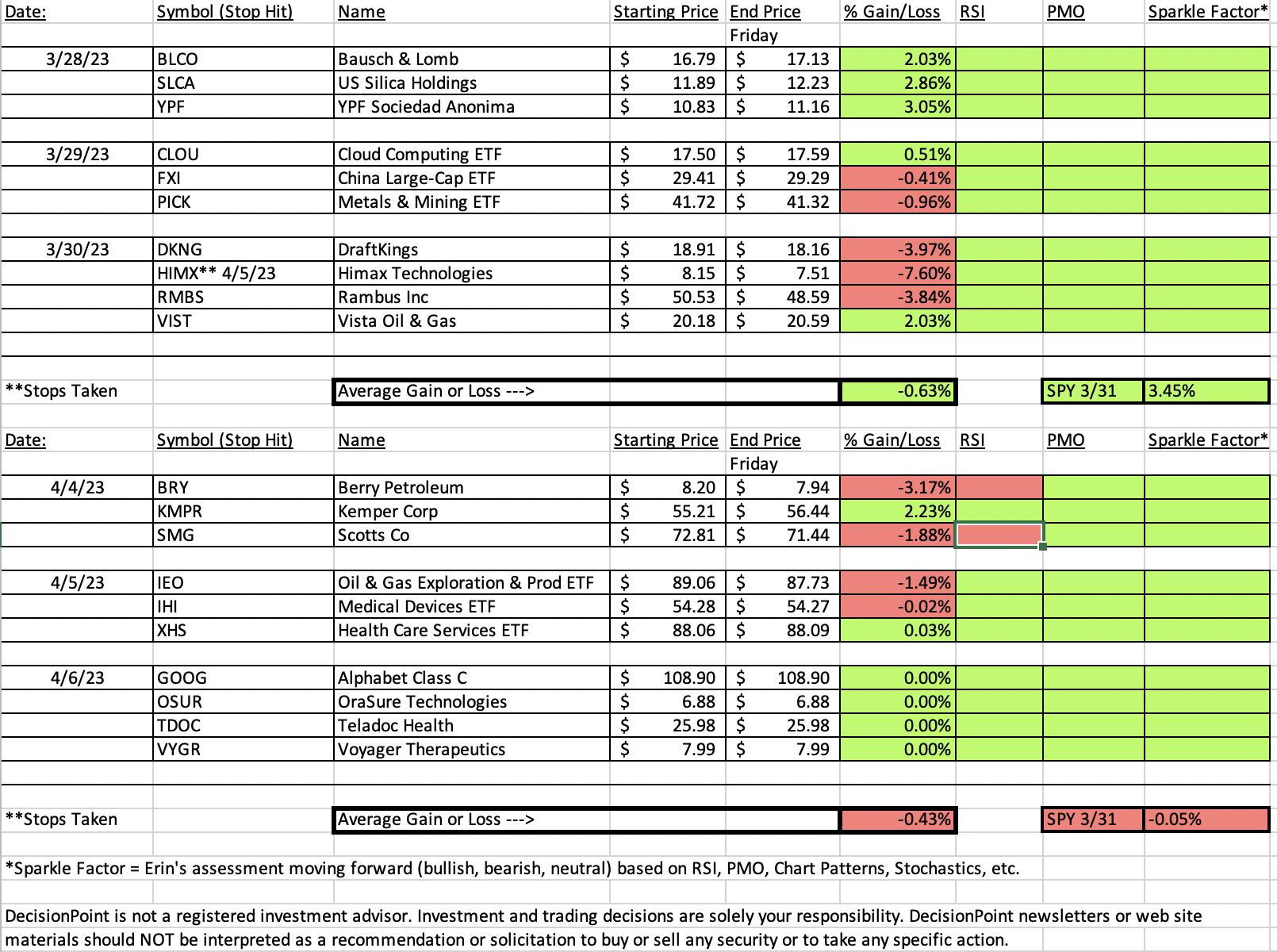

This Recap will be a little different in that Reader Requests haven't traded as they were picked after the close yesterday. Unfortunately, this means we won't know how the picks will go until next week. Now that we have four weeks on the spreadsheet, it will be easy to monitor as we move forward.

The market finished nearly unchanged and "Diamonds in the Rough" were down just -0.43% which I think is good given we only have six stocks that traded.

This week's "Darling" is Kemper Corp (KMPR) which was up +2.23% since Tuesday. The "Dud" was Berry Petroleum (BRY) which was a surprise as when I picked it Crude Oil had only recently broken out. As Crude consolidated, BRY pulled back.

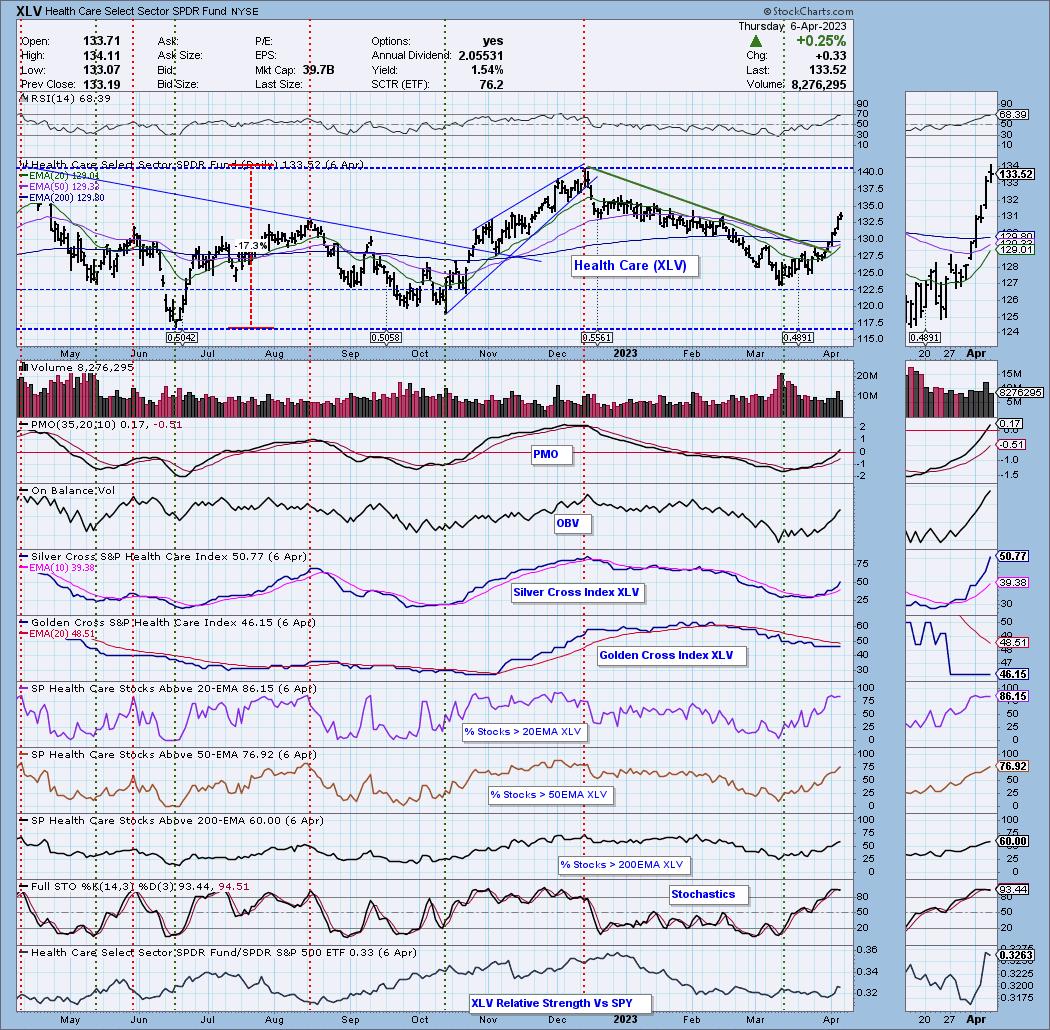

The "Sector to Watch" wasn't too hard to pick this week, Healthcare (XLV). Close seconds were Communication Services (XLC) and Utilities (XLU). XLU was strong, but I felt there were more opportunities available in XLV. The "Industry Group to Watch" is Biotechnology (IBB). Admittedly all of the groups within XLV look strong, but I believe there are more lucrative opportunities in Biotechs. I'll be adding them next week if they continue to rally.

Have a great weekend!

Good Luck & Good Trading,

Erin

RECORDING LINK (4/7/2023):

Topic: DecisionPoint Diamond Mine (4/7/2023) LIVE Trading Room

Passcode: April#7th

REGISTRATION for 4/14/2023:

When: Apr 14, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (4/14/2023) LIVE Trading Room

Register in advance for this webinar HERE.

After registering, you will receive a confirmation email containing information about joining the webinar.

Our latest DecisionPoint Trading Room recording (4/3/2023):

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Kemper Corp. (KMPR)

EARNINGS: 05/01/2023 (AMC)

Kemper Corp. is a holding company, which engages in the property and casualty insurance, and life and health insurance businesses. It operates through the following segments: Specialty Property and Casualty Insurance, Preferred Property and Casualty Insurance, and Life and Health Insurance. The Specialty Property and Casualty Insurance segment provides personal and commercial automobile insurance. The Preferred Property and Casualty Insurance segment sells automobile, homeowners, and other personal insurance. The Life and Health Insurance segment offers financial security for loved ones, as well as financial protection from healthcare. The company was founded in 1990 and is headquartered in Chicago, IL.

Predefined Scans Triggered: P&F Bear Trap.

Here are the commentary and chart from Tuesday (4/4):

"KMPR is unchanged in after hours trading. This one is just developing which is why I liked it. There weren't too many charts like this. I will say that the RSI is negative as it is below net neutral (50). Other than that, the indicators look good. The PMO is going in for a crossover BUY signal in oversold territory. Stochastics are rising in positive territory. Relative strength for the group is mostly in line with the SPY. KMPR over time has been a great relative performer within the group. It is outperforming the SPY modestly. The stop is set below support at 7.3% or $51.17."

Here is Thursday's chart:

KMPR is plugging along, but has reached resistance at the 50-day EMA. I'm not concerned as the chart is maturing nicely. The RSI which was negative when KMPR was selected, has now moved into positive territory above net neutral (50). The PMO has now given us a crossover BUY signal. I like this one moving forward.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Berry Petroleum Corp. (BRY)

EARNINGS: 05/03/2023 (BMO)

Berry Corp. is an energy exploration company, which engages in the acquisition, exploration, development, and production of domestic oil and natural gas reserves. It operates through the Exploration and Production (E&P) and Well Servicing and Abandonment segments. The E&P segment consists of the development and production of onshore, low geologic risk, long-lived conventional oil and gas reserves, primarily located in California, as well as Utah. The Well Servicing and Abandonment segment is involved in the wellsite services in California to oil and natural gas production companies, with a focus on well servicing, well abandonment services and water logistics. The company was founded by C. J. Berry in 1909 and is headquartered in Dallas, TX.

Predefined Scans Triggered: P&F High Pole.

Below are the commentary and chart from Tuesday (4/4):

"BRY is down -1.10% in after hours trading. Price gapped up alongside Crude Oil yesterday, but spent the day digesting that rally. Technically price is beneath near-term resistance, but indicators are very positive suggesting a breakout ahead. The RSI is positive and not overbought. The PMO is rising on a clean crossover BUY signal. OBV is rising in line with price and Stochastics are now above 80 and rising.The stop is set below the gap and below the next level of support at 7.2% or $7.60."

Here is Thursday's chart:

Crude Oil's halting of its rising trend caused BRY to pullback at overhead resistance. The prior gap appears to have been filled which would imply more downside. If I'm right about Crude Oil having a breakaway gap not a reverse island, this one should get a bit of boost. If it loses support at $7.75, you probably do not need to wait until the stop level is reached. Should Crude have a reverse island, this one will likely fall apart. Risk is too high for entry, but okay for a hold.

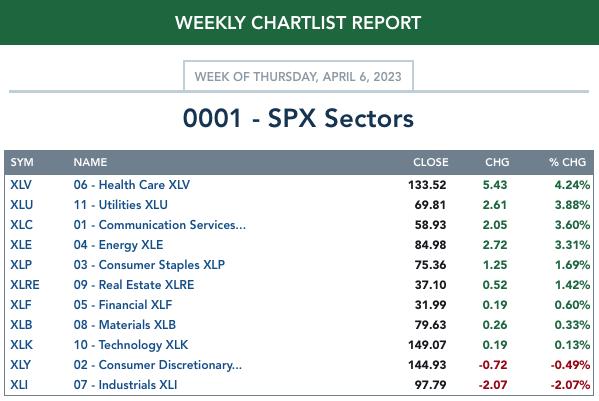

THIS WEEK's Sector Performance:

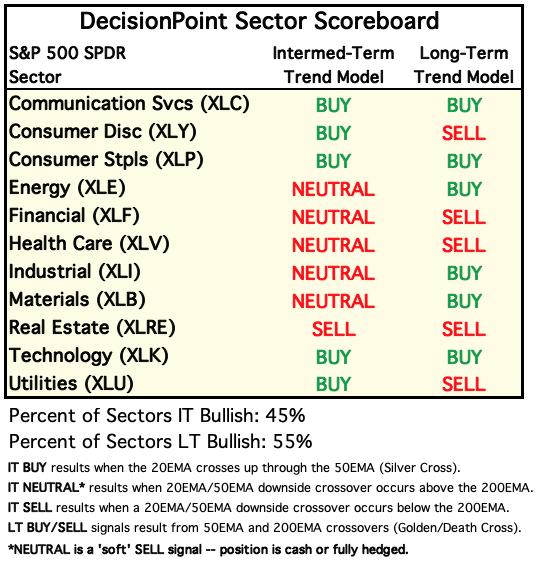

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

Sector to Watch: Healthcare (XLV)

The rally in Healthcare this week was strong and forceful. That managed to improve participation of stocks above their 20/50/200-day EMAs and push the Silver Cross Index higher and above our 50% bullish threshold. The PMO has just gotten above the zero line. If he want to worry about something, the RSI is getting a bit overbought. Other than that the sector looks strong.

Industry Group to Watch: Biotechnology (IBB)

We are fortunate that we have "under the hood" indicators on IBB since Biotechnology is my selection as industry group to watch. ETF fans have an opportunity to add this one. The breakout Thursday above the 200-day EMA was impressive. Price is now flirting with short-term resistance at the March high. The RSI is positive and the PMO rising on an oversold crossover BUY signal. Volume is steadily increasing based on the OBV. I do admit that we aren't over the 50% bullish threshold on any of the participation indicators, but the Silver Cross Index did reverse upward above its signal line which is very bullish. There are plenty of opportunities within this group.

Go to our Sector ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 26% long, 2% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2023 DecisionPoint.com