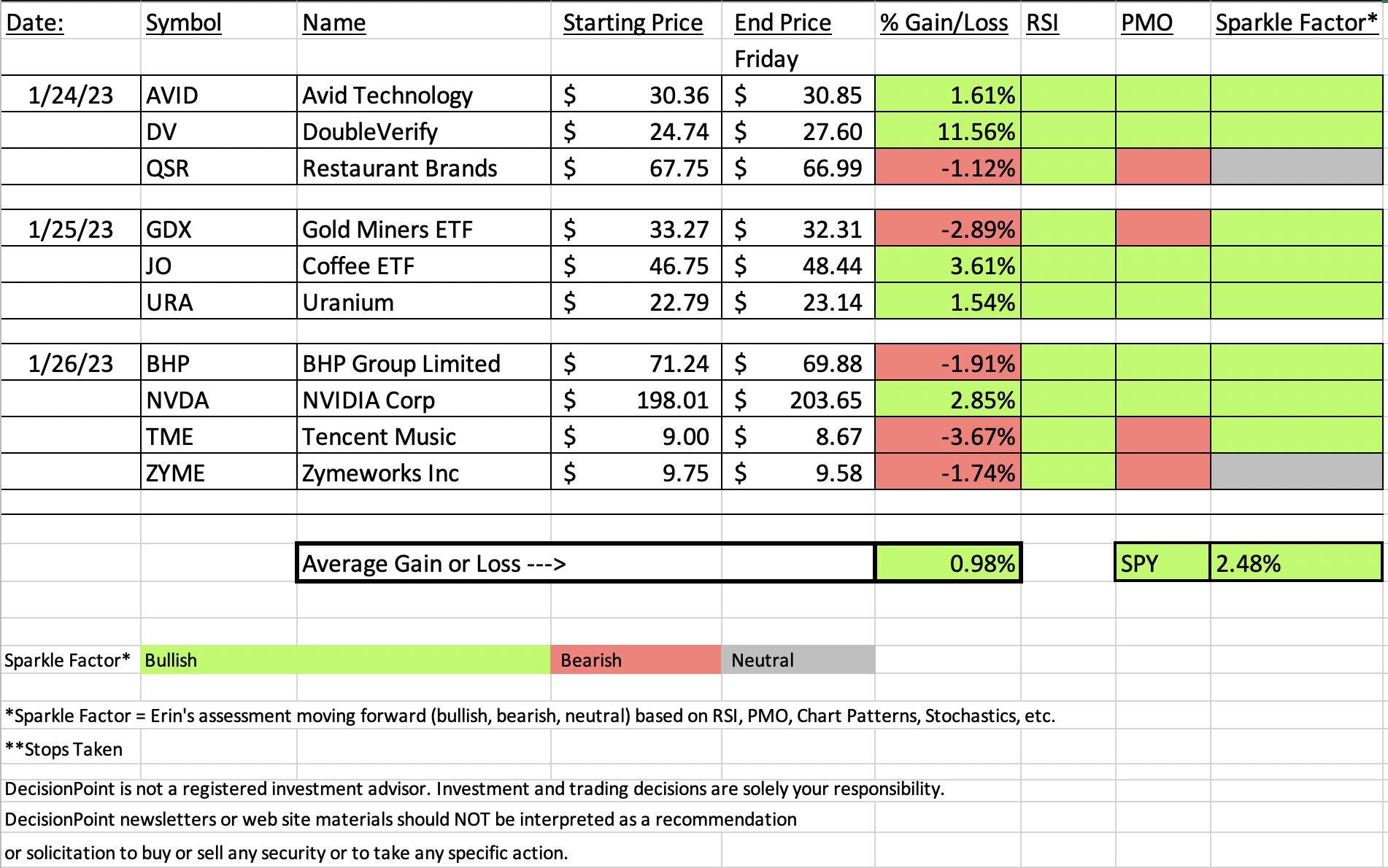

While it wasn't the best week for "Diamonds in the Rough", on average they did finish higher, just not as high as the SPY. The spreadsheet is positive and with the exception of two stocks, all look good moving into next week. One problem is that we do have some PMOs that are turning over. Probably not a good idea to add any with falling PMOs, but if you're in one that did see a PMO reversal, keep a tight leash.

This week's "Darling" was DoubleVerify (DV) which gapped up on Thursday. It is vulnerable to a reverse island, but we'll discuss it further down. This week's "Dud" was Tencent Music (TME). I mentioned TCEHY as a better way to play Tencent. TCEHY was up +0.40 and TME was down -3.67% today.

The Sector to Watch was relatively easy to pick. The Industry Group to Watch is not from the Sector to Watch, but it looks promising coming out of the Consumer Discretionary (XLY) sector (which today had a Silver Cross).

Have a great weekend!

Good Luck & Good Trading,

Erin

RECORDING LINK (1/27/2023):

Topic: DecisionPoint Diamond Mine (1/27/2023) LIVE Trading Room

Passcode: January#27

REGISTRATION for 1/27/2022:

When: Feb 3, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (2/3/2023) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Our latest DecisionPoint Trading Room recording (1/23/2023):

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

DoubleVerify Holdings Inc. (DV)

EARNINGS: 03/07/2023 (AMC)

DoubleVerify Holdings, Inc. engages in the development of software platforms for digital media measurement, data, and analytics. Its software, Pinnacle, is integrated across the entire digital advertising ecosystem including programmatic platforms, social media channels, and digital publishers. The company was founded on August 16, 2017 and is headquartered in New York, NY.

Predefined Scans Triggered: Improving Chaikin Money Flow, New CCI Buy Signals and P&F Low Pole.

Here are the commentary and chart from Tuesday (1/24):

"DV is unchanged in after hours trading. We have a nice little breakout above resistance and the 50-day EMA. This looks like a cup with handle pattern and it is now being confirmed with this breakout. The RSI is positive and the PMO is accelerating higher out of an oversold BUY signal. Stochastics are nearing 80. Relative strength for the Software group is improving and DV is beginning to outperform the group again which is helping it outperform the SPY now. The stop is set below the 20-day EMA at 5.7% around 23.32."

Here is today's chart:

The giant gap up was a surprise. As noted in the opening, I am slightly worried we will see a reverse island here. That would mean a gap down ahead. Yet, when we look at the technicals, the only real problem is an overbought RSI. Overbought conditions can persist in a bull market setup so we could see continuation. Today it digested yesterday's big move. It probably isn't too late to enter this one, but now I would want confirmation with a breakout above overhead resistance first.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Tencent Music Entertainment Group (TME)

EARNINGS: 03/20/2023 (BMO)

Tencent Music Entertainment Group is a holding company, which engages in the operation of an online music and audio entertainment platform. Its platform is composed of online music, online audio, online karaoke, music-centric live streaming, and online concert services. The company was founded on June 6, 2012 and is headquartered in Shenzhen, China.

Predefined Scans Triggered: New CCI Buy Signals, Parabolic SAR Buy Signals, P&F Double Top Breakout and P&F Triple Top Breakout.

Below are the commentary and chart from yesterday (1/27):

"TME is down -1.56% in after hours trading. Another symbol for this company, which has been on my radar, is TCEHY. I'm including its daily chart below TME's for comparison. That chart actually looks better, but this was requested. TCEHY is still advancing while this one is looking a bit "toppy". However, it could see some outperformance as the indicators are just beginning to mature. The RSI is positive and rising. The PMO is turning back up. Stochastics are rising in positive territory. Relative strength I believe tells the story. TCEHY has been a more consistent performer. The stop is set below support at 6% around 8.46."

Here is today's chart:

I knew that TCEHY looked better but this had been requested. The chart really doesn't look that bad, but the PMO is now declining and that is a big problem. Stochastics are still rising and the RSI is positive so all is not lost which is why I listed it as good moving forward. The short-term rising trend is still intact. This is more of a "hold" candidate than an entry.

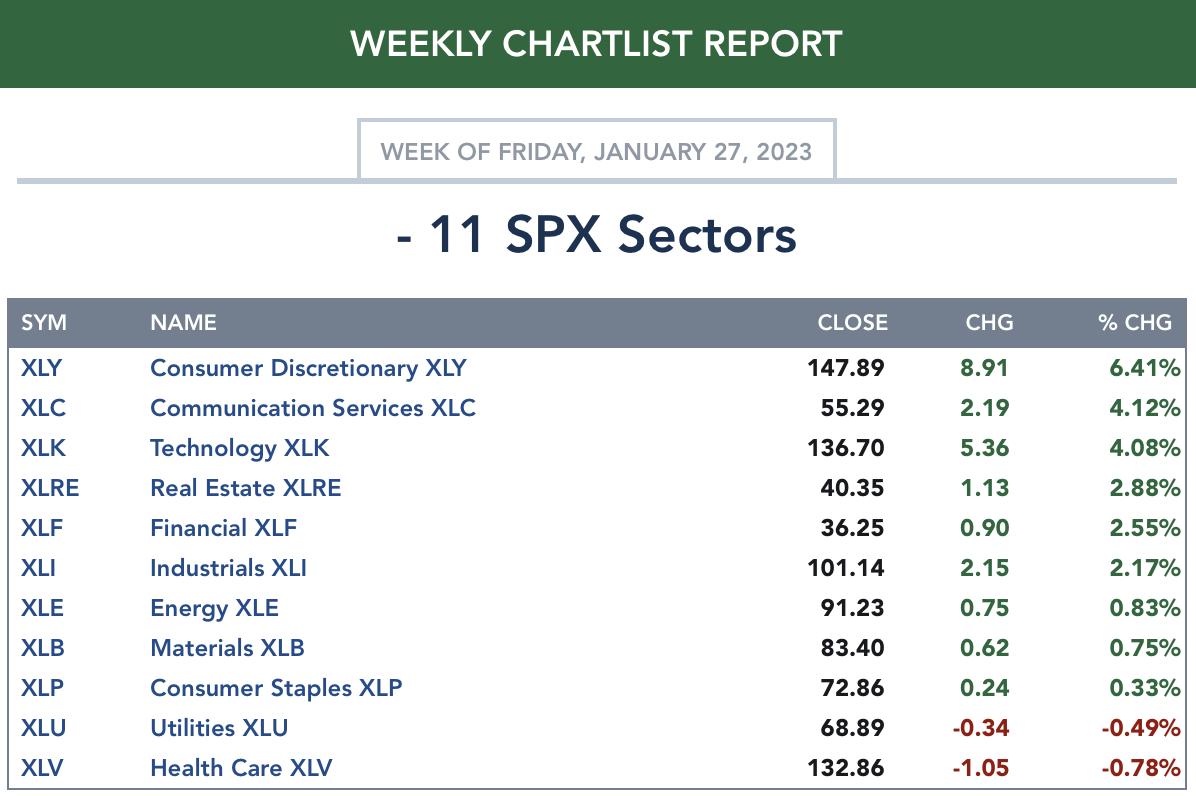

THIS WEEK's Sector Performance:

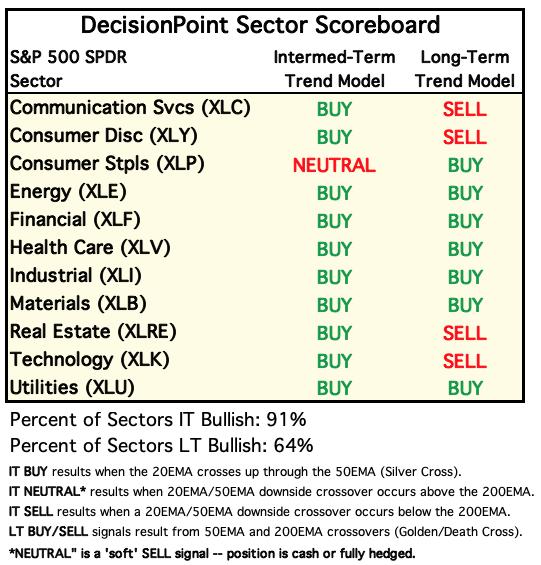

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

Sector to Watch: Technology (XLK)

I picked XLK because it was not overbought and had strong participation numbers beneath the surface. Communication Services (XLC) and Consumer Discretionary (XLY) were close seconds but they both have overbought RSIs and PMOs. XLK pushed past overhead resistance at the 200-day EMA. The RSI is positive and not overbought. The PMO is rising nicely and is not overbought. Both the Silver Cross Index and Golden Cross Index are rising. We have a nice amount of stocks above key moving averages and there is still a little headroom to add more stocks above their 20/50-day EMAs. One problem would be the declining tops trendline hasn't been broken yet and resistance is arriving at the June top. If XLK can hold onto this participation and rising momentum, I would expect a breakout when it next encounters resistance.

Industry Group to Watch: Broadline Retailers ($DJUSRB)

Unfortunately there are no ETFs that target this specific industry group so I'm presenting the Dow Jones US Industry Group for Broadline Retailers. This looks like a possible reverse head and shoulders that is being confirmed by today breakout. The indicators are positive too. The RSI is in positive territory and the PMO is rising. Stochastics are oscillating above 80. We dove into this group in today's Diamond Mine and honestly the best stock there was Amazon (AMZN) which looks almost identical to the chart below. I like AMZN going into next week.

Go to our Sector ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 15% exposed.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2023 DecisionPoint.com