Today the Diamond PMO Scan came up with only one symbol. While it looked okay, I obviously was going to have to run more scans. I decided I wanted to come up with at least one short position today. It's much harder than you would think. The Diamond Dog Scan came up with some interesting ideas, but ultimately I only settled on one and I have included the other in the "Stocks to Review".

Today's theme really blew me away today. I expected to see my scan filled with Energy stocks, but none arrived. What came up in a BIG way was Consumer Discretionary stocks, particularly Apparel Retailers. I wasn't excited about presenting Discretionary stocks as we fight against a bear market, but I'm going to trust my scans and see how the two apparel retailer "Diamonds in the Rough" work out.

Remember, this isn't the time to expand your exposure as the sell-off continues, but certainly we can populate our watch lists at the very least. Overall just be careful. I didn't shave my exposure today, but I did set up some very very tight stops. I'm at 15% right now, primarily Energy and a few Materials stocks (they're the first on the chopping block with the exception of one Gold Miner that I plan on keeping).

Today's "Diamonds in the Rough": CTOS, DLTH, GCO and HXL (Short).

Stocks to Review: BIDU (short), ITCI (only Diamond PMO scan result), GPS and URBN.

RECORDING LINK (1/21/2022):

Topic: DecisionPoint Diamond Mine (1/21/2022) LIVE Trading Room

Start Time: Jan 21, 2022 09:00 AM PT

Meeting Recording Link.

Access Passcode: January#21

REGISTRATION FOR 1/28 Diamond Mine:

When: Jan 28, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (1/28/2022) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (1/24) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Jan 24, 2022 09:00 AM PT

Meeting Recording Link.

Access Passcode: January@24

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from the StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Custom Truck One Source, Inc. (CTOS)

EARNINGS: 3/7/2022 (AMC)

Custom Truck One Source, Inc. engages in the sale and rental of truck and heavy equipment. The firm offers aftermarket parts and service, equipment customization, remanufacturing, financing solutions, and asset disposal services. The company is headquartered in Kansas City, MO.

Predefined Scans Triggered: Bullish MACD Crossovers and Parabolic SAR Buy Signals.

CTOS is unchanged in after hours trading. Currently it is still in a trading range. While traveling within it, it has formed an interesting bullish triple-bottom. We don't see these patterns that often, but they do tend to end with a breakout of some sort. It has managed a close above the 20/50-day EMAs and forayed above the 200-day EMA today. The upside target of the triple-bottom would be right at overhead resistance at the September top. The RSI is positive and the PMO triggered a crossover BUY signal today. Stochastics are rising strongly (although they aren't in positive territory above net neutral (50) yet). Relative strength studies are bullish. I set the stop below the midpoint of the trading range.

The weekly chart is shaping up. It's hard to tell, but the weekly PMO has flattened. The weekly RSI is nearing positive territory. If it can challenge all-time highs (admittedly that will tough right now), it would be about a 37% gain.

Duluth Holdings Inc. (DLTH)

EARNINGS: 3/17/2022 (BMO)

Duluth Holdings, Inc. engages in the provision of lifestyle brand of men and women casual wear, work wear, and accessories. Its products assortment includes shirts, pants, underwear, outerwear, footwear, accessories, and hard goods. It features proprietary designs and distinct names, such as Longtail T shirts, Buck NakedTM underwear, Fire Hose work pants, and No-YankTank. The company was founded by Stephen L. Schlecht in 1989 and is headquartered in Mount Horeb. WI.

Predefined Scans Triggered: Bullish MACD Crossovers, P&F Low Pole and Parabolic SAR Buy Signals.

DLTH is unchanged in after hours trading. This has been a volatile six months as DLTH is traveling within a wide trading range between $13.50 and $16.75. Like I said, I hesitated to include these apparel retailers, but they are bullish set-ups. The RSI is now positive and the PMO nearing a crossover BUY signal. Stochastics are rising and nearing positive territory. Volume is coming in on the past three days of rally. Relative strength for the group has improved quickly and DLTH is a very strong performer within the group and against the SPY. The stop is set below the mid-December low.

The weekly RSI is about to hit positive territory and the weekly PMO has decelerated and could finish higher this week. Even if it were to just reach strong overhead resistance at the 2020 high, that would be an over 18% gain, but if the market turns around, we could see it test the 2021 high which would be 44%+ gain.

Genesco, Inc. (GCO)

EARNINGS: 3/10/2022 (BMO)

Genesco, Inc. engages in the retail and sale of footwear, apparel, and accessories. It operates through the following segments: Journeys Group, Schuh Group, Johnston & Murphy Group, and Licensed Brands. The Journeys Group segment contains the Journeys, Journeys Kidz, Shi by Journeys and Little Burgundy retail stores, catalog and e-commerce operations. The Schuh Group segment includes the Schuh retail footwear chain and e-commerce operations. The Johnston & Murphy Group segment covers Johnston & Murphy retail operations, e-commerce and catalog operations, and wholesale distribution. The Licensed Brands segment consists of Dockers Footwear, sourced and marketed under a license from Levi Strauss & Company, SureGrip Footwear, occupational footwear primarily sold directly to consumers and other footwear brands. The company was founded in 1924 and is headquartered in Nashville, TN.

Predefined Scans Triggered: Bullish MACD Crossovers, Moved Above Ichimoku Cloud, P&F Double Top Breakout and Ichimoku Cloud Turned Red.

GCO is unchanged in after hours trading. This one has also been in a wide trading range. We have a messy triple-bottom on this one. The rally out of the second bottom should've reached the $67 level so it isn't your standard triple-bottom. I've annotated the confirmation line in green dashed line at about $67.50. The minimum upside target of the pattern would take price to about $78. We have a positive RSI and a new PMO crossover BUY signal. Volume is coming in. Stochastics are rising in positive territory. GCO is also a leader within the group based on relative strength and it is performing well against the SPY. The stop could be tighter set under the 20-day EMA, but I opted to set it at the late November lows.

The weekly chart shows a flattening weekly PMO and a positive RSI. We are 15% away from the five-year high so I decided to look at the monthly chart as well so we can see where that $78 minimum upside target would land.

Almost like magic, the minimum upside target of the triple-bottom on the daily chart puts price at the 2012 high.

Hexcel Corp. (HXL)

EARNINGS: 1/26/2022 (AMC) ** REPORTS TOMORROW! **

Hexcel Corp. engages in the development, manufacture, and marketing of lightweight structural materials. It includes carbon fibers, specialty reinforcements, prepregs and other fiber-reinforced matrix materials, honeycomb, adhesives, radio frequency / electromagnetic interference (RF/EMI) and microwave absorbing materials, engineered honeycomb and composite structures. The firm operates through the following segments: Composite Materials and Engineered Products. The Composite Materials segment consists of carbon fiber, specialty reinforcements, resins, prepregs and other fiber-reinforced matrix materials, and honeycomb core product lines and pultruded profiles. The Engineered Products segment consists of lightweight high strength composite structures, engineered core and honeycomb products with added functionality, and additive manufacturing. The company was founded by Roger C. Steele and Roscoe T. Hughes in 1946 and is headquartered in Stamford, CT.

Predefined Scans Triggered: Hollow Red Candles and P&F High Pole.

HXL is unchanged in after hours trading. Here is my short. They report tomorrow so that could definitely work in our favor. The EMAs look particularly bearish as they are configured with the fastest EMA on the bottom and slowest on top. There is support at $49, but more than likely it will test support at the December low given the negative RSI and nearing PMO crossover SELL signal. Stochastics are negative and falling. The group has been doing well but HXL is underperforming. The stop is on the "upside". If price gets above the 50-day EMA or as in the case of this stop, above the 200-day EMA, you should cover.

While support seems close on the daily chart above, there is still support at the early 2021 low around $42. That would be my downside target for this short. The weekly RSI is negative and the weekly PMO topped beneath its signal line.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to shoot me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

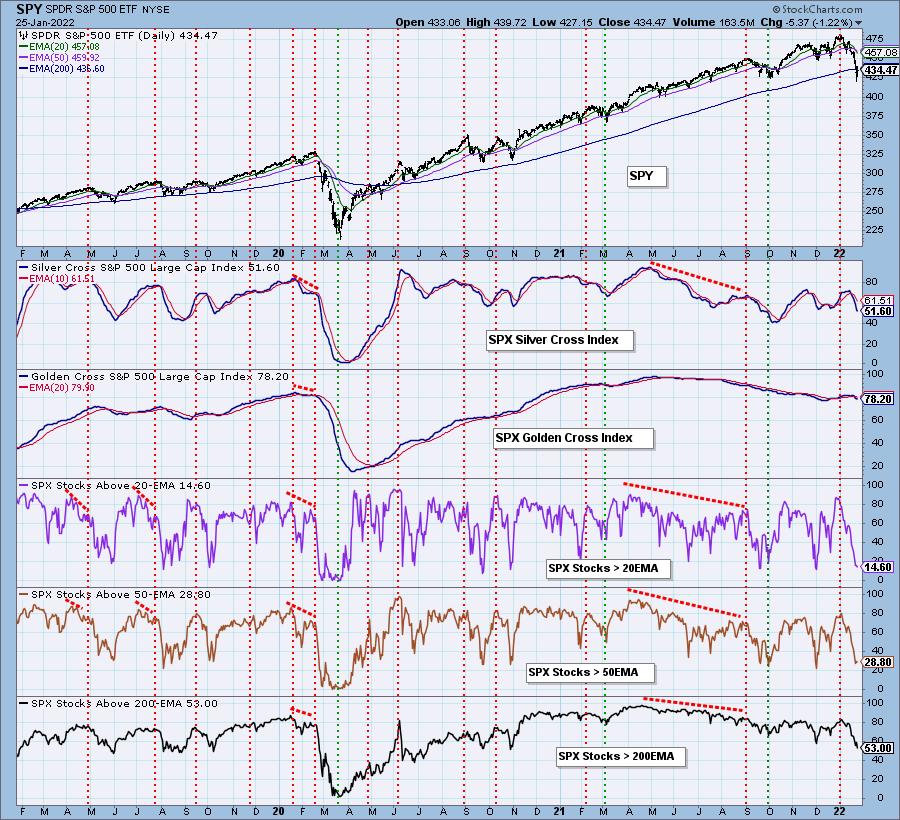

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 15% invested and 85% is in 'cash', meaning in money markets and readily available to trade with.

I'm required to disclose if I currently own a stock and/or may buy it within the next 72 hours.

Happy Charting!

- Erin

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com