Tomorrow I'll be on the StockChartsTV special, "The Pitch". I and two other analysts will present five stocks each that we believe are actionable investments right now. I am presenting you four of my selections. The fifth stock I'll present I already gave to you yesterday, Kraft Heinz Co (KHC). The show airs at 6:00p ET. Of course, as I always say, there are no "sure things".

I decided to bring a mixture of defensive and aggressive picks. Two are from the Healthcare sector, one is a Biotech, one is in Consumer Discretionary and the fifth in Food Products (yesterday's KHC).

Today's "Diamonds in the Rough": CYH, HAIN, ILMN and WHR.

Stocks to Review: INVA, MRCY, BPMC, HACK, UTHR and CYTK.

RECORDING LINK Wednesday (12/10):

Topic: DecisionPoint Diamond Mine (12/10/2021) LIVE Trading Room

Start Time: Dec 10, 2021 09:00 AM

MeetingRecording Link.

Access Passcode: December#10

REGISTRATION FOR Friday 12/17 Diamond Mine:

When: Dec 17, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (12/17/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (12/13) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Dec 13, 2021 09:00 AM

Meeting Recording Link.

Access Passcode: December+13

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Community Health Systems (CYH)

EARNINGS: 2/16/2022 (AMC)

Community Health Systems, Inc. engages in the management and operations of hospitals. It operates general acute care hospitals and related healthcare entities that provide inpatient and outpatient healthcare services. The company was founded in March 1985 and is headquartered in Franklin, TN.

Predefined Scans Triggered: None.

CYH is unchanged in after hours trading. This is in the hot group of HealthCare Providers. Yesterday's MOH was up +2.55% today and it could move higher. After breaking above key moving averages, price is consolidating. The RSI is positive and the PMO is rising toward a new crossover BUY signal. Stochastics are rising strongly and are in positive territory. The group is outperforming the SPY by a mile and CYH is beginning to outperform. I set the stop somewhat arbitrarily at 7.5%. To set it at the December low would have been over 11% and that just doesn't work for me.

The weekly RSI just returned to positive territory. The PMO does have a very bearish top below the signal line, but it is beginning to reverse again. Upside potential is juicy at 29%.

Hain Celestial Group, Inc. (HAIN)

EARNINGS: 2/8/2022 (BMO)

The Hain Celestial Group, Inc. engages in the production and distribution of organic and natural products. Its brands include Alba Botanica, Avalon Organics, Earth's Best, JASON, Live Clean, Imagine, and Queen Helene. The company was founded by Irwin David Simon on May 19, 1993 and is headquartered in Lake Success, NY.

Predefined Scans Triggered: None.

HAIN is unchanged in after hours trading. I've covered HAIN three times on April 1st 2020, July 27th 2020 and September 30th 2021. The first position is still open and up +60.1%, the second position was stopped out and the last position stopped out after reaching a 14% gain on the major breakdown in November.

The chart looks good, but I do note that we haven't seen a breakout above resistance at the August top/late November bottoms. However, it did breakout above the 50-EMA. There is a strong positive OBV divergence. The RSI is now positive and the PMO had a crossover BUY signal today. Stochastics are strongly rising in positive territory. Relative strength studies are bullish. The stop is set below the December low at about 8.4%.

The indicators on the weekly chart are beginning to improve. The weekly RSI hit positive territory and the PMO has turned back up. If it can reach the all-time high, that would be an 18% gain.

Illumina, Inc. (ILMN)

EARNINGS: 2/10/2022 (AMC)

Illumina, Inc. engages in the development, manufacturing, and marketing of life science tools and integrated systems for large-scale analysis of genetic variation and function. It operates through Core Illumina segment, which serves customers in the research, clinical and applied markets, and enable the adoption of a variety of genomic solutions. The firm's products include instruments, kits and reagents, selection tools, and software and analysis. Its services include sequencing and microarray services; proactive instrument monitoring; and instrument services, training, and consulting. The company was founded by David R. Walt, John R. Stuelpnagel, Anthony W. Czarnik, Lawrence A. Bock, and Mark S. Chee in April 1998 and is headquartered in San Diego, CA.

Predefined Scans Triggered: Moved Above Upper Price Channel, P&F Double Top Breakout and P&F Bearish Signal Reversal.

ILMN is up +0.83% in after hours trading. I covered it on June 9th 2021. The position has stopped out, but it was up over 20% at the high. Biotechs keep trying to outperform the market, but so far they haven't really stepped on the gas. I like ILMN. Today it popped above the 50-EMA for the first time since it began this long declining trend. There is a large bullish falling wedge that has been confirmed with this breakout. The PMO is on a crossover BUY signal and the RSI is in positive territory. Stochastics are above 80. Relative strength for ILMN is strong and getting stronger. The stop is somewhat deep so you could tighten it up a bit more if you'd like. I set it at 8.3% as it is halfway down in the prior trading range.

The weekly PMO is beginning to decelerate and the weekly RSI is rising, although not yet in positive territory. Upside potential is fantastic if it can reach its summer highs.

Whirlpool Corp. (WHR)

EARNINGS: 1/26/2022 (AMC)

Whirlpool Corp. engages in manufacturing and marketing of home appliances. Its products include home laundry appliances, refrigerators and freezers, cooking appliances, home dishwashers, and room air-conditioning equipment, mixers, and portable household appliances. The company's brands include Whirlpool, KitchenAid, Maytag, Consul, Brastemp, Amana, Bauknecht, JennAir, and Indesit. It operates through the following segments: North America; Europe, Middle East & Africa; Latin America; and Asia. Whirlpool was founded by Emory Upton, Fred Upton, and Louis C. Upton in 1898 and is headquartered in Benton Harbor, MI.

Predefined Scans Triggered: New CCI Buy Signals, Moved Above Upper Bollinger Band and Moved Above the Upper Price Channel.

WHR is unchanged in after hours trading. This one straddles the line between Staples and Discretionary in my opinion. Durable Household Products seems rather defensive, but it is situated within the aggressive XLY. It had a strong rally today that furthered its breakout above the August top and has now brought it above the November high. The RSI is positive and the PMO just triggered a crossover BUY signal. Stochastics are rising and positive. Relative strength studies suggest it will continue to outperform.

The weekly chart is fantastic. The weekly PMO just triggered a crossover BUY signal and the weekly RSI is positive. It is at all-time highs so I would consider an upside target around 18% or $280.67.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to shoot me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

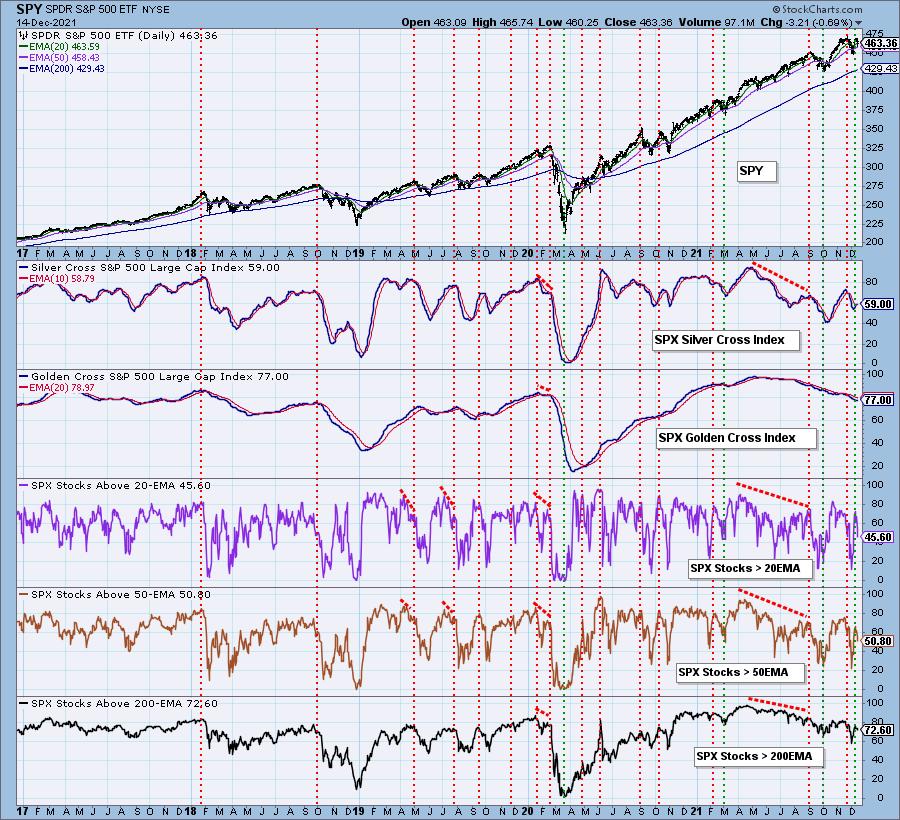

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 10% invested and 90% is in 'cash', meaning in money markets and readily available to trade with.

I'm required to disclose if I currently own a stock and/or may buy it within the next 72 hours.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com