During Friday's Diamond Mine trading room and on the DecisionPoint Show Monday, I noted some industry groups that were looking good going into this week. Two "Diamonds in the Rough" are in outperforming industry groups, Food Products and Healthcare Providers. The last is in Commodity Chemicals, a group that is beginning to outperform.

Busy week! Today I recorded my segment for StockCharts.com's "Top 10 Influential Events/Charts of 2021". I looked at the run up in Crude Oil and Natural Gas. Tomorrow I'll be recording this week's Chartwise Women on the Power of Chart Patterns (the show will air on Thursday at 5p ET). On Thursday, I am a guest on The Pitch where I and two other analysts will be presenting five actionable stock ideas. I'm not sure when that one will air, but I will be sure to put the link in our DP Newsletter on Monday and tweet it out.

Let's dig in.

Today's "Diamonds in the Rough": KHC, MOH and MTX.

RECORDING LINK Wednesday (12/10):

Topic: DecisionPoint Diamond Mine (12/10/2021) LIVE Trading Room

Start Time: Dec 10, 2021 09:00 AM

Meeting Recording Link.

Access Passcode: December#10

REGISTRATION FOR Friday 12/17 Diamond Mine:

When: Dec 17, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (12/17/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (12/6) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Dec 13, 2021 09:00 AM

Meeting Recording Link.

Access Passcode: December+13

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Kraft Heinz Co. (KHC)

EARNINGS: 2/10/2022 (BMO)

The Kraft Heinz Co. engages in the manufacture and market of food and beverage products. The firm operates through the following geographical segments: United States, Canada and International. Its brands include Oscar Meyer, Velveeta, Smart Ones, Caprisun, Kool-Aid, Golden circle and Honig. The company was founded on July 2, 2015 and is headquartered in Pittsburgh, PA.

Predefined Scans Triggered: P&F High Pole.

KHC is up +0.35% in after hours trading. I presented this one on this week's DecisionPoint Show as a "Diamond of the Week". The set up is even better today as we have a confirmed bullish double-bottom on the breakout above the confirmation line. The minimum upside target is around $36.50, but if it gets that far, I would expect it to at least reach resistance at $37.50. The RSI is about to hit positive territory above net neutral (50). The PMO is nearing a crossover BUY signal and Stochastics are rising strongly in positive territory. Relative strength is beginning to pick up for the group as well as KHC. The stop is set below the double-bottom at a thin 6%.

The weekly chart isn't anything to write home about given the falling weekly PMO that just hit negative territory. The weekly RSI is rising but is still firmly stuck in negative territory below net neutral (50). If we do get the rebound that the daily chart suggests, upside potential is over 26%.

Molina Healthcare, Inc. (MOH)

EARNINGS: 2/9/2022 (AMC)

Molina Healthcare, Inc. engages in the provision of health care services. It operates through the Health Plans and Other segments. The Health Plans segment consists of health plans in 11 states and the Commonwealth of Puerto Rico and includes direct delivery business. The Other segment includes the historical results of the MMIS and behavioral health subsidiaries. The company was founded by C. David Molina in 1980 and is headquartered in Long Beach, CA.

Predefined Scans Triggered: P&F Low Pole.

MOH is unchanged in after hours trading. I like Healthcare Providers. Their relative strength is pushing higher quickly. We have a "V" bottom that has already retraced halfway; you only need for a 33% retracement to confirm the pattern. The pattern's expectation is a breakout above the left side of the "V". The RSI is positive and the PMO is nearing a crossover BUY signal in oversold territory. Stochastics are rising nicely. While MOH is only performing in line with the group, given the group is taking off, we can see MOH is performing spectacularly against the SPY. The stop is set at 7.8% to match up with the August top, but if you have a higher risk appetite, you can move it below the "V".

The weekly RSI is positive and price has been on a steady rising trend. The PMO is very flat but that is indicative of the steady rising trend. There is no acceleration so the PMO flattens and that is okay. We are already near all-time highs, so I'd set an upside target at about 18% or $361.30.

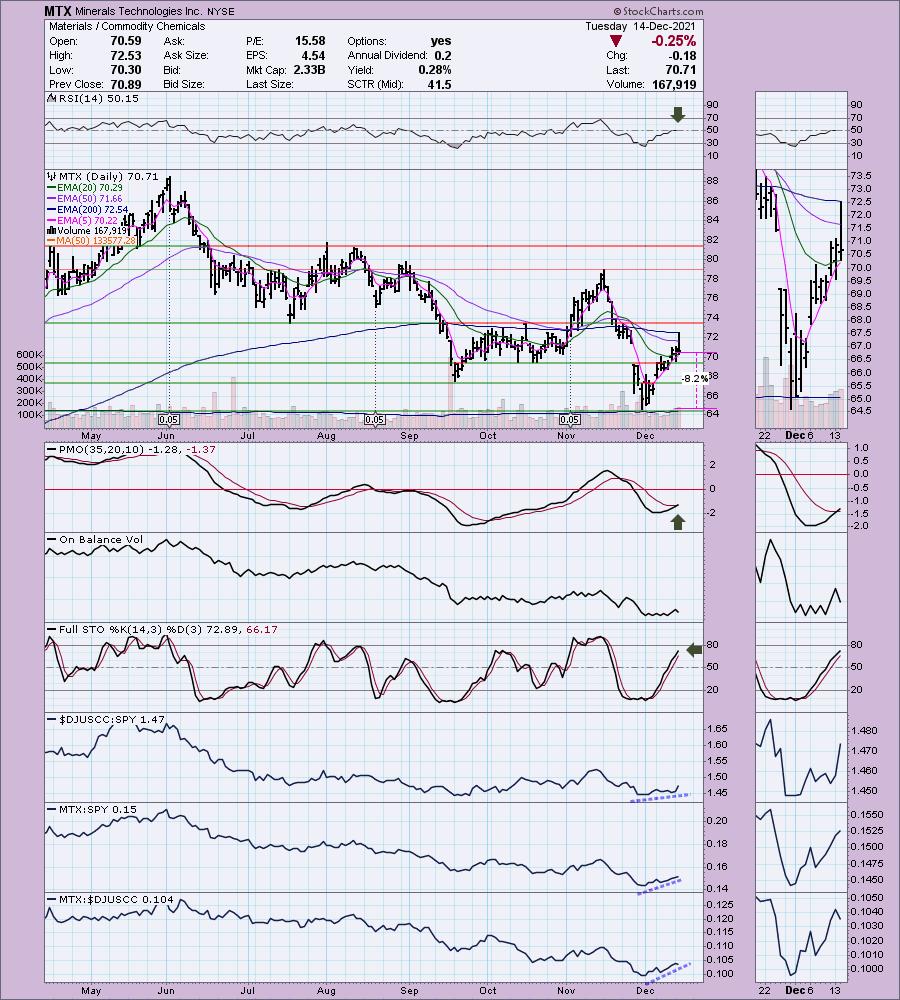

Minerals Technologies Inc. (MTX)

EARNINGS: 2/3/2022 (AMC)

Minerals Technologies, Inc. is a resource and technology-based company. It develops, produces, and markets a range of mineral, mineral-based, and synthetic mineral products. It operates through the following four segments: Performance Materials, Specialty Minerals, Refractories and Energy Services. The Performance Materials segment supplies bentonite and bentonite-related products, chromite and leonardite. The Specialty Minerals segment produces and sells the synthetic mineral product precipitated calcium carbonate and processed mineral product quicklime, and mines mineral ores then processes and sells natural mineral products, primarily limestone and talc. The Refractories segment produces monolithic and shaped refractory materials and products, and also provides services and sells application and measurement equipment, and calcium metal and metallurgical wire products. The Energy Services segment provides services to improve the production, costs, compliance, and environmental impact of activities performed in oil & gas industry. The company was founded on February 19, 1968 and is headquartered in New York, NY.

Predefined Scans Triggered: Hollow Red Candles and P&F Low Pole.

MTX is unchanged in after hours trading. I like the set up here. We have another "V" bottom only this one hasn't retraced as far. It has covered the November gap, although it didn't close above it or above the 200-EMA. It's early, but the RSI is now positive and the PMO triggered a crossover BUY signal today. Stochastics are rising nicely and should get above 80 soon. You can see the that the group is gaining relative strength and MTX is outperforming the group and the SPY right now. You could set a deep stop at the bottom of the "V" or you could set a 5.5% stop at the September low.

I note that the PMO is beginning to decelerate. The weekly RSI doesn't look that great. You could make a case for this being a very large bull flag. The best part of the weekly chart is the positive OBV divergence. If it can reach its all-time highs, that would be a 26%+ gain.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to shoot me an email. I read every email I receive and try to answer them all!

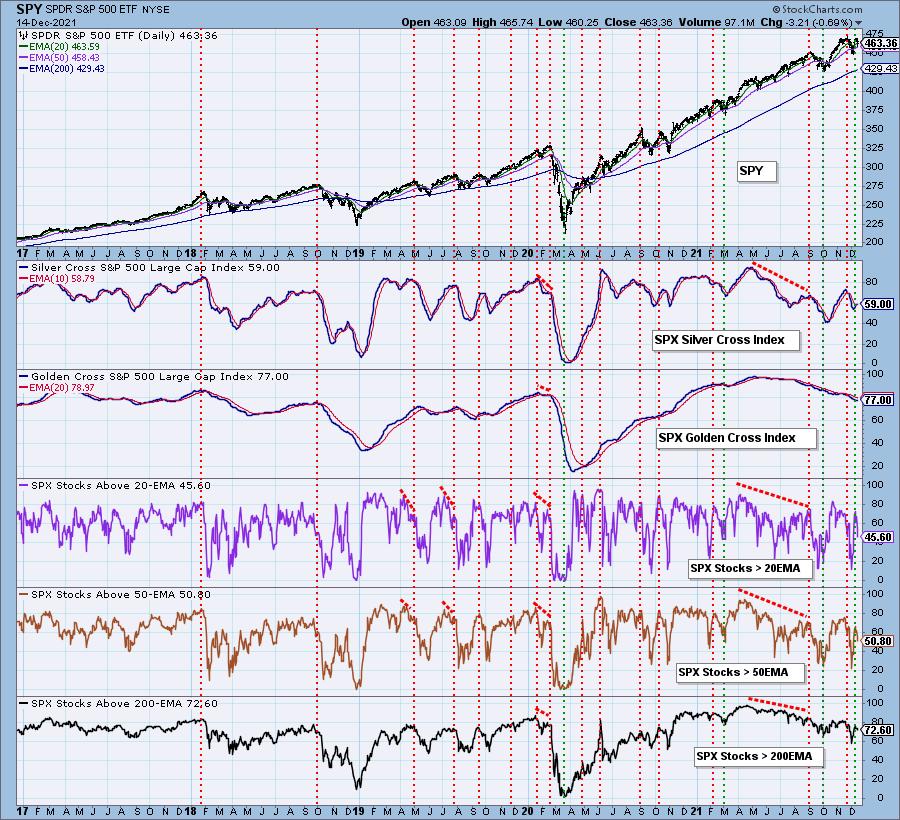

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 10% invested and 90% is in 'cash', meaning in money markets and readily available to trade with.

I'm required to disclose if I currently own a stock and/or may buy it within the next 72 hours.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com