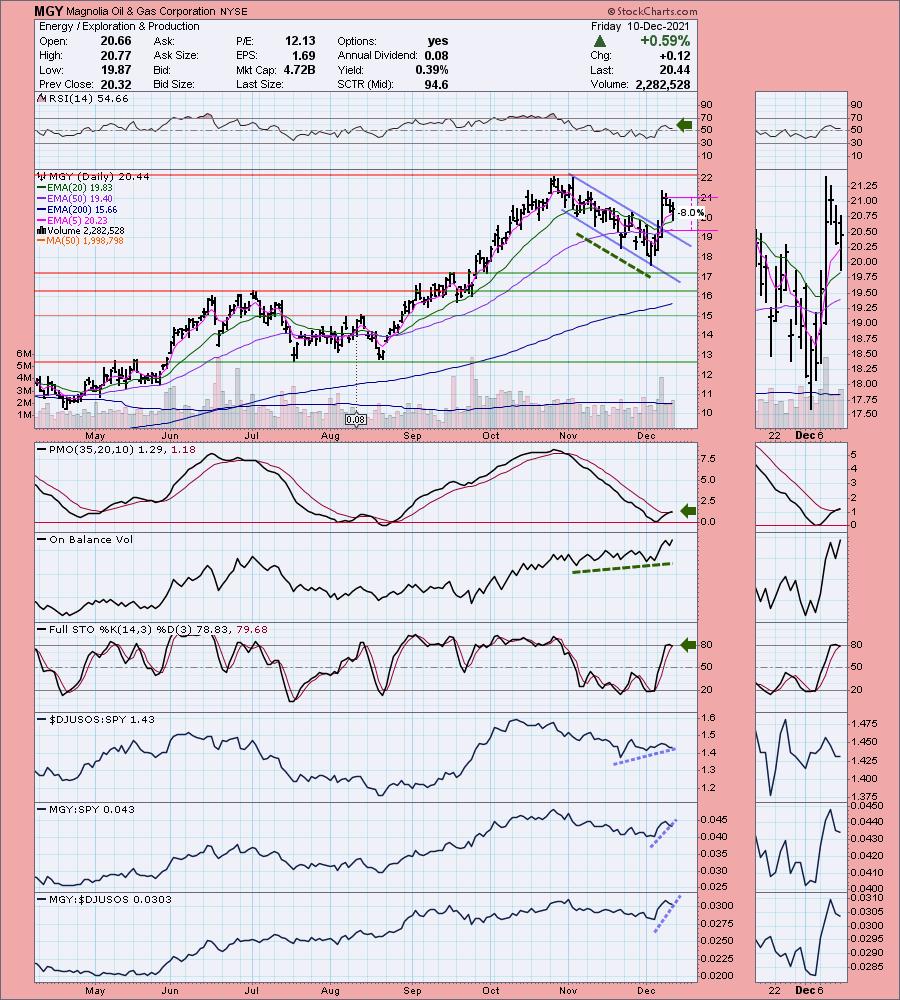

The market rallied this week with the SPY finishing up +3.82% for the week and closing at a new all-time high. It appeared that "Diamonds in the Rough" were going to end the week lower, but the end of day rebound pushed the average into the green. The question is whether we will get follow-through on this week's rally.

I think we could see some follow-through, so if I like price action, I will cautiously expand my exposure. Things are certainly looking up given all sectors except for Discretionary (XLY) are displaying positive momentum. It was only about two or three weeks ago when every sector but a few had negative momentum. I think this bodes well for the market in general.

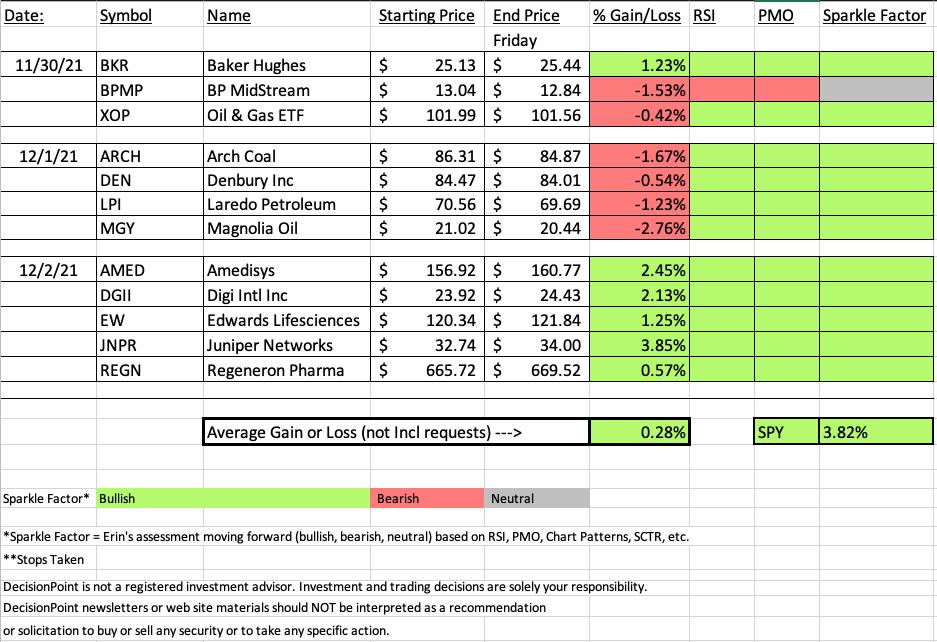

This week's "Darling" is Juniper Networks (JNPR) which I selected yesterday. It is up +3.85% with plenty of upside potential.

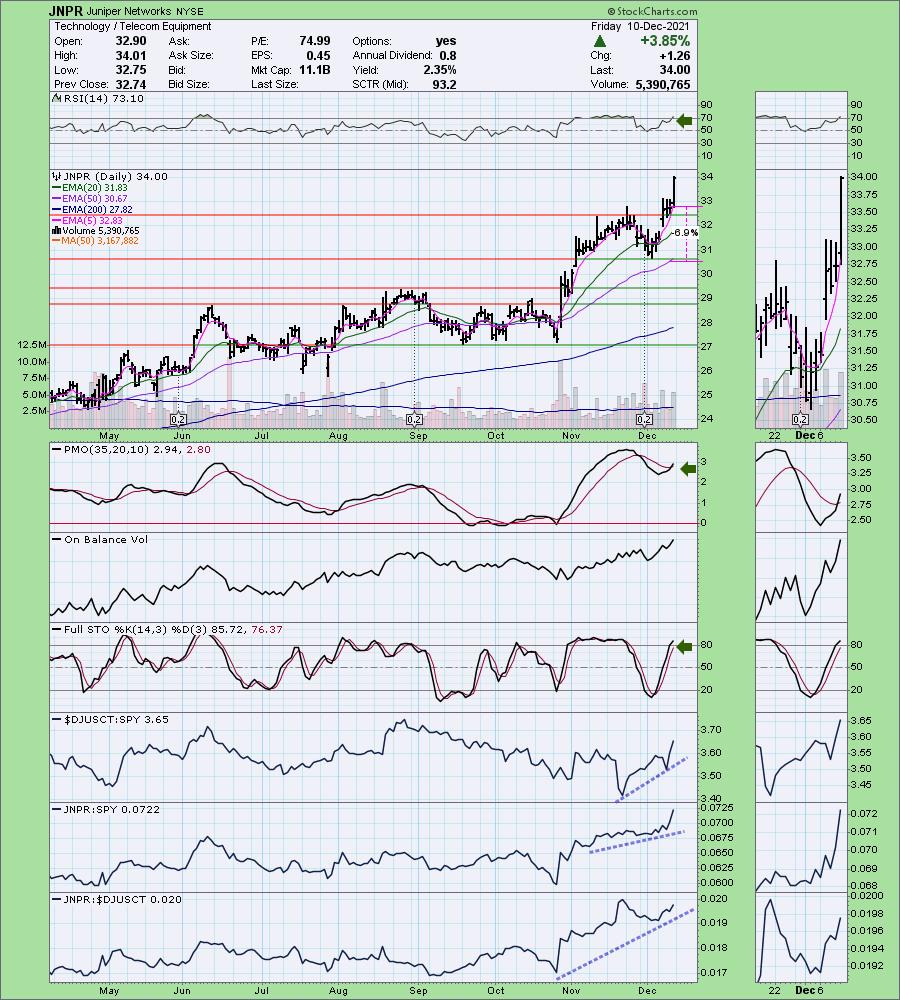

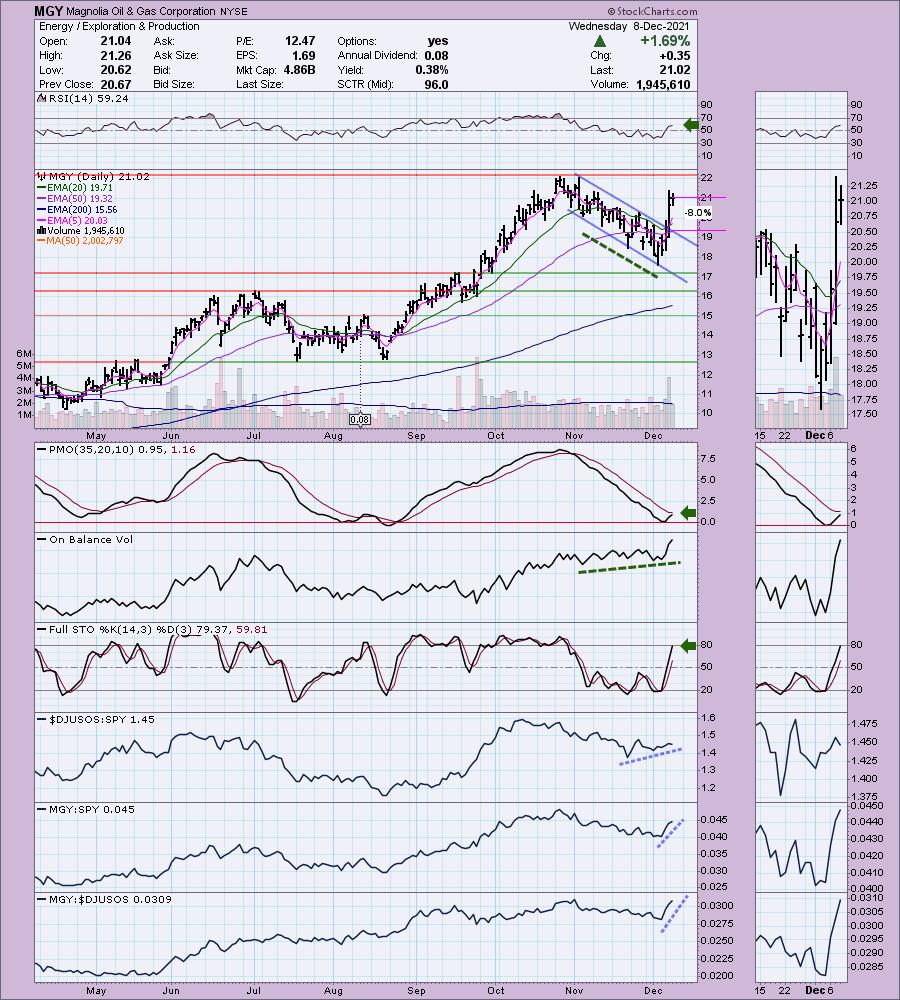

This week's "Dud" was Magnolia Oil (MGY). I went "all in" on Energy stocks early this week and with Crude Oil pulling back, those stocks pulled back too. Still MGY found its way into my scan results for two days after I picked it. It's not so bad.

You'll notice that all but one of the "Diamonds in the Rough" have bullish Sparkle Factors. This means I believe all of these stocks should outperform moving forward despite some of them pulling back. The only one without a bullish factor moving forward is BP Midstream (BPMP), but that is only listed as Neutral.

Just be careful when expanding your exposure next week, while the market is looking a bit better, I still expect some chop and churn.

Hope everyone has great weekend! The next Diamonds report will be on Tuesday of next week.

RECORDING LINK Wednesday (12/10):

Topic: DecisionPoint Diamond Mine (12/10/2021) LIVE Trading Room

Start Time: Dec 10, 2021 09:00 AM

Meeting Recording Link.

Access Passcode: December#10

REGISTRATION FOR Friday 12/17 Diamond Mine:

When: Dec 17, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (12/17/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (12/6) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Dec 6, 2021 09:00 AM

Meeting Recording Link.

Access Passcode: December@6

For best results, copy and paste the access code to avoid typos.

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Juniper Networks (JNPR)

EARNINGS: 1/27/2022 (AMC)

Juniper Networks, Inc. engages in the design, development, and sale of products and services for high-performance networks. Its products address network requirements for global service provides, cloud providers, national governments, research and public sector organizations, and other enterprises. The company was founded by Pradeep S. Sindhu on February 6, 1996 and is headquartered in Sunnyvale, CA.

Predefined Scans Triggered: P&F Double Top Breakout.

Below are the commentary and chart from yesterday (12/9):

"JNPR is up +0.43% in after hours trading. Price broke out and is now consolidating on top of support at all-time highs. The RSI is positive and the PMO is rising toward a crossover BUY signal. Stochastics are rising strongly. Relative strength studies are bullish with JNPR outperforming the group and the SPY. I like that I can set a stop that isn't too deep at 6.9% that aligns with the December low and the 50-EMA."

Here is today's chart:

Huge breakout today made it the "Darling". The chart still looks very favorable. The RSI is now in overbought territory, but we can see that it can maintain a rising trend for a week or two even when overbought. The new PMO crossover BUY signal looks great. Watch for a pullback early next week to bring the RSI out of overbought territory. The 5-minute candlestick chart should offer you an entry opportunity regardless.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Magnolia Oil & Gas Corporation (MGY)

EARNINGS: 2/24/2022 (AMC)

Magnolia Oil & Gas Corp. engages in oil and gas exploration and production business. It operates assets located in the Eagle Ford Shale and Austin Chalk formations in South Texas. The company was founded on July 31, 2018 and is headquartered in Houston, TX.

Predefined Scans Triggered: New CCI Buy Signals and P&F Double Top Breakout.

Below are the commentary and chart from Wednesday (12/8):

"MGY is up +0.14% in after hours trading. It saw a beautiful breakout from a declining trend channel. The RSI is positive and there is an OBV positive divergence. The PMO is about to trigger a crossover BUY signal. Stochastics are rising and relative strength studies are very bullish. I set an 8% stop at the 50-EMA."

Below is today's chart:

May I should've looked at BPMP, I'll add the chart under this one. Although it didn't fall as far, it has a more bearish chart than MGY. Certainly it did pullback considerably after it became a "Diamond in the Rough", but it is perched on the 20-EMA with a flag-ish pattern. The PMO had a crossover BUY signal in spite of the pullback and the RSI remains in positive territory.

Here's a bonus chart of BPMP since it was the only stock that I listed with a "Neutral" Sparkle Factor. Price is sneaking back into the bullish falling wedge. The biggest issue would be the PMO turning down below its signal line and the failure of price to push above the 20/50-EMAs. To add insult to injury we have a negative RSI and topping Stochastics. I listed it as "neutral" going forward because with such a tight stop available we can see whether it holds the 200-EMA. However, I don't think I'd go out and purchase this one if I didn't own it.

THIS WEEK's Sector Performance:

Since it is not technically the end of the week for trading, I don't have the weekly sector performance report. Below is today's results and performance.

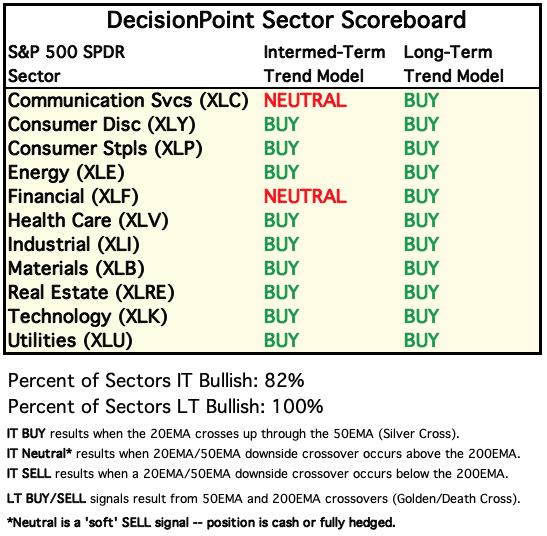

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

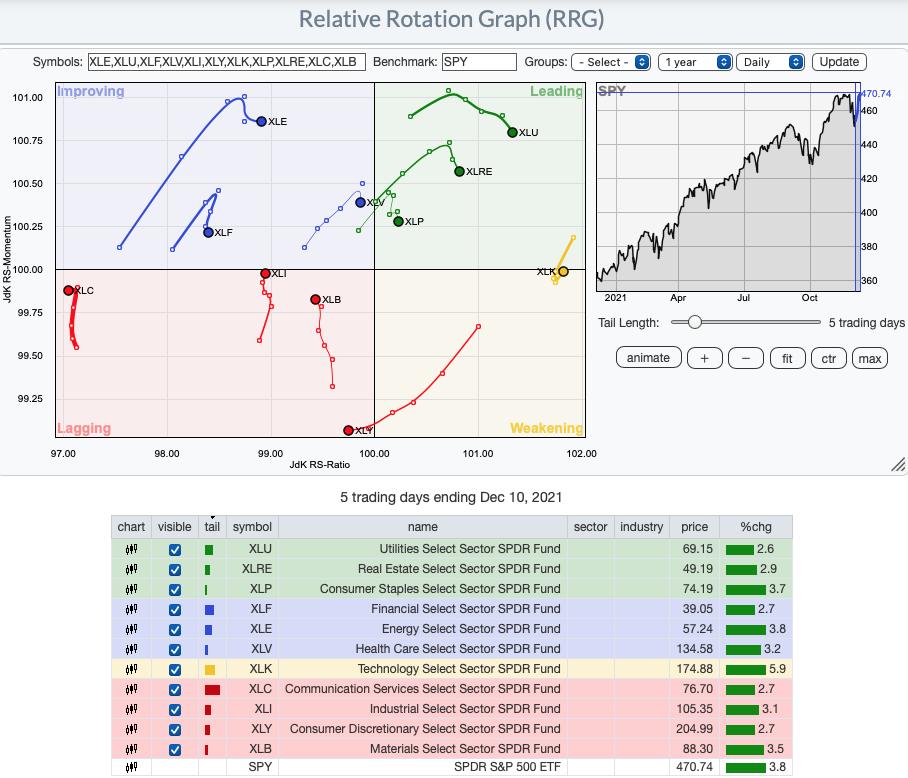

Short-term RRG: While all but XLY have positive momentum, relatively speaking on the daily RRG, the strongest sector is actually XLK. It is Weakening, but has already hooked back around and should hit Leading soon. The defensive XLU, XLRE and XLP are the only residents of Leading. When money rotates into defensive areas of the market, that is usually a last gasp for the market. Technology's outperformance tempers that characterization given it is one of the more aggressive sectors. XLE looks promising as it travels eastward toward Leading. I would avoid Lagging sectors for now, although XLI should hit Improving next week.

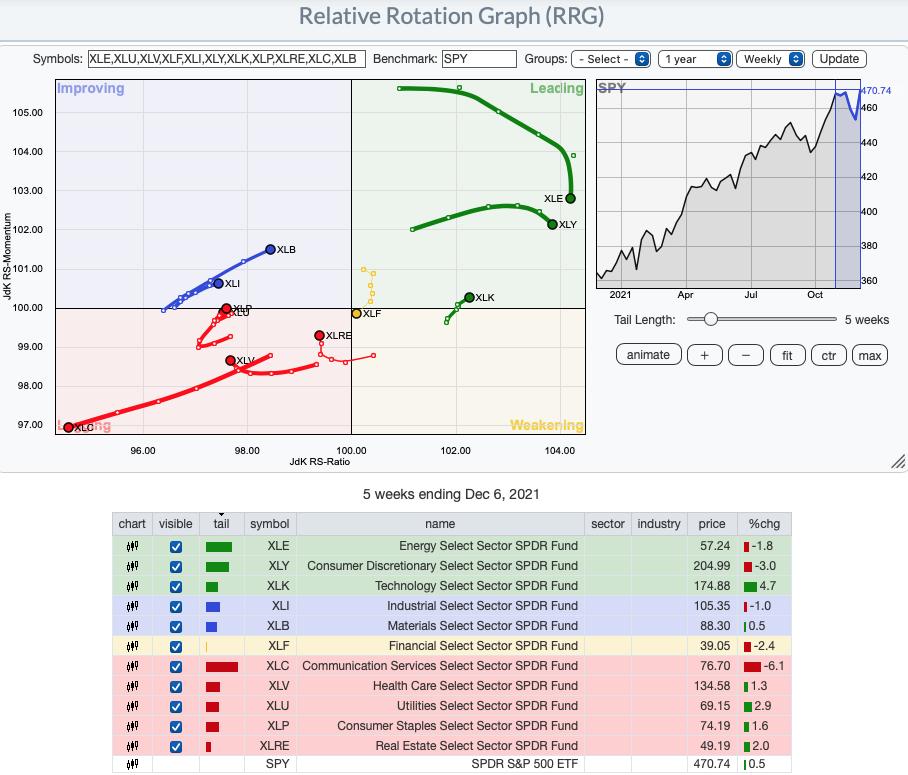

Intermediate-Term RRG: The intermediate-term RRG confirms the daily as far as the strength of XLK. Not far behind are XLI and XLB which are pushing toward Leading out of Improving. XLC is the weakest sector by far. XLF is headed toward Lagging so it is a close runner-up. XLE and XLY are turning over, but still are considered Leading.

Sector to Watch: Technology (XLK)

It was a tie for me this week between Consumer Staples (XLP) and Technology (XLK). Both had breakouts today, but I liked the consistent relative strength of XLK. Basically XLK's relative strength line looked better. XLP's runs fairly flat while XLK has been trending higher since May. Today we had a PMO crossover BUY signal to go along with the breakout. The RSI is positive and Stochastics are above 80 again. Participation is reading higher than the SCI. This gives XLK a bullish bias in the short term. Participation numbers also have room to move higher.

Industry Group to Watch: Telecom Equipment ($DJUSCT)

I discussed yesterday that this industry group was providing plenty of choices within my scan results. Our "Darling" this week is from this industry group. We saw a strong breakout for the group today. The PMO is on a BUY signal and the RSI is positive and not overbought. Stochastics are above 80 and relative performance has already been excellent.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend & Happy Charting! The next Diamonds Report is Tuesday 12/14.

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 10% exposed to the market.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2021 DecisionPoint.com