Scans are producing more results, but so many of them are overbought given they've seen 5% to 10% gains in the past two days. I was selective, but I do have plenty of "Stocks to Review" that you can sort through.

Healthcare is still dominating the scan results, particularly Pharma, Medical Supplies and Medical Equipment. Banks were strongly represented in the results today, but I just didn't like the setups and I'm still not seeing the kind of industry group strength we should see. I did find a Financial stock for you to look at. It has one of the best setups of the day.

I am still not expanding my exposure to equities and remain at 10% exposed. I don't trust this rally yet.

Don't forget that this week's Diamond Mine trading will be held TOMORROW! Registration information is below.

THIS WEEK's HOLIDAY SCHEDULE:

I will present five "Diamonds in the Rough" Tuesday/Wednesday. On Thursday, we will hold the Diamond Mine and I will do a Recap of the ten stocks picked this week.

Today's "Diamonds in the Rough": A, ANGO, ATLC, BLFS and MDGL.

"Stocks to Review": TNL, WSFS, TTGT, TGI, FLNG, AVXL, CENT, STL, SUPN, CERE, SPPP, LGND and TVTY.

RECORDING LINK Friday (12/17):

Topic: DecisionPoint Diamond Mine (12/17/2021) LIVE Trading Room

Start Time: Dec 17, 2021 09:00 AM

MeetingRecording Link.

Access Passcode: December@17

REGISTRATION FOR Thursday 12/23 Diamond Mine:

When: Dec 23, 2021 09:00 PM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (THURSDAY, 12/23/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

There was no free trading room on 12/20.

Free DP Trading Room (12/13) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Dec 13, 2021 09:00 AM

Meeting Recording Link.

Access Passcode: December+13

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Agilent Technologies, Inc. (A)

EARNINGS: 2/15/2022 (AMC)

Agilent Technologies, Inc. engages in the provision of application focused solutions for life sciences, diagnostics, and applied chemical markets. It operates through the following segments: Life Sciences and Applied Markets; Diagnostics and Genomics; and Agilent CrossLab. The Life Sciences and Applied Markets segment offers application-focused solutions that include instruments and software that enable to identify, quantify, and analyze the physical and biological properties of substances and products, as well as the clinical and life sciences research areas to interrogate samples at the molecular and cellular level. The Diagnostics and Genomics segment consists of activity providing active pharmaceutical ingredients for oligo-based therapeutics, as well as solutions that include reagents, instruments, software and consumables. The Agilent CrossLab segment includes startup, operational, training and compliance support, software as a service, and asset management and consultative services. The company was founded in May 1999 and is headquartered in Santa Clara, CA.

Predefined Scans Triggered: New CCI Buy Signals and Entered Ichimoku Cloud.

A is down -0.26% in after hours trading. Price broke out above the 50-EMA, but hasn't quite executed the bullish double-bottom pattern. It will need to get above the December high to do that. The chart is configured positively so I believe it will trigger the pattern soon. The RSI just moved into positive territory and the PMO just generated a crossover BUY signal. Stochastics are rising and are in positive territory. I like the short-term positive OBV divergence. Those positive divergences typically lead to a sustained rally. Relative strength for the industry group is improving. A is outperforming both the group and the SPY. I set the stop below the 200-EMA and double-bottoms.

The pullback landed on the 43-week EMA. This week (so far) it is above the 17-week EMA. The weekly RSI is positive and rising. The weekly PMO still declining but could be decelerating right now. Upside potential if it can challenge all-time highs is just over 16%.

AngioDynamics Inc. (ANGO)

EARNINGS: 1/6/2022 (BMO)

AngioDynamics, Inc. is a medical device company, which engages in the development, manufacture, and sale of medical devices for vascular access, surgery, peripheral vascular disease, and oncology. It offers ablation systems, fluid management systems, vascular access, angiographic, drainage. thrombolytic, and venous products. The company was founded by Eamonn P. Hobbs on February 9, 1988 and is headquartered in Latham, NY.

Predefined Scans Triggered: New CCI Buy Signals, P&F High Pole and Entered Ichimoku Cloud.

ANGO is unchanged in after hours trading. We have a bullish "V" bottom pattern. The RSI is back in positive territory. The PMO triggered a crossover BUY signal today. Stochastics are rising in positive territory. The group is outperforming again and ANGO is a strong performer within the group as well as against the SPY. The stop is set at the October low that I marked.

The weekly chart shows a nice bounce off the 43-week EMA. It has just popped above the 17-week EMA. The weekly RSI is positive and the weekly PMO has turned up. Upside potential is 16% if it reaches all-time highs.

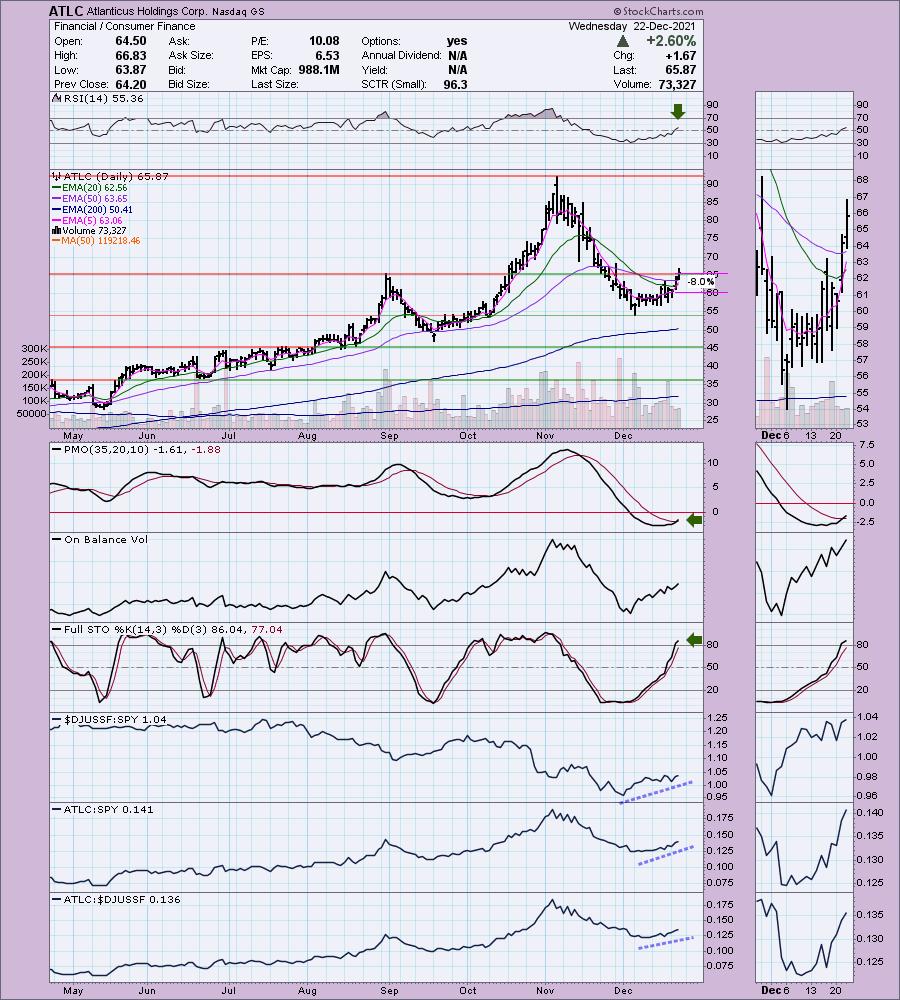

Atlanticus Holdings Corp. (ATLC)

EARNINGS: 3/31/2022 (AMC)

Atlanticus Holdings Corp. is a financial holding company, which engages in the provision of financial technology and related services. It operates through the Credit and Other Investments; and Auto Finance segments. The Credit and Other Investments segment includes point-of-sale and direct-to-consumer finance operations, investments in and servicing of its credit card receivables portfolios, product development, and limited investment in consumer finance technology platforms that capitalize on its credit infrastructure. The Auto Finance segment offers purchases and services loans secured by automobiles from or for a pre-qualified network of independent automotive dealers and automotive finance companies in the buy-here, pay-here used car business. The company was founded by David G. Hanna in August 1996 and is headquartered in Atlanta, GA.

Predefined Scans Triggered: New CCI Buy Signals, Moved Above Upper Bollinger Band, P&F Ascending Triple Top Breakout and P&F Double Top Breakout.

ATLC is down -1.28% in after hours trading. Even so, a pullback of -1.28% still would have price above the 50-EMA. It did break above resistance at the August top and I always like a saucer shaped bottom that goes along with a saucer shaped PMO. The PMO just triggered a crossover BUY signal. The RSI just reached positive territory. The OBV is confirming the rally. This group is outperforming and ATLC is outperforming both the group and SPY. The stop is set at the December tops at $60.

The breakout looks good on the weekly chart. At first I thought the pattern might be parabolic, but it is on a fairly steady rising trend. The trend get steeper, but isn't vertical. The weekly RSI is positive, but the PMO hasn't reversed yet. If it can hold this breakout, the only overhead resistance left is the all-time high. Should price reach that level it would be an over 40% gain.

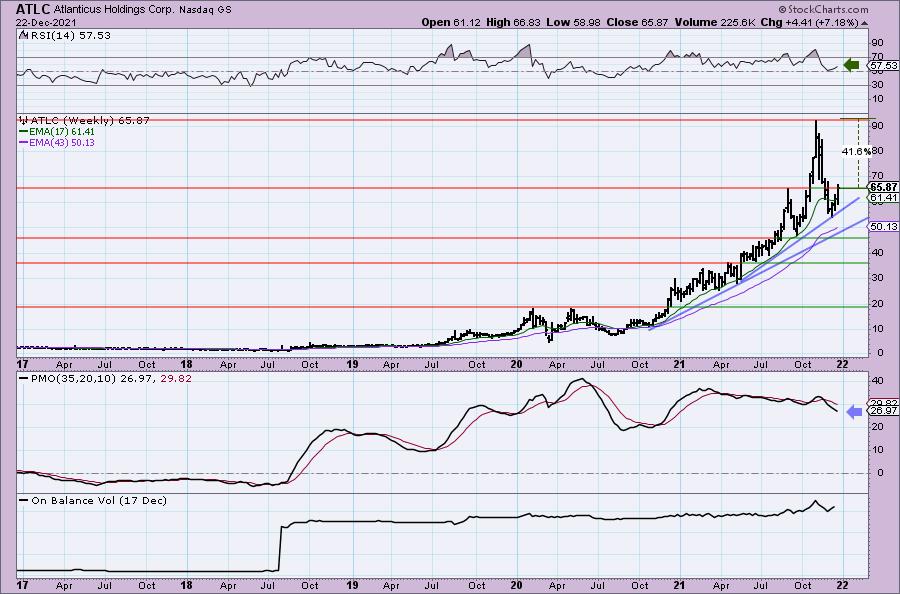

BioLife Solutions Inc. (BLFS)

EARNINGS: 2/10/2022 (AMC)

BioLife Solutions, Inc. engages in the development, manufacture and marketing of bio preservation tools for cells and tissues. Its product offerings include proprietary hypothermic storage and cryopreservation freeze media products for cells, tissues, and organs, generic blood stem cell freezing and cell thawing media products and custom product formulation and custom packaging services. The company was founded by Boris Rubinsky in 1987 and is headquartered in Bothell, WA.

Predefined Scans Triggered: P&F Double Top Breakout and P&F Bearish Signal Reversal.

BLFS is unchanged in after hours trading. I covered BLFS back on July 7th 2020. The position is still open and is up 124.1%. One I wish I'd bought for sure. It's lining up favorably again. The one major detractor is the "Death Cross" of the 50/200-EMAs which appears imminent. The rest of the chart looks great. The RSI just hit positive territory. The PMO just triggered a crossover BUY signal and Stochastics are rising strongly above 80. There is a very positive OBV divergence leading into the current rally. Relative strength studies are bullish. The stop is set at 8.2% which would bring price to the middle of the support resistance zone I annotated between the April top and October bottom.

The weekly RSI is still negative, but it is rising toward positive territory. The weekly PMO is decelerating, but is still in decline. Still, if price can reach the early 2021 highs, that would be an over 20% gain.

Madrigal Pharmaceuticals, Inc. (MDGL)

EARNINGS: 2/24/2022 (BMO)

Madrigal Pharmaceuticals, Inc. engages on the development and commercialization of innovative therapeutic candidates for the treatment of cardiovascular, metabolic, and liver diseases. Its lead product, MGL-3196, is used for the treatment of non-alcoholic steatohepatitis and familial hypercholesterolemia. The company was founded by Rebecca Taub and Edward Chiang on September 2011 and is headquartered in Fort Washington, PA.

Predefined Scans Triggered: New CCI Buy Signals, P&F Double Top Breakout and P&F Triple Top Breakout.

MDGL is up +2.68% in after hours trading so this one could be a "runner". I covered it back at the beginning of the bear market on March 5th 2020 so it is no surprise the stop was hit fairly quickly. I like today's big breakout above the 50-EMA. There is a new ST Trend Model BUY signal as the 5-EMA crossed above the 20-EMA. The PMO just triggered a crossover BUY signal and the RSI has hit positive territory. Stochastics are also configured bullishly. My one gripe is the reverse divergence with the OBV. We have a LOT of volume coming in and yet price hasn't tested the November top. I am not kicking it out of bed over the OBV as the rest of the chart is very positive. Relative strength is great except for the tipping over of the Pharma industry group. The stop is set below the 20-EMA.

The weekly RSI is negative but improving. The weekly PMO is flat but is still holding a crossover BUY signal. If price reaches the early 2021 lows that would be a 24%+ gain. If that area of resistance is broken, the next level of resistance is at $125 which is an over 50% gain. If it can reach the 2021 high, that would be an over 73% gain.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to shoot me an email. I read every email I receive and try to answer them all!

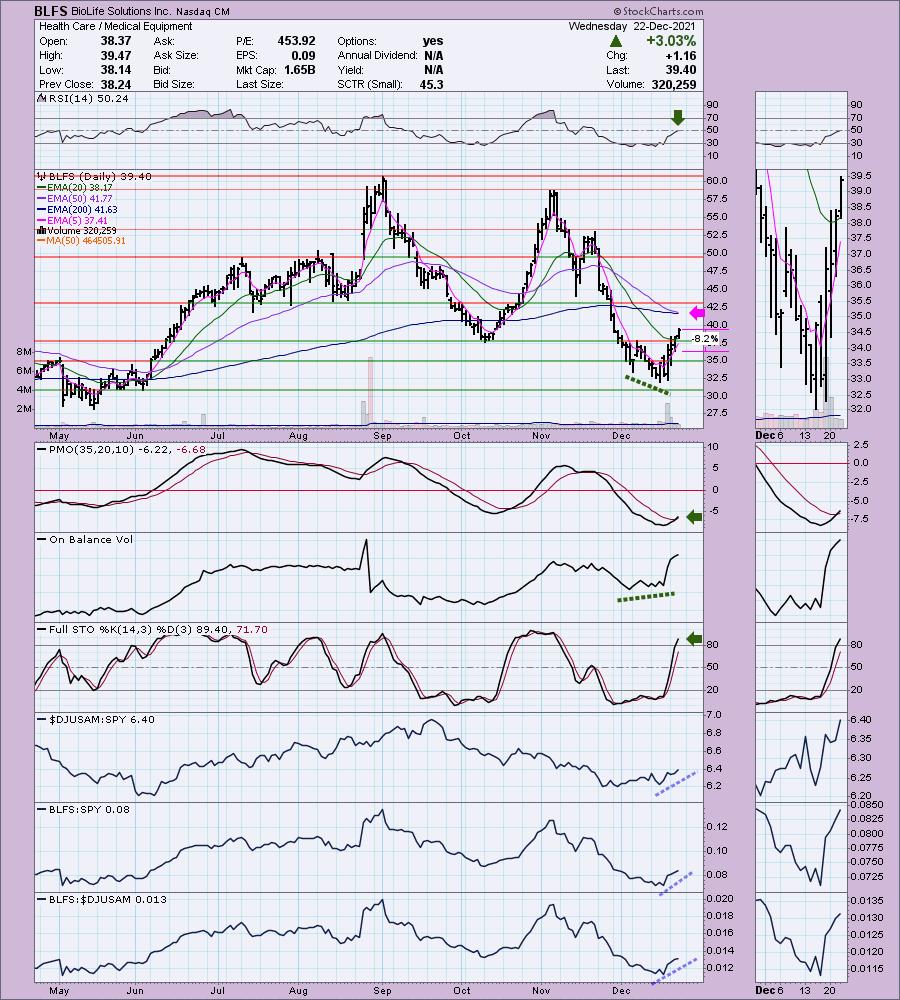

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 10% invested and 90% is in 'cash', meaning in money markets and readily available to trade with.

I'm required to disclose if I currently own a stock and/or may buy it within the next 72 hours.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com