Today I found a few charts that display what I call a "scooping" PMO. This means that the PMO has taken its time on its reversal as it nears a crossover BUY signal in oversold territory. These don't all work out, but the stage is set for some upside.

The last one is a specialty retailer in the home improvement area. Tractor Supply (TSCO) has a nice looking chart as it continues to flirt with new all-time highs.

Don't forget to send me symbols of charts that you are curious about right now for Reader Request Thursday tomorrow!

Today's "Diamonds in the Rough" are: AMEH, HMC and TSCO.

"Stocks to Review" from my short list are: AMZN, CWK, DCP, HD, TRNO and WPC.

RECORDING LINK Friday (9/3):

Topic: DecisionPoint Diamond Mine (09/03/2021) LIVE Trading Room

Start Time : Sep 3, 2021 09:00 AM

Meeting Recording Link.

Access Passcode: Sept-3rd

REGISTRATION FOR FRIDAY 9/10 Diamond Mine:

When: Sep 10, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (9/10/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Julius de Kempenaer joined Erin in the free DP Trading Room this week! The recording link is below:

Free DP Trading Room (9/7) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Sep 7, 2021 09:00 AM PT

Meeting Recording Link HERE.

Access Passcode: Sept@7th

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "Diamonds in the Rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

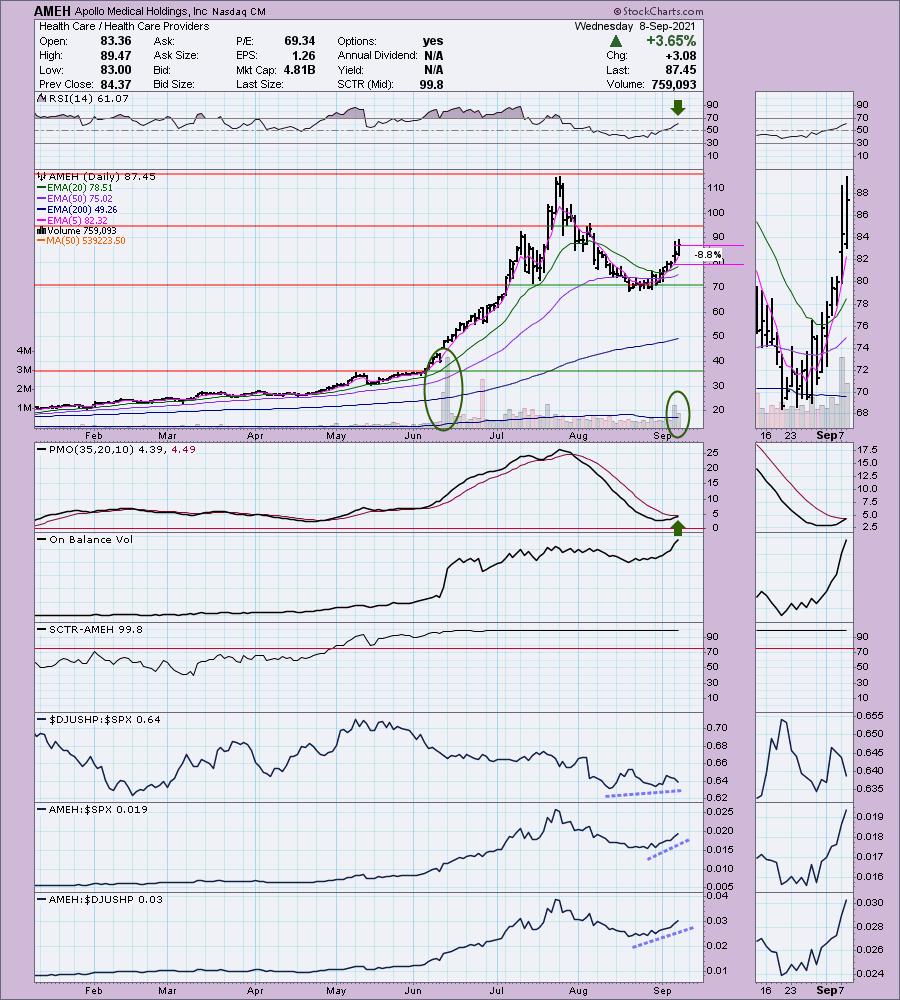

Apollo Medical Holdings, Inc (AMEH)

EARNINGS: 11/3/2021 (AMC)

Apollo Medical Holdings, Inc. is a physician-centric, technology-powered, risk-bearing healthcare management company. It focuses on providing population health management and healthcare delivery platform. The company operates as an integrated, value-based healthcare model, which aims to empower the providers in its network to deliver the highest quality of care to its patients in a cost-effective manner. Apollo Medical Holdings was founded on November 1, 1985 and is headquartered in Alhambra, CA.

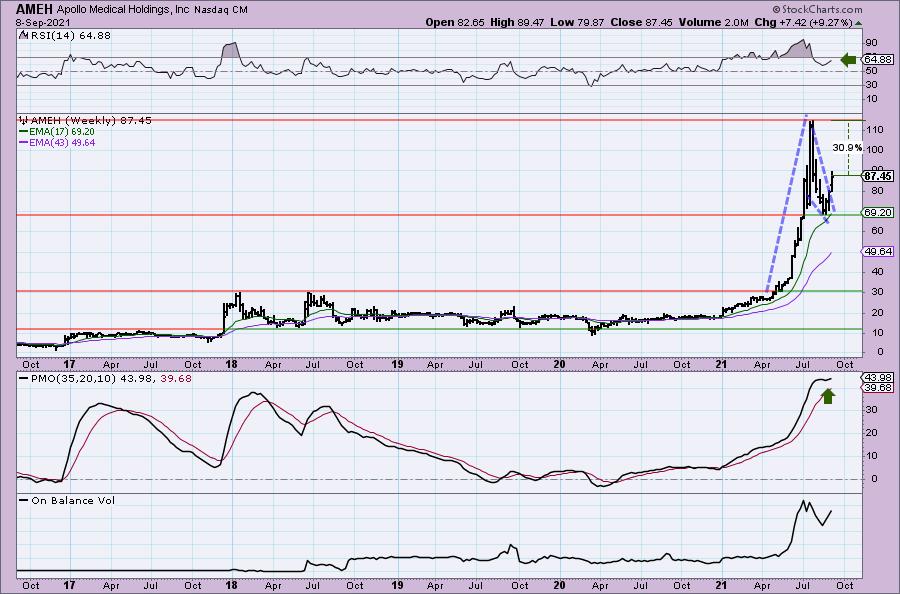

AMEH is up a big +2.86% in after hours trading so we may have found a good one here. Hopefully it will offer a good opportunity for a pick up tomorrow. This chart suggests price will be moving higher. The PMO is "scooping" up toward an oversold BUY signal. The RSI is positive and not overbought. Price sailed and then corrected. After reaching important support at the 50-EMA it began to make its run back toward all-time highs. Notice the high volume on the original breakout back in June. While we don't have volume coming in to that degree, we are seeing strong volume patterns right now. The SCTR can't get much better and relative strength is positive. I've set the stop near the 20-EMA.

The weekly chart sports a large bullish flag formation and this week it is executing the pattern with a strong breakout. The weekly PMO is overbought, but it has topped well-above the signal line which is positive. The weekly RSI is positive and not overbought. Upside potential is excellent should it get back to those all-time highs.

Honda Motor Co. Ltd. (HMC)

EARNINGS: 11/5/2021 (BMO)

Honda Motor Co., Ltd. engages in the manufacture and sale of automobiles, motorcycles, and power products. It operates through the following segments: Automobile, Motorcycle, Financial Services, and Power Product and Other Businesses. The Automobile segment manufactures and sells automobiles and related accessories. The Motorcycle segment handles all-terrain vehicles, motorcycle business, and related parts. The Financial Services segment provides financial and insurance services. The Power Product and Other Businesses segment offers power products and relevant parts. The company was founded by Soichiro Honda on September 24, 1948 and is headquartered in Tokyo, Japan.

HMC is down -0.58% in after hours trading. Based on relative strength, we can see that the auto industry group is slowly outperforming the SPX. HMC is doing about as well as the group, but is showing nice strength against the SPX. Volume has been coming in on the current rally. I like the pullback to support and the subsequent rally. The RSI is now positive and the PMO is "scooping" up and has triggered a crossover BUY signal. The 5-EMA is about to cross above the 20-EMA for a ST Trend Model BUY signal. Price is now up against overhead resistance at the 50-EMA and the June/July lows (also March through May tops). This may be the point that it consolidates the rally, but given the indicators, I would expect it to get back up to last month's highs. The stop can be set conservatively at 6.8% or less.

The weekly chart is okay. The weekly RSI has hit positive territory, but the PMO is still moving lower with little to no deceleration visible. If price can reach the high from 2018 that would be a nearly 19% gain.

Tractor Supply Co. (TSCO)

EARNINGS: 10/21/2021 (BMO)

Tractor Supply Co. engages in the retail sale of farm and ranch products. It operates retail farm & ranch stores and focuses on supplying the lifestyle needs of recreational farmers and ranchers, as well as tradesmen and small businesses. The firm operates the retail stores under the names: Tractor Supply Company, Del's Feed & Farm Supply, and Petsense. Its product categories includes equine, livestock, pet, and small animal; hardware, truck, towing, and tool; heating, lawn and garden items, power equipment, gifts, and toys; recreational clothing and footwear; and maintenance products for agricultural and rural use. The company was founded by Charles E. Schmidt, Sr. in 1938 and is headquartered in Brentwood, TN.

TSCO is unchanged in after hours trading. I covered TSCO as a reader request in the October 8th 2020 issue. Unfortunately price hit overhead resistance at that time and turned back down, eventually triggering the 8.8% stop. After that... well is began a climb that would take it to where we are today. It's hitting overhead resistance again which does give me pause, but with a positive RSI and a bottom above the signal line on the PMO, I still like it. The SCTR is now entering the "hot zone" above 75 (meaning it is in the upper quartile of all large-cap stocks in the intermediate and long terms). Relative strength is positive. I'm expecting a breakout here, but you can set a 6% stop in case it doesn't.

Price is hovering around all-time highs. The weekly RSI is positive and the weekly PMO is turning back up.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm about 70% invested and 30% is in 'cash', meaning in money markets and readily available to trade with.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com