This week's "Diamonds in the Rough" shined up nicely with only three positions finishing in the red. The Diamond Mine went long today, but we covered a lot of ground. Be sure and take a look at the recording.

I did add some positions today, but I also closed a few so my exposure didn't change too much. I'm about 35% exposed right now. Of this week's "Diamonds in the Rough", I did purchase Twilio (TWLO). I also purchased one of yesterday's "Stocks to Review", Tandem Diabetes (TNDM). I like the Healthcare sector going into next week and TNDM has a nice bullish chart.

The "Darling" this week is DR Horton (DHI) the Home Builder that I presented on Wednesday. I was very happy to see Wednesday's stocks have a good finish this week as I presented them at my webinar for Synergy Traders that evening. If you didn't register, you normally wouldn't get the recording of my "Under the Hood" Indicators webinar, but they kindly sent me the recording link so I am sharing it with my subscribers. My presentation was the last one on Day 2 of the conference. Here is the link for Day 1 and Day 2.

Technically the "Dud" this week was Anixa Bioscience (ANIX) down -2.30%, but given it is a low-priced stock and also still looks good moving forward, I will be going over what I believe was the real dud this week, Flower Foods (FLO) which was down -1.58%. It is only stock this week that is showing all "red" as far as PMO, RSI and Sparkle Factor. If you did get into this one, I would take the loss and move on.

Here is the link to next Friday's Diamond Mine trading room.

RECORDING LINK Friday (7/16):

Topic: DecisionPoint Diamond Mine (7/16/2021) LIVE Trading Room

Start Time : Jul 16, 2021 09:02 AM

Meeting Recording Link.

Access Passcode: July-16th

RECORDING LINK Friday (7/23):

Topic: DecisionPoint Diamond Mine (07/23/2021) LIVE Trading Room

Start Time : Jul 23, 2021 09:00 AM

Recording link for 7/23 Diamond Mine is HERE.

Access Passcode: July/23rd

REGISTRATION FOR FRIDAY 7/23 Diamond Mine:

When: Jul 30, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (7/30/2021) LIVE Trading Room

Register in advance for the 7/30 Diamond Mine HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room with Leslie Jouflas, CMT--RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Jul 12, 2021 08:41 AM

Meeting Recording Link.

Access Passcode: W72^WzSb

Free DP Trading Room from Monday, July 19th Recording Link:

Topic: DecisionPoint Trading Room

Start Time : Jul 19, 2021 08:57 AM

Meeting Recording Link for 7/19 free DP Trading Room HERE.

Access Passcode: July/19th

For best results, copy and paste the access code to avoid typos.

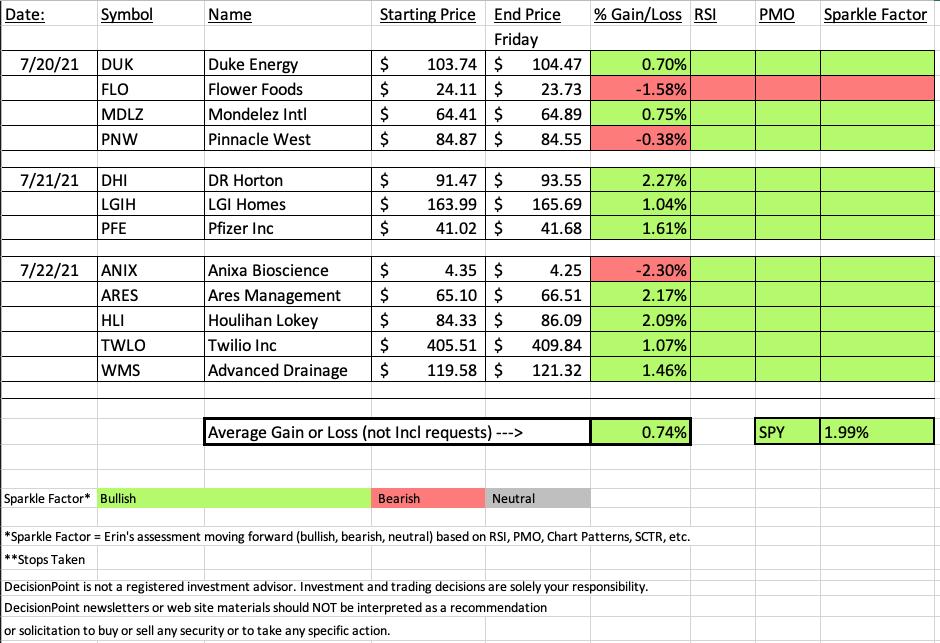

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

DR Horton Inc. (DHI)

EARNINGS: 11/9/2021 (BMO)

D.R. Horton, Inc. engages in the construction and sale of single-family housing. It operates through the following segments: Homebuilding and Financial Services. The Homebuilding segment includes the sub-segments East, Midwest, Southeast, South Central, Southwest and West regions. The Financial Services segment provides mortgage financing and title agency services to homebuyers in many of its homebuilding markets. The company was founded by Donald Ray Horton in 1978 and is headquartered in Arlington, TX.

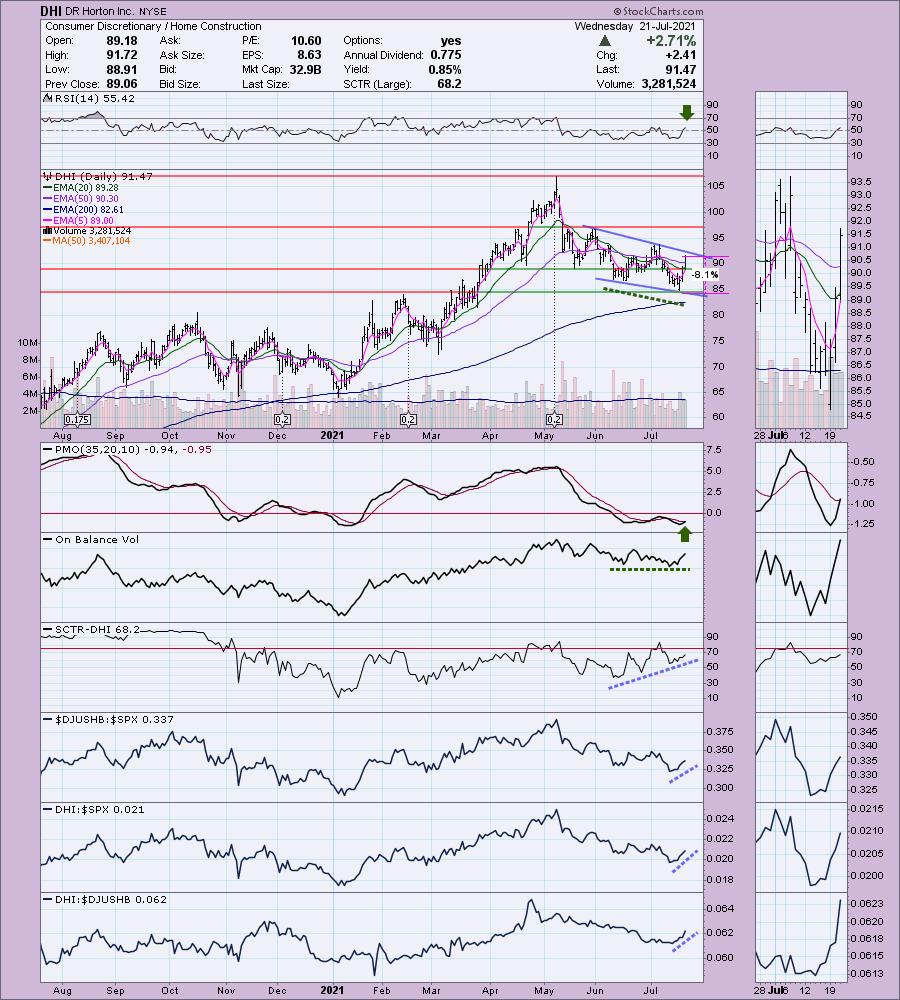

Below is the commentary and chart from Wednesday 7/21:

"DHI is up +0.19% in after hours trading. It does report earnings tomorrow, so you'll definitely want to watch how investors handle it before entering. I covered DHI in the January 19th 2021 DP Diamonds Report. Even with the correction from the May top, the original position would still be open and sitting on a +28.3% gain right now. Home Builders were definitely a big winner for Diamonds back in January. As the fine print always says, "Past performance is no guarantee of future results", but I do have to say it is poised to breakout again. The RSI is now in positive territory and not overbought. Price is in a bullish falling wedge, although it hasn't executed the pattern with a breakout yet. The PMO is on a new crossover BUY signal and the OBV while not in a perfect positive divergence, it is showing flat lows in comparison to declining lows on price. Relative performance is very good. The SCTR is trending toward the "hot zone" above 75. The stop level is deeper than I like it given the market is shaky right now, but you could also tighten it up to about 4% and be just below the April/May lows."

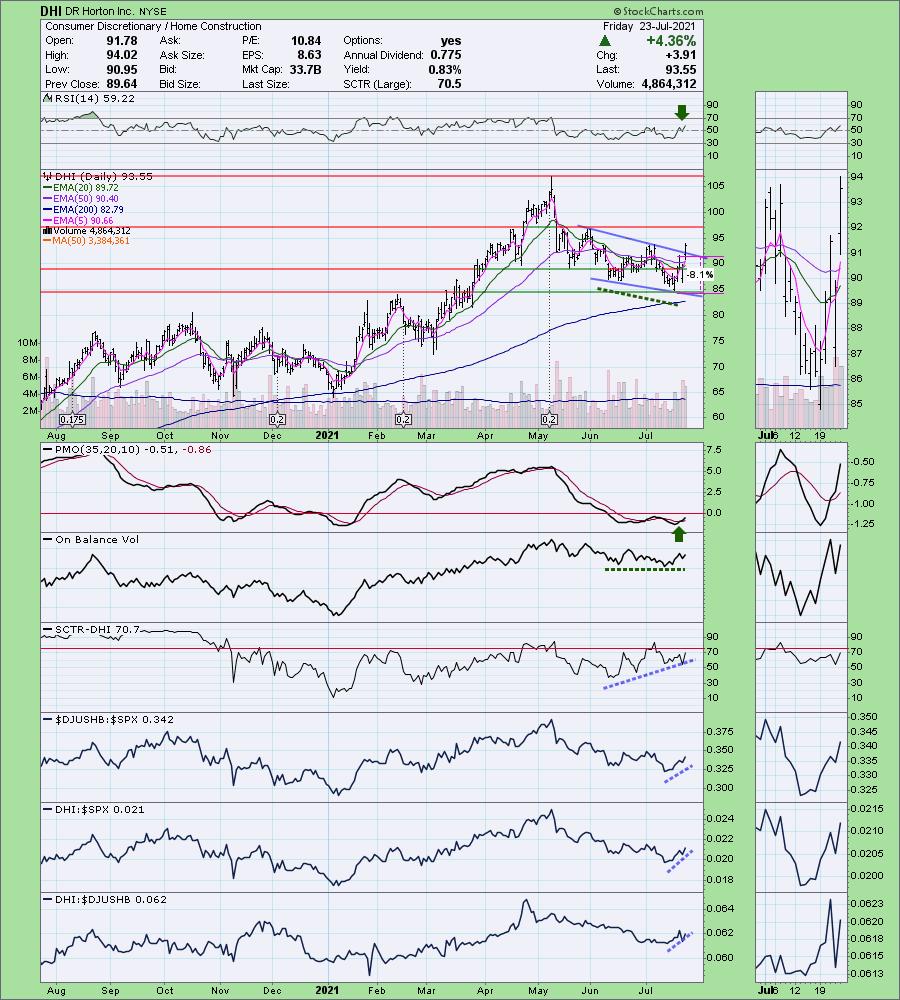

Here is today's chart:

This chart just keeps getting better and better. They did report earnings on Thursday and the price did drop, but today we have a strong breakout from a bullish falling wedge. You can that lovely OBV positive divergence. That tells us that this current rally should sustain for awhile longer.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Flowers Foods, Inc. (FLO)

EARNINGS: 8/5/2021 (AMC)

Flowers Foods, Inc. engages in the manufacture and sale of bakery products. The firm offers bakery foods for retail and food service customers in the United States. Its brands include Nature's Own, Dave's Killer Bread, Wonder, Canyon Bakehouse, Tastykake and Mrs. Freshley's. The company was founded by William Howard Flowers, Sr. and Joseph Hampton Flowers, Jr. in 1919 and is headquartered in Thomasville, GA.

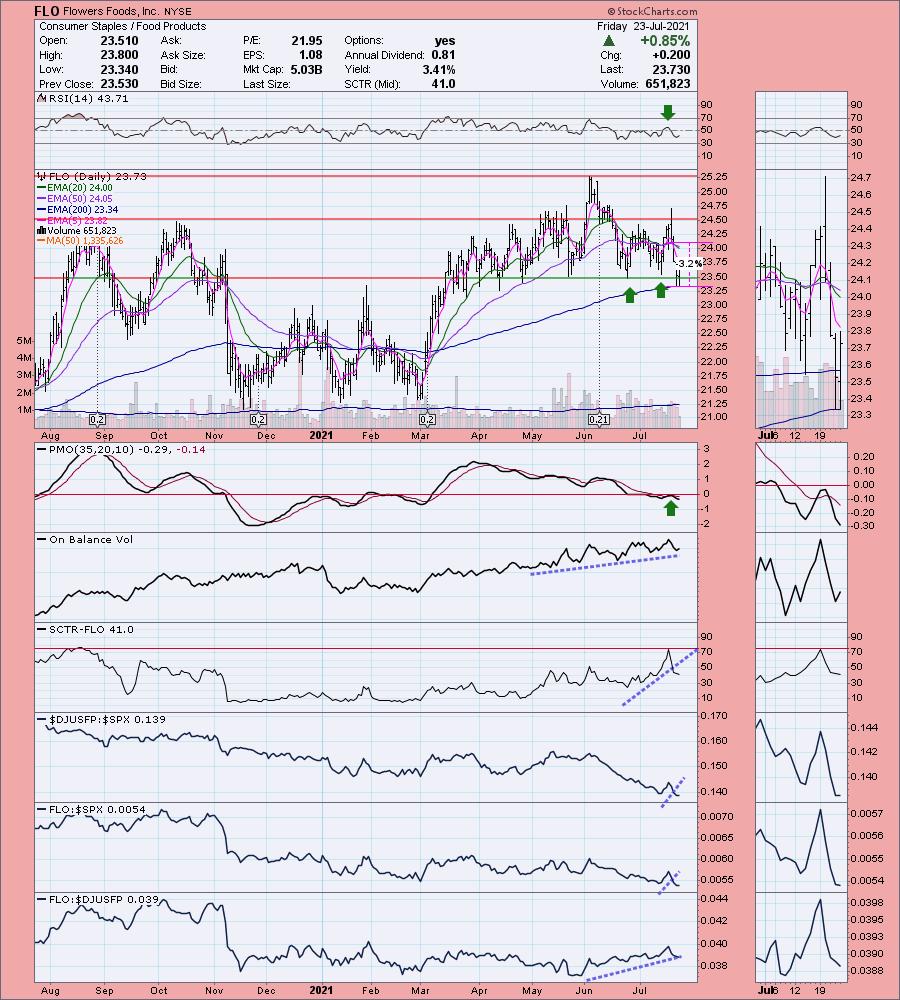

Below is the commentary and chart from Tuesday, 7/20:

"FLO is unchanged in after hours trading. I've covered this one twice before on April 15th, 2020 (stop never hit so up a modest +6.26%) and May 13th, 2020 (stop never hit so position is up +6.6% gain). I selected this as my "Diamond of the Week" for the DecisionPoint Show yesterday. I wasn't thrilled with the pullback today, but it really hasn't damaged the chart too much. The RSI did dip into negative territory, but the PMO still okay. Relative performance was damaged somewhat, but overall it is in a rising trend. Because it dropped today, the stop can be set thinly at only 3.2%. It also has a 3.6% yield!"

Below is today's chart:

We had a thin stop set just below the 200-EMA. It nearly triggered but price rebounded off the 200-EMA. I was banking on the bullish double-bottom. Since that pattern disintegrated and the RSI and PMO are negative, I would cut my losses. It certainly could make a move next week given XLP's chart is bullish, but I believe there are better choices out there.

THIS WEEK's Sector Performance:

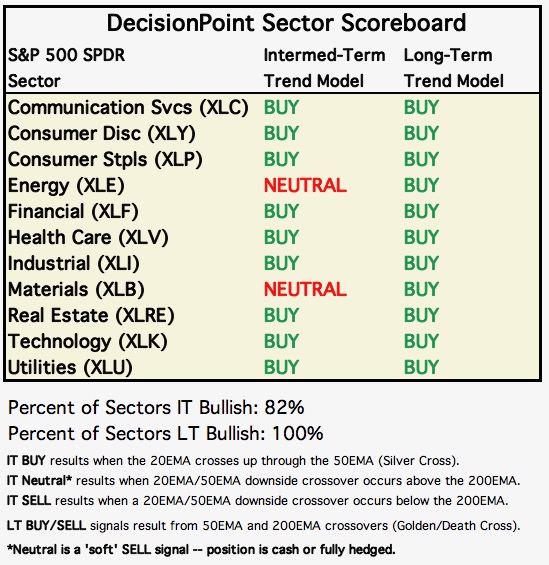

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

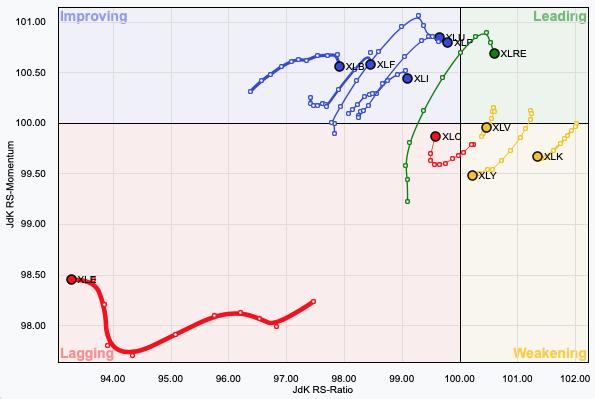

Short-term RRG: No significant changes. I would just note that XLV which is in Weakening has reversed direction and is headed back to Leading. XLU and XLP are also heading toward Leading. For those in the Diamond Mine this morning, there is no surprise here as those were short-listed for "Sector to Watch" next week.

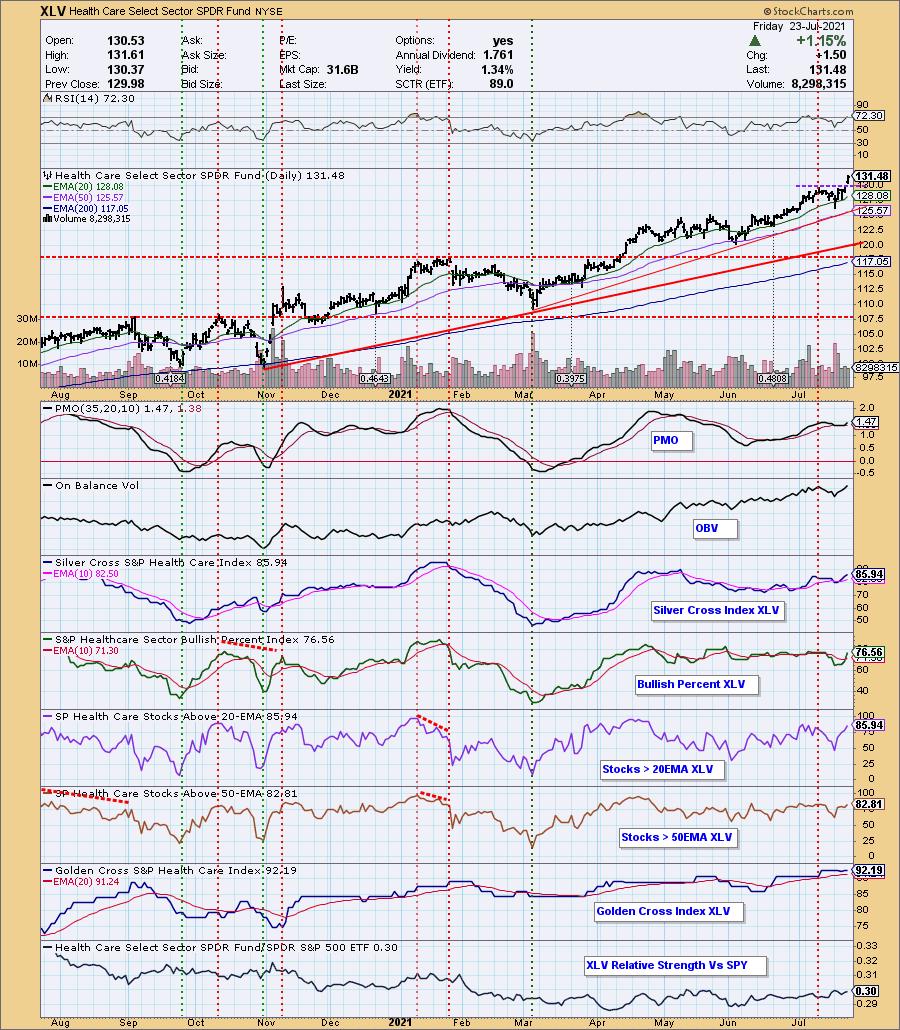

Sector to Watch: Healthcare (XLV)

I struggled "live" in the Diamond Mine trying to find the perfect sector to watch next week. I opted to go with XLV because the only real negative on the chart was the newly overbought RSI. Today's gap up breakout also affected my decision. The configuration of the PMO, SCI and BPI as well as strong but participation numbers sold it for me.

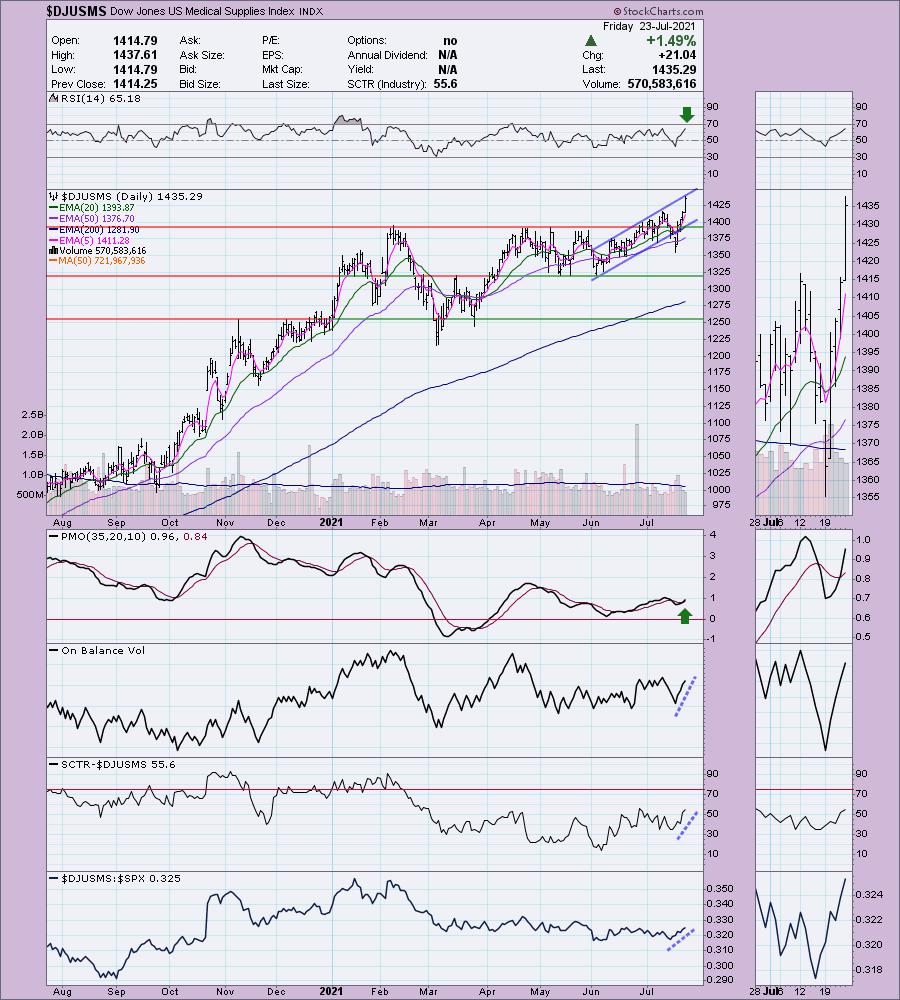

Industry Group to Watch: Medical Supplies ($DJUSMS)

After breaking down from the rising trend channel, price successfully tested the 50-EMA and recaptured the rising trend. The RSI is positive and not overbought and the PMO just gave us a crossover BUY signal. Relative performance is strong.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend & Happy Charting! Next Diamonds Report is Tuesday 7/27.

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 35% invested right now and 65% is in 'cash', meaning in money markets and readily available to trade with. I added TWLO and TNDM, but I also closed a position or two so that my exposure is only 35% right now.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2021 DecisionPoint.com