As always we had a very fruitful Diamond Mine trading room today. The link to the recording is within this report. I apologize for cutting it a little short so that I could prepare for my interview with MarketViews.TV. It's been an interesting trading week and will likely continue to see more all-time highs next week if the Swenlin Trading Oscillators (STOs) are correct.

I attempted to get in early on the Energy sector Wednesday when Crude Oil (USO) broke out. Unfortunately, two of the "Diamonds in the Rough" didn't quite pan out, but fortunately one of them is performing (DCP and I do own it).

This week I'm looking at Natural Gas (UNG) to continue higher after its excellent breakout. It is the winner this week, up +2.28% since I picked it on Wednesday. I'll be looking at UNG in detail in my upcoming ChartWatchers article that I will publish in a few hours so I'll skip reviewing it here. The CW article will arrive in your email box later this evening in the DecisionPoint Newsletter that goes out every Friday night.

So the stocks I'm covering in today's Recap are the biggest loser, Nabors (NBR) down -3.28% and the next biggest winner, Luna Innovations (LUNA) up +1.52%.

Register for next week's Diamond Mine below or HERE.

Diamond Mine Information:

RECORDING LINK:

Topic: DecisionPoint Diamond Mine (04/16/2021) LIVE Trading Room

Start Time : Apr 16, 2021 09:00 AM

Meeting Recording LINK.

Access Passcode: April_16

REGISTRATION:

When: Apr 23, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

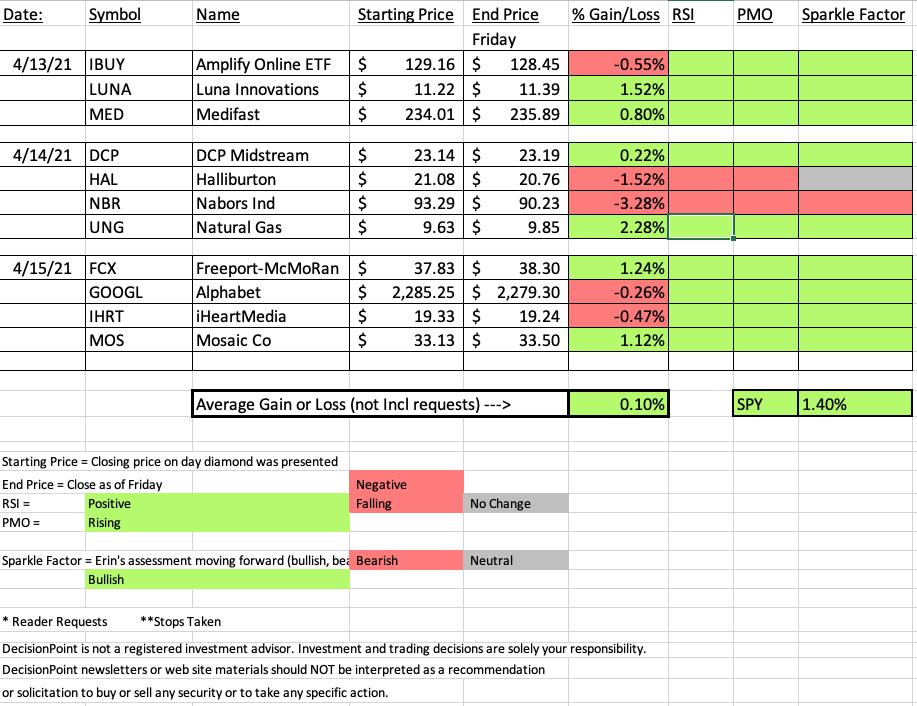

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Free DecisionPoint Trading Room on Mondays, Noon ET

*Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!*

=======================================

BELOW is a link to Monday's recording:

Topic: DecisionPoint Trading Room

Start Time : Apr 12, 2021 08:55 AM

DP Trading Room Meeting Recording LINK

Access Passcode: April_12

For best results, copy and paste the access code to avoid typos.

Darling:

Luna Innovations Inc. (LUNA)

EARNINGS: 5/6/2021 (AMC)

Luna Innovations, Inc. engages in the development and manufacture of fiber optic test and measurement, sensing and instrumentation products for the automotive, aerospace, energy and infrastructure industries. It operates through the following segments: Lightwave and Luna Labs. The Lightwave segment develops, manufactures and markets distributed fiber optic sensing products and fiber optic communications test and control products. The Luna Labs segment performs applied research principally in the areas of sensing and instrumentation, advanced materials and health science. The company was founded by Kent A. Murphy in July 1990 and is headquartered in Roanoke, VA.

Below is the commentary from Tuesday 4/13:

"LUNA is down -1.87% in after hours trading, basically reclaiming all of today's gain plus some. Be sure and give this one a close review and position size appropriately on this low priced bargain. You can see why I love this chart. RSI has just moved positive. The PMO is nearing a crossover BUY signal and the SCTR is nearing the "hot zone" above 75. I like its outperformance as well. There is a double-bottom formation and yesterday's breakout put it above the confirmation line. Today's follow-through looks good. It triggered a Short-Term Trend Model BUY signal when the 5-EMA crossed above the 20-EMA today. I'm not happy to see that it is down in after hours trading, but that doesn't always translate to trading the next day. As long as it stays above the 20-EMA I'll be happy."

Here is today's chart:

It pulled back slightly today, but the rising trend looks great. The minimum upside target of the double-bottom pattern is nearing at $12, but given the newly positive PMO rising and positive RSI, I would look for continued higher prices. If you want something to worry about, we do see a reverse divergence with the OBV. Note the OBV has made new highs, but price is far from doing so. This tells us price isn't following volume. However, given the rest of the chart, I can forgive that.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Nabors Industries, Inc. (NBR)

EARNINGS: 4/28/2021 (AMC)

Nabors Industries Ltd. engages in the provision of platform work over and drilling rigs. It operates through the following segments: U.S. Drilling, Canada Drilling, International Drilling, Drilling Solutions, and Rig Technologies. The U.S. Drilling segment includes land drilling activities in the lower 48 states and Alaska, as well as offshore operations in the Gulf of Mexico. The Canada segment consists of land-based drilling rigs in Canada. The International segment focuses in maintaining a footprint in the oil and gas market, most notably in Saudi Arabia, Algeria, Argentina, Colombia, Kazakhstan, and Venezuela. The Drilling Solutions segment offers drilling technologies, such as patented steering systems and rig instrumentation software systems that enhance drilling performance and wellbore placement. The Rig Technologies segment comprises Canrig, which manufactures and sells top drives, catwalks, wrenches, drawworks, and drilling related equipment, such as robotic systems and downhole tools. The company was founded by Clair Nabors in 1952 and is headquartered in Hamilton, Bermuda.

Below is the commentary from Wednesday 4/14:

"NBR is down -2.30% in after hours trading so a better entry will be available, just watch to make sure the PMO doesn't crash. This one is probably the weakest of the three today, but the upside potential was just too hard to pass up. We're bottom fishing as early birds. Consider a small position in case the chart goes south. I like the bullish falling wedge and the positive divergence on the OBV. The pattern has not actually resolved to the upside and the RSI is still negative (though rising). The PMO turned up on today's big rally. Performance hasn't been great, but it has been beat down. This week it is beginning to outperform."

Below is today's chart:

NBR just isn't ripe yet. I noted in my commentary that if you were going to give this one a shot, you'd want a small position. At this point the chart isn't horrible which is why I gave it a "neutral" Sparkle Factor. It just appears that it wants to test the bottom of the bullish falling wedge another time. Put this on your watch list. When/if it gets ripe with a rising PMO and positive RSI, it will be worth another look or try.

THIS WEEK's Sector Performance:

Click Here to view Carl's annotated Sector ChartList!

CONCLUSION:

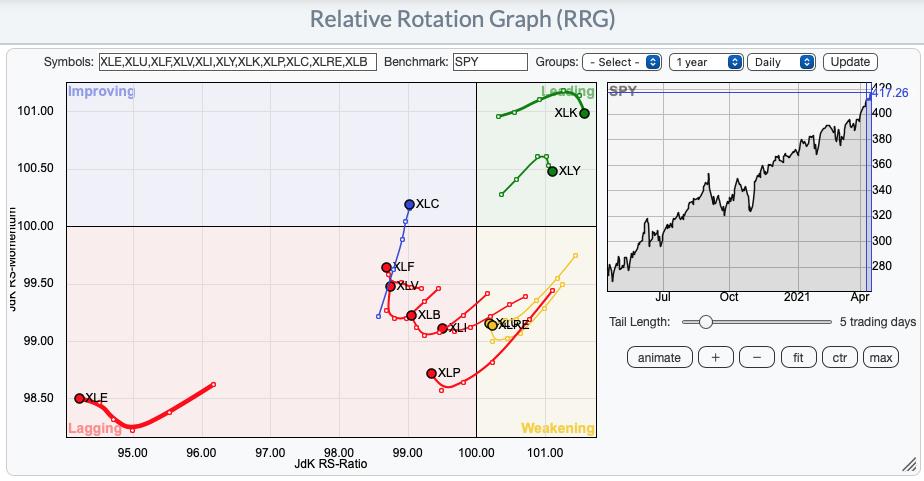

You can see how XLE was making a turn on the short-term RRG, but it is still a clear under performer. The interesting one is Communications Services (XLC). It is the only sector with a northeast heading which is what you look for on an RRG. Therefore, I'm going to highlight this one as the sector to watch.

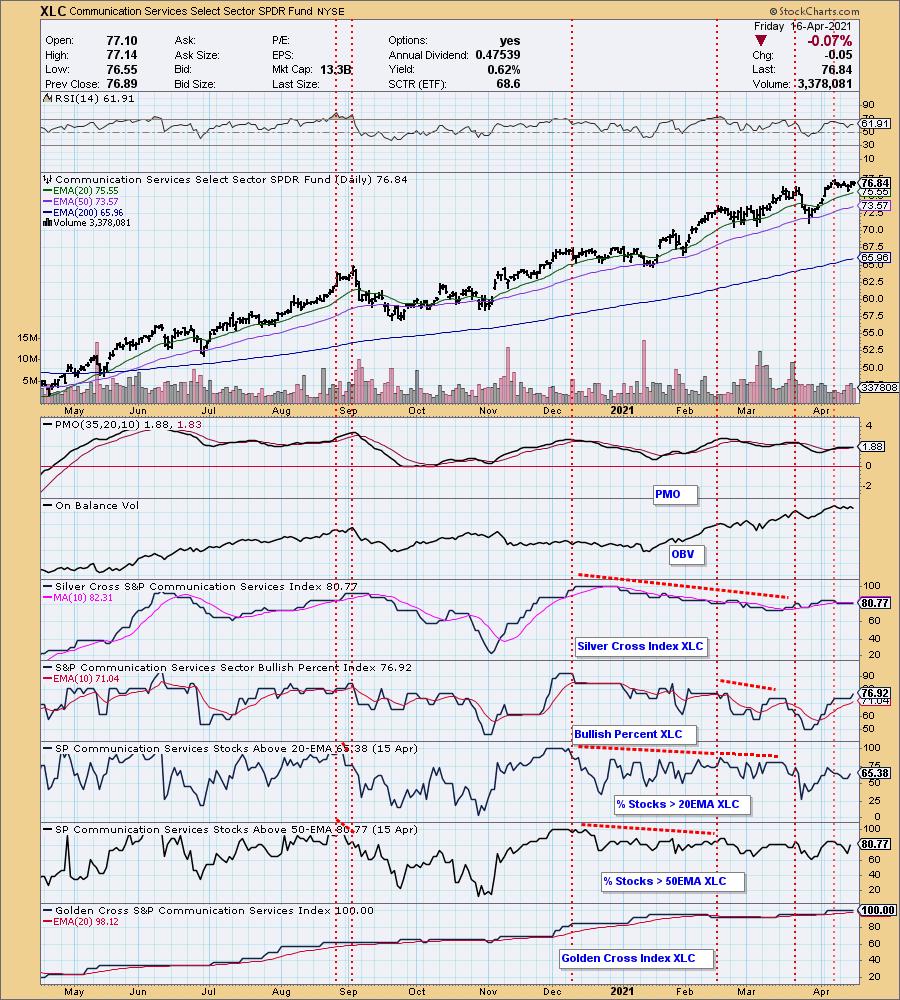

Sector to Watch: Communication Services (XLC)

This sector does look ready for a breakout. The PMO flattened as momentum began to wane, but it is on a BUY signal. I see a flag formation ready to break to the upside. Notice that participation is improving again with more stocks above their 20/50-EMAs. There is also a solid long-term foundation with 100% of stocks having their 50-EMA > 200-EMA.

Industry Group to Watch: Gold Mining ($DJUSPM)

Honestly I decided to keep this industry group as the one to watch. It is set up for continued success. Additionally, GDX might be a good vehicle to take advantage of the move given that not all of the Miners seem to participate. Yesterday we had a "silver cross" of the 20/50-EMAs which triggered an IT Trend Model BUY signal. Just more confirmation that this group should continue to do well.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend & Happy Charting!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 75% invested right now and 25% is in 'cash', meaning in money markets and readily available to trade with. This week I added Diamonds: EXC, RAD, BLBD and SPWR. I sold BOIL, but have a $9.60 stop on UNG. I felt overexposed to Nat Gas and pared back the position by selling BOIL.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)