Reader request day already! Remember to submit them before Thursday for possible inclusion in the DP Diamonds Report. I had a tough time deciding on my pick for the day. I went back out into the Materials sector, but I was tempted to add a Healthcare Provider or Gold Miner. You can see some of the stocks I thought about, as well as reader requests I opted not to do under the "Stocks/ETFs to Consider" below.

Register for tomorrow's Diamond Mine trading room now before you forget! Remember that recordings are available. This is only for Diamond subscribers so take advantage! Here is the link for tomorrow.

Today's "Diamonds in the Rough" are: FCX, GOOGL, IHRT and MOS.

Stocks/ETFs to Consider (no particular order): ANTM, BRKS, CI, GDX, IIVI, RIO, TSLA, AMAT and SOXX.

Diamond Mine REGISTRATION Information:

Diamond Mine REGISTRATION Information:

When: Apr 16, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (04/16/2021) LIVE Trading Room

Register in advance for this webinar HERE.

After registering, you will receive a confirmation email containing information about joining the webinar, including the password.

=======================================================================

Diamond Mine RECORDING Link from 4/9/2021:

Topic: April 9th DecisionPoint Diamond Mine LIVE Trading Room

Start Time : Apr 9, 2021 08:58 AM

Meeting Recording HERE.

Access Passcode: TD6^5K^@

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Free DP Trading Room RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Apr 12, 2021 08:55 AM

Meeting Recording LINK HERE.

Access Passcode: April_12

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

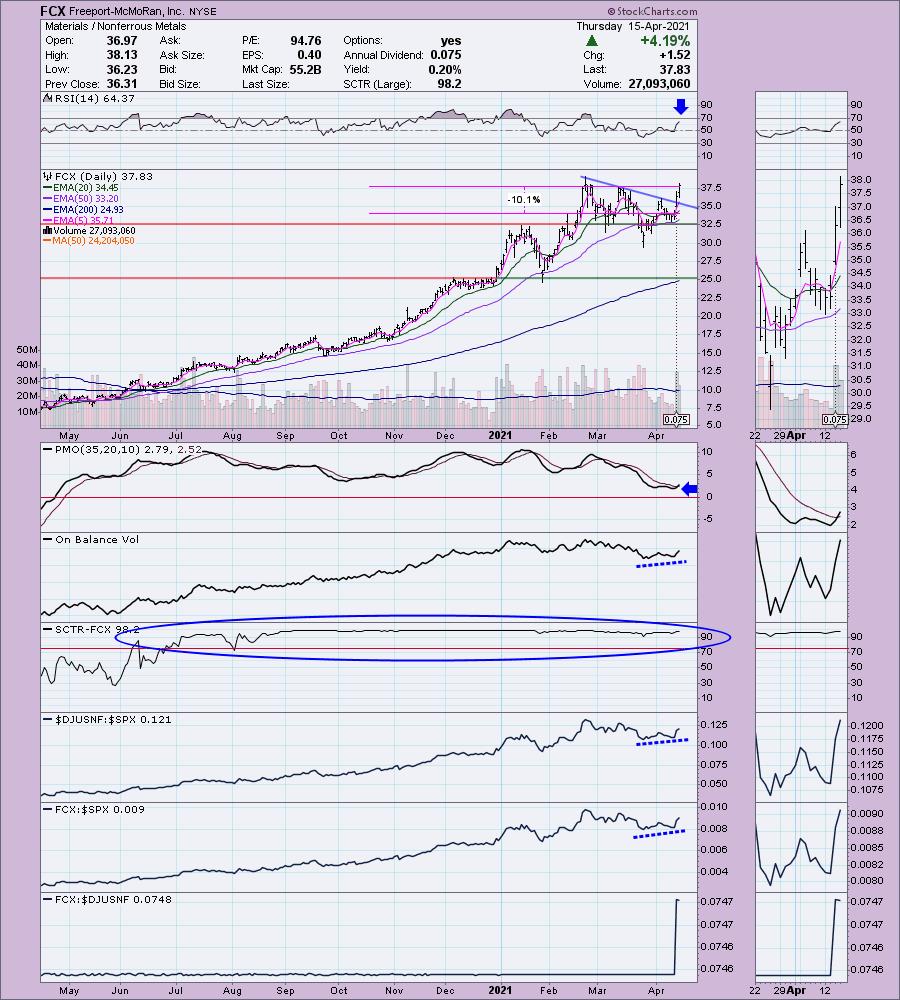

Freeport-McMoRan, Inc. (FCX)

EARNINGS: 4/22/2021 (BMO)

Freeport-McMoRan, Inc. engages in the mining of copper, gold and molybdenum. It operates through the following segments: North America Copper Mines, South America Mining; Indonesia Mining, Molybdenum Mines, Rod and Refining, Atlantic Copper Smelting and Refining and Corporate, Other and Eliminations. The North America Copper Mines segment operates open-pit copper mines in Morenci, Bagdad, Safford, Sierrita and Miami in Arizona and Chino and Tyrone in New Mexico. The South America Mining segment includes Cerro Verde in Peru and El Abra in Chile. The Indonesia Mining segment handles the operations of Grasberg minerals district that produces copper concentrate that contains significant quantities of gold and silver. The Molybdenum Mines segment includes the Henderson underground mine and Climax open-pit mine, both in Colorado. The Rod and Refining segment consists of copper conversion facilities located in North America and includes a refinery, rod mills, and a specialty copper products facility. The Atlantic Copper Smelting and Refining segment smelts and refines copper concentrate and markets refined copper and precious metals in slimes. The Corporate, Other and Eliminations segment consists of other mining and eliminations, oil and gas operations and other corporate and elimination items. The company was founded by James R. Moffett on November 10, 1987 and is headquartered in Phoenix, AZ.

FCX is up +0.19% in after hours trading. I covered it three times before in the March 19th 2020, October 20th 2020 and February 10th 2021 Diamonds Reports. On March 19th, 2020 this reader request made its official low and moved higher from there. It is up +559.1% since then. I can't take credit as this was a reader request and I panned it in that issue. I'm a momentum trader and on March 19th that chart looked ugly. I presented this one again on October 20th, given the stop didn't hit, it is up +114.8% since then. That gain I will take credit for. Finally, the stop for the February 10th 2021 Diamond Report was not hit and so FCX is up +21.1% since then.

We've had quite a bit of success with this one and it looks like another entry is available. Yesterday we saw a strong breakout. There is a new PMO BUY signal and a positive RSI. The SCTR has been first rate and clearly it is outperforming right now. I set a 10.1% stop at that mid-February breakout top.

There is a new PMO SELL signal on the weekly chart, but the PMO has already flattened in anticipation of higher prices. The RSI is positive and not quite overbought.

I've included the monthly chart to show you there is still plenty of upside potential.

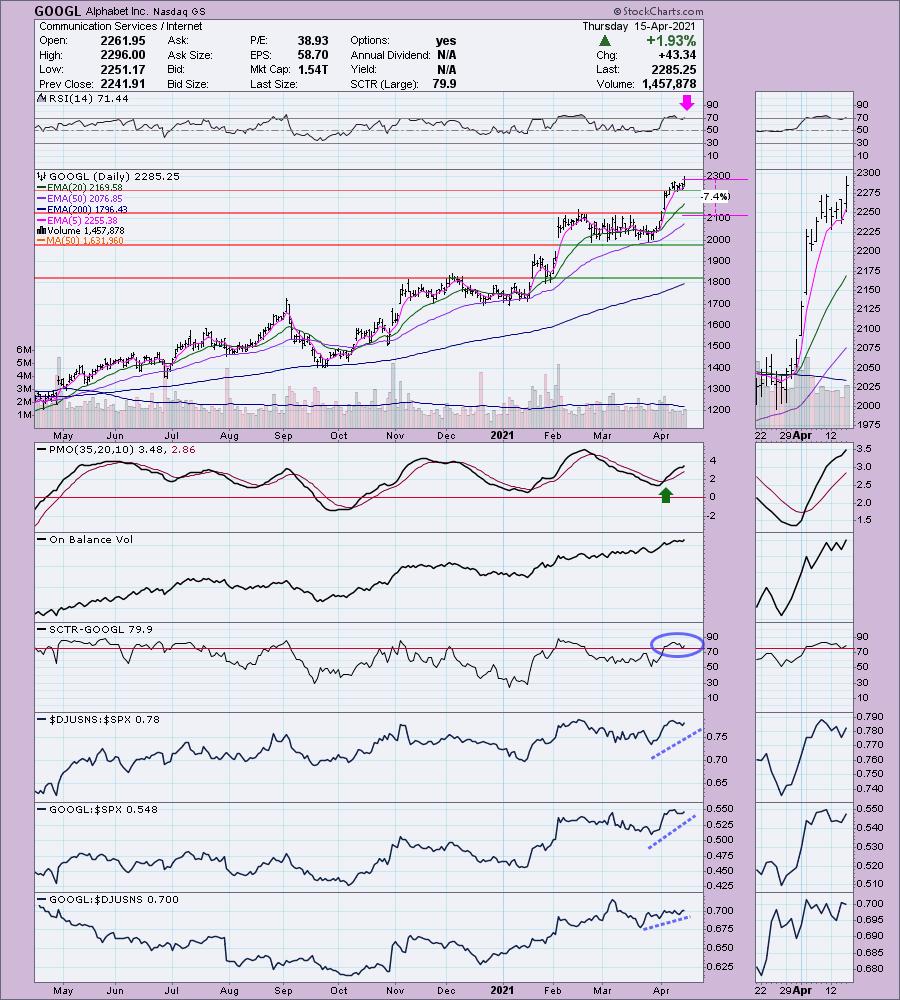

Alphabet Inc. (GOOGL)

EARNINGS: 4/27/2021 (AMC)

Alphabet, Inc. is a holding company, which engages in the business of acquisition and operation of different companies. It operates through the Google and Other Bets segments. The Google segment includes its main Internet products such as ads, Android, Chrome, hardware, Google Cloud, Google Maps, Google Play, Search, and YouTube. The Other Bets segment consists of businesses such as Access, Calico, CapitalG, GV, Verily, Waymo, and X. The company was founded by Lawrence E. Page and Sergey Mikhaylovich Brin on October 2, 2015 and is headquartered in Mountain View, CA.

GOOGL is down -0.14% in after hours trading. Amazingly, I've never covered Alphabet in the Diamonds Reports. I know I've looked at other FAANG+ stocks like AAPL, AMZN and MSFT. Google is going into earnings and this reader is interested in knowing my thoughts. I very much like today's breakout from a textbook flag. The PMO is on a BUY signal and after today's breakout it is accelerating higher. The OBV is confirming and the SCTR is back in the "hot zone" above 75. It has been outperforming since the end of March. You can set a reasonable stop just below the top of the March trading range.

The weekly RSI is overbought, but the PMO looks very strong.

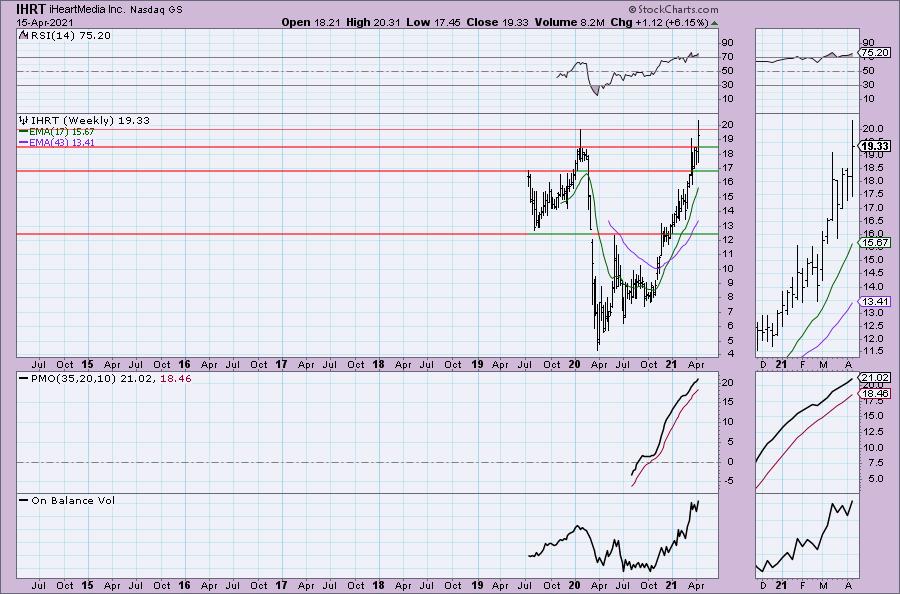

iHeartMedia Inc. (IHRT)

EARNINGS: 5/6/2021 (AMC)

iHeartMedia, Inc. engages in the provision of media and entertainment services. It operates through the following segments: Audio and Audio and Media Services. The Audio segment comprises of media and entertainment services via broadcast and digital delivery and also includes events and national syndication businesses. The Audio and Media Services segment consists of the other audio and media services, including the media representation business (Katz Media) and the provider of scheduling and broadcast software (RCS). The company was founded by L. Lowry Mays and B. J. McCombs in May 2007 and is headquartered in San Antonio, TX.

IHRT is unchanged in after hours trading. I very much like the strong breakout and reflexive pullback to the point of the breakout. It had a difficult day, but the rising PMO wasn't damaged much. The RSI is positive and the SCTR is currently in the "hot zone" above 75. The OBV is confirming the rally. While the industry group has suffered, IHRT has bucked the trend and outperformed the SPX since October of last year! The stop is a bit deep, but I wanted to get it close to the April low.

We have a very positive and rising weekly PMO, but the RSI is on the overbought side. Additionally, price is at overhead resistance at the 2020 top. It broke above that this week, but looks like it will close beneath. Not a horrible condition, it may mean that it will cool down soon.

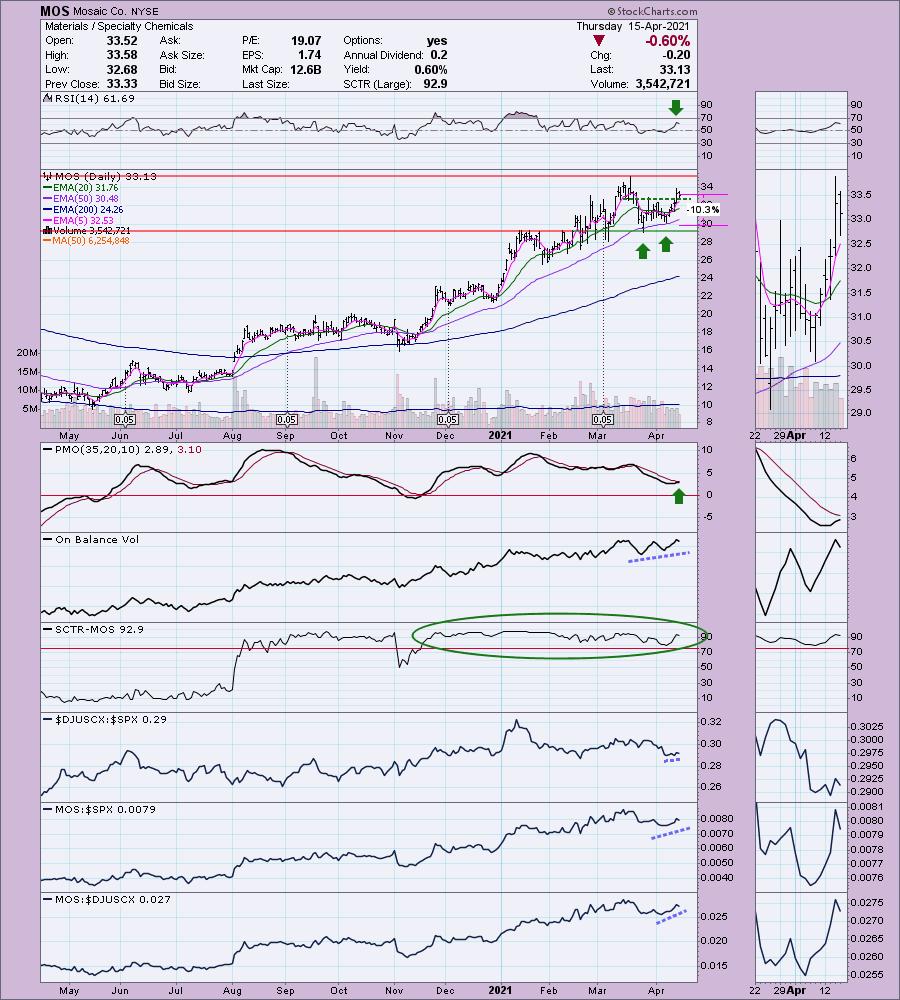

Mosaic Co. (MOS)

EARNINGS: 5/3/2021 (AMC)

The Mosaic Co. engages in the production and marketing of concentrated phosphate and potash crop nutrients. The company operates its businesses through it's wholly and majority owned subsidiaries. It operates through the following segments: Phosphates, Potash, and Mosaic Fertilizantes. The Phosphates segment owns and operates mines and production facilities in North America which produces concentrated phosphate crop nutrients and phosphate-based animal feed ingredients, and concentrated crop nutrients. The Potash segment owns and operates potash mines and production facilities in North America which produce potash-based crop nutrients, animal feed ingredients, and industrial products. The Mosaic Fertilizantes segment produces and sells phosphate and potash-based crop nutrients, and animal feed ingredients, in Brazil. The company was founded on October 22, 2004 and is headquartered in Plymouth, MN.

MOS is up +0.15% in after hours trading. I covered Mosaic in the February 17th 2021 Diamonds Report. It didn't hit it stop and is up a modest +8.9% since then. For some reason I kept coming back to this chart today. While isn't a "wow" of a chart, it fills in all the squares. Price broke out yesterday and today pulled back to the breakout point without losing support. The PMO has bottomed and is headed toward a crossover BUY signal. The RSI is positive and the OBV is confirming the rally. The SCTR is excellent at 92.9 and it outperforming along with its industry group. The stop is set rather deep, but I wanted it below at least one of the bottoms on the bullish double-bottom pattern.

The weekly chart looks pretty good although both the weekly RSI and weekly PMO are overbought. Even though the PMO has topped, I note in the thumbnail that it is turning back up above its signal line. Plenty of upside potential on this one.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Full Disclosure: I'm about 80% invested and 20% is in 'cash', meaning in money markets and readily available to trade with. I now own Diamonds, DCP and UNG. Considering CI, SBSW and MOS as adds.

Current Market Outlook:

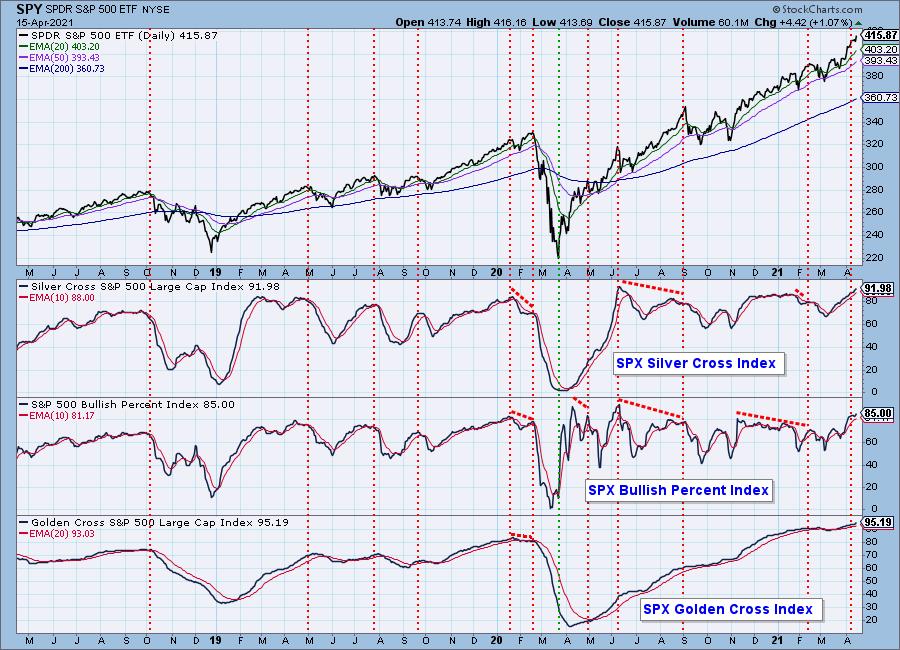

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

The Diamond Index chart looks at the number of scan results from my bullish Diamond PMO Scan and the number of scan results from the inverse Diamond Dog Scan. The Diamond Ratio divides the bullish results by the bearish results.

I only have data going back to October 2019 so I won't make any sweeping conclusions about the Diamond Index chart. I have marked cardinal tops with red dotted vertical lines and cardinal price bottoms with green dotted vertical lines. I believe that when the Diamond Dog results spike, it usually comes at a price bottom, or marks a strong continuation of the rising trend.

Unfortunately, the Diamond PMO Scan result numbers aren't providing much insight. The Diamond Ratio has promise, but again I don't see a clear correlation to the market tops/bottoms right now. I need to study and manipulate the data some more. Keep you posted!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!