Excellent market week! I gave everyone a preview in today's Diamond Mine that Monday's DecisionPoint Show "Diamond of the Week" would be the ever popular...... Netflix (NFLX). Rather than looking at the biggest winner today, I'll look at NFLX instead. You'll see on the spreadsheet that the biggest loser is Athenex (ATNX). It's a Biotech and of course one of the "diamonds in the rough" that I bought yesterday. I'll be looking for a way to sell it on Monday. Of all of this week's Diamonds, I managed to buy the worst one. Such is the trader's life.

Don't forget to sign up now for next Friday's Diamond Mine trading room! Why wait? You'll find the link below as well as the link to the recording from today's Diamond Mine. Zoom will send you an email reminder one-hour before the webinar starts.

Diamond Mine Information:

Diamond Mine Information:

Here is today's (11/6/2020) recording link. Access Passcode: #g8G^J&3

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (11/13/2020) 12:00p ET:

Here is the registration link for Friday, 11/13/2020. Password: warmer

Please do not share these links! They are for Diamonds subscribers ONLY!

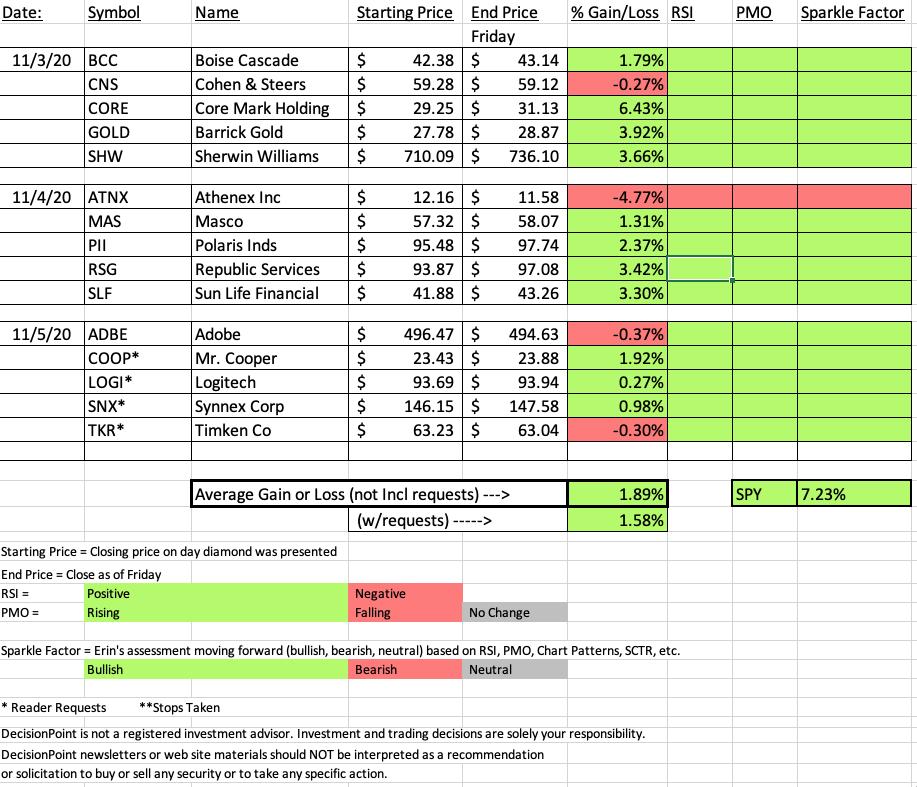

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

It's FREE!

***Click here to register for this recurring free DecisionPoint Trading Room!***

Did you miss the 10/26 (no meeting on 11/2) trading room? Here's a link to the recording (Passcode: X+2gJfpd)

For best results, copy and paste the password to avoid typos.

DUD:

Atenex, Inc (ATNX)

EARNINGS: 11/5/2020 (BMO)

Athenex, Inc. is a biopharmaceutical company, which engages in the discovery, development and commercialization of novel therapies for the treatment of cancer. It operates through the following segments: Oncology Innovation Platform, Global Supply Chain Platform, and Commercial Platform. The Oncology Innovation Platform segment focuses on the research and development of proprietary drugs. The Global Supply Chain Platform segment provides supply of active pharmaceutical ingredients (APIs) for clinical and commercial efforts. The Commercial Platform segment involves in the sales and marketing of specialty drugs and market development of proprietary drugs. The company was founded by Lyn M. Dyster and David G. Hangauer in November 2003 and is headquartered in Buffalo, NY.

Below is Wednesday's chart. You can see the original write-up in the November 4th Diamonds Report. I noted that on Thursday we could end up seeing an upside price shock on earnings Thursday.

Well, we got follow-through on the breakout on Thursday after earnings. I liked the set-up and then.... today's chart. What used to be a bullish falling wedge is now a declining trend channel more or less. The RSI turned negative and the PMO turned down below its signal line. No upside on this chart, I'm going to unload it next week.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Preview of Next Week's "Diamond of the Week":

Netflix, Inc (NFLX)

EARNINGS: 1/19/2021 (AMC)

Netflix, Inc. is a streaming entertainment service company, which provides subscription service streaming movies and television episodes over the Internet and sending DVDs by mail. It operates through the following segments: Domestic Streaming, International Streaming and Domestic DVD. The Domestic Streaming segment derives revenues from monthly membership fees for services consisting solely of streaming content to its members in the United States. The International Streaming segment includes fees from members outside the United States. The Domestic DVD segment covers revenues from services consisting solely of DVD-by-mail. The company was founded by Marc Randolph and Wilmot Reed Hastings Jr., on August 29, 1997 and is headquartered in Los Gatos, CA.

Netflix is coming off the bottom of a wide trading channel. In fact, price didn't have to test the bottom of the channel before reversing. We can see accumulation of this stock right now. The PMO is rising and the RSI just reached positive territory. My only issue is that the October gap hasn't been closed so we have gap resistance at $520. I have a blue arrow pointing the the EMAs, this is because today we had both a ST and IT Trend Model BUY signals trigger.

I'd be happy with a test of all-time highs at a near 12% gain. The weekly PMO isn't good, which tells me to be happy with a move to new all-time highs. I'll recheck the weekly chart when we see price hit that resistance level.

THIS WEEK's Sector Performance:

CONCLUSION:

I'm not making any changes to the sector and industry groups to watch this week. I still like this area of the market and I believe you can add Gold and Gold Miners as well. I thought about Technology, but I believe we'll see a pullback next week. Those are typically led by Technology. Materials seem to get a boost when the market is soft.

Sector to Watch: Materials Sector (XLB)

Industry Group to Watch: Nonferrous Metals ($DJUSNF)and Containers & Packaging ($DJUSCP)

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Have a Great Weekend! Happy Charting!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 40% invested right now and 60% is in 'cash', meaning in money markets and readily available to trade with.

Technical Analysis is a windsock, not a crystal ball.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!