So far we're having a very good week in the market and with this week's Diamonds. Not a surprise given the SPY is currently up 7.16% so far this week. I mentioned that I would be adding positions last night. I ended up adding three recent Diamonds to my personal portfolio. You can read about that in the "disclosure" statement at the end of the report. I'm still heavy in Miners and Solar so I'm glad to see those industry groups rallying strongly.

I had quite a few reader requests so it was actually hard to pick my favorites. However, one of the benefits of having a large amount is the opportunity to be very selective. My readers are nearly all experienced traders and it is always great to see what names are popping up on their radar that I may've missed. Don't forget to register for tomorrow's Diamond Mine!

Today's "Diamonds in the Rough" are: ADBE, COOP, LOGI, SNX and TKR.

Diamond Mine Information:

Diamond Mine Information:

Here is the (10/30/2020) recording link. Access Passcode: ?=&@p9wm

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (11/6/2020) 12:00p ET:

Here is the registration link for Friday, 11/6/2020. Password: sparkle

Please do not share these links! They are for Diamonds subscribers ONLY!

It's Free!

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

There was no trading room on 11/2, but did you miss the 10/27 trading room? Here is a link to the recording (access code: X+2gJfpd). For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Adobe Systems, Inc. (ADBE)

EARNINGS: 12/9/2020 (AMC)

Adobe, Inc. engages in the provision of digital marketing and media solutions. It operates through the following segments: Digital Media, Digital Experience, and Publishing. The Digital Media segment offers creative cloud services, which allow members to download and install the latest versions of products, such as Adobe Photoshop, Adobe Illustrator, Adobe Premiere Pro, Adobe Photoshop Light room and Adobe InDesign, as well as utilize other tools, such as Adobe Acrobat. The Digital Experience segment provides solutions, including analytics, social marketing, targeting, media optimization, digital experience management, and cross-channel campaign management, as well as premium video delivery and monetization. The Publishing segment includes legacy products and services for eLearning solutions, technical document publishing, web application development, and high-end printing. The company was founded by Charles M. Geschke and John E. Warnock in December 1982 and is headquartered in San Jose, CA.

This is my selection today. Mostly unchanged in after hours trading, ADBE was covered in the May 5th Diamonds Report (a 39.4% gain as of today). This one is looking really good right now after a big breakaway gap yesterday. The RSI is positive and we just saw a 20/50-EMA positive crossover which gives us an IT Trend Model BUY signal. In preparation for the gap up, ADBE had set up a very strong positive divergence with price. Those conditions generally lead to a solid rally. The PMO has turned back up and the SCTR is respectable at 73.1. I set the stop just below the gap, but you could certainly choose to stretch it out to the recent low. Personally, I wouldn't want it if the gap closed.

The weekly chart is somewhat neutral. The RSI is positive, but the PMO is suspect. It is decelerating, but ultimately is still on an IT PMO SELL signal.

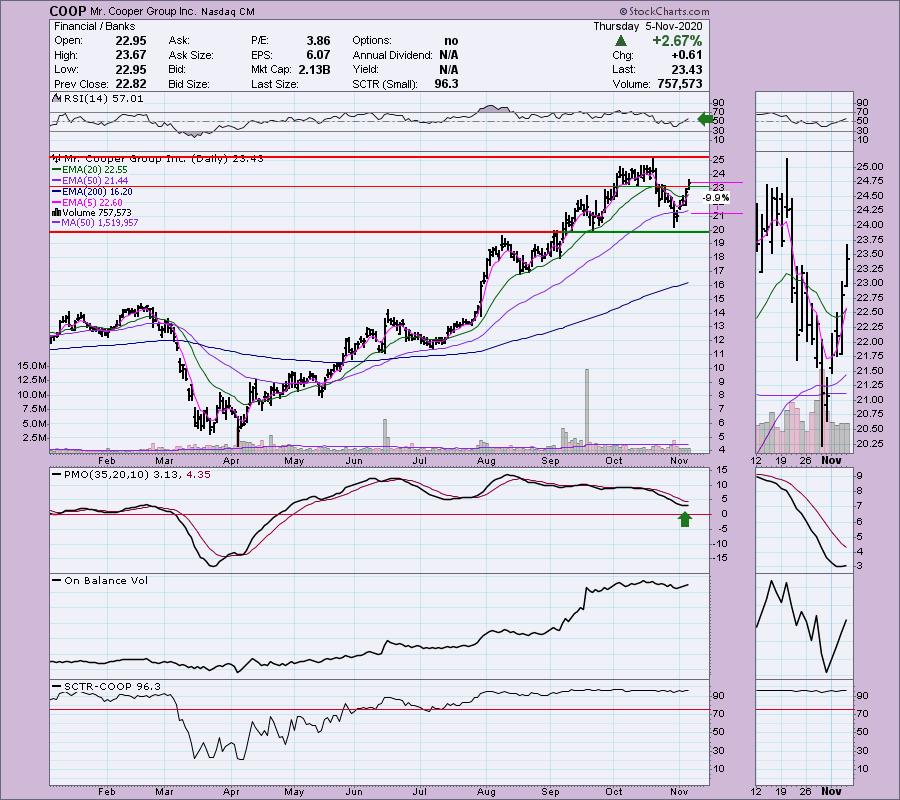

Mr. Cooper Group Inc. (COOP)

EARNINGS: 2/25/2021 (BMO)

Mr. Cooper Group, Inc. engages in the provision of residential loan services. It operated through the following segments: Servicing, Originations, Xome, and Corporate/Other. The Servicing segment consists of collecting loan payments, remitting principal and interest payments to investors, managing escrow funds for the payment of mortgage-related expenses, such as taxes and insurance, performing loss mitigation activities on behalf of investors and otherwise administering mortgage loan servicing portfolio. The Originations segment provides refinance opportunities to the existing servicing customers through direct-to-consumer platform and purchases loans from originators through correspondent channel. The Xome segment offers technology and data-enhanced solutions to banks, non-banks, investment companies, and GSEs engaged in the origination, investment, servicing of mortgage loans, as well as to home buyers, home sellers, real estate professionals mortgage professionals, and real estate investors. The Corporate/Other segment comprises unallocated overhead expenses, including the costs of executive management and other corporate functions that are not directly attributable to operating segments, senior unsecured notes, and the results of a legacy mortgage investment portfolio. The company was founded in 1889 and is headquartered in Coppell, TX.

Brian, this is could be my favorite reader request this week (although the others a great too). There is a "V" bottom bullish chart pattern. The expectation of those patterns is an upside move that will break above the left top of the "V". The RSI has turned positive and the PMO is just turning over. The SCTR is strong too. Today price broke out above resistance at the bottom of the October trading channel. The stop is pretty deep right now even though I lined it up with the 50-EMA.

The weekly chart looks okay. The RSI is positive but getting overbought again. The PMO had topped, but it appears it will turn up this week which is very positive. I would look for a move to at least challenge this month's top, but given the favorable daily chart, I think it is reasonable to look for a move to $30.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

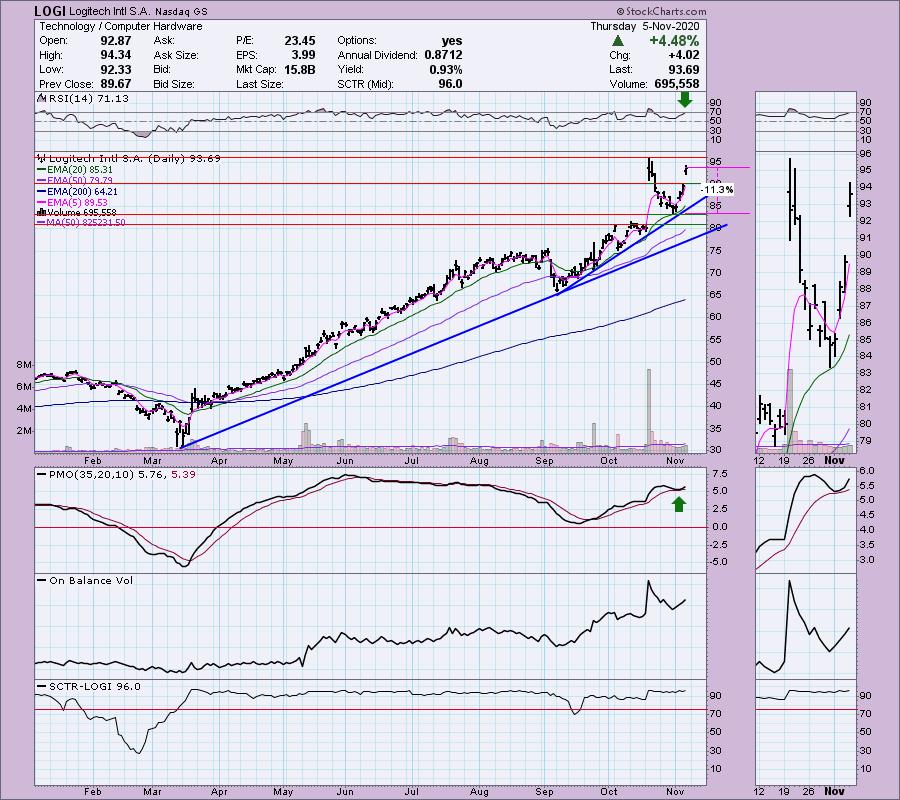

Logitech Intl S.A. (LOGI)

EARNINGS: 2/2/2021 (AMC)

Logitech International SA is a holding company, which engages in design, manufacture, and marketing of peripherals for PCs, tablets and other digital platforms. It offers headsets, speakers, mice, keyboards, and webcams. The firm's brand include Logitech, Jaybird, Ultimate Ears, Logitech G, ASTRO Gaming, and Blue Microphones. The company was founded by Daniel Borel, Pierluigi Zappacosta, and Giacamo Marini on October 2, 1981 and is headquartered in Lausanne, Switzerland.

LOGI is down -0.74% in after hours trading. I covered LOGI in the August 3rd Diamonds Report (up 26.6% as of today). The big gap up on October 20th was due to earnings being reported on October 19th. There is certainly a concern that this might be a reverse island formation. I would take a chance on this one despite that. Two of my close colleagues, Mary Ellen McGonagle and Tom Bowley, both preach that stocks that report good earnings tend to keep on winning. We're now entering territory where it closed after earnings. The RSI is bit overbought, but the PMO looks very bullish with the bottom above the signal line. The PMO isn't territory overbought either.

The weekly chart looks great except for how overbought the RSI is. The PMO isn't that overbought and the weekly PMO has a bottom above the signal line which I always consider especially bullish. Nice one!

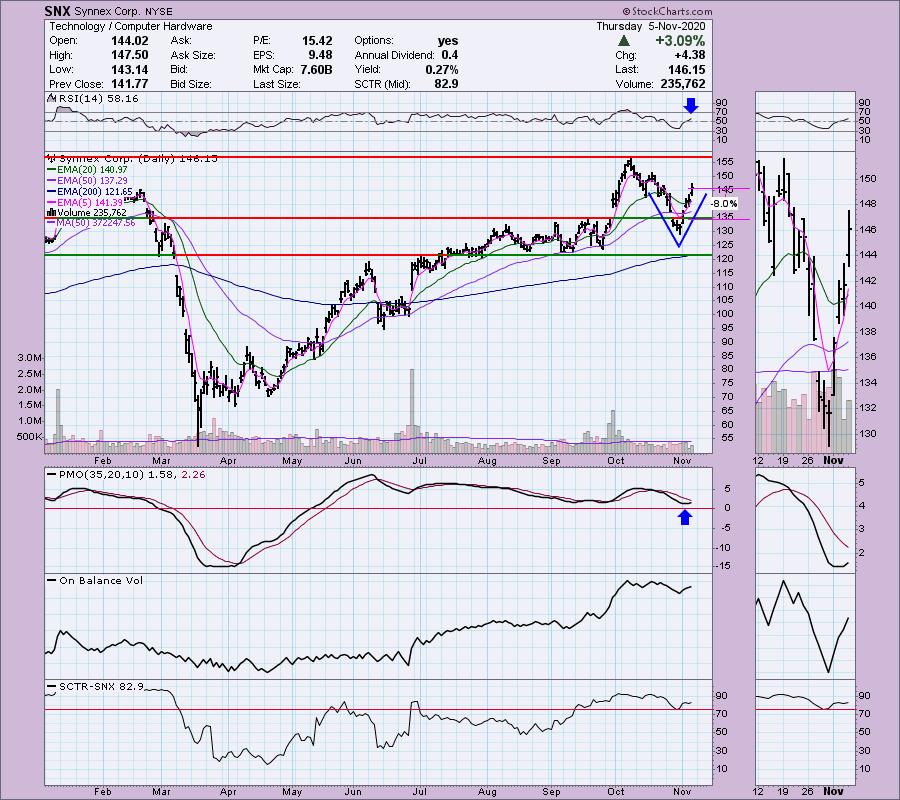

Synnex Corp. (SNX)

EARNINGS: 1/7/2021 (AMC)

SYNNEX Corp. engages in the provision of distribution, logistics and integration services for the technology industry. It operates through the following segments: Technology Solutions and Concentrix. The Technology Solutions segment distributes peripherals, IT systems including data center server and storage solutions, system components, software, networking equipment, consumer electronics, and complementary products. The Concentrix segment offers a portfolio of strategic solutions and end-to-end business services to customers in industry vertical markets. The company was founded by Robert T. Huang in November 1980 and is headquartered in Fremont, CA.

This one comes from a new reader, Fred. Thanks for sending me some great choices and welcome aboard. Hope to see you in the Diamond Mine soon! I really like this chart, but I found out that it is down -3% in after hours trading so most of today's gain is being taken back. That's okay! There's a better entry. I would just want to make sure that the PMO continued to rise after a pullback should it materialize tomorrow. Here is another "V" bottom. When price makes it a third of the way up on the other side of the "V", the pattern is triggered. The expectation is a move above the top left side of the "V". The RSI is just entering positive territory and the SCTR is strong. I set the stop below the 50-EMA and the September tops.

The weekly PMO has bottomed above the signal line and the RSI is positive. I'd look for new all-time highs.

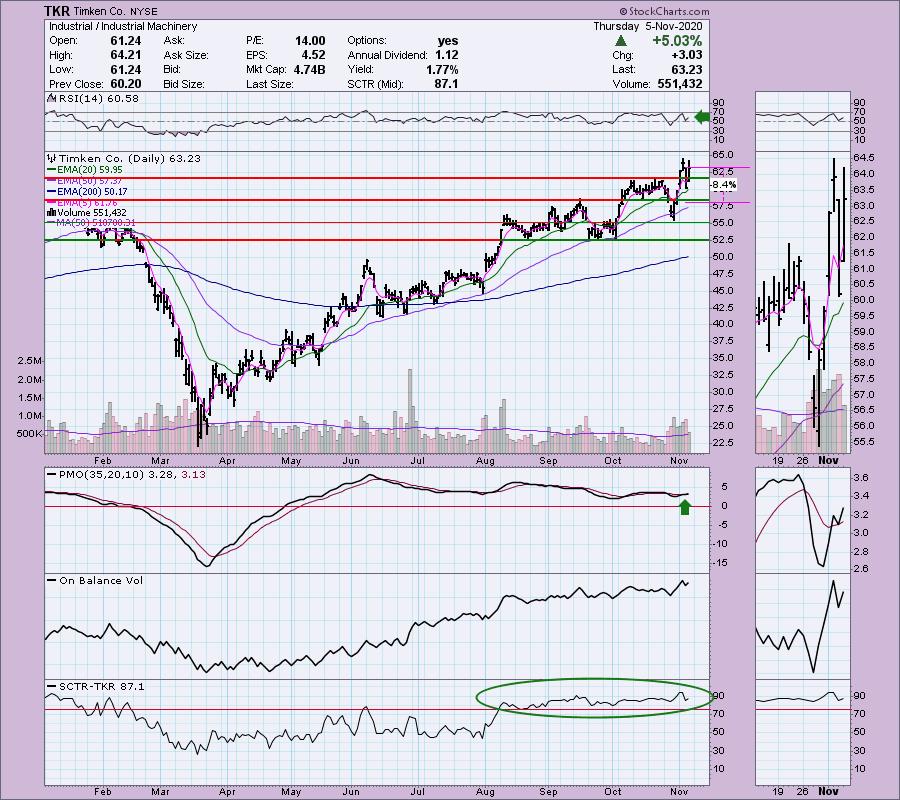

Timken Co. (TKR)

EARNINGS: 2/3/2021 (BMO)

The Timken Co. engages in the engineering, manufacturing and marketing of bearings and power transmission products. It offers gearboxes, belts, chain, lubrication systems, couplings, industrial clutches and brakes. It operates through the Mobile Industries and Process Industries segments. The Mobile Industries segment serves OEM customers that manufacture off-highway equipment for the agricultural, mining and construction markets; on-highway vehicles including passenger cars, light trucks, and medium- and heavy-duty trucks; rail cars and locomotives; outdoor power equipment; and rotorcraft and fixed-wing aircraft. The Process Industries segment handles OEM and end-user customers in industries that place heavy demands on the fixed operating equipment they make or use in heavy and other general industrial sectors. The company was founded by Henry Timken in 1899 and is headquartered in North Canton, OH.

TKR is unchanged in after hours trading. You know all of these requests are outstanding! Very positive rising trend that has been in place since the bear market low. The SCTR is in the "hot zone" above 75 and the RSI ticked up before going negative. The PMO has bottomed above the signal line which is very positive. The October low was set after they reported earnings. On 10/30, it began a strong rally. The OBV broke to a higher high as price did so that is a nice confirmation. I put the stop in just below the bottom of the October trading channel.

The weekly RSI is getting overbought and the PMO is overbought, but I like this chart anyway. The PMO is rising steadily with very few bumps in the road.

Full Disclosure: I added positions today there that were Diamonds: ATNX, BCC and CNS. I will always disclose if I own a Diamond. I'm about 40% invested and 60% is in 'cash', meaning in money markets and readily available to trade with.

Current Market Outlook:

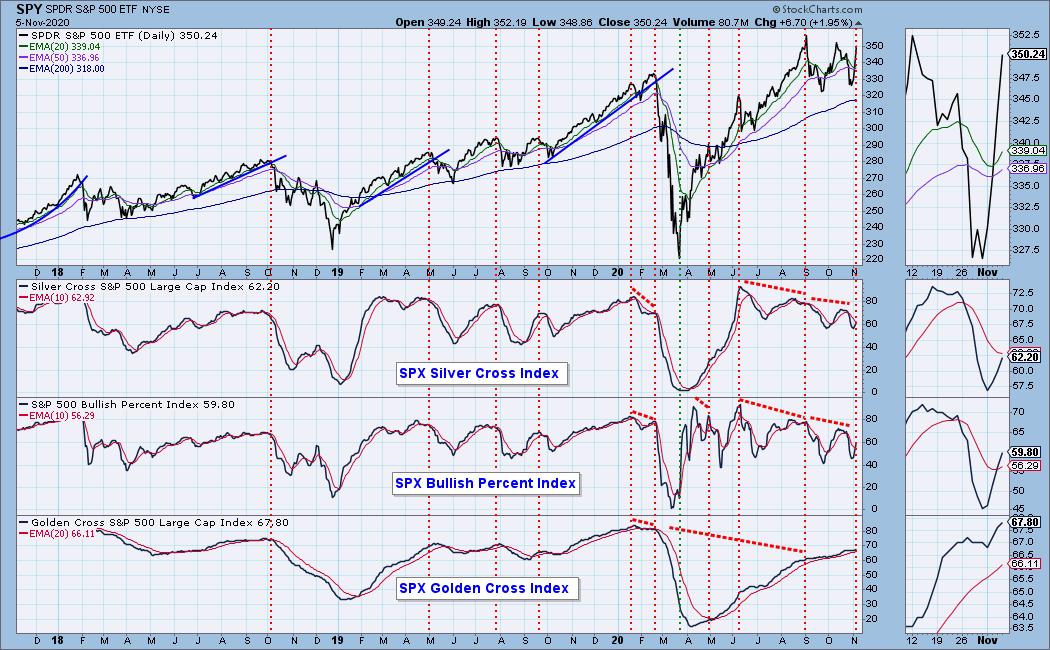

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 51

- Diamond Dog Scan Results: 5

- Diamond Bull/Bear Ratio: 10.2

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!