The market rallied strongly today and with that we saw sector rotation moving toward Health Care as well as the Technology sector. Communications Services (XLC) remains strong. My selections today came from two scans: the Diamond PMO Scan and my Momentum Sleepers Scan. I found some OBV positive divergences, double-bottoms again and breakouts from declining trends. Don't forget that tomorrow is Reader Request Day! I'll be taking your requests up until the close tomorrow. Additionally, if you have not registered for this week's Diamond Mine trading room, I invite you to do so using the link below.

Today's "Diamonds in the Rough" are: ATNX, MAS, PII, RSG and SLF.

Diamond Mine Information:

Diamond Mine Information:

Here is the (10/30/2020) recording link. Access Passcode: ?=&@p9wm

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (11/6/2020) 12:00p ET:

Here is the registration link for Friday, 11/6/2020. Password: sparkle

Please do not share these links! They are for Diamonds subscribers ONLY!

It's Free!

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

There was no trading room on 11/2, but did you miss the 10/27 trading room? Here is a link to the recording (access code: X+2gJfpd). For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Athenex, Inc. (ATNX)

EARNINGS: 11/5/2020 (BMO)

Athenex, Inc. is a biopharmaceutical company, which engages in the discovery, development and commercialization of novel therapies for the treatment of cancer. It operates through the following segments: Oncology Innovation Platform, Global Supply Chain Platform, and Commercial Platform. The Oncology Innovation Platform segment focuses on the research and development of proprietary drugs. The Global Supply Chain Platform segment provides supply of active pharmaceutical ingredients (APIs) for clinical and commercial efforts. The Commercial Platform segment involves in the sales and marketing of specialty drugs and market development of proprietary drugs. The company was founded by Lyn M. Dyster and David G. Hangauer in November 2003 and is headquartered in Buffalo, NY.

Be aware that ATNX will be reporting earnings tomorrow, so tread carefully. I like the set-up so I'm presenting it despite being vulnerable to an earnings price shock on the Recap Friday. You have the ability to watch the open and find the best entry if available...that can be hard on an upside price shock. The chart has a bullish falling wedge with a breakout today. It closed right on the declining tops trendline which put it above all of its EMAs. The PMO is turning up and going in for a crossover BUY signal and the RSI has just entered positive territory.

The weekly chart isn't particularly bullish as we could be looking at a double-top. However, the RSI is positive and the PMO has turned up while above its signal line.

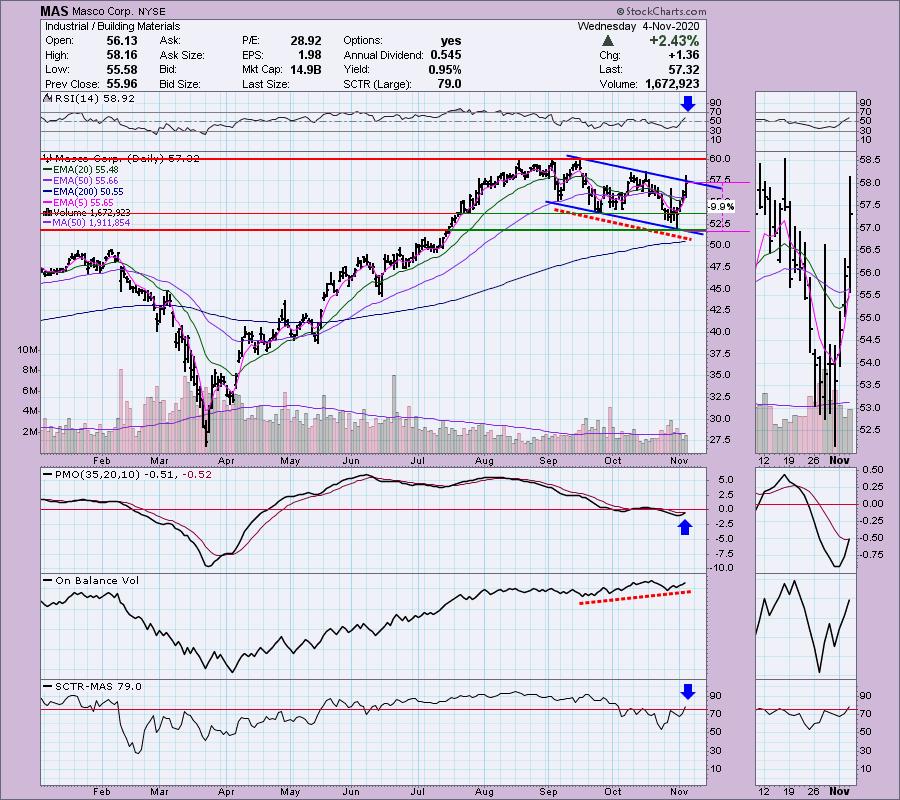

Masco Corp. (MAS)

EARNINGS: 2/9/2021 (BMO)

Masco Corp. engages in the design, manufacture, marketing and distribution of branded home improvement and building products. It operates through the following business segments: Plumbing Products and Decorative Architectural Products. The Plumbing Products segment includes faucets; plumbing fittings and valves; showerheads and hand showers; bathtubs and shower enclosures; toilets; spas, and exercise pools. The Decorative Architectural Products segment offers paints and coating products; and cabinet, door, window, and other hardware. The company was founded by Alex Manoogian in 1929 and is headquartered in Livonia, MI.

Here we have a breakout from a declining trend channel coming alongside a new PMO BUY signal. The RSI has moved into positive territory. The SCTR just entered the "hot zone" above 75. I really like the OBV positive divergence. The stop is set under support at the October low.

The RSI is staying in positive territory. You could make a case for a bull flag off the bear market low. However, that doesn't negate a PMO SELL signal which gives MAS a negative weekly chart. Good news would be the PMO is decelerating and could turn back up.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Polaris Inds, Inc. (PII)

EARNINGS: 1/26/2021 (BMO)

Polaris Inc. engages in designing, engineering, and manufacturing powersports vehicles. The company was founded by Allen Hetteen, Edgar E. Hetteen, and David Johnson in 1954 and is headquartered in Medina, MN.

Down a little over -1%, PII has an interesting double-bottom. It isn't exactly textbook as the decline preceding the formation wasn't in place for very long and this is considered a reversal pattern. If it is a double-bottom, we should expect a move past $105 to confirm the pattern and then a minimum upside target just under $125. The PMO is nearing a BUY signal and the RSI has just entered positive territory. The stop is set below the double-bottom formation.

The RSI is positive, but the PMO is on a SELL signal. This is another one where the weekly PMO is decelerating which could mean the intermediate term is getting better.

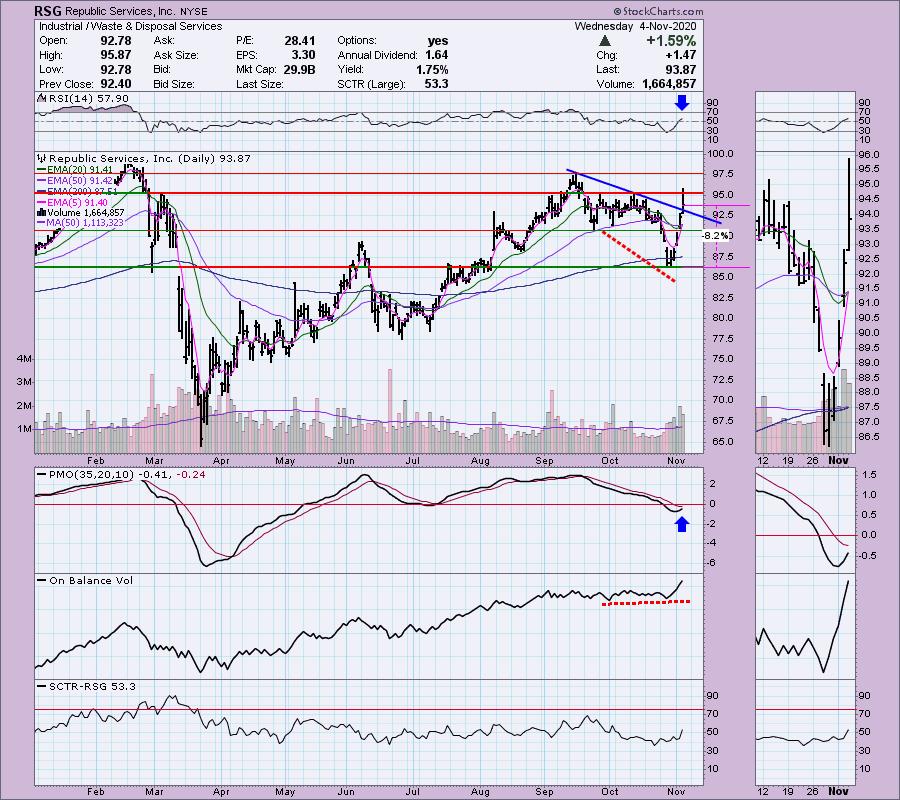

Republic Services, Inc. (RSG)

EARNINGS: 11/5/2020 (AMC)

Republic Services, Inc. engages in the provision of services in the domestic non-hazardous solid waste industry. It provides integrated waste management services, which offers non-hazardous solid waste collection, transfer, recycling, disposal and energy services. The company operates through the following segments: Group 1 and Group 2. The Group 1 segment consists of geographic areas located in western United States. The Group 2 segment consists of geographic areas located in the southeastern and mid-western and the eastern seaboard of the United States. Republic Services was founded in 1996 and is headquartered in Phoenix, AZ.

Here is another one that will be reporting earnings tomorrow. It happens to be down -1.14% in after hours trading. I really like the rally coming off a positive OBV divergence. The RSI has just entered positive territory and the PMO has turned up and is headed toward a crossover BUY signal. We have a nice breakout from a declining trend, but I do note it wasn't able to close above $95 overhead resistance.

The weekly chart shows a positive RSI and a PMO that is bottoming above the signal line.

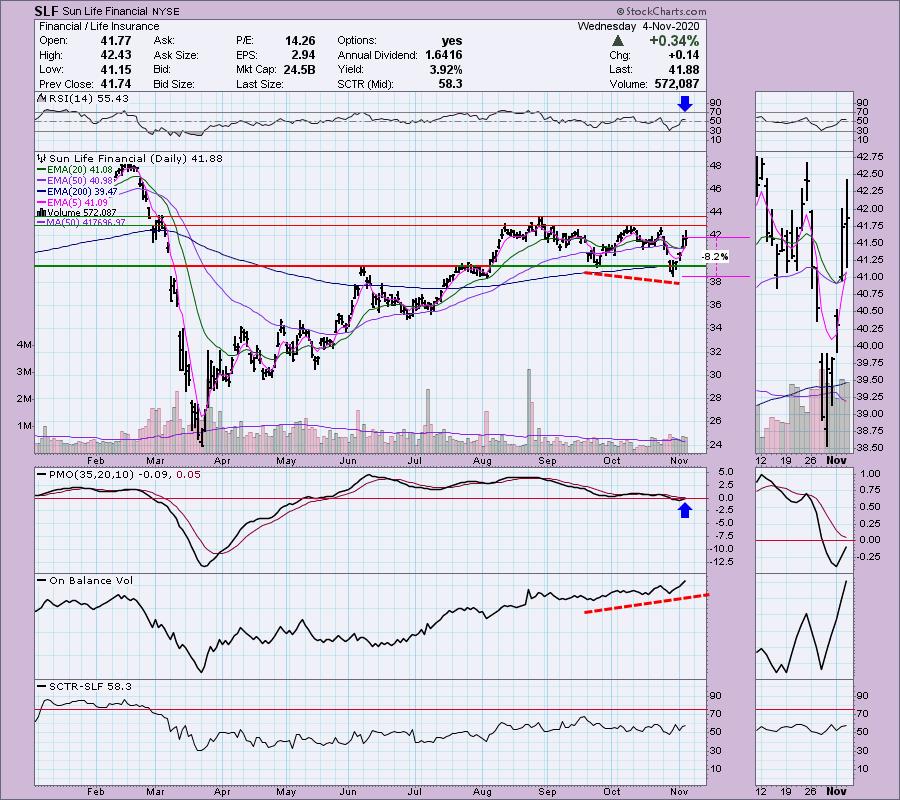

Sun Life Financial (SLF)

EARNINGS: 11/4/2020 (AMC)

Sun Life Financial, Inc. is a holding company. The firm engages in the provision of financial services. It operates through the following segments: Sun Life Financial Canada, Sun Life Financial United States, Sun Life Financial Asset Management, Sun Life Financial Asia, and Corporate. The Sun Life Financial Canada segment offers individual insurance and wealth, and group benefits and retirement services. The Sun Life Financial United States segment consists of group benefits, international and in-force management services. The Sun Life Financial Asset Management segment focuses on the design and delivers investment products through MFS investment management, and Sun Life investment management. The Sun Life Financial Asia segment comprises of Philippines, Hong Kong, Indonesia, Vietnam, Malaysia, India, and China markets. The Corporate segment represents United Kingdom business unit and corporate support operations, which include run-off reinsurance operations as well as investment income, expenses, capital, and other items. The company was founded on March 18, 1865 and is headquartered in Toronto, Canada.

I don't think that I've presented a Financial sector stock in some time. I debated whether to include this one given the trading range an inability to breakout. However, I note there is a strong positive divergence between price and the OBV. These usually lead to sustained rallies. The RSI is positive, the PMO is rising and the SCTR is respectable at 58.3 which tells us that SLF is at least considered in the top half of all mid-cap stocks.

The weekly chart isn't as favorable as I'd like so keep your eye on this one. In the thumbnail you could make out a possible double-top. Good news is a positive RSI and a PMO that appears to be bottoming above the signal line.

Full Disclosure: It is time for me to add positions. I'll keep you posted. I'm about 30% invested and 70% is in 'cash', meaning in money markets and readily available to trade with.

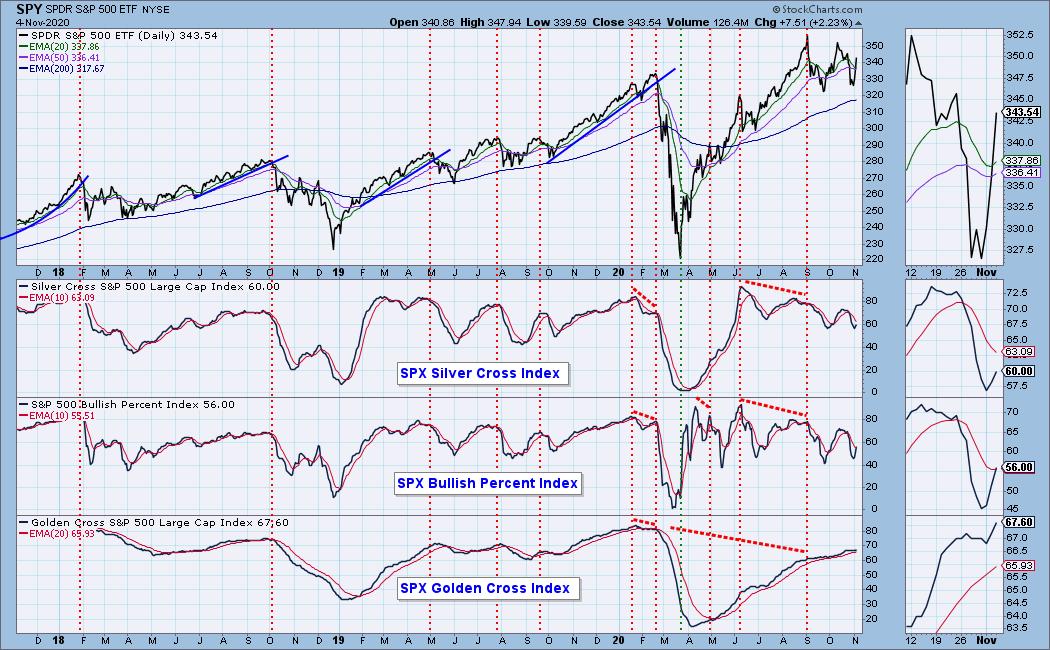

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 14

- Diamond Dog Scan Results: 8

- Diamond Bull/Bear Ratio: 1.75

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!