It was interesting, we ended the Diamond Mine Trading Room last Friday with all of us agreeing it may be better to look for short positions since the scans were showing slim pickings going into this week. I said that I likely would look for shorts the following week. However, since then we are seeing short-term internal strength and amazingly, the Diamond Dog Scan only returned 7 choices today; whereas last week, I had 14, 53, 76, 70 & 30. The Diamond PMO Scan didn't improve on its readings, but there were far more possibilities for longs today versus Friday. We have some double-bottom patterns forming on some choice stocks that I will share.

I worked on finding stocks from a variety of industries in sectors that have held strength or are building strength. Industrials and Materials have been relatively strong and of course Consumer Staples is generally an area of the market where investors go wait out a market storm. Additionally, I am covering the DecisionPoint Show "Diamond of the Week" which didn't move much today but is still set up nicely to outperform.

Today's "Diamonds in the Rough" are: BCC, CNS, CORE, GOLD and SHW

Diamond Mine Information:

Diamond Mine Information:

Here is the (10/30/2020) recording link. Access Passcode: ?=&@p9wm

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (11/6/2020) 12:00p ET:

Here is the registration link for Friday, 11/6/2020. Password: sparkle

Please do not share these links! They are for Diamonds subscribers ONLY!

It's Free!

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

There was no trading room on 11/2, but did you miss the 10/27 trading room? Here is a link to the recording (access code: X+2gJfpd). For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Boise Cascade Co. (BCC)

EARNINGS: 2/22/2021 (AMC)

Boise Cascade Co. engages in the manufacture and distribution of vertically-integrated wood products and building materials. It operates through the Wood Products and Building Materials Distribution (BMD) segments. The Wood Products segment manufactures and sells engineered wood products, plywood, particleboard, studs and ponderosa pine lumber. The Building Materials Distribution segment distributes and sells broad line of building materials, including engineered wood products, oriented strand board, plywood, lumber, and general line items such as siding, metal products, insulation, roofing, and composite decking. The company was founded on October 29, 2004 and is headquartered in Boise, ID.

BCC has a great set up. We have a double-bottom forming off two lows that occurred right on the 200-EMA. It's a tall pattern so the minimum upside target would be substantial at about $62! I'm not saying it will go there, but the pattern is highly favorable. The RSI is now in positive territory and the PMO triggered a new BUY signal today. The SCTR just reentered the "hot zone" above 75. I don't like having to set a deep stop, but I suspect you can find a better entry than today's closing price and that would give you the ability to set your stop just below the 200-EMA.

The weekly PMO is currently on a SELL signal, but you can see that it is already decelerating with this week's 10%+ move. Upside potential still has a gain of over 15% even if bought at the current price.

Cohen & Steers Inc. (CNS)

EARNINGS: 1/20/2021 (AMC)

Cohen & Steers, Inc. is a holding company which operates as an investment manager specializing in liquid real assets, which include real estate securities, listed infrastructure, commodities, natural resource equities, preferred securities, and other income solutions. It manages investment vehicles, such as institutional accounts, open-end funds and closed-end funds. The company was founded by Martin Cohen and Robert Hamilton Steers in 1986 and is headquartered in New York, NY.

I really like the double-bottom that has formed on CNS. It isn't "officially" a double-bottom until it crosses above the confirmation line, but it is heading there quickly. Notice we just got a ST Trend Model BUY signal as the 5-EMA crossed above the 20-EMA. The PMO generated a crossover BUY signal today and is headed back into positive territory. The RSI is now in positive territory. We have a possible island reversal here, so I wouldn't set any overnight orders, just in case. We may get confirmation of the pattern with a breakout above $60.50, but overhead resistance at $62.50 is right there to be reckoned with.

The RSI hasn't been able to get above net neutral (50) and the weekly PMO is falling. I would consider this a short-term investment.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Core Mark Holding Co., Inc. (CORE)

EARNINGS: 11/5/2020 (BMO)

Core-Mark Holding Co., Inc. engages in distribution and marketing of consumer goods. It offers products, marketing programs, and technology solutions. It operates through United States, and Canada, and Corporate geographical segments. The company was founded in 1888 and is headquartered in South San Francisco, CA.

Here is another double-bottom. However in this case, the confirmation line is above strong overhead resistance, in this case, the April top. I really like how this one is set up. We have a positive OBV divergence and an RSI that popped into positive territory. The PMO is headed back up for a crossover BUY signal. You can set a stop below support around $26.75.

You can see the earmarks of a "Staples" stock. They aren't sexy, they tend to move in wide trading ranges. Price is struggling with the 17/43-week EMAs and $30 overhead resistance. If it can overcome that price level, we could eke out a 15%+ gain if it challenges the most recent top. If that level can be vaulted, $40 is the next stop.

Barrick Gold Corp. (GOLD)

EARNINGS: 11/5/2020 (BMO)

Barrick Gold Corp. engages in the production and sale of gold and copper, as well as related activities such as exploration and mine development. It operates through the following segments: Barrick Nevada, Veladero, Pueblo Viejo, Lagunas Norte, Turquoise Ridge, Acacia, and Pascua-Lama. The company was founded by Peter D. Munk in 1983 and is headquartered in Toronto, Canada.

GOLD is up +0.14% in after hours trading. I covered GOLD in the April 7th Diamond Report. It is up 36.8% since then, but it hasn't done much for the past few months. I'm presenting this Gold Miner, but I think everyone has their favorite. This is a solid company that (as I'm sure you heard) Warren Buffett recently purchased a major stake in. That aside, the technicals are looking good. Today we saw a breakout from a falling wedge pattern. The RSI has just moved in to positive territory and the PMO is going in for a BUY signal. I like the pop in volume that has moved the OBV up substantially. The stop is reasonable being set under support at the most recent low.

I do not like the PMO here at all, but the RSI is positive. May not be the best intermediate-term investment, but it has promise in the short term.

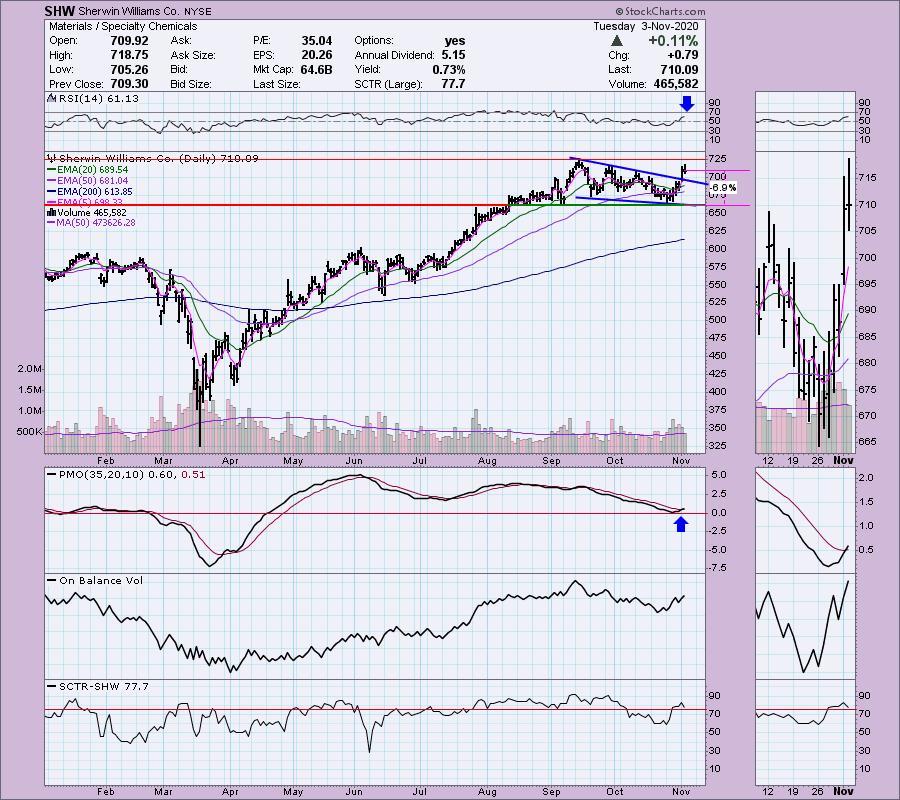

Sherwin Williams Co. (SHW)

EARNINGS: 1/28/2021 (BMO)

The Sherwin-Williams Co. engages in the manufacture and trade of paint and coatings. It operates through the following segments: America Group, Consumer Brands Group, and Performance Coating Group. The America Group segment manages the exclusive outlets for Sherwin-Williams branded paints, stains, supplies, equipment, and floor covering. The Consumer Brands Group segment sells portfolios of branded and private-label products through retailers in North America and in parts of Europe, Australia, New Zealand and China, and also operates global supply chain for paint and coatings. The Performance Coating Group segment offers coatings and finishes, and sells in industrial wood, protective and marine, coil, packaging, and automotive markets. The company was founded by Henry Sherwin and Edward Williams in 1866 and is headquartered in Cleveland, OH.

I found this stock before the taping of yesterday's DecisionPoint Show to present as the "Diamond of the Week". Price has just broken out from a bullish falling wedge. The PMO just had a crossover BUY signal and the RSI is positive. Volume is coming in and the SCTR is in the hot zone. You do not need to set a deep stop on this one.

The weekly RSI is positive, although getting a bit overbought. The PMO was going in for a crossover SELL signal, but looking at the thumbnail, it appears it will avoid that. Price does have the look of a bull flag.

Full Disclosure: I'm about 30% invested and 70% is in 'cash', meaning in money markets and readily available to trade with.

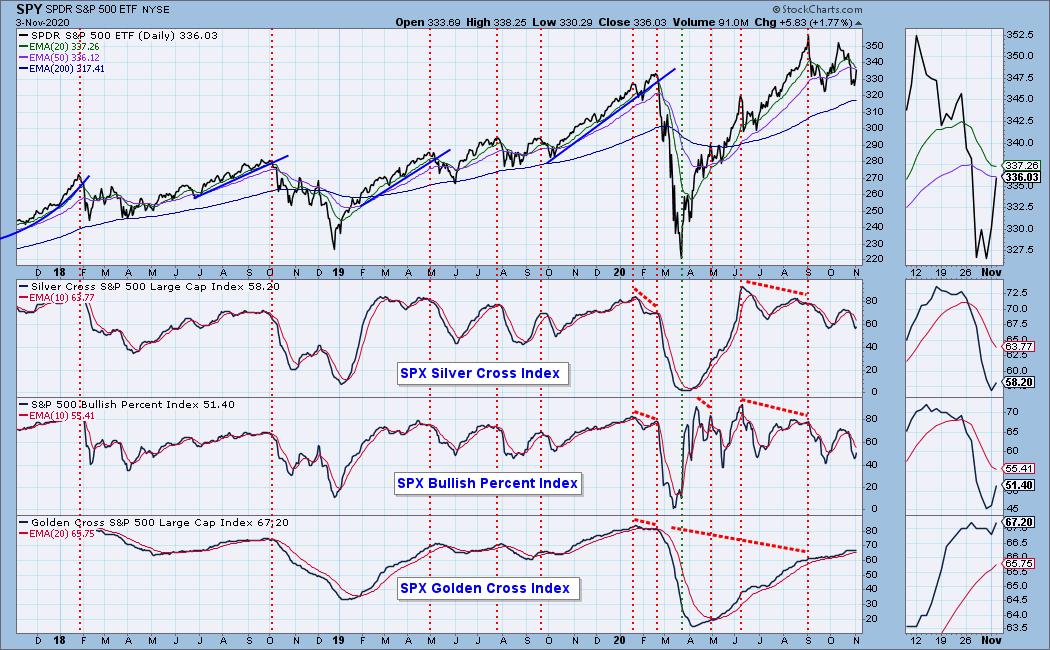

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 1

- Diamond Dog Scan Results: 7

- Diamond Bull/Bear Ratio: 0.14

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!