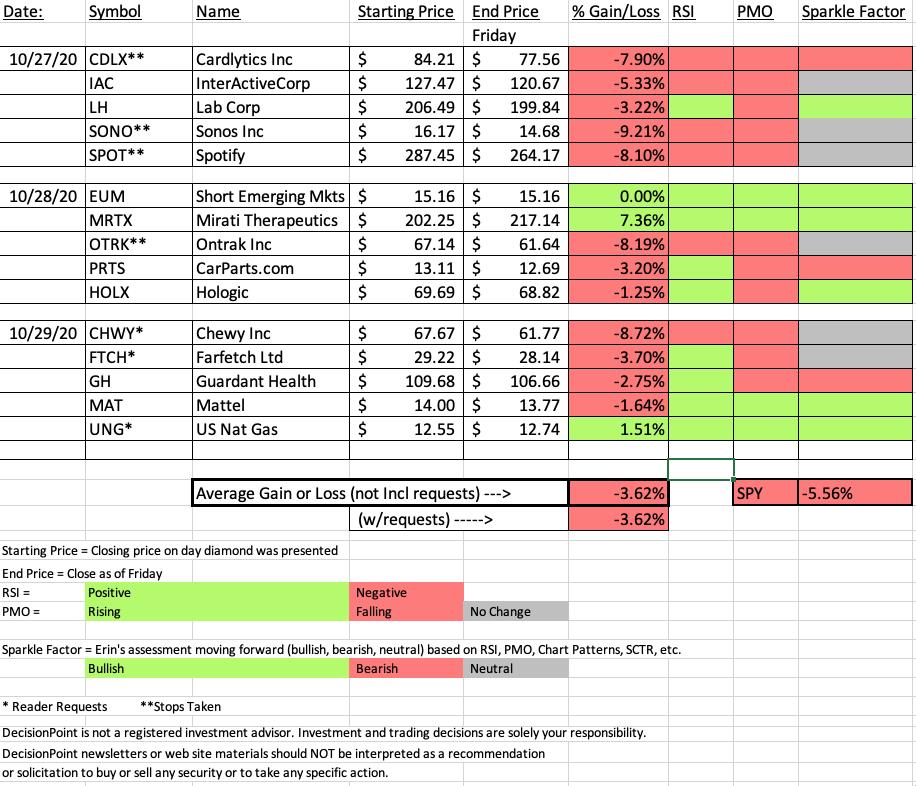

Time to reveal the spreadsheet for this week's "Diamonds in the Rough". The market decline didn't leave our diamonds unscathed, but ultimately the SPY was down -5.56% on the week and Diamonds were down on average -3.62%. Nothing to brag about, a loss is a loss in my portfolio. Four of this week's diamonds hit their stop levels. Last week was the first time since doing the recap that it had happened. In today's Diamond Mine trading room, I ran my bullish scans and had really no good results. Consequently, I will likely be concentrating on short positions going into next week. Although, I am seeing strength in the Materials (XLB) sector going into next week.

The big loser this week was Sonos Inc (SONO). I was very surprised as the chart had been set up well. I felt this week's Diamond Mine was especially helpful. With so many stocks going the wrong way, it was an excellent opportunity to look back and see if there were clues on the charts that they would fail.

The big winner this week is Mirati Therapeutics (MRTX). I continue to like this stock and I'll tell you more below.

Don't forget to sign up now for next Friday's Diamond Mine trading room! You'll find the link below as well as the link to the recording from today's Diamond Mine.

Diamond Mine Information:

Diamond Mine Information:

Here is today's (10/30/2020) recording link. Access Passcode: ?=&@p9wm

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (11/6/2020) 12:00p ET:

Here is the registration link for Friday, 11/6/2020. Password: sparkle

Please do not share these links! They are for Diamonds subscribers ONLY!

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

It's FREE!

***Click here to register for this recurring free DecisionPoint Trading Room!***

Did you miss the 10/19 trading room? Here is a link to the recording (password: Au6B.X*1).

For best results, copy and paste the password to avoid typos.

DUD:

Sonos Inc. (SONO)

EARNINGS: 11/18/2020 (AMC)

Sonos, Inc. provides multi-room wireless smart home sound systems. It supports streaming services around the world, providing customers with access to music, Internet radio, podcasts, and audiobooks, with control from Android smartphones, iPhone, or iPad. The company was founded by Mai Trung, John MacFarlane, Craig A. Shelburne and Thomas S. Cullen in 2002 and is headquartered in Santa Barbara, CA.

Here is the chart from Tuesday. Were there any hints that this was going to be a "dud"? I really don't think so. The only negative I can see is a possible reverse divergence. The OBV had a lower top in July than the most current one. Basically, despite more volume, price was unable to challenge the July top.

Today's chart shows us that the breakout from the declining trend was a fake out. It is now trying to break the short-term rising trend that formed off the September low. The RSI and PMO have completely tanked. However, you will notice that I have it listed with a "Neutral" Sparkle Factor on the spreadsheet. Price is now reaching important horizontal support at $13.50. I think this one deserves a place on a watch list.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Darling:

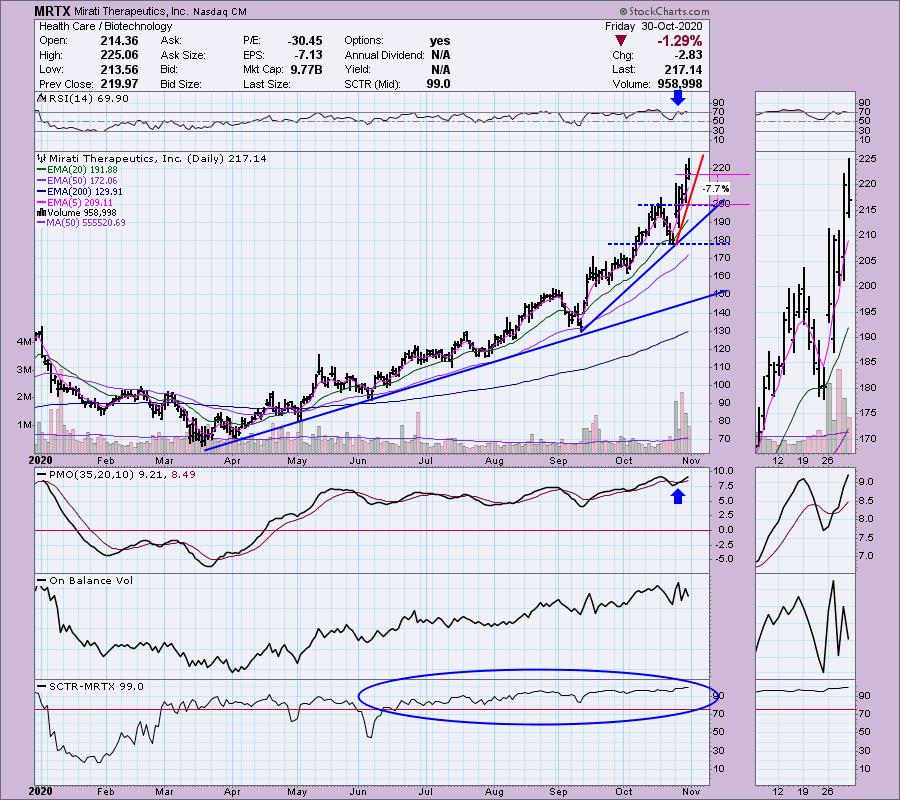

Mirati Therapeutics, Inc. (MRTX)

EARNINGS: 11/4/2020 (AMC)

Mirati Therapeutics, Inc. is a clinical-stage oncology company. The firm engages in developing a pipeline of oncology products to treat genetic, immunological and epigenetic drivers of cancer in subsets of cancer patients. Its clinical pipeline consists of glesatinib, sitravatinib and mocetinostat. The company was founded on December 13, 1995 and is headquartered in San Diego, CA.

I liked this one on the pullback Wednesday and that turned out to be a good entry point. Notice the difference in the OBV compared to SONO above. OBV tops are rising with price tops. Volume is coming in and price is following it as it should.

I still like the stock today, although it is now overbought and we can see yet another change to a steeper rising trend. The steeper the trend, the more difficult it is to sustain. I've adjusted the stop to coincide with the mid-October top.

THIS WEEK's Sector Performance:

CONCLUSION:

Sector to Watch: Materials Sector (XLB)

Industry Group to Watch: Nonferrous Metals ($DJUSNF) and Containers & Packaging ($DJUSCP)

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Have a Great Weekend! Happy Charting!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 35% invested right now and 65% is in 'cash', meaning in money markets and readily available to trade with. I have no interest in adding positions right now.

Technical Analysis is a windsock, not a crystal ball.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!