This morning "The Pitch" aired where Mark Newton, John Kosar and I presented five actionable trades. I presented four of Tuesday's Diamonds in the Rough in addition to Repligen (RGEN). They had a better day today after pulling back during yesterday's blood bath. However, I had two of those Tuesday picks triggered their stops yesterday. I'll be annotating that in tomorrow's spreadsheet. Despite that, in two days, "diamonds in the rough" are outperforming the SPY by almost 3% (of course that still means the average is negative, but I feel much better today than I did yesterday). Below is the link to watch "The Pitch". It was a great show!

Register now for tomorrow's Diamond Mine trading room! The link is below the video.

Today's "Diamonds in the Rough" are: CHWY, FTCH, GH, MAT, and UNG.

Diamond Mine Information:

Diamond Mine Information:

Register in advance for the 10/30/2020 "DecisionPoint Diamond Mine" trading room on Friday 12:00p ET:

Registration Password: diamond

********************************************************************************************************

Recording from Today's (10/23/2020) is at this link. Access Passcode: 3F36ts=$

Please do not share these links! They are for Diamonds subscribers ONLY!

********************************************************************************************************

It's Free!

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

Did you miss the 10/27 trading room? Here is a link to the recording (access code: X+2gJfpd). For best results, copy and paste the access code to avoid typos.

** Please note there will NOT be a free Trading Room on November 2nd! **

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Chewy Inc. (CHWY)

EARNINGS: 12/9/2020 (AMC)

Chewy, Inc. engages in the provision of pure-play e-commerce business. It supplies pet medications, food, treats and other pet-health products and services for dogs, cats, fish, birds, small pets, horses, and reptiles. The company was founded by Ryan Cohen and Michael Day in September 2011 and is headquartered in Dania Beach, FL.

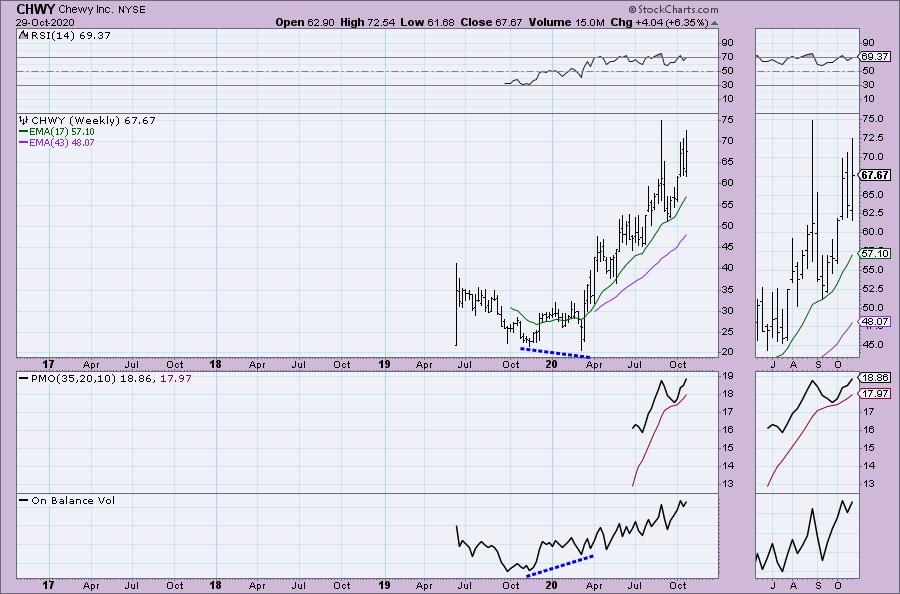

CHWY is down -0.10% in after hours trading. I am surprised I haven't covered CHWY yet. I think we are timing the presentation well. Thank you, Brian for your request as I very much like it! I see a possible cup and handle pattern that executed on Tuesday. It pulled back mightily today which makes me like it even more. The RSI remains positive and the PMO is still rising despite today's harrowing -6% decline.

Really nice weekly chart. We don't know if the PMO is overbought since we don't have the historic data. However, we do know that it is rising. Also note the textbook positive divergence that began this long-term rally.

Farfetch Ltd. (FTCH)

EARNINGS: 11/12/2020 (AMC)

Farfetch Ltd. engages in the provision of technology platform for the luxury fashion industry. It operates through the following segments: Digital Platform, Brand Platform, and In-Store. The Digital Platform segment activities include the Farfetch Marketplace, FPS, BrownsFashion.com, StadiumGoods.com, and Farfetch Store. The Brand Platform segment is comprised of design, production, brand development and wholesale distribution of brands. The In-Store segment covers the activities of group-operated stores including Browns, Stadium Goods and certain brands in the New Guards portfolio. Its products include womenswear, menswear, kidswear, vintage, fine watches, and fine jewelry. The company was founded by José Manuel Ferreira Neves in 2007 and is headquartered in London, the United Kingdom.

Down -1.44% in after hours trading, FTCH has formed a 'V' bottom which is a bullish pattern. The PMO has turned back up and is not overbought. The OBV is confirming the rally.

The PMO has flattened and it appears we have executed a bull flag pattern. Overall this reader request looks good.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Guardant Health Inc. (GH)

EARNINGS: 11/5/2020 (AMC)

Guardant Health, Inc. is a precision oncology company, which engages in treatment of cancer through use of proprietary blood-based tests, vast data sets, and advanced analytics. Its solutions include treatment selection, recurrence detection, and early detection. The company was founded by Helmy Eltoukhy, AmirAli H. Talasaz, and Michael Joseph Wiley in 2012 and is headquartered in Redwood City, CA.

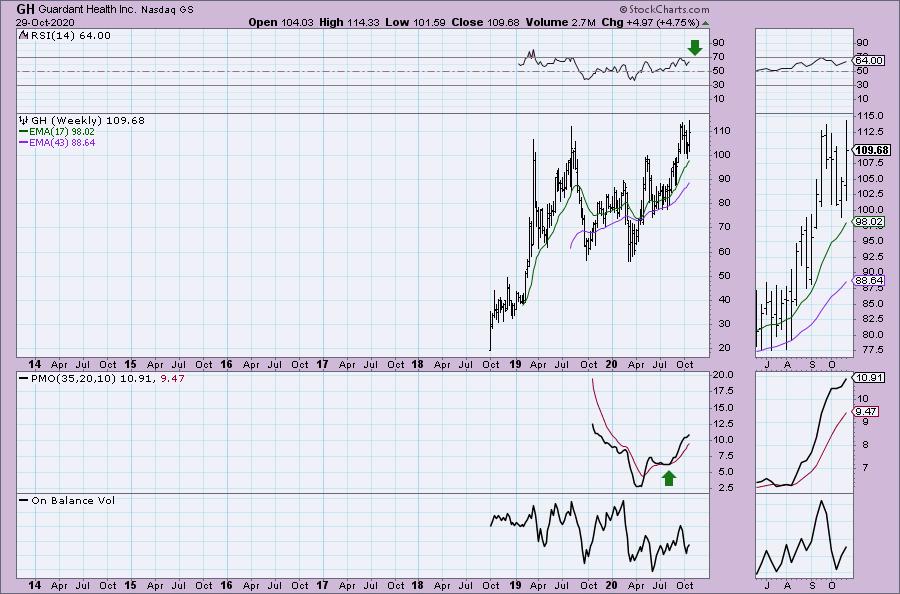

Up +0.02% in after hours trading, GH has broken from a declining trend channel. It is now pulling back to the breakout point. The RSI is positive and the PMO is rising out of oversold territory. Notice the positive divergence that appeared even before earnings were released that suggested a rally might be on tap. The current rally is a bull flag. The expectation is a breakout and rally the height of the pattern, that makes a minimum upside target set at $130.

The RSI is positive and the PMO is rising. At this point GH is setting new all-time highs. It's a very positive chart.

Mattel, Inc. (MAT)

EARNINGS: 2/11/2021 (AMC)

Mattel, Inc. is a global children's entertainment company that specializes in the design and production of toys and consumer products. The company engages consumers through its portfolio of iconic franchises, including Barbie, Hot Wheels, American Girl, Fisher-Price, Thomas & Friends, UNO and MEGA. It operates through the following segments: North America, International and American Girl. The North America and International segments market and sell products organized into four categories: 1.) Dolls, 2.) Infant, Toddler and Preschool, 3.) Vehicles and 4.) Action Figures, Building Sets, and Games. The American Girl Brands segment markets and sells historical dolls, books and accessories through Truly Me, Girl of the Year, Bitty Baby, and WellieWishers brands. The company was founded by Elliot Handler, Ruth Handler and Harold Matson in 1945 and is headquartered in El Segundo, CA.

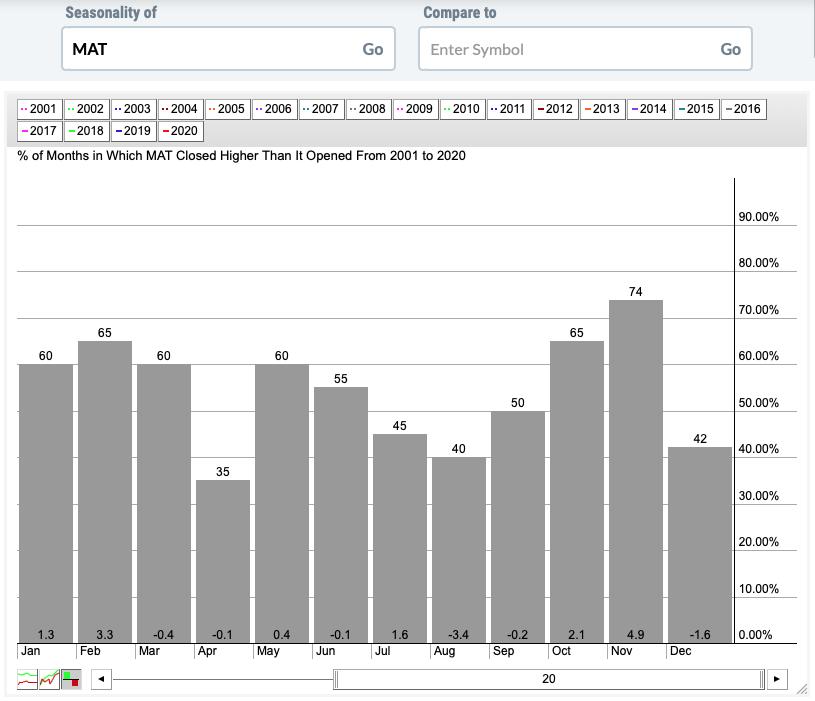

MAT is down -1.07% in after hours trading so a better entry may be available tomorrow. This one was not in my scan results, this one Mary Ellen brought to the table during "Yeah, That Happened..." segment on today's Chartwise Women show. I like it, especially going into November which tends to be a great month based on seasonality which you can see below the weekly chart. MAT gapped up on earnings and has been digesting that move. It is still overbought, but the RSI is now catching up to this new price range and will be out of overbought territory very soon. The PMO is rising, albeit overbought. Overhead resistance has so far held, but seasonality could be the trigger to a breakout.

The weekly chart is very favorable. The PMO is accelerating higher and is only somewhat overbought. The RSI is positive. You can see that overhead resistance could be a problem, but again looking at seasonality as well as the health of this weekly chart, I believe it can breakout here.

United States Natural Gas Fund (UNG)

EARNINGS: N/A

UNG holds near-month futures contracts in natural gas and swaps on natural gas.

Up +0.08% in after hours trading, most of you know that I have covered UNG numerous times in Diamonds. I've marked the price levels on those days. The links to the relevant Diamond Reports are June 11th, July 27th, August 20th and September 2nd. Currently, I'm not particularly bullish on UNG mainly due to the crazy volatility and the uncertainty of the election. I don't usually consider 'news', but given the pro and con policies of each candidate, this could spike either way. The technicals are pretty good, but as I said I don't like the volatility we've seen since we left the position in September. The PMO is rising after bottoming above the signal line and the RSI is neutral to positive. Admittedly, the indicators are acting similarly, but we did have a strong breakout from a declining trend, a pullback toward that breakout point and rising bottoms.

I do like the weekly chart. We have a double-bottom forming. Those bottoms are also rising. The PMO is rising, but it is still below the zero line. Additionally, price needs to push past the 43-week EMA.

Full Disclosure: I'm about 35% invested and 65% is in 'cash', meaning in money markets and readily available to trade with.

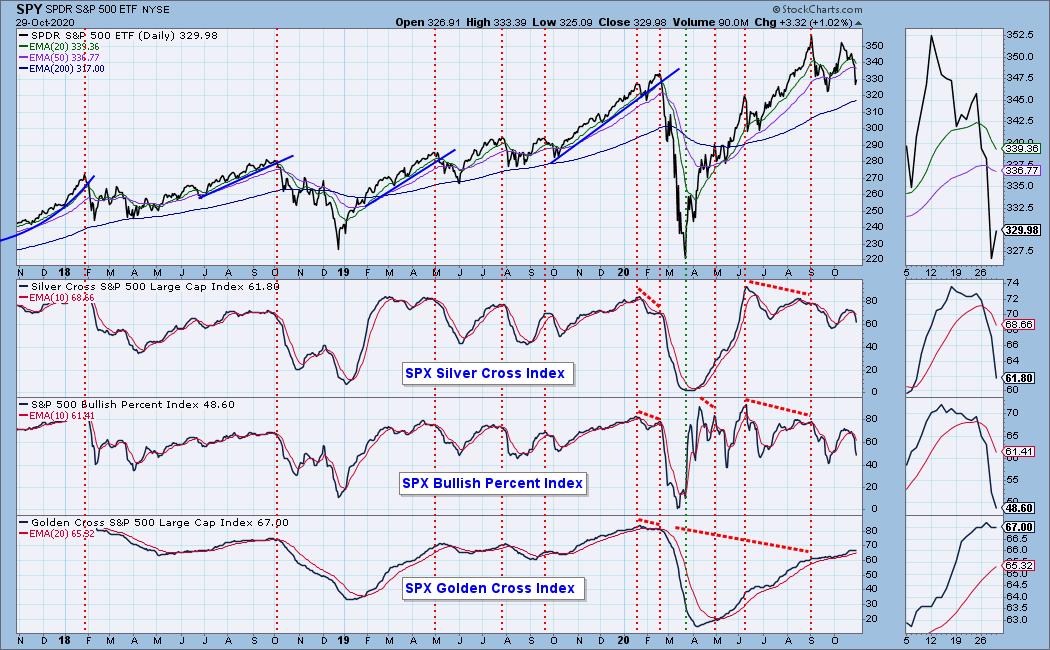

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 1

- Diamond Dog Scan Results: 70

- Diamond Bull/Bear Ratio: 0.01

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!