I will continue to preach caution right now. I have tightened up my stops and am looking to close out some positions this week. Today the Diamond PMO Scan had only four results while the Diamond Dog Scan had 30 results. These "diamonds in the rough" certainly have nice set-ups, but the market bias and sentiment is clearly shifting based on these scans so we have to be nimble and make sure we are protected.

Today's "Diamonds in the Rough": AN, DY, INSG, LOW, and SPOT.

Diamond Mine Information:

Diamond Mine Information:

Recording from 10/9/2020 is at this link. Access Passcode: .6O2G.E!

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (10/9/2020) 12:00p ET:

Here is the registration link for Friday, 10/16/2020. Password: outlook

Please do not share these links! They are for Diamonds subscribers ONLY!

IT'S FREE!

***Click here to register for this recurring free DecisionPoint Trading Room!***

Did you miss the 10/12 trading room? Here is a link to the recording (password: qE58C9.E). For best results, copy and paste the password to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Autonation, Inc. (AN)

EARNINGS: 10/21/2020 (BMO)

AutoNation, Inc. engages in the provision of automotive products and services. It operates through the following segments: Domestic, Import, Premium Luxury, and Corporate & Other. The Domestic segment comprises retail automotive franchises that sell new vehicles manufactured by General Motors, Ford and Chrysler. The Import segment includes retail automotive franchises that sell new vehicles manufactured primarily by Toyota, Honda, and Nissan. The Premium Luxury segment consists of retail automotive franchises that sell new vehicles manufactured primarily by Mercedes-Benz, BMW, Audi, and Lexus. The Corporate & Other segment involves in the collision centres, auction operations and stand-alone used vehicle sales and service centres. The company was founded by Steven Richard Berrard and Harry Wayne Huizenga Sr. in 1991 and is headquartered in Fort Lauderdale, FL.

I spy a flag on AN and the ability to hold onto support. The RSI is positive and not overbought. The PMO is rising and also is not overbought. The stop is fairly deep, but I think the 50-EMA is about right.

The RSI is positive and the weekly PMO is accelerating upward.

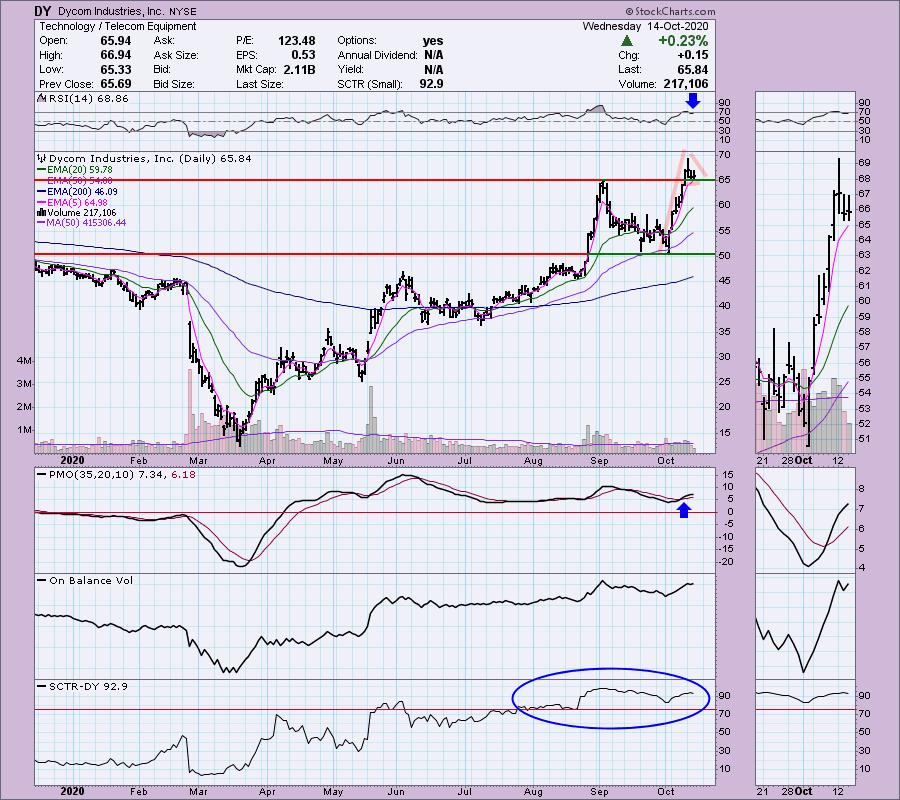

Dycom Industries, Inc. (DY)

EARNINGS: 11/24/2020 (BMO)

Dycom Industries, Inc. provides contracting services throughout the United States. Its services include engineering, construction, maintenance and installation services to telecommunications providers, underground facility locating services to various utilities, including other construction and maintenance services to electric and gas utilities, and others. The company was founded in 1969 and is headquartered in Palm Beach Gardens, FL.

This chart is very similar to AN, a flag formation with the flag staying above support. The RSI is a bit overbought, but the PMO is not.

The weekly PMO is accelerating higher and there is plenty of upside potential. The RSI could be an issue as it is overbought.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Inseego Corp. (INSG)

EARNINGS: 11/4/2020 (AMC)

Inseego Corp. engages in the design and development of fixed and mobile wireless solutions. It offers enterprise Internet of things, 4G long term evolution, and 5G services. The company was founded on April 26, 1996 and is headquartered in San Diego, CA.

I offer you Inseego as a possible bottom fish. It came up in Carl's Scan that finds those down and out stocks that are showing signs of life below the surface. The PMO is rising. The 200-EMA held once, it should hold again. The OBV is confirming this short move off this month's low and the SCTR is improving.

The weekly PMO leaves a lot to be desired, but the RSI has been in positive territory. This $10 support level is critical when you look at the weekly chart. They are in the 5G business and so I was willing to present it.

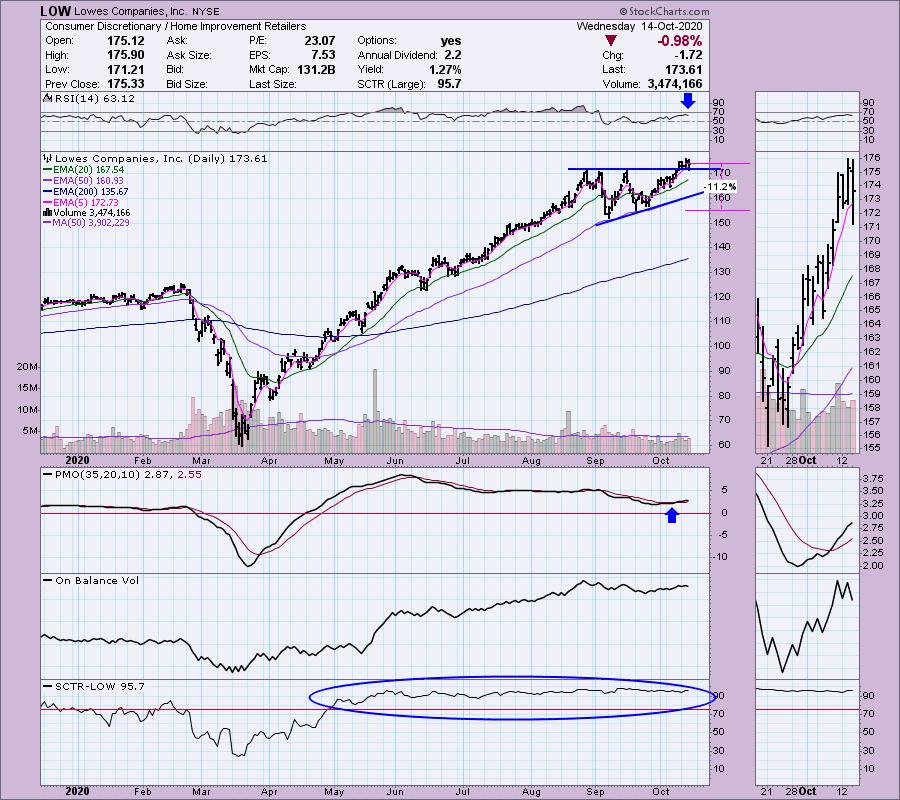

Lowes Companies, Inc. (LOW)

EARNINGS: 11/18/2020 (BMO)

Lowe's Cos., Inc. engages in the retail sale of home improvement products. The firm offers products for maintenance, repair, remodelling, home decorating and property maintenance. It also provides home improvement products in the following categories: appliances, bathroom, building supply, electrical, flooring, hardware, paint, kitchen, plumbing, lighting & fans, outdoor living, windows and doors. The company was founded in 1946 and is headquartered in Mooresville, NC.

Down -0.34% in after hours trading, LOW has a lovely ascending triangle pattern. Price hasn't had a "decisive" breakout, but it is holding onto support. The PMO is rising out of oversold territory. The RSI is positive and not overbought.

The weekly PMO is overbought, but it just bottomed above the signal line. The RSI is overbought here, but if it begins to run, that can persist just as it did in 2014/15.

Spotify Technology S.A. (SPOT)

EARNINGS: 10/29/2020 (BMO)

Spotify Technology SA is a digital music service offering music fans instant access to a world of music. The company operates through the following segments: Premium and Ad-Supported. The Premium segment provides subscribers with unlimited online and offline high-quality streaming access of music and podcasts on computers, tablets, and mobile devices, users can connect through speakers, receivers, televisions, cars, game consoles, and smart watches. It also offers a music listening experience without commercial breaks. The Ad-Supported segment provides users with limited on-demand online access of music and unlimited online access of podcasts on their computers, tablets, and compatible mobile devices. It also serves both premium subscriber acquisition channel and a robust option for users who are unable or unwilling to pay a monthly subscription fee but still want to enjoy access to a wide variety of high-quality audio content. The company was founded by Daniel Ek and Martin Lorentzon in April, 2006 and is headquartered in Luxembourg.

Down -0.10% in after hours trading, SPOT is one that I mentioned as a possible diamond yesterday, but it was up over 6.5% on the day and I didn't want to start at a disadvantage. Today we got the pullback I was looking for. I think the chart still has merit. The RSI and PMO have readings. The PMO is rising from an oversold crossover BUY signal. This was a hefty pullback today, but it didn't damage the OBV as volume wasn't that high today on the decline. The 20-EMA has just crossed above the 50-EMA which triggers an IT Trend Model BUY signal.

Not the best looking weekly chart as the weekly PMO is on a SELL signal. Good news is that at least the RSI is positive. Upside potential is good. You can see why I put my stop in the chart above at the $240 level.

Full Disclosure: I won't be adding to my positions. I'm about 50% invested and 50% is in 'cash', meaning in money markets and readily available to trade with.

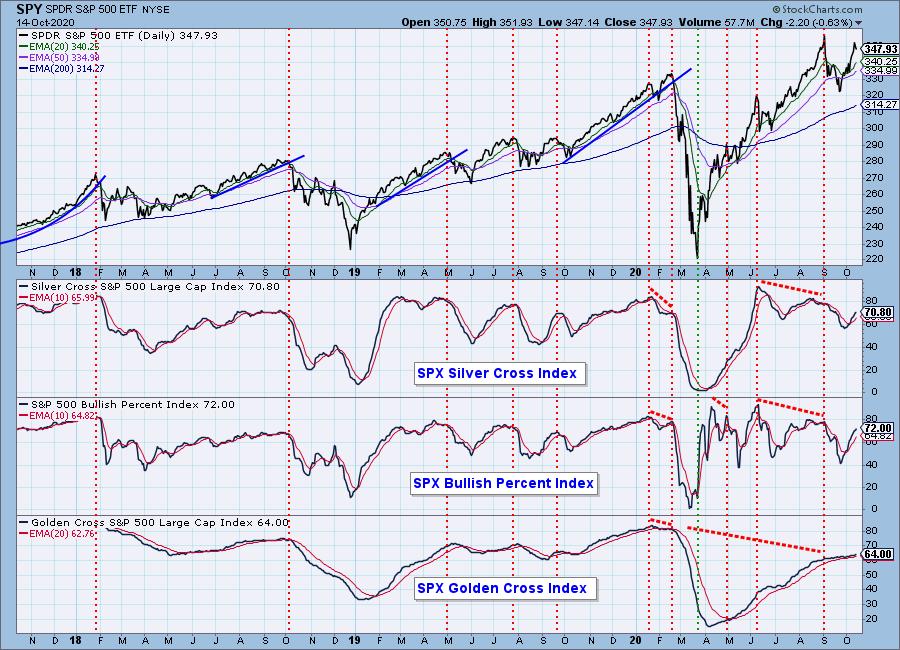

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index 10/13:

- Diamond Scan Results: 4

- Diamond Dog Scan Results: 30

- Diamond Bull/Bear Ratio: 0.13

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!