Reader requests were somewhat light today, but interestingly (and really not surprisingly), one of the reader requests was on my short list to present as my own diamond in the rough today so you're getting two from my list. Today's "diamond in the rough" I chose first is a company that I use and am familiar with.

The company is StitchFix (SFIX). They have relied heavily on recurring subscription purchases. Each delivery includes five items selected especially for you by a "stylist" from dresses and jeans to purses, shoes and jewelry. It's like Christmas when the box arrives because you have no idea what they've selected for you. It's fabulous for girls like me who rarely go out shopping for clothes but want to keep an updated wardrobe for special occasions, travel, business, etc. They used to charge a fee with each shipment, then they set it up that you pay one fee annually. One of the frustrating aspects of StitchFix has always been that if you like a particular item or want to shop for an item yourself, it is not an option. They have changed up their business model slightly and I believe it to be a smart move. Now they are offering "one-off" purchases, allowing you to browse items based on what you've liked before. They even have some of the items you may have previously purchased in different colors and patterns. I've found that this ekes out a few more dollars from me and I suspect the same is happening with other customers. It also reels in those who only want a few items and they prefer to choose themselves. Without my girls living with me to give me advice, I rely on the stylist!

Don't forget to register for tomorrow's Diamond Mine trading room! Additionally, I apologize to my readers. Last night I sent out the "draft" version of my report and not the final version, so it probably didn't make a whole lot of sense on a few of the write ups. I fixed it an hour or so after I published so some of you may want to go back and reread it.

Today's "Diamonds in the Rough" and Reader Requests: AME, KRO, LULU, SFIX, and TTD.

Diamond Mine Information:

Diamond Mine Information:

Recording from 10/9/2020 is at this link. Access Passcode: .6O2G.E!

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (10/16/2020) 12:00p ET:

Here is the registration link for Friday, 10/16/2020. Password: outlook

Please do not share these links! They are for Diamonds subscribers ONLY!

IT'S FREE!

***Click here to register for this recurring free DecisionPoint Trading Room!***

Did you miss the 10/12 trading room? Here is a link to the recording (password: qE58C9.E). For best results, copy and paste the password to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

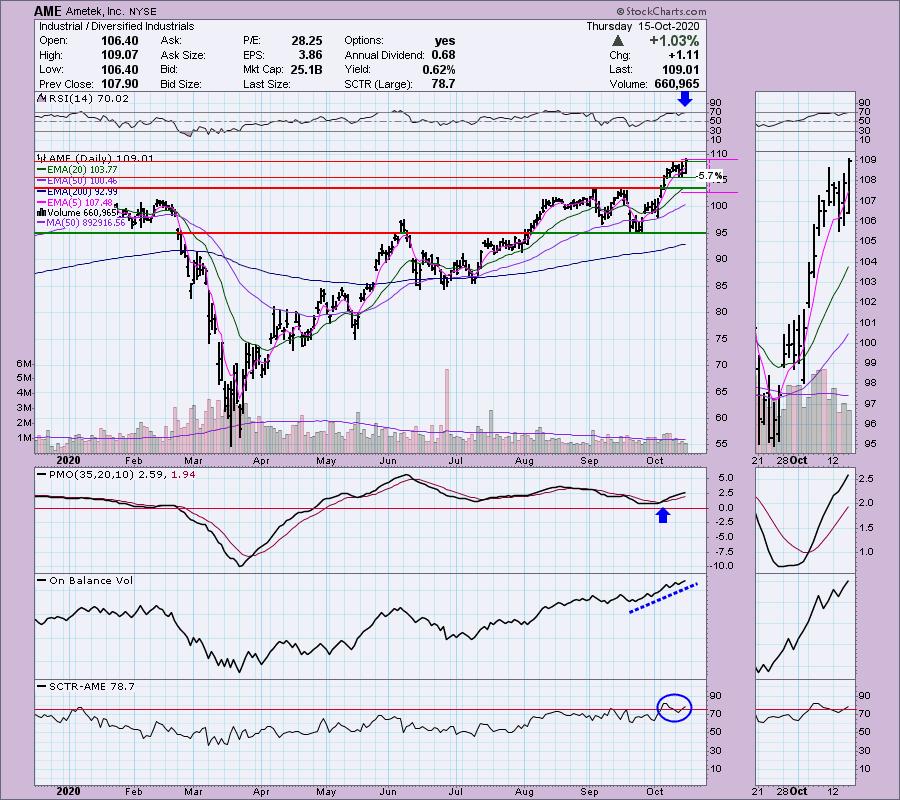

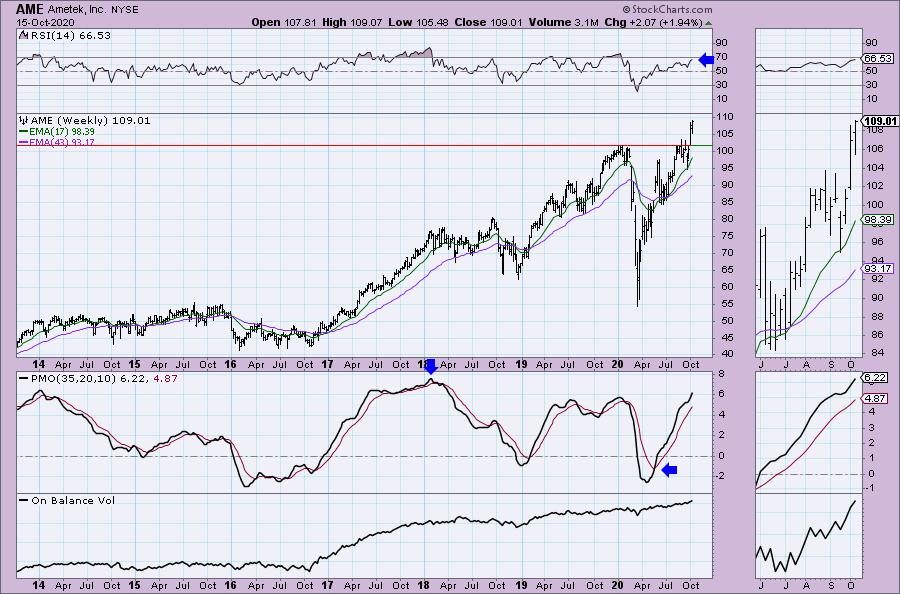

Ametek, Inc. (AME)

EARNINGS: 10/29/2020 (BMO)

AMETEK, Inc. engages in the manufacture of electronic instruments and electromechanical devices. It operates through the following two segments: Electronic Instruments and Electromechanical. The Electronic Instruments segment designs and manufactures advanced instruments for the process, aerospace, power and industrial markets. The Electromechanical segment supplies automation solutions, thermal management systems, specialty metals and electrical interconnects. The company was founded in 1930 and is headquartered in Berwyn, PA.

Ametek (AME) broke out today from the consolidation cluster. The PMO is on a BUY signal and OBV is confirming the rising trend. The RSI is slightly overbought. I would've liked to have seen more volume on today's breakout to confirm conviction, but the SCTR is in the "hot zone" above 75 now suggesting it is in the top 25% of all large-cap stocks.

Nice weekly PMO rising and not extremely overbought yet. The RSI is positive and not overbought.

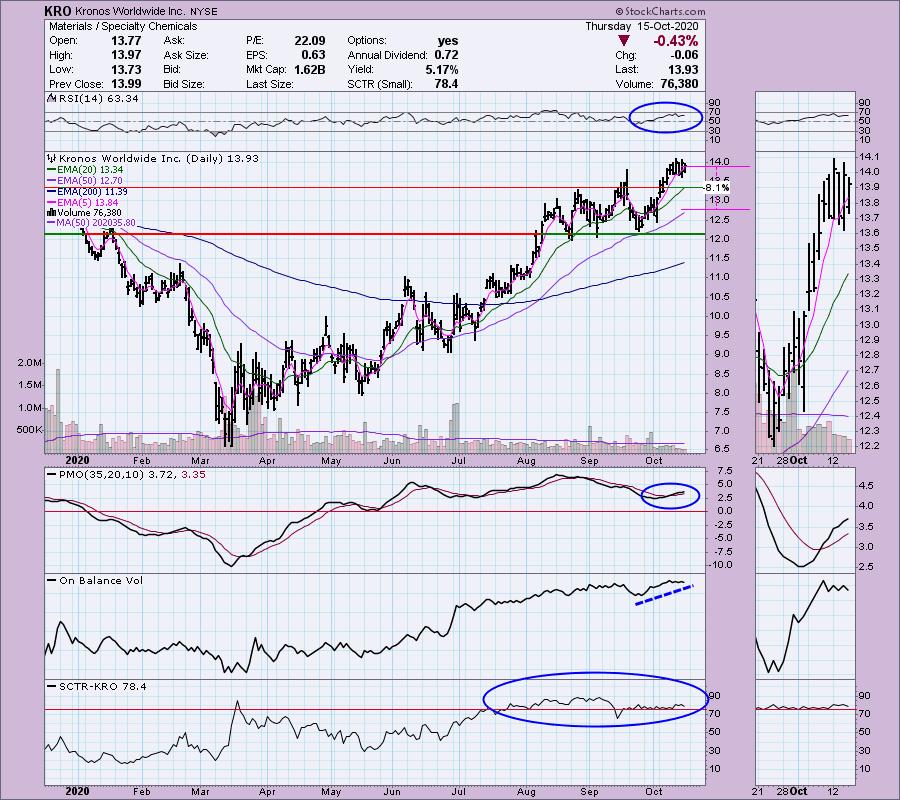

Kronos Worldwide Inc. (KRO)

EARNINGS: 11/4/2020 (AMC)

Kronos Worldwide, Inc. engages in the production and market of value-added titanium dioxide pigments. The firm sells and provides technical services for its products to customers in Europe and North America. It offers its customers a portfolio of products that include TiO2 pigment grades under the Kronos trademark. Its customers include domestic and international paint, plastics and paper manufacturers. The company was founded in 1916 and is headquartered in Dallas, TX.

This one is mixed for me. I probably wouldn't have selected it as a diamond myself, but there are good things here. I'll explain my issues after. The RSI is positive and the PMO is rising and on a BUY signal. The rising trend out of the late September low is being confirmed by the OBV. My issue would be the somewhat "diamond" shape of the consolidation zone and that very short-term OBV tops are falling as intraday highs fall. This doesn't mean it won't breakout here, it just makes it a little less likely.

I also am concerned about long-term overhead resistance on the weekly chart. Price has tried twice before to break above that early 2019 top and it failed both times. Now it is getting ready to test that same overhead resistance. On KRO's side is a much more positive PMO that is rising strongly. It has overtaken the previous tops and has been firmly positive since August.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

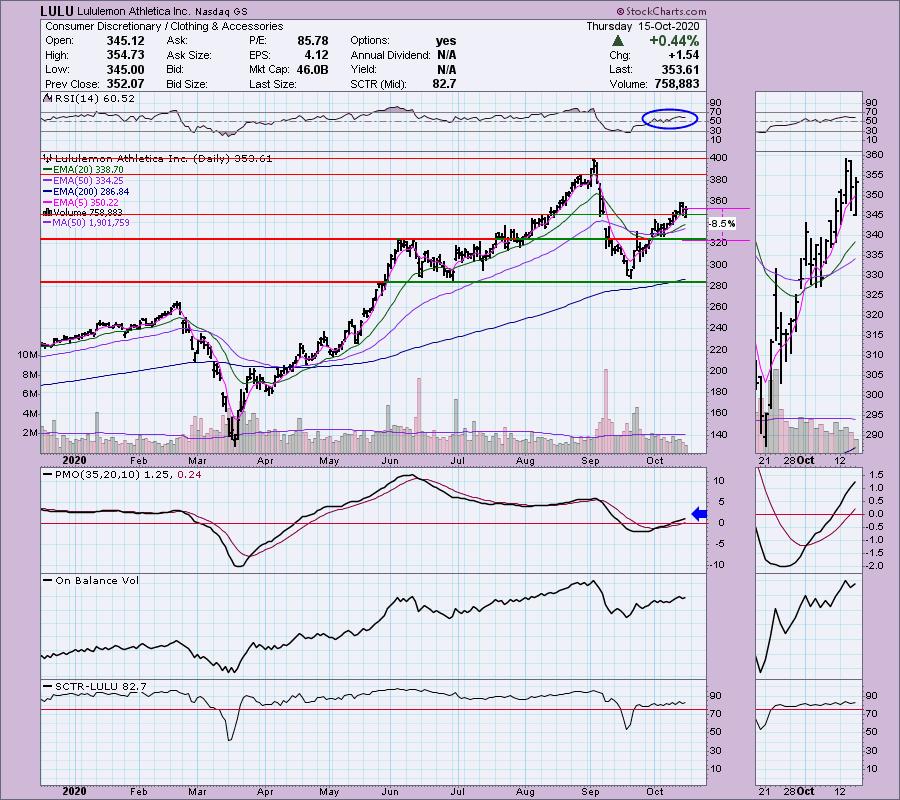

Lululemon Athletica Inc. (LULU)

EARNINGS: 12/9/2020 (AMC)

Lululemon Athletica, Inc. engages in the designing, distributing and retail of athletic apparel and accessories. It company operates through the following business segments: Company-Operated Stores, Direct to Consumer. The Company-Operated Stores segment comprises of lululemon and ivivva brands; and specialize in athletic wear for female youth. The Direct to Consumer segment is involved in e-commerce business. The company was founded by Dennis J. Wilson in 1998 and is headquartered in Vancouver, Canada.

Up +0.05% in after hours trading, I've covered LULU two previous times, once in the March 26th Diamond Report as a reader request that I was bullish on (+76% since); and, in the April 16th Diamond Report (+69% since). Not a bad selection back in March and April, but let's be honest, most everything stormed out of bear market lows. This was the other one on my short list today that I will take partial credit for it if that's okay with you, Brian. Mainly, I'll have it count in tomorrow's spreadsheet toward my percentage too. It is in a nice rising trend and it recently closed the September gap. The 20-EMA crossed above the 50-EMA ("silver cross") for an IT Trend Model BUY signal. The RSI is positive and has been all month. The OBV is confirming the rising trend and the PMO is above the zero line and rising. The SCTR is quite healthy.

The PMO did just trigger a SELL signal on the weekly chart, but we can see how it is beginning to curl back up. The RSI is positive. If it can recapture this year's high, that would be about a 15% gain.

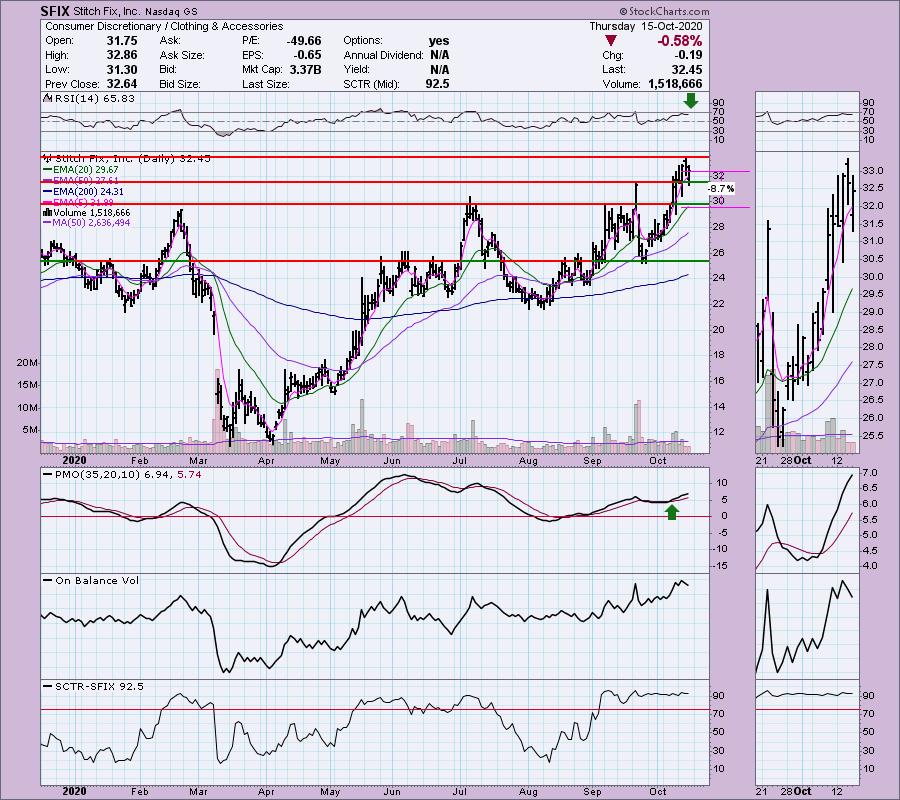

Stitch Fix, Inc. (SFIX)

EARNINGS: 12/1/2020 (AMC)

Stitch Fix, Inc. is an online personal styling service that delivers personalized fixes of apparel and accessories to men, women and kids. The company was founded by Katrina Lake and Erin Morrison Flynn in February 2011 and is headquartered in San Francisco, CA.

It was down -0.86% in after hours trading so the spreadsheet might have an issue tomorrow, but it did finish after hours trading as "unchanged". The PMO is on a BUY signal and not overbought. The RSI is positive and also is not overbought. The OBV continues to confirm the rising trend. I would set my stop just below $30 based on the July top.

I like this week's breakout so far. I'm not thrilled with declining tops on the OBV matching to rising tops in price (very clear in the thumbnail). However, the PMO looks great and the RSI is positive and not overbought.

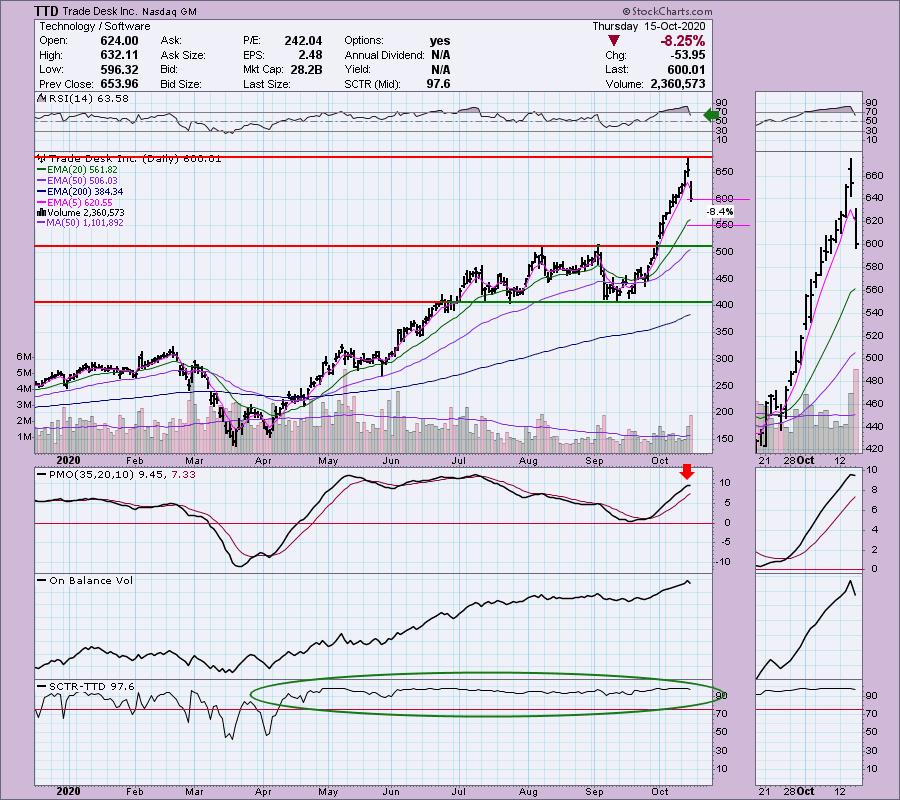

Trade Desk Inc. (TTD)

EARNINGS: 11/5/2020 (AMC)

The Trade Desk, Inc. offers a technology platform for advertising buyers. It operates through United States and International geographical segments. The firm's products include audio advertising, mobile advertising, native advertising, data management platform, cross-device targeting, and inventory and marketplaces. The company was founded by Jeffrey Terry Green and David Pickles in November 2009 and is headquartered in Ventura, CA.

Up +0.17% in after hours trading, TTD has been on a GREAT run, but it does appear it hit the wall today. This did move the RSI out of overbought territory, but it also made the PMO top. I think getting this one on the pullback could be interesting, but I suspect it will need to test the 20-EMA before it turns back up. It could even drop back to the $500 level. The SCTR is strong though, so it should avoid a deep decline like that.

The weekly RSI is overbought which could be a problem given its recent run. The PMO looks good though as it bottomed above the signal line which I generally find to be especially bullish for momentum. I think this runner is catching its breath. Worth a spot on your bench, but not really a starter just yet. (Forgive the fantasy football analogy, but I'm rocking my league this year!)

Full Disclosure: I won't be adding to my positions. I'm about 50% invested and 50% is in 'cash', meaning in money markets and readily available to trade with.

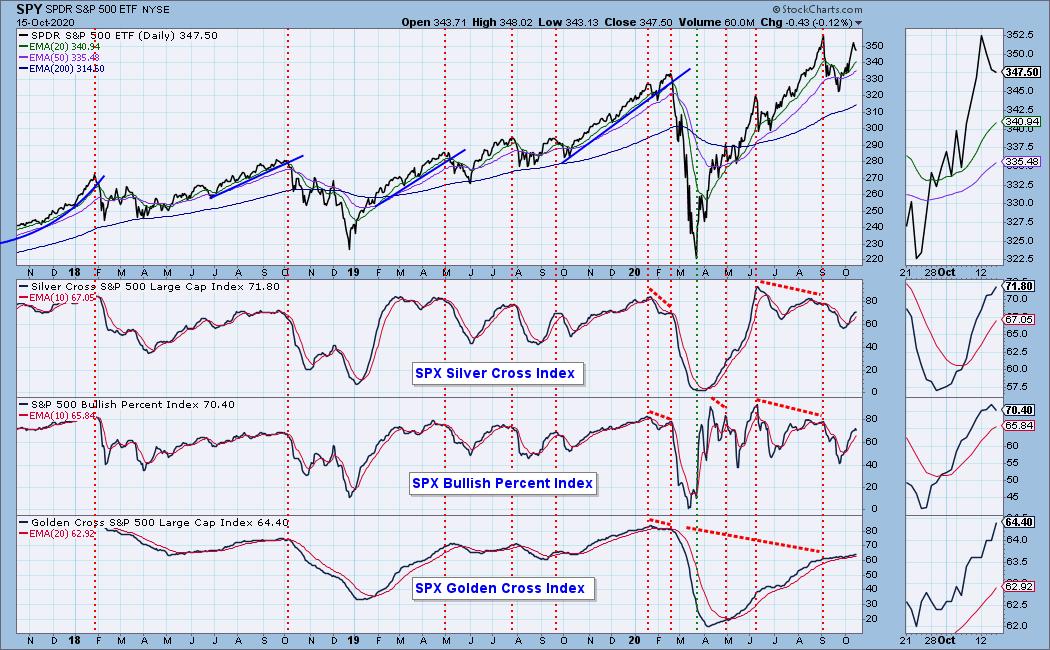

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index 10/13:

- Diamond Scan Results: 2

- Diamond Dog Scan Results: 38

- Diamond Bull/Bear Ratio: 0.05

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!