While I only had 36 Diamond PMO Scan results, there were plenty of choices. As I usually do, I looked specifically for diamonds in the rough that I would want to invest in myself. In fact, one of them I am planning on getting into. Today I was able to be a little more picky than usual given the quality results. I believe there is something for everyone. I was really excited over Lumber Liquidators (LL) chart yesterday and rightly so! It tied with YETI for best day at +3.4%. I have a chart today that reminds me very much of the LL chart from yesterday. Don't forget to register for Friday's Diamond Mine!

Today's "Diamonds in the Rough": AES, CE, EPAM, ODFL, and WSC.

Diamond Mine Information:

Diamond Mine Information:

Recording from 10/2/2020 is at this link. Access Passcode: kvm=m6zU

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (10/9/2020) 12:00p ET:

Here is the registration link for Friday, 10/9/2020. Password: diamonds

Please do not share these links! They are for Diamonds subscribers ONLY!

IT'S FREE!

***Click here to register for this recurring free DecisionPoint Trading Room!***

Did you miss the 10/5 trading room? Here is a link to the recording (password: J942MF*c). For best results, copy and paste the password to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

AES Corp. (AES)

EARNINGS: 11/6/2020 (BMO)

AES Corp. engages in the provision of power generation and utility services through its renewable and thermal generation facilities and distribution businesses. It operates through the following business segments: U.S. and Utilities Strategic Business Unit (SBU), South America SBU, MCAC SBU, Eurasia SBU, and Corporate and Other. The U.S. and Utilities SBU segment consists of facilities in the United States, Puerto Rico, and El Salvador. The South America SBU segment covers Chile, Colombia, Argentina, and Brazil. The MCAC SBU segment refers to Mexico, Central America, and the Caribbean. The Eurasia SBU segment handles operations in Europe and Asia. The Corporate and Other segment includes the results of the AES self-insurance company. The company was founded by Dennis W. Bakke and Roger W. Sant in 1981 and is headquartered in Arlington, VA.

Up +0.53% in after hours trading, AES has a sizable yield. It has been in a trading range since August, but it is beginning to rise and broke out above the $18.45 very short-term resistance level. The PMO has turned up. The RSI has stayed in positive territory all summer. The OBV shows steady volume and interest in AES. The SCTR is above 75 again. I put in a 9% stop level that matches the bottom of the current trading range. However, I don't think I would ride it down that far. If it pulls back, it is likely a sign that it will go and test that $17 level.

No complaints on the weekly chart.

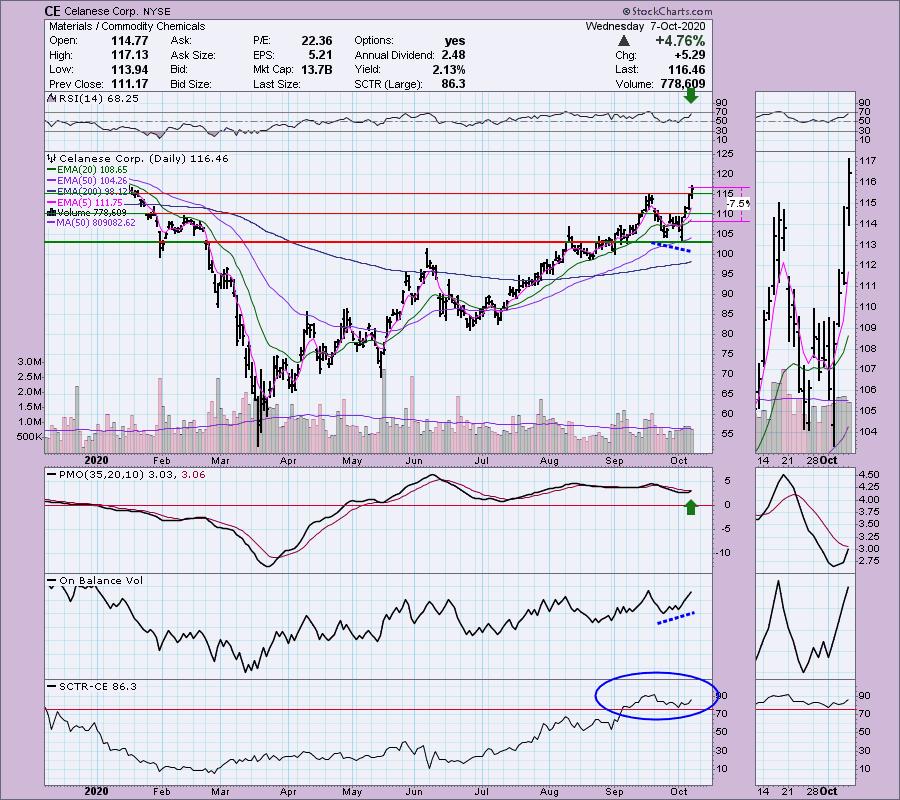

Celanese Corp. (CE)

EARNINGS: 10/25/2020

Celanese Corp. engages in the provision of technology and specialty materials businesses. It operates through the following segments: Engineered Materials, Acetate Tow, Acetyl Chain and Other Activities .The Engineered Materials segment includes the engineered materials business, food ingredients business and certain strategic affiliates. The Acetate Tow segment serves consumer-driven applications and is a global producer and supplier of acetate tow and acetate flake, primarily used in filter products applications. The Acetyl Chain segment includes the integrated chain of intermediate chemistry, emulsion polymers and ethylene vinyl acetate (EVA) polymers businesses, based on similar products, production processes, classes of customers and selling and distribution practices as well as economic similarities over a normal business cycle and The Other Activities segment primarily consists of corporate center costs, including administrative activities such as finance, information technology and human resource functions, interest income and expense associated with financing activities. The company was founded by Camille Dreyfus and Henri Dreyfus in 1918 and is headquartered in Irving, TX.

I really like the breakout today as the rally continued. The RSI is positive, although getting slightly overbought. The PMO is going in for a crossover BUY signal. Notice the positive OBV divergence that preceded this rally. The stop level matches up with the August top.

Great looking weekly chart with a positive RSI and a rising PMO that isn't that overbought. OBV bottoms are rising to confirm the rising trend and we just got a 17/43-week EMA positive crossover.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

EPAM Systems, Inc. (EPAM)

EARNINGS: 11/5/2020 (BMO)

EPAM Systems, Inc. engages in the provision of software product development and digital platform engineering services. It operates through the following segments: North America, Europe, and Russia. The company was founded by Leonid Lozner and Arkadiy Dobkin in 1993 and is headquartered in Newtown, PA.

Up about +0.20% in after hours trading, EPAM had a successful upside breakout from a bullish ascending triangle. The RSI is positive and not overbought. The PMO is ready for a clean positive crossover and we have rising bottoms on the OBV to confirm the rising trend. The SCTR is exceptional.

We could be looking at the execution of a bull flag on the weekly chart. I would just beware of the persistent overbought RSI. The PMO is strong and rising after faltering at the formation of the flag.

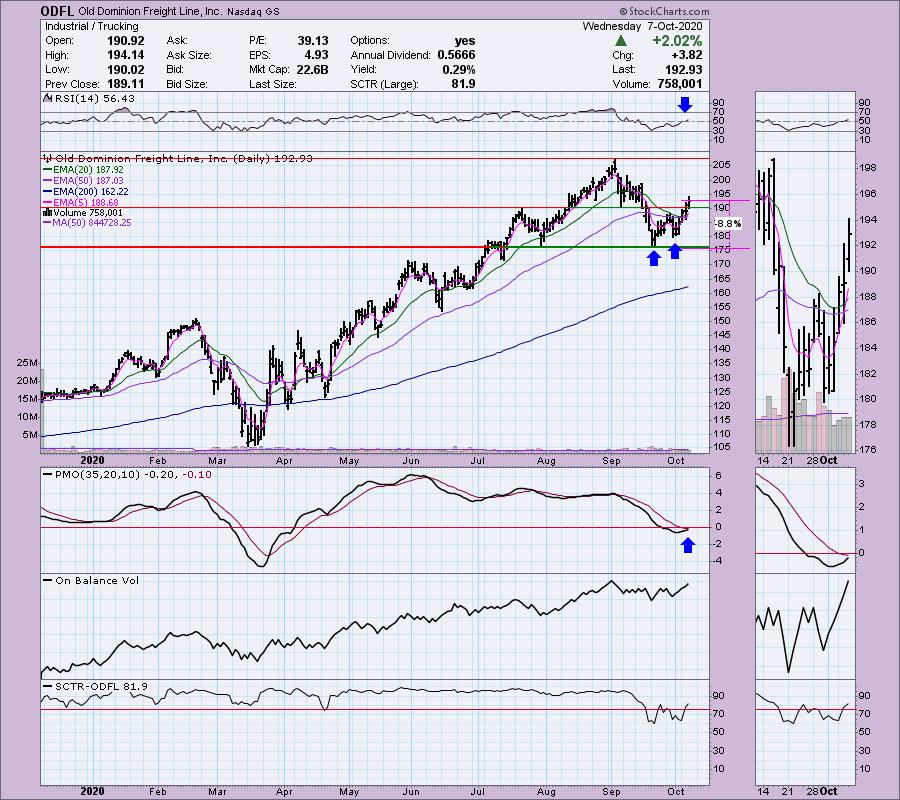

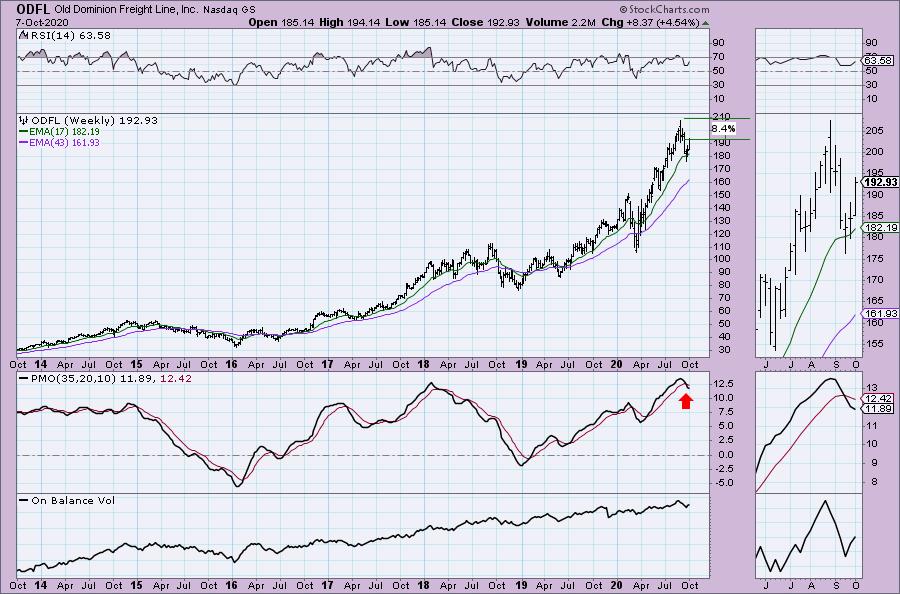

Old Dominion Freight Line, Inc. (ODFL)

EARNINGS: 10/27/2020 (BMO)

Old Dominion Freight Line, Inc. engages in the provision of less-than-truckload services. The company involves in the ground and air expedited transportation, and consumer household pickup and delivery. Its services include container drayage, truckload brokerage, supply chain consulting, and warehousing. The company was founded by Earl Congdon Sr. and Lillian Congdon in 1934 and is headquartered in Thomasville, NC.

Here's my favorite chart of the day. It looks very similar to Lumber Liquidators (LL) yesterday. I've actually brought this one to Diamond table two previous times. Here are the report dates and links: March 26th (+37% gain since then) and August 12th (+0.03% gain since). This chart is tasty with an RSI that just moved into positive territory. The PMO is about to give us a BUY signal in oversold territory just below the zero line. We have rising OBV bottoms and a SCTR that just reentered the "hot zone" above 75. I like the

We've seen a pullback to the 17-week EMA. Bounces from that EMA seem to be launch points for rallies. I think you can make a case for a bull flag here as well. Of course, that weekly PMO is not ideal. Just watch this one in the short term until the weekly PMO looks a bit better. The good news is that it is decelerating. The weekly RSI is positive and not overbought. The OBV bottoms are rising to confirm the rising trend.

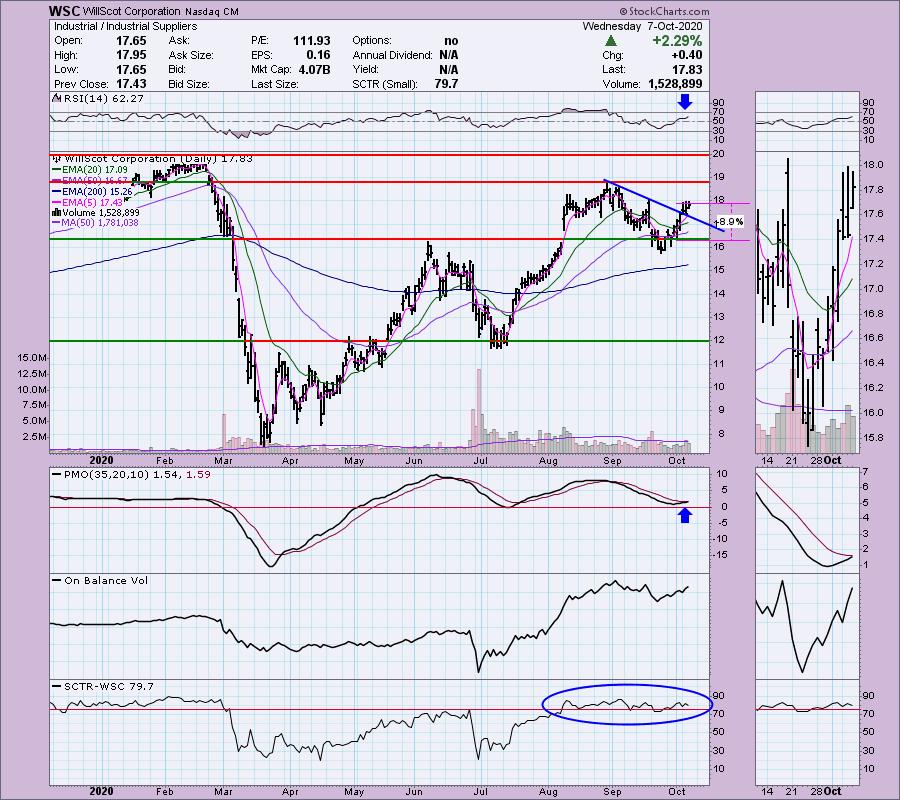

WillScot Corporation (WSC)

EARNINGS: 11/5/2020 (BMO)

WillScot Mobile Mini Holdings Corp. provides modular and portable storage services. The firm offers furniture rental, transportation and logistics, storage & facilities services and commercial real estate services. It offers turnkey office space and storage solutions for temporary applications in the commercial and industrial, construction, retail, education, health care, government, transportation, security and energy sectors. The company was founded on November 29, 2017 and is headquartered in Phoenix, AZ.

WSC is up +0.95% in after hours trading. The PMO is just about to crossover its signal line for a crossover BUY signal. PMO crossovers have been very clean and prescient when combined with a positive RSI. The RSI has been rising and is now in positive territory. Price broke from a short-term declining trend. The OBV is confirming the short-term rising trend and the SCTR is strong.

The weekly PMO has turned up and the RSI is positive and rising again. Even with that deep pullback, the RSI remained positive.

Full Disclosure: I did lock in HOG this morning. I'm looking for entry into ODFL and LL tomorrow. I didn't like the entry points on LL today. I'm about 50% invested and 50% is in 'cash', meaning in money markets and readily available to trade with.

Current Market Outlook:

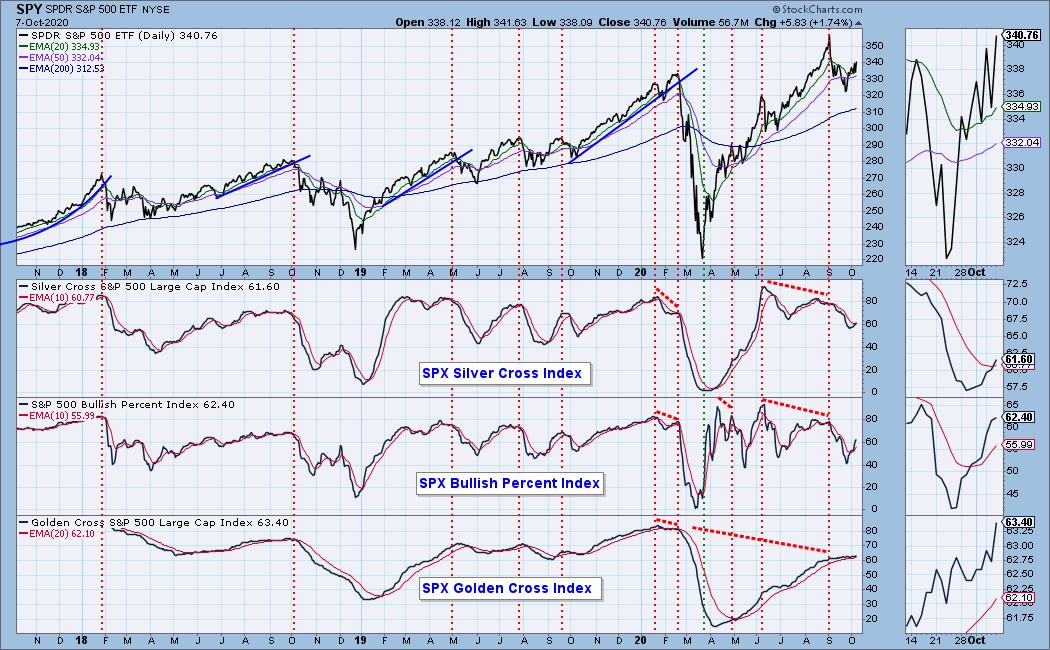

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 36

- Diamond Dog Scan Results: 3

- Diamond Bull/Bear Ratio: 12.00

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!