Today is Reader Request Day! I had a ton of symbols come in and I meticulously went through each to pick out the most instructive or most likely to succeed. On Tuesday, I had a spectacular chart set-up for Lumber Liquidators (LL) and yesterday we had a similar set-up on Old Dominion Freight (ODFL). Today, I had another chart jump out at me with an amazing set-up that I will present as my own today. It's another must-see chart.

Thank you to readers, Cotton, Art, Stephan, Olivia, George, Brandon, Brian, Julie and Frank for your many symbol requests!

Today's "Diamonds in the Rough": ATRS, BABA, SYF, TSCO, and WU

Diamond Mine Information:

Diamond Mine Information:

Recording from 10/2/2020 is at this link. Access Passcode: kvm=m6zU

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (10/9/2020) 12:00p ET:

Here is the registration link for Friday, 10/9/2020. Password: diamonds

Please do not share these links! They are for Diamonds subscribers ONLY!

IT'S FREE!

***Click here to register for this recurring free DecisionPoint Trading Room!***

Did you miss the 10/5 trading room? Here is a link to the recording (password: J942MF*c). For best results, copy and paste the password to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Antares Pharmaceutical, Inc. (ATRS)

EARNINGS: 11/3/2020 (BMO)

Antares Pharma, Inc. is a combination drug device company, which engages in the development and commercialization of self-administered parenteral pharmaceutical products and technologies. Its proprietary products include XYOSTED injection, OTREXUP injection for subcutaneous use, and Sumatriptan injection. The company was founded in February 1979 and is headquartered in Ewing, NJ.

This is a low priced small-cap stock that should be sized appropriately:

Up +0.30% in after hours trading right now, ATRS has been in a trading range for some time. It appears it has garnered some interest with all of the volume coming in. The momentum has kicked in as well. However, we are getting close to another area of overhead resistance and the RSI while positive is overbought. I've marked the three previous times that the RSI got overbought (and not even as overbought as it is now) and it came at a top. The PMO looks great and the OBV is confirming the move. I would make the 200-EMA my stop.

The trading range on the weekly chart suggests we should see price move higher. The PMO and RSI are very positive. Normally I would say you could possibly consider it as a longer-term investment, but I don't generally go into stocks at this price point for the long haul.

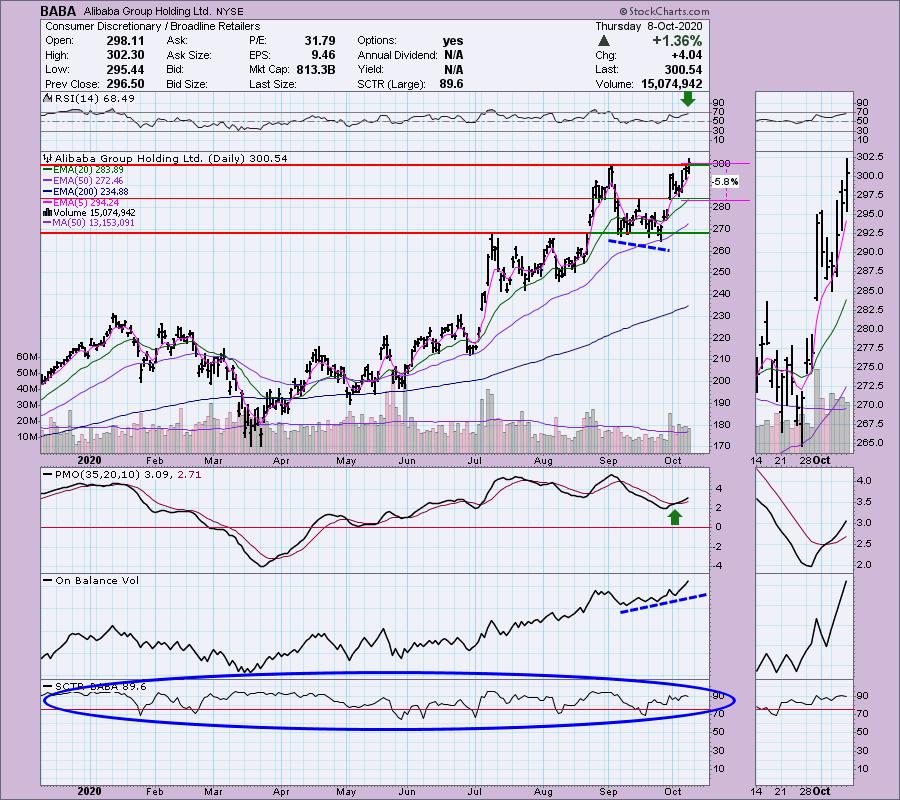

Alibaba Group Holding Ltd. (BABA)

EARNINGS: 10/29/2020 (BMO)

Alibaba Group Holding Ltd. engages in providing online and mobile marketplaces in retail and wholesale trade. It operates through the following business segments: Core Commerce; Cloud Computing; Digital Media and Entertainment; and Innovation Initiatives and Others. The Core Commerce segment comprises of platforms operating in retail and wholesale. The Cloud Computing segment consists of Alibaba Cloud, which offers elastic computing, database, storage and content delivery network, large scale computing, security, management and application, big data analytics, a machine learning platform, and other services provide for enterprises of different sizes across various industries. The Digital Media and Entertainment segment relates to the Youko Tudou and UC Browser business. The Innovation Initiatives and Others segment includes businesses such as AutoNavi, DingTalk, Tmall Genie, and others. The company was founded by Chung Tsai and Yun Ma on June 28, 1999 and is headquartered in Hangzhou, China.

I was surprised that I've not ever covered BABA as a diamond in the rough. It currently is up +0.49% in after hours trading. This current rally came off a beautiful OBV positive divergence. The RSI is positive and today saw a new breakout to all-time highs. The PMO just gave us a BUY signal in oversold territory. The SCTR is positive. Very nice chart!

The current rally is very steep and the RSI is overbought. However, the PMO is very positive and not overbought and the OBV still looks good on the weekly.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Synchrony Financial (SYF)

EARNINGS: 10/20/2020 (BMO)

Synchrony Financial engages in the provision of consumer financial services. It operates through three sales platforms: Retail Card, Payment Solutions, and CareCredit. The Retail Card platform is a provider of private label credit cards, and also provides Dual Cards and small-and medium-sized business credit products. The Payment Solutions platform is a provider of promotional financing for major consumer purchases, offering private label credit cards and instalment loans. The CareCredit platform is a provider of promotional financing to consumers for elective healthcare procedures or services, such as dental, veterinary, cosmetic, vision and audiology. The company was founded on September 12, 2003 and is headquartered in Stamford, CT.

SYF is currently down -0.93% in after hours trading so you might be able to get a better entry on a pullback to the breakout point. The PMO is now on a BUY signal and the RSI is positive. There is a negative OBV divergence currently, but that could go away if enough positive volume comes in and raises the OBV above its September top. Financials are picking up and really SYF has had a wonderful run since July.

I like the upside potential here. The PMO is very positive and the RSI is positive and not overbought.

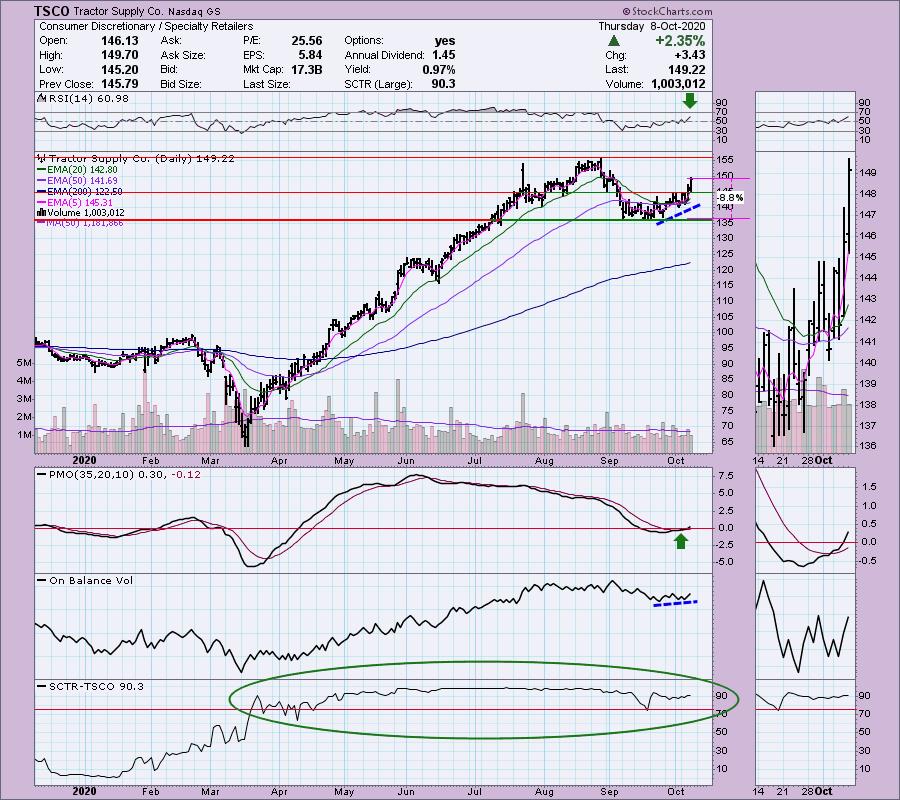

Tractor Supply Co. (TSCO)

EARNINGS: 10/22/2020 (BMO)

Tractor Supply Co. engages in the retail sale of farm and ranch products. It operates retail farm & ranch stores and focuses on supplying the lifestyle needs of recreational farmers and ranchers, as well as tradesmen and small businesses. The firm operates the retail stores under the names: Tractor Supply Company, Del's Feed & Farm Supply, and Petsense. Its product categories includes equine, livestock, pet, and small animal; hardware, truck, towing, and tool; heating, lawn and garden items, power equipment, gifts, and toys; recreational clothing and footwear; and maintenance products for agricultural and rural use. The company was founded by Charles E. Schmidt, Sr. in 1938 and is headquartered in Brentwood, TN.

This is a great chart, Brian. I very much like this week's breakout. The PMO is now in positive territory after a crossover BUY signal. The RSI has just moved positive and isn't overbought. The SCTR is first class and the OBV is confirming the rally. You can even set a reasonable stop just below $136.

It sure looks like a flag on the weekly chart. Interestingly, COVID was magic for TSCO. It's been straight up since the bear market low. The PMO at first glance seems an issue, but you can see in the thumbnail that it is flat and trying to rise.

Western Union Co. (WU)

EARNINGS: 10/29/2020 (AMC)

The Western Union Co. is a holding company, which engages in the provision of money transfer and payment services. It operates through the following segments: Consumer-to-Consumer; Business Solutions; and Other. The Consumer-to-Consumer segment facilitates money transfers between two consumers. The Business Solutions segment offers payment and foreign exchange solutions, primarily cross-border, cross-currency transactions, for small and medium size enterprises and other organizations and individuals. The Other segment comprises electronic-based and cash-based bill payment services. The company was founded in 1851 and is headquartered in Denver, CO.

This is my pick today. This chart honestly has everything going for it. First, the obvious, the RSI has just moved into positive territory and the PMO is nearing a BUY signal. The SCTR is the only flaw on this chart and I see rising bottoms on it. My sense is that this is the beginning of the next big move. We have a very short-term double-bottom pattern that executed today. It nearly broke out of a bullish falling wedge in the intermediate term. The OBV has a great positive divergence going. And, best of all, you can set a very reasonable stop just below $21.

The weekly RSI is back in positive territory and currently, the PMO is avoiding a crossover SELL signal. My one concern is that it will decide to make another test of the $20 support level. My hope is that it is rebounding now without having to test that level which would be bullish.

Full Disclosure: I was able to buy LL today and I added ODFL to my portfolio. Tomorrow I'll be looking at WU. In the meantime, I have closed a few positions as well. I'm still very heavy solar. I'm about 50% invested and 50% is in 'cash', meaning in money markets and readily available to trade with.

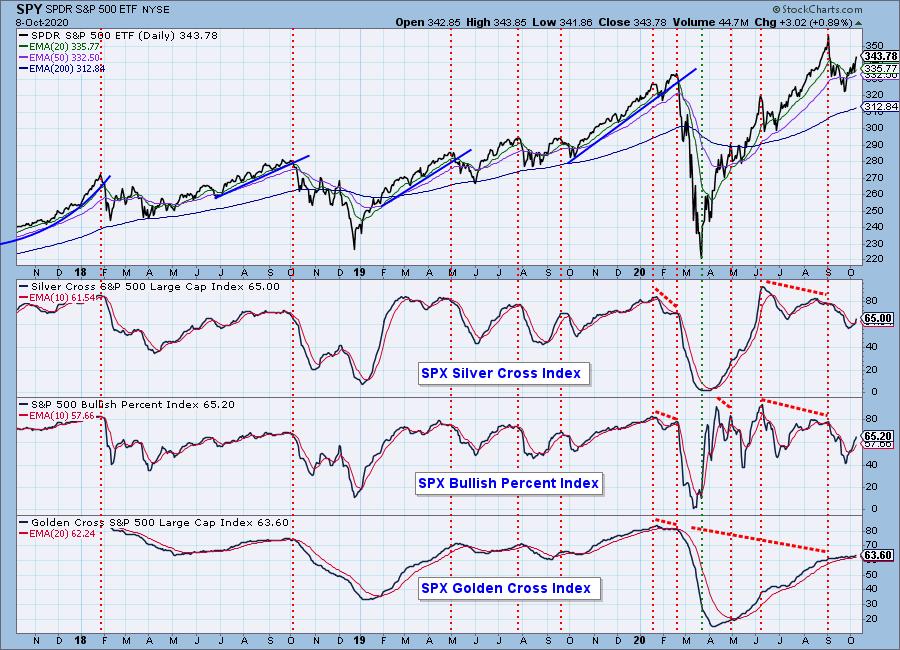

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 9

- Diamond Dog Scan Results: 5

- Diamond Bull/Bear Ratio: 1.80

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!