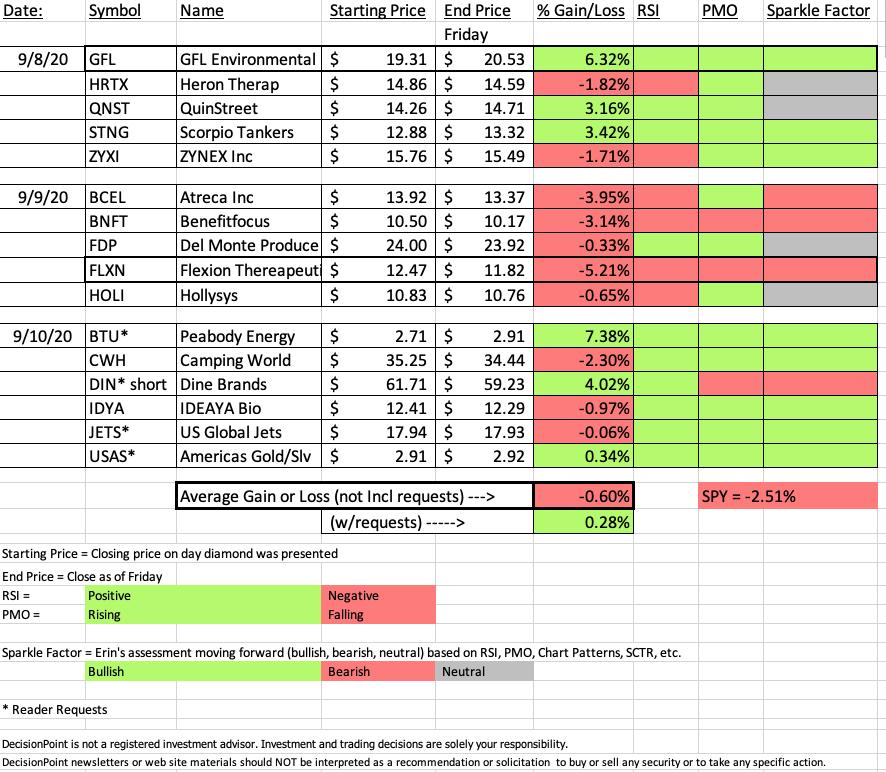

Overall this week Diamonds were down -0.68% which isn't bad given the SPX was down -2.51%. If you add the Reader Requests in, the week ended in the green. Thank you, readers for adding more green to the spreadsheet, especially for the DIN short that I didn't fully support.

The market is still acting "toppy" despite a positive close today. Given I don't have much faith in the broad market right now, I am simply managing the positions I currently hold and am being disciplined in not adding any more. If we see the market recover in a meaningful way, I'll revisit this strategy.

Looking at the spreadsheet, I decided to look at two of the positions. First would be my best position this week and one that I like going forward which is GFL Environmental (GFL). BTU performed better than GFL this week, but I'll have looked at that chart for a third time if I did it today. Suffice it to say I still like the chart and continue to be bullish on BTU. The second Diamond I'll review is the worst performer, Flexion Therapeutics (FLXN). We will see what went wrong and see why I'm bearish going forward.

Diamond Mine Information:

Diamond Mine Information:

Recording from Today (9/11/2020) is at this link. Access Passcode: w*1fJKrN

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (9/18) 12:00p EST:

Here is this week's registration link. Password: decision

Please do not share these links! They are for Diamonds subscribers ONLY!

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Register for the Free Trading Room at this link or click above. Our next session is on 9/14/2020!

GFL Environmental Holdings Inc (GFL)

EARNINGS: 11/5/2020 (AMC)

GFL Environmental, Inc. engages in the provision of ecological solutions. It operates through the following segments: Solid Waste; Infrastructure and Soil Remediation; Liquid Waste; and Corporate. The Solid Waste segment includes hauling, landfill, transfers, and material recovery facilities. The Infrastructure and Soil Remediation provides remediation of contaminated soils as well as complementary services, including civil, demolition, excavation, and shoring services. The Liquid Waste segment collects, transports, processes, recycles, and disposes liquid wastes from commercial and industrial customers. The company was founded by Patrick Dovigi in 2007 and is headquartered in Vaughan, Canada.

This chart has only improved with age. This was my "Diamond of the Week" during my interview with MarketViewsTV this morning (I'll send the link when I have it) so you know I still like it. The PMO continues to rise and the RSI has only gotten more positive.

From Tuesday to today, GFL nearly reached its first resistance checkpoint. It's too new to have weekly PMO readings, but the price chart looks very encouraging.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Flexion Therapeutics Inc (FLXN)

EARNINGS: 11/5/2020 (AMC)

Flexion Therapeutics, Inc. operates as a biopharmaceutical company, which engages in the development and commercialization of novel and local therapies. It specializes in the treatment of patients with musculoskeletal conditions including osteoarthritis. It offers products under the Zilretta brand. The company was founded by Michael D. Clayman and Neil Bodick on November 5, 2007 and is headquartered in Burlington, MA.

FLXN was our stinker this week. You can still see the remnants of the bullish annotations I had on Wednesday. The switch was immediately flipped the following day and it only continued to get worse today. I was concerned about overhead resistance at $13.00. It never reached that level and has clearly lost steam. Since it couldn't even test overhead resistance before turning south, I find it very bearish going forward.

When we looked at this weekly chart on Wednesday, the weekly PMO was just starting to rise. To finish the week it is declining. I'd scratch this from your watchlist unless you're considering a short.

CONCLUSION:

Sector to Watch: Materials (XLB) and Industrials (XLI)

Industry Groups to Watch: Waste & Disposal Services ($DJUSPC) & Metals/Mining ($DJUSNF/$DJUSMG)

Gold and Gold Miners didn't have much of a week, but they held important support. Metals in general still seem to have momentum. GLF is in the Waste & Disposal Service industry group. Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Have a Great Weekend! Happy Charting!

- Erin

erin@decisionpoint.com

Full Disclosure: I do not own any of the stocks on the spreadsheet. I'm about 50% invested right now and 50% is in 'cash', meaning in money markets and readily available to trade with.

Technical Analysis is a windsock, not a crystal ball.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!