Today I found that the Industrials were still dominating my scan results. Additionally, I've noticed Health Care stocks are beginning to make a resurgence in my scan results as well. So, you'll find three Industrials and two Health Care "diamonds in the rough". As the headline suggests, Railroads are enjoying a new short-term rally. I had two different Railroad companies hit my scan results. Additionally, I took a look at the group and found other Railroads that look bullish. I'll review not only the Industry Group chart, but also my favorite of the Railroad stocks which is Union Pacific (UNP). I will say that Norfolk Southern (NSC) and CSX Inc (CSX) are two other railroads that look pretty good too.

Today's "Diamonds in the Rough": CRL, DGX, DOV, IBP, and UNP.

The Railroad industry group broke out beginning yesterday. Today was a confirmed follow-through as we saw higher volume on the move. The RSI is getting overbought, but certainly isn't at extremes.

Diamond Mine Information:

Diamond Mine Information:

Recording from Friday (9/11/2020) is at this link. The password to view the recording is: w*1fJKrN

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (9/18) 12:00p EST:

Here is this week's registration link. Password: decision

Please do not share these links! They are for Diamonds subscribers ONLY!

Click here to register in advance for the recurring free DecisionPoint Trading Room (Next one is 9/21)! Did you miss the 9/14 trading room? Here is a link to the recording (password: 3^aXxCJ2).

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Charles River Laboratorie (CRL)

EARNINGS: 11/4/2020 (BMO)

Charles River Laboratories International, Inc. is an early-stage contract research company, which provides essential products and services to help pharmaceutical and biotechnology companies, government agencies and academic institutions. It operates through the following segments: Research Models & Services, Discovery & Safety Assessment and Manufacturing Support. The Research Models & Services segment comprises of the production and sale of research models, and also offers services designed to support its client's use of research models in screening non-clinical drug candidates. The Discovery & Safety Assessment segment offers discovery and safety assessment services, both regulated and non-regulated, in which it include both in vivo and in vitro studies, supporting laboratory services, and strategic preclinical consulting and program management to support product development. The Manufacturing Support segment provides endotoxin and microbial detection, avian vaccine and biologics testing solutions. The company was founded by Henry L. Foster in 1947 and is headquartered in Wilmington, MA.

Down -0.13% in after hours trading, CRL had a very nice breakout today. It looks like a continuation gap today that followed the breakaway gap from last week. The PMO has turned up in bullish oversold territory just above the zero line. The RSI is positive and not overbought. Notice that the OBV did break above the previous top, although it hasn't quite gotten above its August top. I have the stop level set at the July top, but you could tighten it up to the bottom of the August congestion area.

Everything looks good here.

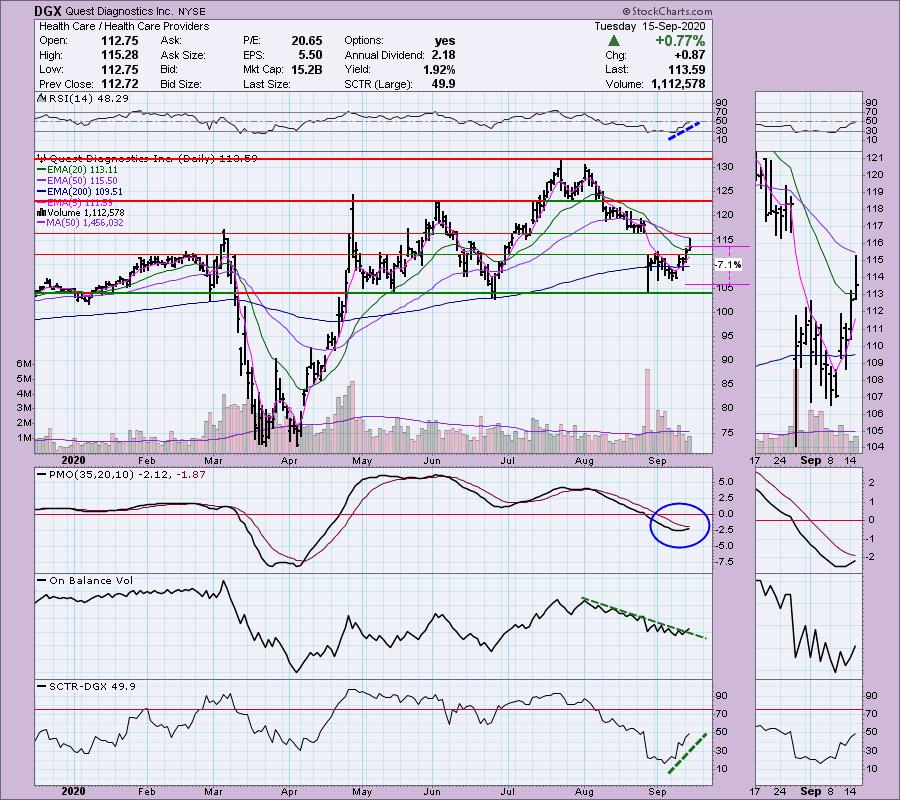

Quest Diagnostics Inc (DGX)

EARNINGS: 10/20/2020 (BMO)

Quest Diagnostics, Inc. engages in the provision fo diagnostic testing, information and services. It operates through the Diagnostic Information Services (DIS) and All Other segments. The DIS segment offers diagnostic information services to patients, clinicians, hospitals, health plans, and employers. The All Other segment consists of risk assessment services, healthcare information technology, diagnostic products, and clinical trials testing businesses. The company was founded in 1967 and is headquartered in Secaucus, NJ.

Up +0.01% in after hours trading, DGX was a Diamond in the 2/27/2020 report. It was at $110.97. I did mention that I would be adding it to a watch list and the stop level was around $103. Obviously the stop was hit fairly quickly as the bear market began. Today it appears to be closing a gap. The PMO is rising and the RSI is nearly positive. I would definitely like to see more volume coming in on this one, but the OBV did just barely break a declining trend. I like that you don't need to set a deep stop to take advantage of near-term support.

Of course I don't want to see a PMO SELL signal on the weekly chart coming in overbought territory, but the RSI is still positive and this week, trading has taken place above the 2018 top.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dover Corp (DOV)

EARNINGS: 10/22/2020 (BMO)

Dover Corp. engages in the manufacture of equipment, components, and specialty systems. It also provides supporting engineering, testing, and other similar services. It operates through the following segments: Engineered Systems, Fluids, and Refrigeration and Food Equipment. The Engineered Systems segment focuses on the design, manufacture, and service of critical equipment and components serving the fast-moving consumer goods, digital textile printing, vehicle service, environmental solutions, and industrial end markets. The Fluids segment focuses on the safe handling of critical fluids and gases the retail fueling, chemical, hygienic, and industrial end markets. The Refrigeration and Food Equipment segment provides innovative and energy-efficient equipment and systems serving the commercial refrigeration and food equipment end markets. The company was founded by George L. Ohrstrom in 1947 and is headquartered in Downers Grove, IL.

DOV is down -0.16% in after hours trading, DOV had a tiny breakout on Monday. Today looked much like yesterday as price traded above the 5-EMA and above resistance at the August top. The RSI is positive and the PMO is reaching for a BUY signal. There is a nice OBV positive divergence with rising OBV bottoms that correspond to declining price bottoms. The SCTR has just now entered the "hot zone" above 75. The stop level is very manageable.

The weekly chart is very bullish with a positive RSI and rising PMO. Even OBV bottoms are rising.

Installed Building Products Inc (IBP)

EARNINGS: 10/29/2020 (BMO)

Installed Building Products, Inc. engages in the business of installing insulation for the residential new construction market. Its products include garage doors, rain gutters, shower doors, closet shelving, and mirrors. The company was founded in 1977 and is headquartered in Columbus, OH.

I always like to present a diamond in the rough that has just experienced a pullback, but I am bit nervous about this one given that it did close near the bottom of the range. It still is holding above support at $95 and the PMO is rising. The RSI has been mostly positive since late April. The OBV has been confirming this longer-term rally. I have set the stop around $87.50 or about mid-way down the congestion zone.

The weekly RSI is bit overbought, but I'm okay with that. We have positive PMO, although it is overbought at this point. Hard to say whether it is extremely overbought since we don't have as much data as we normally do.

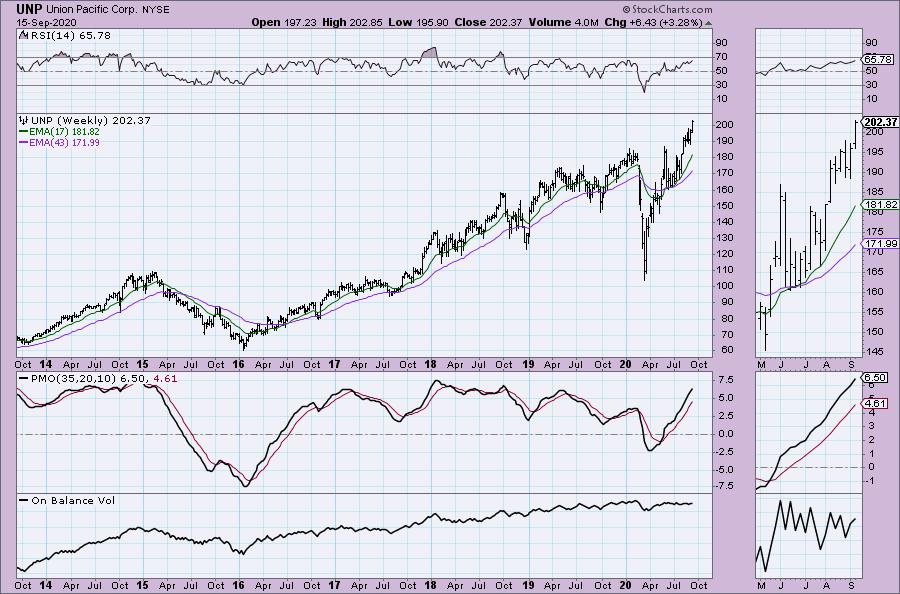

Union Pacific Corp (UNP)

EARNINGS: 10/22/2020 (BMO)

Union Pacific Corp. engages in the provision of railroad and freight transportation services. Its principal operating company, Union Pacific Railroad Co., operates as a railroad franchise. The Railroad's diversified business mix includes agricultural products, automotive, chemicals, coal, industrial products, and intermodal. The company was founded in 1969 and is headquartered in Omaha, NE.

Up +0.18% in after hours trading, UNP has a chart much like $DJUSRR. That shouldn't be a surprise, this company is the big mover and shaker in this industry. The RSI is getting overbought, but not extremely so. The PMO will give us crossover BUY signal very soon. The OBV is confirming the rising trend and the SCTR is above 75. I put the stop level at support formed at the June top and at the bottom of the August consolidation zone.

Great looking weekly chart. If I had to complain, I would prefer the OBV to be rising and not flat.

Full Disclosure: I am not adding any new positions. I'm about 50% invested and 50% is in 'cash', meaning in money markets and readily available to trade with.

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 14

- Diamond Dog Scan Results: 4

- Diamond Bull/Bear Ratio: 3.50

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!