The number of Diamond PMO Scan results averages about 12 stocks/ETFs per day. September has been particularly lean with only 6 to 10 results/day. Today the Diamond PMO Scan returned 53 results! Since October of last year, 53 was the highest number of results ever returned, with the exception of August 15th, 2019 where I had 83 results and February 6th, 2020 where I had 96. I need to plot the data, but given that I only have about a year's worth, I don't believe I can reliably draw any conclusions from it just yet. My point is that given I had so many results to sift through today, I am looking for good gains going into Friday. I will add that Tesla (TSLA) landed in the results. I didn't include it (it's chart is beaten to death by most analysts), but I wanted to give readers a heads up since it is widely held.

The stocks chosen come from industry groups that I definitely like right now so that raises my confidence in the selections. I will say that Gold and Silver Miners are starting to look really interesting right now. I picked my favorite Miner from my scan results, but I think that area is ready to rally so you could really go with any of your favorites if they have a similar set-up to the one I'll present today. We have the following industry groups represented today: Home Construction, Consumer Finance, Gold Mining, Specialty Chemicals and Electrical Components.

Today's "Diamonds in the Rough": AEM, CCS, GPRE, OMF, and TEL.

Diamond Mine Information:

Diamond Mine Information:

Recording from Friday (9/11/2020) is at this link. The password to view the recording is: w*1fJKrN

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (9/18) 12:00p EST:

Here is this week's registration link. Password: decision

Please do not share these links! They are for Diamonds subscribers ONLY!

Click here to register in advance for the recurring free DecisionPoint Trading Room (Next one is 9/21)! Did you miss the 9/14 trading room? Here is a link to the recording (password: 3^aXxCJ2).

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

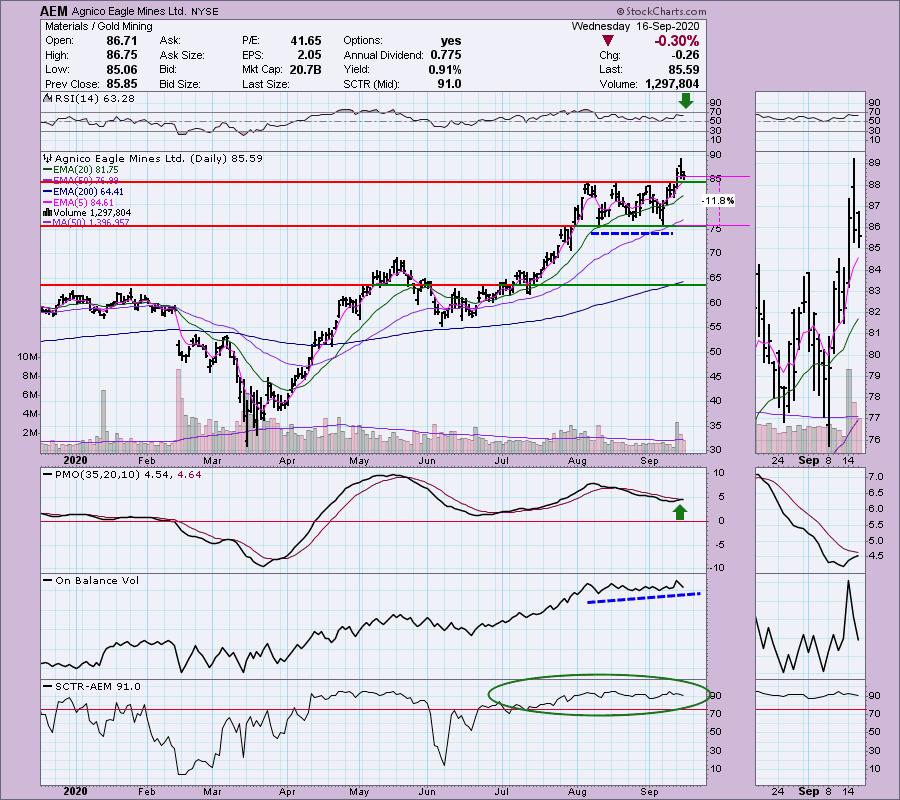

Agnico Eagle Mines Ltd. (AEM)

EARNINGS: 10/28/2020 (AMC)

Agnico Eagle Mines Ltd. engages in the exploration and production of gold. It operates through the following segments: Northern Business, Southern Business, and Exploration. The Northern Business segment comprises of LaRonde mine, LaRonde Zone 5 mine, Lapa mine, Goldex mine, Meadowbank mine including the Amaruq deposit, Canadian Malartic joint operation, Meliadine project and Kittila mine. The Southern Business segment consists of Pinos Altos mine, Creston Mascota mine, and La India mine. The Exploration segment represents the exploration offices in the United States, Europe, Canada, and Latin America. The company was founded by Paul Penna in 1957 and is headquartered in Toronto, Canada.

AEM is up +.47% in after hours trading. I sense a rally coming for general miners, gold miners and silver miners. The scan returned the following Miners: AEM, AG, EGO, NEM, PAAS, BBL, BHP. You could take your pick, but you'll note that this chart really is superior. AEM has been in a sideways trading channel rather than a declining trend as many of the other Miners. We had a nice breakout on Monday and since then it is pulling back toward the breakout point. The PMO is rising and about to give us a crossover BUY signal. The RSI is positive. The one thing I don't care for is the deep stop level, but you could certainly tighten it up and use the 20-EMA as your stop.

The RSI is overbought, but not extremely so. The PMO is not yet overbought which is positive.

Century Communities Inc (CCS)

EARNINGS: 10/27/2020 (AMC)

Century Communities, Inc. engages in the development, design, construction, marketing and sale of single-family attached and detached homes. It operates through the following business segments: West, Mountain, Texas, Southeast, and Wade Jurney Homes. The West segment refers to Southern California, Central Valley, Bay Area and Washington. The Mountain segment represents Colorado, Nevada and Utah. The Texas segment is comprised of Houston, San Antonio and Austin. The Southeast segment is consisting of Georgia, North Carolina, South Carolina and Tennessee. The Wade Jurney Homes segment is consist of Alabama, Arizona, Florida, Georgia, Indiana, North Carolina, Ohio, South Carolina, and Tennessee. The company was founded by Dale Francescon and Robert J. Francescon in 2000 and is headquartered in Greenwood Village, CO.

CCS was a Diamond in theJuly 21st report. I liked today's breakout move. The RSI is positive and the OBV is confirming. The PMO is beginning to rise up toward a crossover BUY signal. The SCTR continues to impress. The stop level is about halfway into the consolidation zone.

The PMO was beginning to decelerate and top, but today's breakout has prevented that from continuing.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

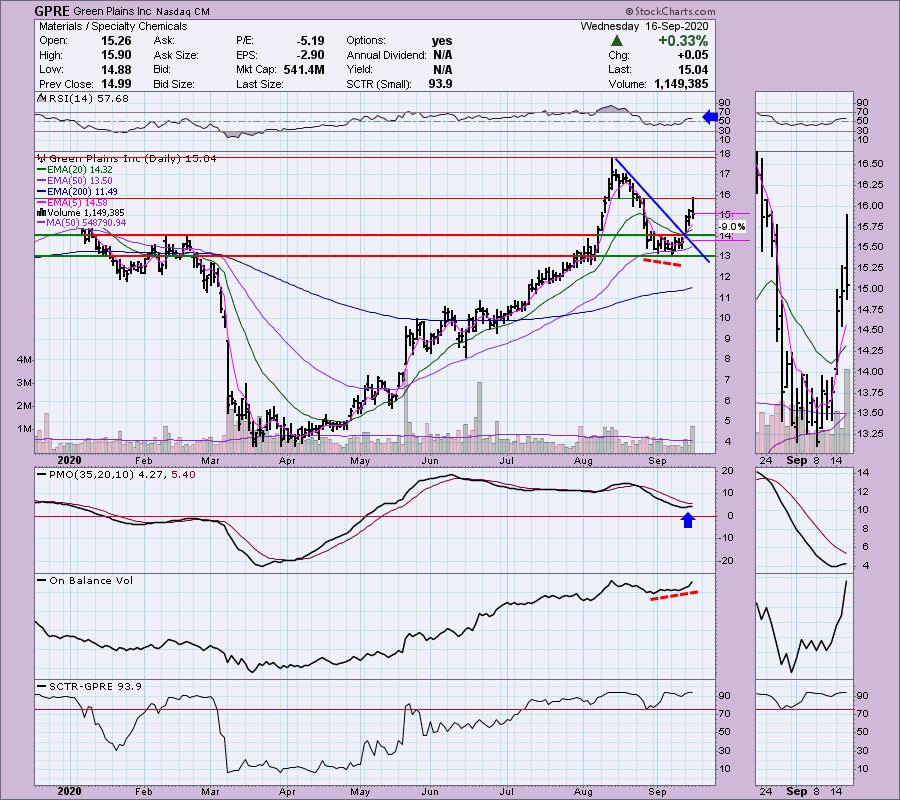

Green Plains Inc (GPRE)

EARNINGS: 11/3/2020 (AMC)

Green Plains, Inc. engages in the production of fuel-grade ethanol and corn oil; provision of grain handling; and storage commodity marketing and distribution services. It operates through the following segments: Ethanol Production; Agribusiness and Energy Services; Food and Ingredients; and Partnership. The Ethanol Production segment produces ethanol, distillers grain, and corn oil at ethanol plants in Indiana, Iowa, Minnesota, Nebraska, Tennessee, and Texas. The Agribusiness and Energy Services segment includes grain procurement and its commodity marketing business, which markets, sells, and distributes ethanol, distillers grains, and corn oil produced at ethanol plants. The Food and Ingredients segment is involved in cattle food-grade corn oil operations. The Partnership segment provides fuel storage and transportation services by owning, operating, developing, and acquiring ethanol and fuel storage tanks, terminals, transportation assets, and other related assets and businesses. The company was founded in June 2004 and is headquartered in Omaha, NE.

GPRE is currently up +1.25% in after hours trading so we might be onto something here. Not too hard to see the major breakout from the congestion area. The PMO has turned back up and the RSI has moved into positive territory. Volume has been increasing on the breakout. The SCTR is in the "hot zone". I put the stop below the top of the congestion area.

The declining trend has been broken. Notice that after the breakout, there was a pullback to the breakout point. Currently it is holding above which is positive. There are few different possibilities for upside potential. I would be happy with the August high being recaptured, but I believe with this breakout, we could see it challenge the 2018 top.

OneMain Holdings, Inc. (OMF)

EARNINGS: 10/26/2020 (AMC)

OneMain Holdings, Inc. is a consumer finance company, which provides origination, underwriting and servicing of personal loans, primarily to non-prime customers. It operates through the following the Consumer and Insurance, and Other segments. The Consumer and Insurance segment comprises of service secured and unsecured personal loans, voluntary credit and non-credit insurance, and related products through its combined branch network, digital platform, and centralized operations. The Other segment consists of the liquidation of SpringCastle Portfolio activities and non-orginating operations. The company was founded on August 5, 2013 and is headquartered in Evansville, IN.

OMF is up +1.85% in after hours trading. The RSI is positive and the PMO is hundredths of a point away from a crossover BUY signal. The OBV is confirming the rally with a breakout above its August top. The SCTR just shot up into the "hot zone" above 75.

The weekly RSI is very positive and the PMO is on a BUY signal and not that overbought.

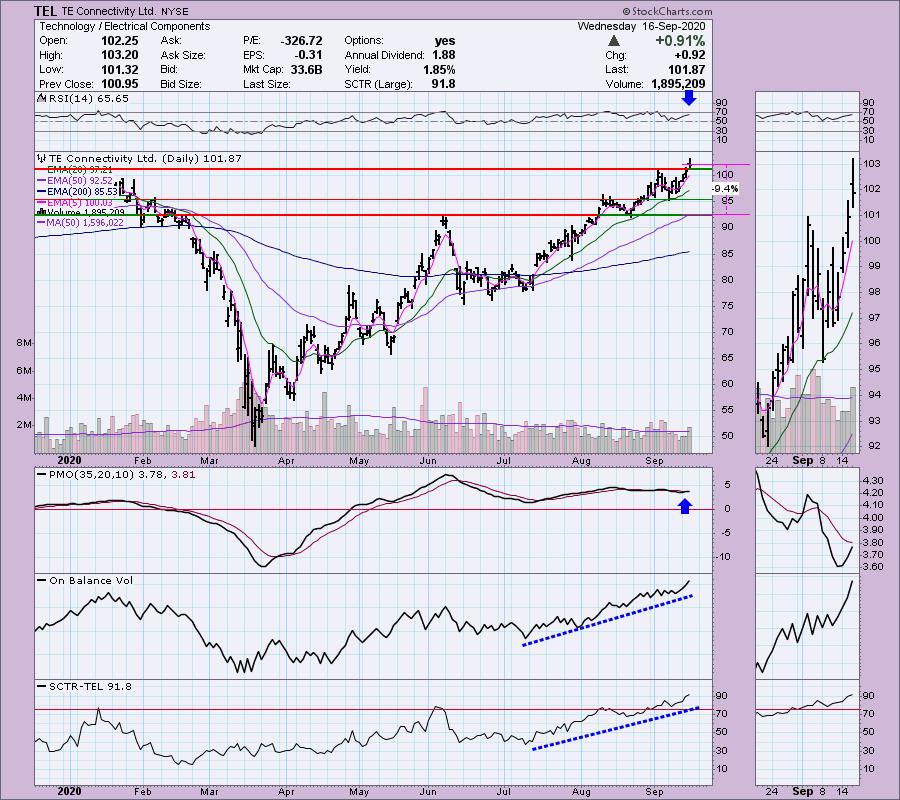

TE Connectivity Ltd. (TEL)

EARNINGS: 10/28/2020 (BMO)

TE Connectivity Ltd. engages in the design and manufacture of connectivity and sensors solutions. It operates through the following segments: Transportation, Industrial, and Communications Solutions. The Transportation Solutions segment offers products that are used in the automotive, commercial transportation, and sensors markets. The Industrial Solutions segment provides products that connect and distribute power, data, and signal. The Communications Solutions segment supplies electronic components for the data and devices and appliances markets. The company was founded in 2000 and is headquartered in Schaffhausen, Switzerland.

While the Technology sector is 'iffy' for me, I do like this industry group. TEL just broke out after a nice rally off the 20-EMA. The RSI is positive and the PMO is looking ready to give us a BUY signal. One of the things that really stood out was the consistent volume that has been coming in since the July lows. Internal and relative strength have been improving as represented by the steadily rising SCTR.

The importance of this breakout is very clear on the weekly chart. It is now logging all-time highs. The PMO is getting somewhat overbought, but not terribly so.

Full Disclosure: I am not adding any new positions. I'm about 50% invested and 50% is in 'cash', meaning in money markets and readily available to trade with.

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 53

- Diamond Dog Scan Results: 5

- Diamond Bull/Bear Ratio: 10.60

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!