The Diamond PMO Scan returned 41 stocks today, but I only got to choose one since it is Reader Request day. I also had quite a selection from readers this week. Don't be upset if I don't review yours, I can only pick four. I ended up picking my personal selection from the Health Care sector. We have representation today from Technology and Consumer Staples sectors too.

Don't forget to register for tomorrow's Diamond Mine trading room! This is a perk only for Diamonds subscribers. I'll be looking at this week's selections and will address all of the reader requested symbols even if I didn't write about them today. I'll always have the registration link for the next Diamond Mine as well as the latest recording links in every Diamonds Report.

Today's "Diamonds in the Rough": AGEN, AXNX, CLVS, DGII, and FOOD.TO. Thanks to Harry, Arthur, Steph and Olivia for your requests! And thank you to all of the other readers who submitted symbols. I'll look at them in the morning!

Diamond Mine Information:

Diamond Mine Information:

Recording from Friday (9/11/2020) is at this link. The password to view the recording is: w*1fJKrN

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (9/18) 12:00p EST:

Here is this week's registration link. Password: decision

Please do not share these links! They are for Diamonds subscribers ONLY!

Click here to register in advance for the recurring free DecisionPoint Trading Room (Next one is 9/21)! Did you miss the 9/14 trading room? Here is a link to the recording (password: 3^aXxCJ2).

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Agenus Inc. (AGEN)

EARNINGS: 11/5/2020 (BMO)

Agenus, Inc. is a clinical-stage immuno-oncology company, which engages in the development and commercialization of technologies to treat cancers and infectious diseases. Its product pipeline includes AGEN1884, AGEN2034, INCAGN1876, INCAGN1949, Prophage, AutoSynVax, PhosphoSynVax, and AS-21 Stimulon. The company was founded by Garo H. Armen and Pramod K. Srivastava in March 1994 and is headquartered in Lexington, MA.

AGEN is down -0.19% in after hours trading so far. I really like the bull flag or pennant formation. These are continuation patterns, so we should see an upside breakout. The PMO reversed a SELL signal earlier this month and momentum has continued higher since. I am seeing some slight deceleration on the PMO, but it is still rising and isn't that overbought yet. The RSI is positive and the SCTR is strong.

The RSI is overbought, but not extremely so. The PMO is rising nicely and isn't overbought yet. I don't like the zone of resistance that is coming, but if it can get to the next strong resistance level, that would still be a 20%+ gain.

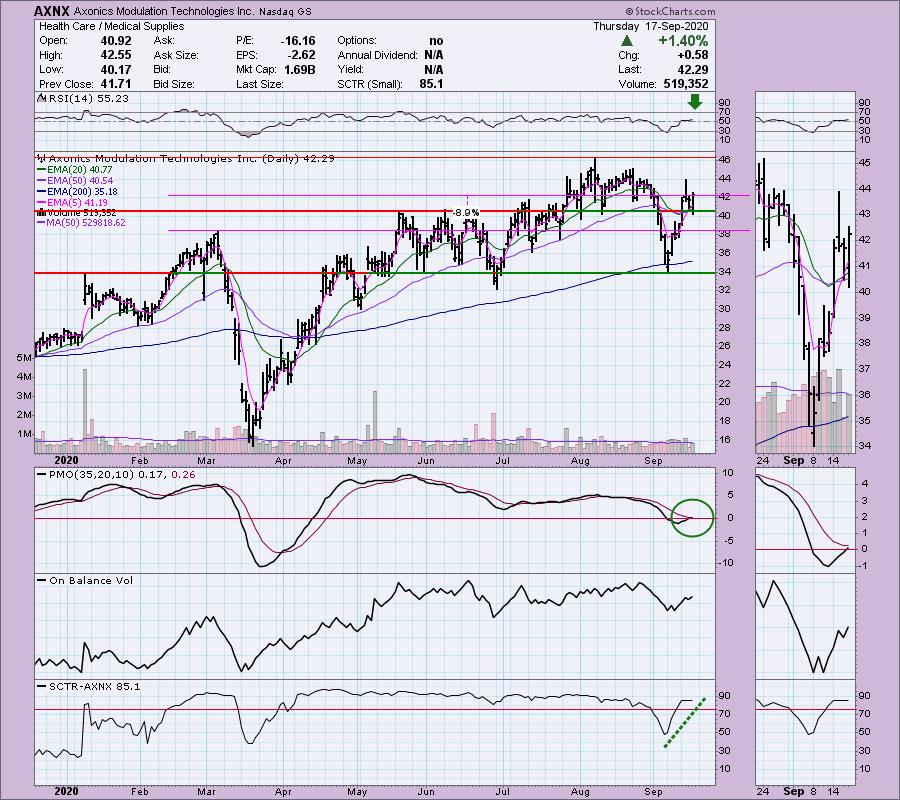

Axonics Modulation Technologies Inc. (AXNX)

EARNINGS: 11/12/2020 (AMC)

Axonics Modulation Technologies, Inc. operates as a medical technology company, which engages in the design, development, and commercialization of sacral neuromodulation solutions. The firm focuses on the treatment of patients with overactive bladder (OAB), fecal incontinence (FI), and urinary retention (UR). It offers rechargeable SNM system, which delivers mild electrical pulses to the targeted sacral nerve in order to restore normal communication to and from the brain to reduce the symptoms of OAB, FI, and UR. The company was founded by Guang Qiang Jiang, Danny L. Dearen, Timothy Deer, and Michael V. Williamson in March 2012 and is headquartered in Irvine, CA.

Down -0.69% in after hours trading, AXNX is my Diamond in the Rough today. I like the indicators here. The RSI is just getting positive and the PMO is about to give us a crossover BUY signal. In the thumbnail, you can see that the 20/50-EMAs are the current support point. I set the stop level to the March top. The SCTR had retreated from the "hot zone" above 75, but has recovered.

I like the RSI on the weekly, but I'm not thrilled with the PMO. The good news is that it is trying to turn back up.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Clovis Oncology, Inc. (CLVS)

EARNINGS: 11/5/2020 (AMC)

Clovis Oncology, Inc. is a biopharmaceutical company, which engages in the acquisition, development, and commercialization of cancer treatments. Its marketed product Rubraca (rucaparib), an oral small molecule inhibitor of poly ADP-ribose polymerase (PARP), is offered for the maintenance treatment of adult patients with recurrent epithelial ovarian, fallopian tube, and primary peritoneal cancer. The company was founded by Andrew R. Allen, Gillian C. Ivers-Read, Patrick J. Mahaffy, and Erle T. Mast on April 20, 2009 and is headquartered in Boulder, CO.

Down -0.40% in after hours trading so far, CLVS has been on a big run to the upside. This 'runner' has now come up against the next level of overhead resistance. This also coincides with resistance at the 200-EMA. The 20-EMA just crossed above the 50-EMA which gives us an Intermediate-Term Trend Model BUY signal. I would just worry that we are at a point where a pullback could come into play given it is up against strong resistance. Notice the RSI is overbought and could use a breather to clear those conditions. The PMO certainly seems bullish.

I like the weekly chart. We have a now positive RSI and a PMO that has just turned up. Price is coming off an all-time low so this one is pretty beat down. If price could just make it past resistance here, upside potential is phenomenal. I just think there is a better entry after a pullback.

Digi Intl Inc. (DGII)

EARNINGS: 11/12/2020 (AMC)

Digi International, Inc. provides business and mission-critical Internet of Things (IoT) connectivity products, services and solutions. It operates through the following segments: IoT Products & Services and IoT Solutions. The IoT Products & Services segment offers products and services that help original equipment manufacturers, enterprise and government customers create and deploy, secure IoT connectivity solutions. The IoT Solutions segment offers wireless temperature and other condition-based monitoring services as well as employee task management services. The company was founded in 1985 and is headquartered in Hopkins, MN.

This one looked much better a few days ago. Unfortunately the chart is taking a turn for the worse. This isn't to say it is all over for DGII, I have a feeling they are getting caught up in the Technology exodus and correction. I don't like that it hit overhead resistance and then turned down. It broke out from a bearish descending triangle which is particularly bullish, then it decided to stall. This stall erased the PMO BUY signal it had. I would watch the 20-EMA closely. The OBV isn't that negative and the RSI is positive which tells me we could see that breakout, just protect yourself or be ready for a possible retest of support at $13.

The weekly chart looks great. Rising PMO that isn't overbought, rising RSI that isn't overbought and confirming action on the OBV. Looking here, it appears that the strongest overhead resistance at $14.50 has technically been broken. Interestingly price stopped right on $14.50. Upside potential is very nice.

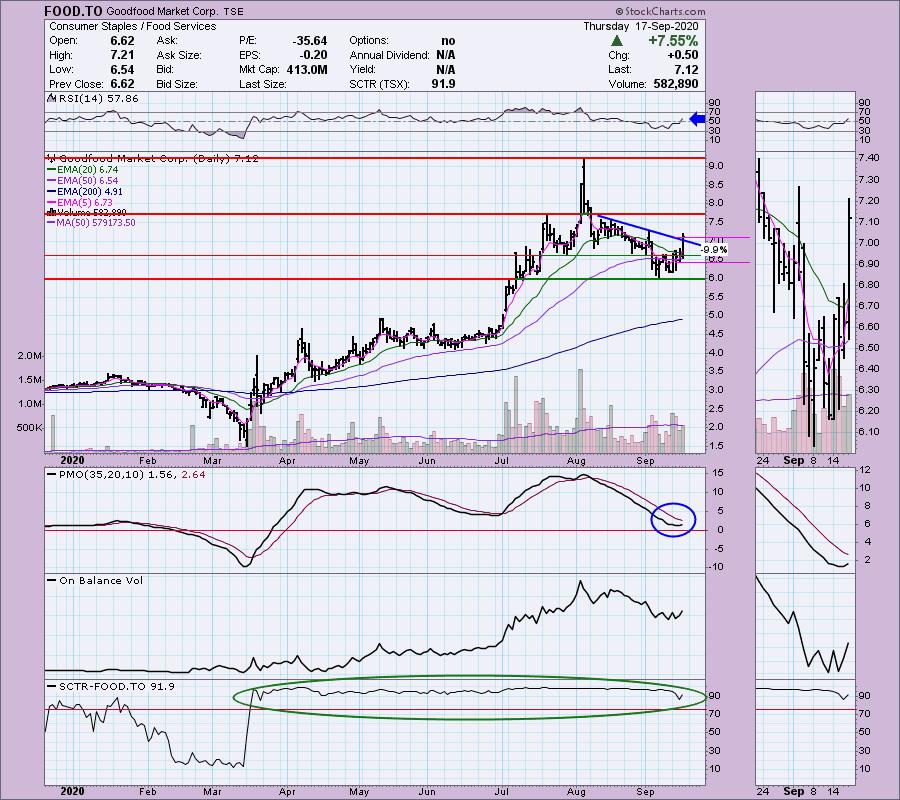

Goodfood Market Corp. (FOOD.TO)

EARNINGS: N/A

Goodfood Market Corp. engages in the provision of dinner subscription services. The firm delivers fresh ingredients to its subscribers. It offers classic basket, vegetarian basket, and family basket. The company was founded by Jonathan Ferrari, Neil Cuggy and Raffi Krikorian in 2014 and is headquartered in Saint-Laurent, Canada.

This was requested yesterday so I hope this reader took the plunge to enjoy today's very nice breakout. We now have a declining trend broken and the PMO is beginning to rise. The RSI is positive. The OBV isn't telling us much right now. The SCTR has been looking great. For reference, the SCTR "universe" for this stock is the entire TSX. I put the stop level in the middle of the prior consolidation zone.

This one was extremely overbought before this deep pullback. The RSI is now positive and not overbought. I'm not happy with the weekly PMO's top, but it does appear it is going to reverse.

Full Disclosure: I am not adding any new positions. I'm about 50% invested and 50% is in 'cash', meaning in money markets and readily available to trade with.

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 41

- Diamond Dog Scan Results: 3

- Diamond Bull/Bear Ratio: 13.67

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!