A reader told me that he doesn't think I need to provide 15 stocks a week, especially when there is a troubling overall market outlook (like I have now). However, I disagree. Don't forget that the purpose of this newsletter is to teach you to read and sort charts when you invest. There will always be a great lesson to be learned. In fact, I had a reader ask about a shorting opportunity for today and I think it is today's most instructive chart.

Thank you to Cotton, Ralph, Olivia and Ian for your selections today! For those not selected, I have to determine which charts will enlighten my readers the most. It's not a slight and it doesn't mean that your requested chart isn't bullish. Come to the Friday morning Diamond Mine and I promise to look at them!

I will be doing a relook at three previous Diamonds that readers would like an update on. Here are today's symbols: BTU, CWH, DIN, IDYA, JETS, USAS. I threw in one of my own so there are six today.

Diamond Mine Information:

Diamond Mine Information:

Recording from Friday (9/4/2020) is at this link. The password to view the recording is: 4DDe4g8+

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (9/11) 12:00p EST:

Here is this week's registration link. Password: wisdom

Please do not share these links! They are for Diamonds subscribers ONLY!

Click here to register in advance for the recurring free DecisionPoint Trading Room (Next one is 9/14)! Did you miss the 8/31 trading room? Here is a link to the recording (password: V#^P89Yv).

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

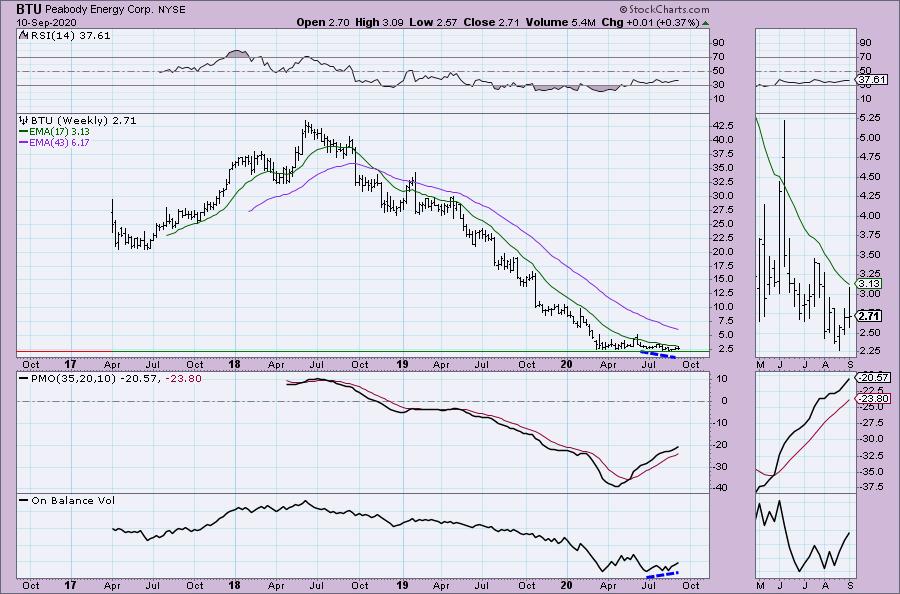

Peabody Energy Corp (BTU)

EARNINGS: 10/27/2020 (BMO)

Peabody Energy Corp. engages in the business of coal mining. It operates through the following segments: Powder River Basin Mining, Midwestern U.S. Mining, Western U.S. Mining, Seaborne Metallurgical Mining, Seaborne Thermal Mining, and Corporate and Other. The Powder River Basin Mining segment consists of its mines in Wyoming. The Midwestern U.S. Mining segment includes Illinois and Indiana mining operations. The Western U.S. Mining segment reflects the aggregation of its New Mexico, Arizona, and Colorado mining operations. The Seaborne Metallurgical Mining segment covers mines in Queensland, Australia. The Seaborne Thermal Mining segment handles operations in New South Wales, Australia. The Corporate and Other segment includes selling and administrative expenses, results from equity affiliates, corporate hedging activities, and trading and brokerage activities. The company was founded by Francis S. Peabody in 1883 and is headquartered in St. Louis, MO.

Up +4.80% in after hours trading, BTU, which was a Diamond in the Rough on 9/3, still looks good to me. The one thing I don't like is that spike today with price closing near the low to remain unchanged. It was up nearly 14% today but closed unchanged? Not a great sign, but given it is back up in after hours trading I feel better. The PMO is on a BUY signal still, the RSI is now in positive territory. Like I said the only negatives I see is the OHLC bar and probably that price didn't close above the 50-EMA.

The weekly PMO still looks good and there is a positive divergence with the OBV. The RSI is oversold and price hasn't penetrated the 17-week EMA. I'm not ready to give up on this one, but there are attention flags so it should be watched closely.

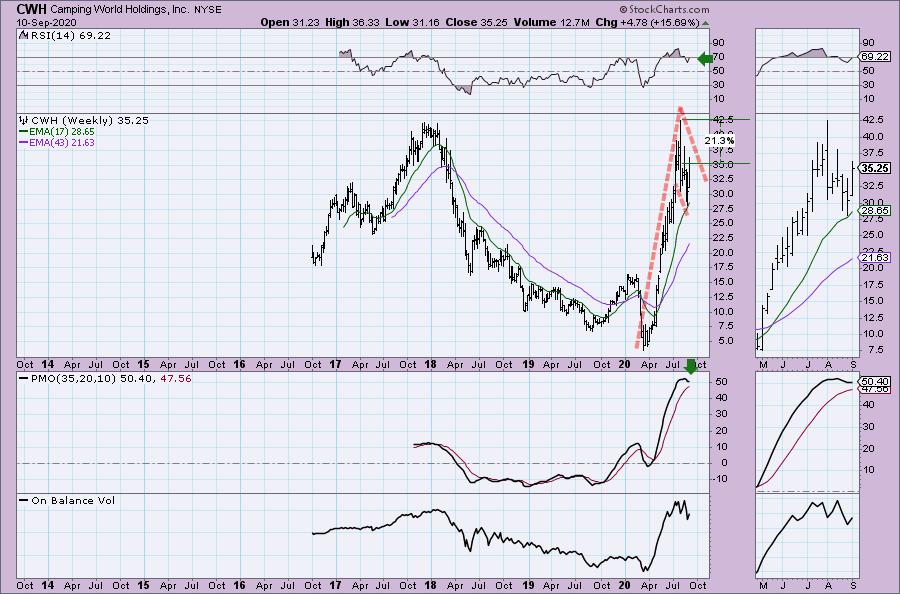

Camping World Holdings Inc (CWH)

EARNINGS: 11/5/2020 (AMC)

Camping World Holdings, Inc. operates as a retailer of recreational vehicles (RV) and related products and services. It operates through the following segments: Good Sam Services & Plans; and RV & Outdoor Retail. The Good Sam Services & Plans segment consists of programs, plans and services that are geared towards protecting, insuring and promoting the RV lifestyle. The RV & Outdoor Retail segment consists of all aspects of company's RV dealership and retail operations. The company was founded in 1966 and is headquartered in Lincolnshire, IL.

Up +1.36% in after hours trading, CWH is my Diamond in the Rough for today. Consumer Discretionary has seen some positive rotation of late and this one looks very interesting. The PMO has turned up, the RSI is positive and there is a positive OBV divergence. We have a breakout from a bullish falling wedge. The stop level would be tricky to set on this one. I currently have the 50-EMA as the stop level at 10%, but I think you could use the 20-EMA as well.

The weekly chart is a bit of a mixed bag. The RSI is positive but on the overbought side. The PMO has topped in overbought territory, but it is starting to decelerate and possibly move higher. I also spot a bull flag which is a continuation pattern so we should expect higher prices if it can break out.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dine Brands Global Inc (DIN) - Shorting Opportunity?

EARNINGS: 10/28/2020 (BMO)

Dine Brands Global, Inc. owns and franchises casual and family dining restaurants. It operates through the following segments: Franchise, Rental, Company Restaurant, and Financing Operations. The Franchise Operations segment comprises of royalties, fees, and other income for Applebee's and IHOP franchised and area licensed restaurants. The Rental Operations segment covers rental income derived from lease or sublease agreements covering IHOP and Applebee's franchised restaurants. The Company Restaurant Operations includes retail sales from IHOP company-operated restaurants. The Financing Operations segment is in charge of interest income from receivables for equipment leases and franchise fee notes generally associated with IHOP franchised restaurants developed before 2003. The company was founded by Jerry Lapin, Al Lapin, Jr. and Albert Kallis on July 7, 1958 and is headquartered in Glendale, CA.

DIN is down -0.13% in after hours trading, so I could be wrong that this is not a good shorting opportunity. I decided to really label this chart more than I normally do. When looking for a short, you want all of the indicators to be flashing a warning or looking bearish. I find too many bullish aspects to this chart to consider a good shorting opportunity. The RSI is positive, it should be neutral or negative. The PMO is negative and is a plus for the short side. However we have an OBV confirmation of the rising trend and possibly a bull flag building. Price is still holding above the 20-EMA and the 50/200-EMAs. The SCTR is in the "hot zone" above 75 and it has been rising. This could turn out to be a great short, but my confidence level is low. On the flip side, the PMO would prevent this one from being a Diamond in the Rough.

The weekly chart is far too bullish. The RSI is in positive territory and not overbought. The PMO is rising, albeit on the overbought side. The OBV is currently confirming this rising trend. One trick that Dave Keller taught me was to invert the entire chart. If you look at it and think, wow, this is a great buying opportunity, then it's a good short. To invert a price chart, just add an underscore before the stock symbol on StockCharts (example: _DIN)

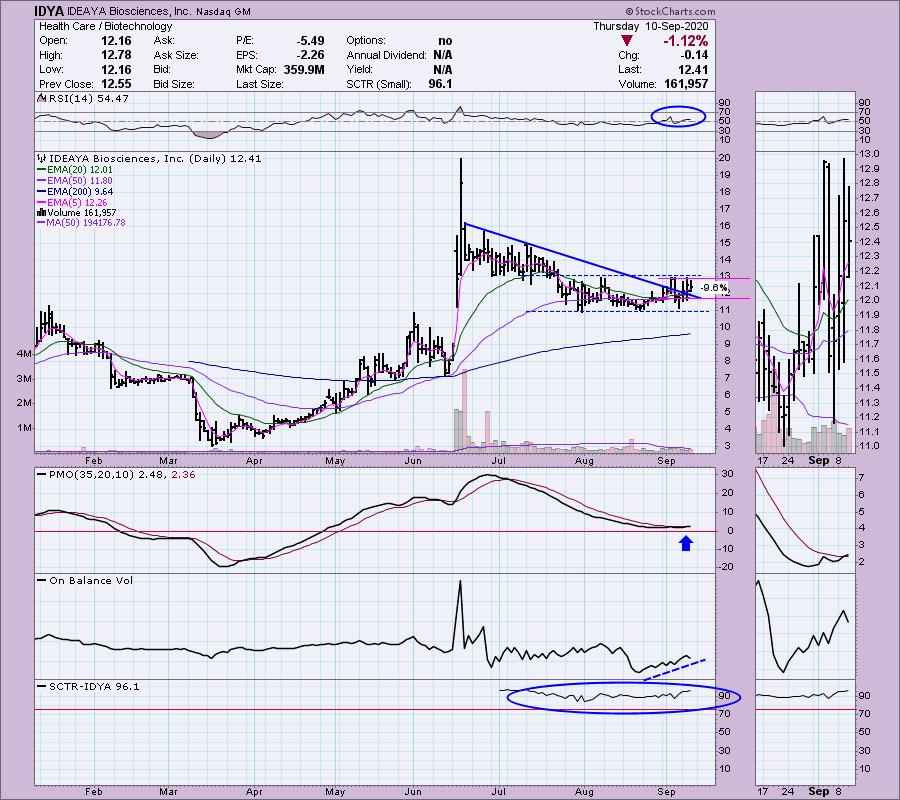

IDEAYA Biosciences Inc (IDYA)

EARNINGS: 11/12/2020 (BMO)

IDEAYA Biosciences, Inc. engages in the research and development of oncology-focused precision medicine. The firm focuses on targeted therapeutics for patients selected using molecular diagnostics. Its product candidate, IDE196, is a protein kinase C inhibitor for genetically-defined cancers having GNAQ or GNA11 gene mutations. The company was founded by Yujiro S. Hata and Jeffrey Hager in June 2015 and is headquartered in South San Francisco, CA.

It is unchanged in after hours trading right now. IDYA was a Diamond in the Rough on 9/2. I honestly have continued to watch this one closely. I so want to get in it, but just can't pull the trigger yet since it hasn't broken above the August top. The indicators are certainly lining up beautifully.

There isn't enough data to make much of the weekly PMO except to say it is trying to turn back up. Support is holding and the RSI is positive. The 17-week EMA is also acting as support.

US Global Jets ETF (JETS)

EARNINGS: N/A

JETS invests in both U.S. and non-U.S. companies involved with the airline industry, including passenger airlines, aircraft manufacturers, airports and terminal services companies.

Up +0.33% in after hours trading, JETS is a compilation request. This reader requested three different airline stocks. All three had similar charts so I decided it might be a good idea to look at the ETF since the reader was wondering if now is a good time to get into airlines. Personally, I have avoided airlines because they aren't being traded on the fundamentals at all, it is speculation in my opinion. Not taking any of that into account, let's just look at the technicals. The RSI is positive and the OBV is confirming this current rally, but it also is telling us in the longer term, there are problems. Notice that the OBV tops are about even, yet the corresponding price tops are declining. What does this mean? It tells us that despite tons of volume to the upside, price couldn't even get near that previous top. Price should follow volume. When it doesn't, worry. The PMO has topped. Price has been stopped at overhead resistance at the August top. I don't like airlines fundamentally or technically right now.

The weekly PMO is rising and the RSI is nearly in positive territory. The OBV is confirming the overall decline since the June top.

Americas Gold and Silver Corp (USAS)

EARNINGS: 11/11/2020 (AMC)

Americas Gold and Silver Corporation is a high-growth precious metals mining company with multiple assets in North America. ... The Company also owns and operates the Cosalá Operations in Sinaloa, Mexico and manages the 60%-owned Galena Complex in Idaho, USA.

Up +0.69% in after hours trading so far, USAS was a Diamond in the Rough on 8/6. I am still a fan of the Materials sector. According Julius de Kempenaer's Relative Rotation Graph, XLB is in the leading category. I like the set up on this chart. The RSI is rising, although not positive yet. The PMO is decelerating and could finally be going in for a BUY signal. There is a bullish double-bottom. We don't have a SCTR for this one and the OBV is mostly neutral.

The weekly PMO is acting toppy. However, the RSI is positive. The OBV is another example of how price is NOT following volume. Major volume came in on the rally out of March, but price couldn't overcome resistance at the 2019 top. I would say that if I owned it, I would likely hold onto it. Like I said I like the sector and I don't see a major price breakdown yet.

Full Disclosure: I do not trust the market right now and am not adding any new positions. I'm about 50% invested and 50% is in 'cash', meaning in money markets and readily available to trade with.

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 4

- Diamond Dog Scan Results: 10

- Diamond Bull/Bear Ratio: 0.40

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!