Tomorrow is a busy day! I'll be doing "The Pitch" for StockCharts TV first thing in the morning, followed by Mary Ellen and my Trading Room immediately after. I'll be presenting the five Diamonds below on "The Pitch", so you may want to see how those Diamonds are working in the morning and get the analysis on video. Mary Ellen and I are very excited to announce that we are going to offer subscriptions to our private trading room! We would love to continue for free, but alas the expert advice and now very individualized attention is priceless! We will now be able to focus on our room subscribers and have tightened up the presentation. For more information, check it out here!

The market overall is showing signs of weakness so tread carefully this week. I opted for a few more "virus" investments given this 'softness' I'm detecting in the overall market. The Financial sector took a hit today, but I found a few strong candidates within.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Biogen Inc (BIIB) - Earnings: 7/21/2020 (BMO)

Biogen, Inc. is a biopharmaceutical company, which engages in discovering, developing, and delivering therapies for neurological and neurodegenerative diseases. It offers TECFIDERA, AVONEX, PLEGRIDY, TYSABRI, ZINBRYTA, and FAMPYRA for the treatment of multiple sclerosis; SPINRAZA for the treatment of spinal muscular atrophy; and FUMADERM for the treatment of severe plaque psoriasis.

In one day, BIIB filled the initial gap down in April. Typically when these type of gaps are covered there will be a follow-on rally. The double-bottom formation executed on today's big rally and suggests a minimum upside target is around 350 where we there is overhead resistance at the April top. The PMO just triggered a BUY signal today. The RSI is rising and above net neutral (>50). The SCTR has now reentered the "hot zone" above 75. I like a stop just below the gap.

Upside potential is at the 2015 all-time high. I would reevaluate this one if it hits 350 to decide if it has the set-up to get to that all-time high or at least to 370. It is currently up slightly in after hours trading.

LIVE Trading Room Subscriptions Available!

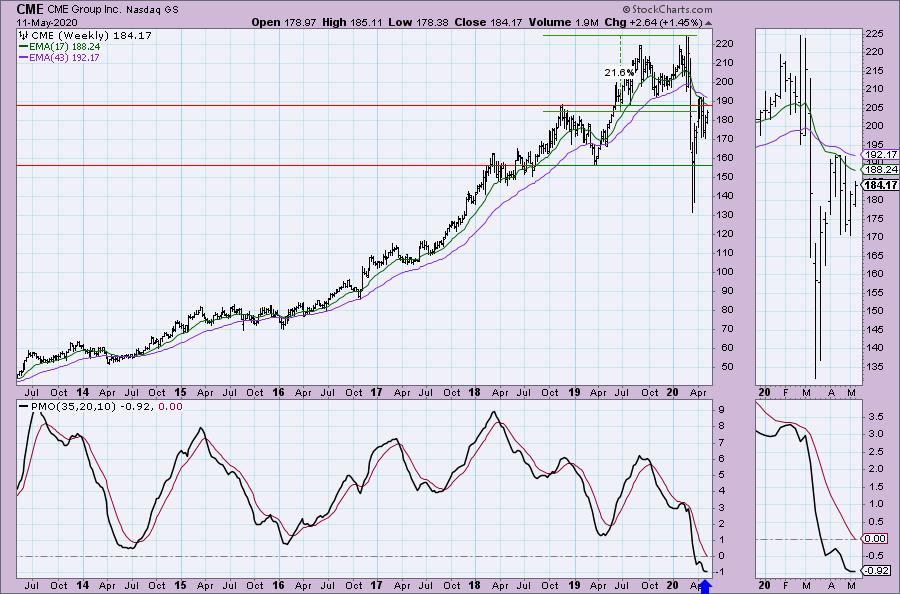

CME Group Inc (CME) - Earnings: 7/29/2020 (BMO)

CME Group, Inc. operates as a security and commodity exchange company. It provides the risk management and investment needs of customers around the globe. The firm offers products across various asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural commodities, metals, weather and real estate. It brings buyers and sellers together through its CME Globex electronic trading platform across the globe and its open outcry trading facilities in Chicago and New York City. The firm also provides clearing and settlement services for exchange-traded contracts, as well as for cleared over-the-counter derivatives transactions. It also offers market data services-including live quotes, delayed quotes, market reports and a comprehensive historical data service and has expanded into the index services business through CME Group Index Services.

CME is up slightly in after hours trading. It has been mostly in a trading range since it recovered from the initial bear market drop. The PMO just triggered a BUY signal right above the zero line so it isn't overbought. The RSI just got above the 50 mark. I would set my stop just below the trading range.

Overhead resistance may be a bit stronger at the 2018 top around $190, so be sure to reevaluate if it hits that level. Upside potential looks doable if that area of resistance can be overcome.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

eHealth Inc (EHTH) - Earnings: 7/23/2020 (AMC)

eHealth, Inc. engages in the provision of Internet-based health insurance agency services for individuals, families, and small businesses. It operates through the following segments: Medicare and Individual, Family, and Small Business. The Medicare segment consists primarily of commissions earned from sale of Medicare-related health insurance plans. The Individual, Family, and Small Business segment includes commissions earned from the sale of individual and family and small business health insurance plans and ancillary products sold to non-Medicare-eligible customers.

EHTH is up slightly in after hours trading after a stellar 7%+ gain today. I would prefer it on a pullback, but the set-up is nice after the breakout from the declining tops trendline. The PMO triggered a BUY signal today and volume is coming in. The SCTR is in the hot zone and the RSI is trending higher and is above net neutral. The stop isn't much lower than the gain today. I've lined it up with the end of April tops and the top of the gap from January.

Upside potential to the all-time high is considerable. I'm not a fan of the weekly PMO, but it is decelerating and may bottom soon.

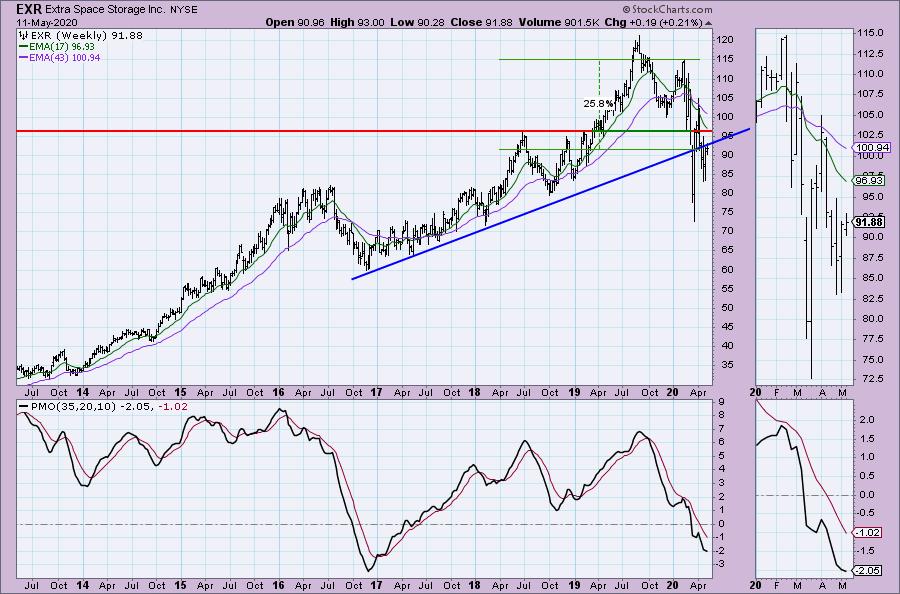

Extra Space Storage Inc (EXR) - Earnings: 7/28/2020 (AMC)

Extra Space Storage, Inc. is a real estate investment trust. It operates through the following segments: Self-Storage Operations and Tenant Reinsurance. The Self-Storage Operations segment includes rents The Tenant Reinsurance segment consists of reinsurance of risks relating to the loss of good stored by tenants in the firm's stores.

I haven't been too excited about the Real Estate sector, but this chart looked very interesting. I would consider it a possible virus play as it is for self-storage. We have an overall intermediate-term declining trend to contend with, but the bullish descending wedge is promising and we've just gotten a breakout to execute the pattern. The RSI is now above net neutral and the SCTR is improving.

It is important to see a follow-on rally given that price is butting up against the rising trend on the weekly chart. The PMO is decelerating in oversold territory. I certainly like the upside potential.

Heartland Express Inc (HTLD) - Earnings: 7/16/2020 (BMO)

Acceleron Pharma, Inc. is a biopharmaceutical company, which engages in the discovery, development, and commercialization of therapeutics to treat serious and rare diseases. Its product candidates include Luspatercept, designed to patients with chronic anemia associated within a wide range of blood diseases; ACE-083, designed for the treatment of focal muscle disorders; and Sotatercept, designed to treat pulmonary arterial hypertension.

HTLD is up slightly in after hours trading after a strong rally off the rising bottoms trendline today. There is about to be a 'silver cross' of the 20/50-EMAs which would trigger a new IT Trend Model BUY signal. The PMO turned up on a new BUY signal today. The RSI is not overbought and above 50. Price is entering a zone of resistance within the trading range set at the end of last year so it may take some work to get above that. I set a stop around the January low.

Overall, HTLD has been trading in a wide range from $17 to $24/25. I have my upside target at $25. The weekly PMO generated a new BUY signal at the end of April.

Current Market Outlook:

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 1

- Diamond Dog Scan Results: 31

- Diamond Bull/Bear Ratio: 0.03

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: I don't own any of the stocks above. I'm currently 20% in cash. My trading timeframe has moved from intermediate-term to short-term and therefore I'm investing more.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!