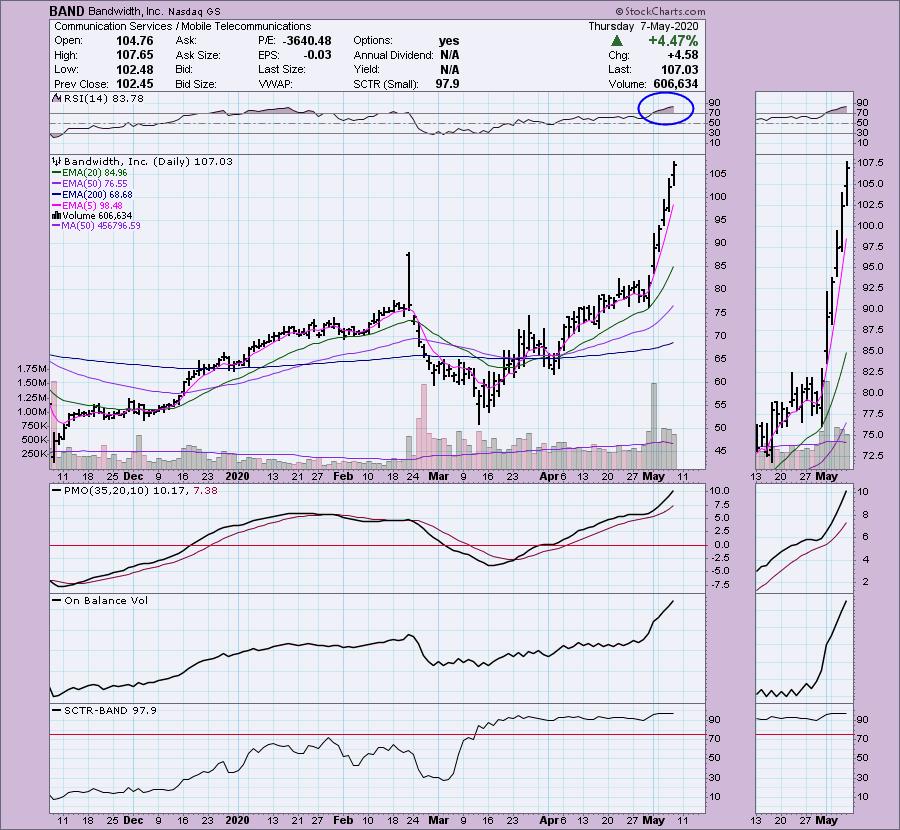

One of our Diamonds readers is always quick to hand me some great symbols. He had Adobe (ADBE) on his list which I'd already covered on Tuesday (great minds or analysts think alike?). The other request was Bandwidth (BAND). I opted not to do that one because it's a 'runner' and while it could certainly move higher, it might be time for a pullback or digestion period given the overbought RSI. It is currently up 2.77% in after hours trading so it's not necessarily done running, at least after hours suggests that.

I can tell that some of you are using my scans when you request a symbol for Thursday which I love! Many times readers request one of the scan results that I wouldn't necessarily look at.

Two requests this week are particularly interesting. First is Disney (DIS). Disney has been talked up as being a good buy right now despite the parks being closed indefinitely (likely 2021) so I'll take a look at that one. The other is Eli Lilly (LLY) which in all honesty looks like a great short and not a buy.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

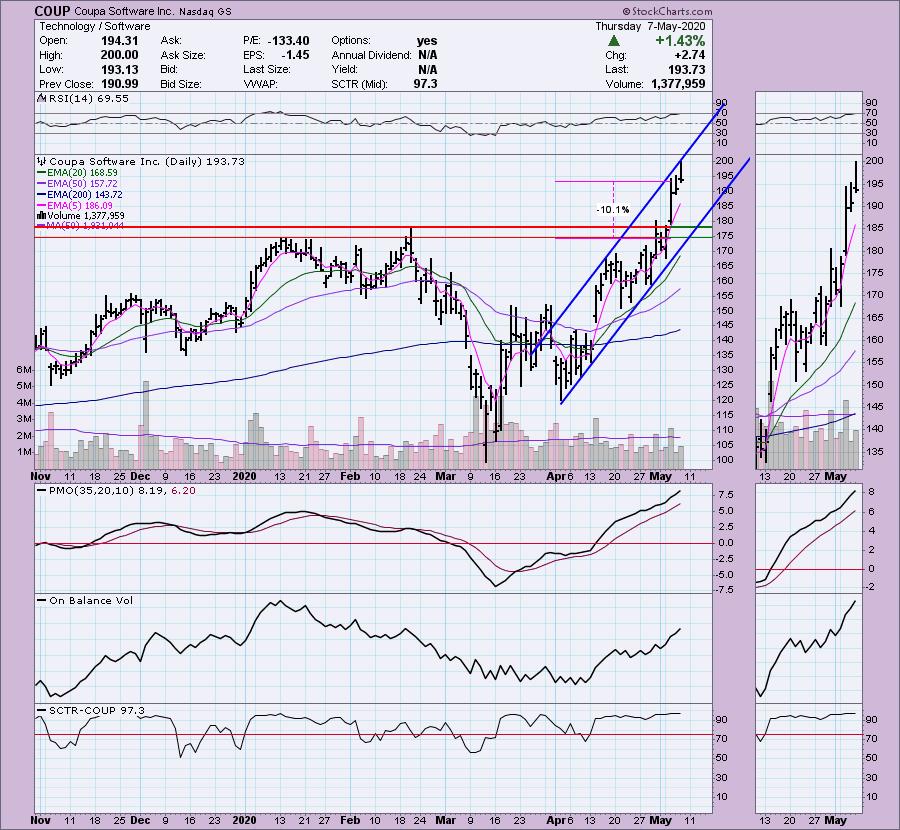

Coupa Software Inc (COUP) - Earnings: 6/8/2020 (AMC)

Coupa Software, Inc. engages in the provision of business spend management (BSM) solutions. Its products include invoice, expense, pay, spend analysis, strategic sourcing, contract management contingent workforce, and supplier management.

Coupa (COUP) is down 1.15% in after hours trading right now. This makes sense. On a major rally of over 10%, it is time for price to digest the move with a pullback or consolidation. I like it and a pullback makes it more enticing if trading after hours is prescient. In any case, it is still interesting. The RSI is positive but not really overbought. The PMO is overbought, but it is still rising. Volume is coming in on the current rally. I set the stop just below the February top.

The weekly PMO will trigger a BUY signal at the end of trading tomorrow when the weekly chart goes "final". It has been a 13% move to the upside for COUP and also suggests a short-term down-turn could be ahead.

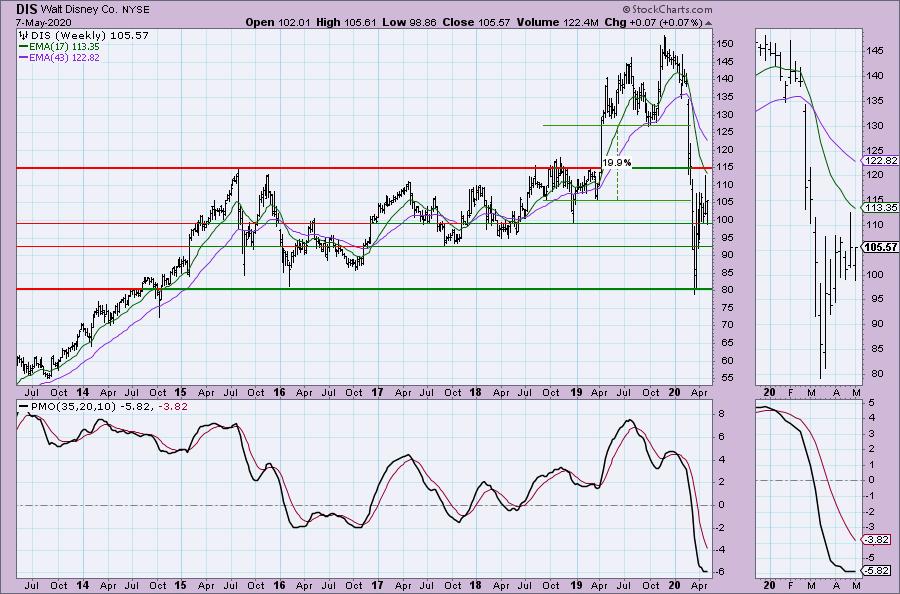

Walt Disney Co (DIS) - Earnings: 8/4/2020 (AMC)

The Walt Disney Co. is a diversified international family entertainment and media enterprise. It operates through the following segments: Media Networks, Parks, Experiences and Products, Studio Entertainment and Direct-to-Consumer and International (DTCI). The Media Networks segment includes cable and broadcast television networks, television production and distribution operations, domestic television stations, radio networks and stations. The Parks, Experiences and Products segment owns and operates the Walt Disney World Resort in Florida; the Disneyland Resort in California; Aulani, a Disney Resort & Spa in Hawaii; the Disney Vacation Club; the Disney Cruise Line; and Adventures by Disney. The Studio Entertainment segment produces and acquires live-action and animated motion pictures, direct-to-video content, musical recordings and live stage plays. This segment distributes films primarily under the Walt Disney Pictures, Pixar, Marvel, Lucasfilm and Touchstone banners. The DTCI segment licenses the company's trade names, characters and visual and literary properties to various manufacturers, game developers, publishers and retailers throughout the world. It also develops and publishes games, primarily for mobile platforms, and books, magazines and comic books. This segment also distributes branded merchandise directly through retail, online and wholesale businesses.

I put in the company info for Disney just so you can see how diversified they are. Many are looking at Disney now based on their diversification. Just remember that while Disney+ is doing well, with no sports, the ESPN streaming service isn't going to help them there. With movies not being filmed or worked on or released, and who knows when movie theaters will reopen, that part of their business is being hurt. This makes me very skeptical as to the longer-term potential of DIS. However, the short-term is looking very interesting right now. Price is holding support around $100. If that is lost, I would be uninterested which is why I would set my stop just below that level of support. The PMO has turned up and the RSI is beginning to improve. Volume came in earlier this week heavily on the decline which is not a good sign, but it appears to be enticing some bottom fishers. It may be time to throw your fishing line in for the short term.

The weekly chart is starting to shape up with the PMO turning around. There are various support levels based on the weekly chart that I've annotated. My upside target would be overhead resistance at the August low.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Eli Lilly & Co (LLY) - Earnings: 7/30/2020 (BMO)

Eli Lilly & Co. engages in the discovery, development, manufacture and sale of pharmaceutical products. Its products include Forteo, Adrica, BAQSIMI, Basaglar and Glucagn.

This was requested today in the trading room as a possible opportunity to buy on this latest pullback. Based on the technicals, I would look at LLY as a possible short. The PMO just had a crossover SELL signal. The RSI is just barely above 50 but declining. We have a textbook head and shoulders reversal pattern that has nearly executed. The minimum downside target is around $137. I personally would rather be on the buy-side of my stocks. I'm not a fan of shorting, but if you want to make this a quick 10% gain on a short...there's that potential.

Price needs to hold that support at the February top. I would likely be getting out of this one if not now, then when the breakdown occurs.

Slack Technologies Inc (WORK) - Earnings: 6/8/2020 (AMC)

Slack Technologies, Inc. develops and publishes real-time collaboration applications and platforms. It provides engineering, sales, marketing, IT, project management and human resources solutions.

Slack is currently up 2.34% in after hours trading even after an 8.4% gain today. There is a HIGH level of interest in this stock. We have two textbook bullish ascending triangles on this chart that both suggest an upside breakout from overhead resistance. The PMO just triggered a BUY signal and the RSI is rising and not overbought.

There isn't enough information for a weekly PMO, but I have marked an upside target at its highest closing price.

Acceleron Pharma Inc (XLRN) - Earnings: 6/8/2020 (AMC)

Acceleron Pharma, Inc. is a biopharmaceutical company, which engages in the discovery, development, and commercialization of therapeutics to treat serious and rare diseases. Its product candidates include Luspatercept, designed to patients with chronic anemia associated within a wide range of blood diseases; ACE-083, designed for the treatment of focal muscle disorders; and Sotatercept, designed to treat pulmonary arterial hypertension.

Today XLRN broke out to a new all-time high. While it closed beneath overhead resistance, I am looking for a breakout here. The PMO just gave us a BUY signal. The OBV is shooting up as positive volume is coming in strong. The RSI is not yet overbought and is sitting above net neutral (50).

The weekly chart shows a PMO that is turning up again. It is clearly overbought, but we don't have a lot of history here, so it is hard to make a judgement.

Overall, there are negative indicators out there so I recommend you keep your stops in play and set them if you haven't already. The market is ready for another decline.

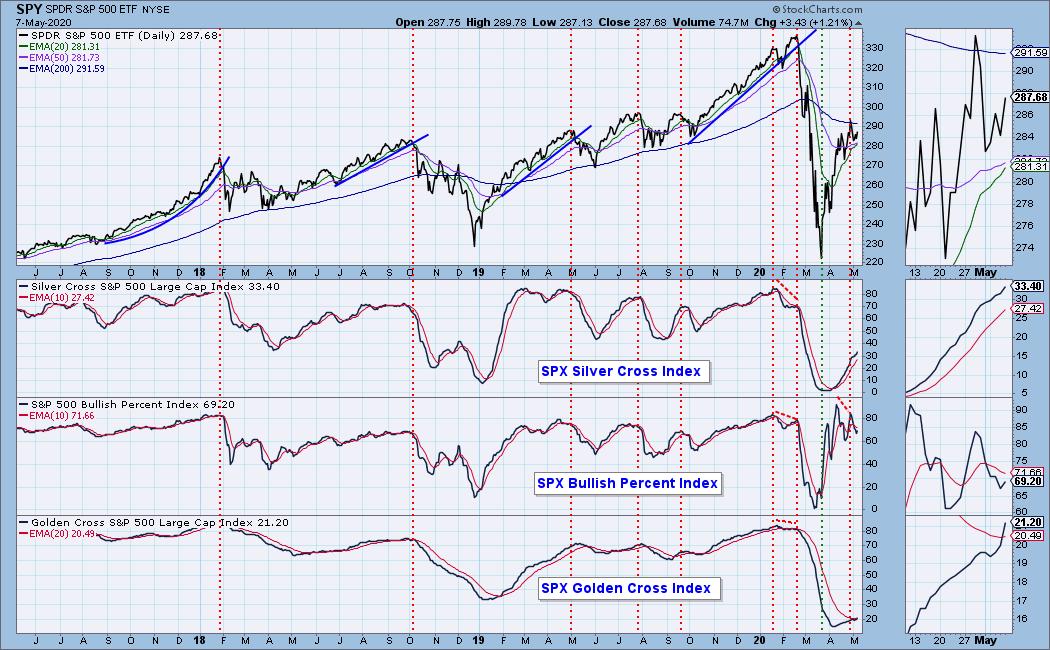

Current Market Outlook:

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 1

- Diamond Dog Scan Results: 303

- Diamond Bull/Bear Ratio: 0.00

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: I don't own any of the stocks above. I'm currently 20% in cash. My trading timeframe has moved from intermediate-term to short-term and therefore I'm investing more.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!