The market is turning and will likely continue this pullback so I believe it is time to look at a few shorting opportunities. I found two! There were plenty to choose from today given I had 497 scan results on the Diamond Dog Scan. I had a few Diamonds to present last night but I recorded "The Pitch" on StockChartsTV yesterday and didn't have the time to write Diamonds. It was a great show with Dave Keller of StockCharts, Dan Russo of Chaikin Analytics and hosted by Grayson Roze. We each presented five stocks to "pitch" to the audience and then we had a discussion afterwards about the markets and our picks. One of the stocks I presented I still very much like and that is Beyond Meat Inc (BYMD) so I will cover that today along with two other stocks that look bullish despite the market decline.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Beyond Meat Inc (BYND) - Earnings: 7/28/2020 (AMC)

Beyond Meat, Inc. engages in the provision of plant-based meats. Its products include ready-to-cook meat under the brands The Beyond Burger and Beyond Sausage; and frozen meat namely Beyond Chicken Strips and Beyond Beef Crumbles.

BYND is up 1.63% in after hours trading currently. Today presents an excellent opportunity given the pullback. The main negative I see on the chart is the overbought RSI which can lead to more decline as we've seen previously when the RSI has gotten overbought on BYND. Other than that, the chart is lovely with a prominent cup and handle formation that has executed. A rising PMO, albeit a bit overbought.

The weekly chart doesn't have much information, but it has enough to show us an interesting large double-bottom pattern that is trying to execute. Even if we look at the June top as a target, that's an over 50% gain. I would probably watch what happens at the $170 level.

Remember DecisionPoint Bundle Subscribers Get the

LIVE Trading Room for FREE ($49.95 Value)! Upgrade Today!

Flowers Foods Inc (FLO) - Earnings: 5/13/2020 (AMC)

Flowers Foods, Inc. engages in the manufacture and sale of bakery products. The firm offers bakery foods for retail and food service customers in the United States. Its brands include Nature's Own, Dave's Killer Bread, Canyon Bakehouse, Tastykake, and Merita.

Up 3.23% in after hours trading already, FLO is poised to make an excellent upside move after breaking out of the declining wedge which could be considered part of a bull flag. The PMO is rising nicely and the RSI is above net neutral. The volume is really coming in on this one and we need that reflected in the price. If after hours trading is any indication, this is a nice play on a Consumer Staple in a weak market.

While upside potential is not as exciting as some, I don't see any reason why it couldn't move past that given the positive PMO BUY signal coming in above the zero line and in near-term oversold territory.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Vipshop Holdings Ltd (VIPS) - Earnings: 5/20/2020 (BMO)

VipShop Holdings Ltd. engages in the provision of online products sales and distributions services. It offers womenswear; menswear; footwear; accessories; handbags; apparel for children; sportswear and sporting goods; cosmetic goods; home and lifestyle products; luxury goods; and gifts and miscellaneous. It cooperates with domestic and overseas brand agents and manufacturers.

VIPS is up .29% in after hours trading. You should note that earnings will be coming in next week and anything can happen. I've marked an 8% stop, but honestly I wouldn't want it if it dropped below the 20-EMA which is closer at $16.29. There is also some overhead resistance to contend with. It has made an attempt today and yesterday to close above that area, but it has been unsuccessful. Given the abysmal performance of the overall market the past two days, I note that VIPS hasn't really been hurt. It is simply consolidating and taking a pause of a very successful breakout from the declining trend. The PMO just triggered a BUY signal today!

We have a very large cup and handle pattern on the weekly chart that has executed. The $19 level does seem to be the make or break level for VIPS. If we get that breakout, this one could bring 33%. The weekly PMO is now headed higher which is good to see.

SHORT: Avalonbay Communities Inc (AVB) - Earnings: 7/29/2020 (AMC)

AvalonBay Communities, Inc. is a real estate investment trust, which engages in the development, acquisition, ownership, and operation of multifamily communities. It operates through the following segments: Established Communities, Other Stabilized Communities, and Development or Redevelopment Communities. The Established Communities segment refers to the operating communities that were owned and had stabilized occupancy. The Other Stabilized Communities segment includes all other completed communities that have stabilized occupancy. The Development or Redevelopment Communities segment consists of communities that are under construction.

I don't generally short, but then we've been in a beautiful bull market for years and I don't like to buck the trend. Well, it's time to get more nimble in this market environment and a short may be a good idea right now as the short-term trend does appear to breaking down for the market. Yesterday AVB executed a descending triangle and broke support that had held since early April. The EMAs are in a negative configuration and the PMO is ready to execute a SELL signal. It's in the Real Estate sector which is floundering.

Downside potential is hefty. The PMO has topped a second time beneath its signal line. It is in oversold territory for the stock, but a short to $140 would still be profitable even if support holds.

SHORT: ITT Inc (ITT) - Earnings: 7/31/2020 (BMO)

ITT, Inc. engages in the manufacture and sale of engineered components and customized technology solutions in the field of energy, transportation, and industrial markets. It operates through the following segments: Motion Technologies, Industrial Process, and Connect and Control Technologies. The Motion Technologies segment manufactures brake components and specialized sealing solutions, shock absorbers and damping technologies primarily for the global automotive, truck and trailer, public bus and rail transportation. The Industrial Process segment includes engineered fluid process equipment in areas such as chemical, oil and gas, mining, and other industrial process markets as well as providing of plant optimization and efficiency solutions and aftermarket services and parts. The Connect and Control Technologies segment offers harsh-environment connector solutions and critical energy absorption and flow control components for the aerospace and defense, general industrial, medical, and oil and gas markets.

This one while in the Industrial sector has ties to the Energy sector which is really suffering right now. There is a head and shoulders reversal pattern clearly visible and price is executing it as it breaks away from its rising trend. The RSI in under 50 and the PMO is about ready to give us a SELL signal.

Downside potential looks good, but we do want to see a break in support at $46 to really make this one a solid short. There is quite a bit of support at that $43 to $45 levels.

Current Market Outlook:

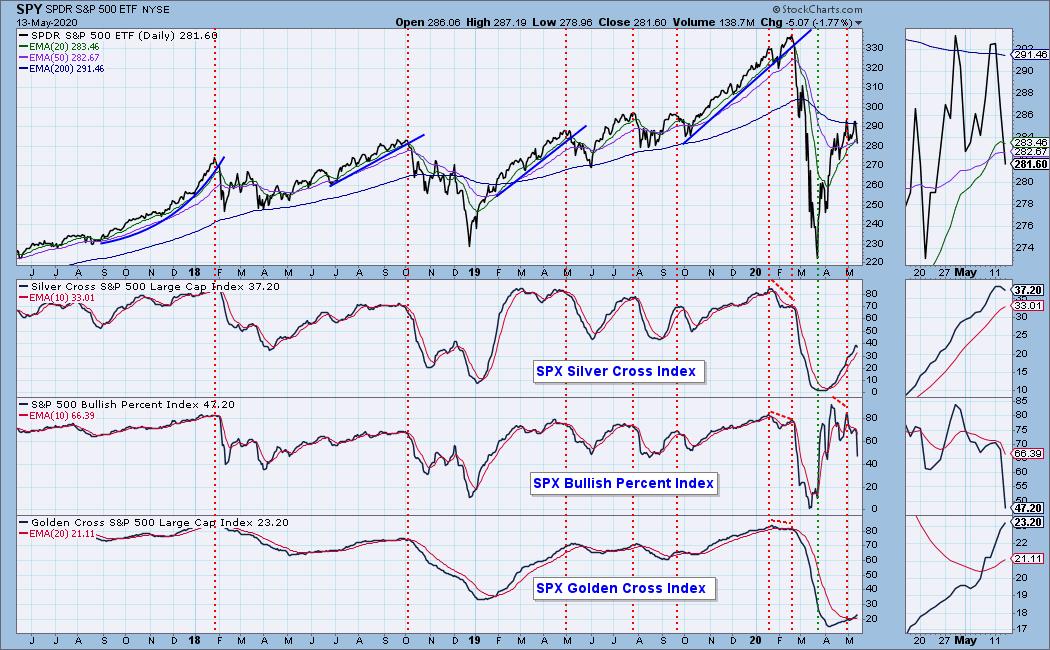

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 6

- Diamond Dog Scan Results: 487

- Diamond Bull/Bear Ratio: 0.01

For a more comprehensive review of current market conditions as well as analysis of Dollar, Gold, Oil and Bonds, subscribe to the DecisionPoint Alert! For a LIMITED TIME you can get a coupon code that will give you a discount for bundling your Diamonds subscription with the DecisionPoint Alert! Contact support@decisionpoint.com for more details.

Full Disclosure: I don't own any of the stocks above but am considering opening one of the short positions. I'm currently 25% in cash. My trading timeframe has moved from intermediate-term to short-term and therefore I'm investing more.

Erin Swenlin will be presenting at the The MoneyShow Las Vegas August 16 - 20 at Bally's/Paris Resort! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. Claim your FREE pass here! You can watch online with this pass too!! There will be online events held in May and when I have more information I'll let you know.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!