I knew that small-caps and mid-caps have been outperforming the market the large-caps; however, I didn't realize by how much. Looking at the broad market indexes chart below we can see that the SPY is 17.6% above the bull market top. The Nasdaq is the best with a 44.4% gain from the bull market top. Look at small- and mid-caps. Both are easily outperforming the SPY. Rallies are sustained longer when the smaller-caps get on board. Right now all of the indexes appear "toppy" as they pause or begin to round off.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

MAJOR MARKET INDEXES

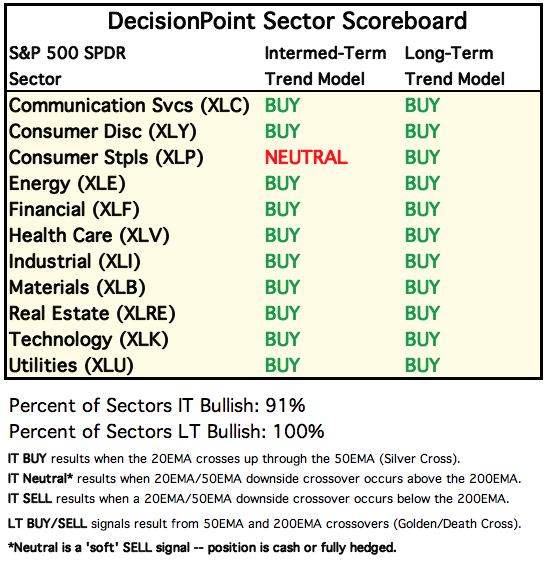

SECTORS

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

CLICK HERE for Carl's annotated Sector charts.

THE MARKET (S&P 500)

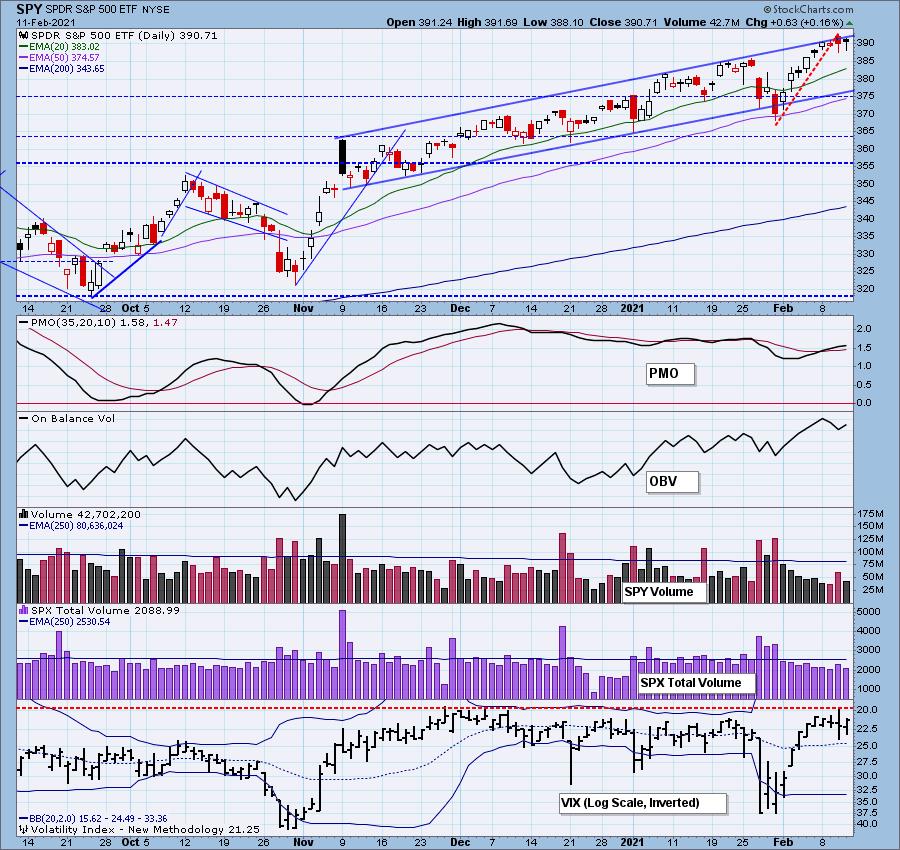

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

SPY Daily Chart: The first thing I noticed on this chart was today's "hammer" candlestick which is bullish when it comes off a decline. However, the PMO is beginning to flatten already. Total volume was underwhelming on today's positive close. The VIX appears to be topping in overbought territory which usually signals a decline but the reading today was higher on the inverted scale so the hammer could resolve upward as expected.

The RSI is positive and not overbought.

* Free Trading Room RESCHEDULED to Tuesday 2/16 *

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

BELOW is a link to Monday's recording:

Topic: DecisionPoint Trading Room Start Time : Feb 8, 2021 Meeting Recording: https://zoom.us/rec/share/mlBq7ioWI3ZRqyrhQZ95MYuBQAVXBzsO_FdkMzTMaSbghcMy3auqs466fnQw3ZaJ.5oEYZb_QCuqh9xHI Access Passcode: H!2B$fn3

For best results, copy and paste the access code to avoid typos.

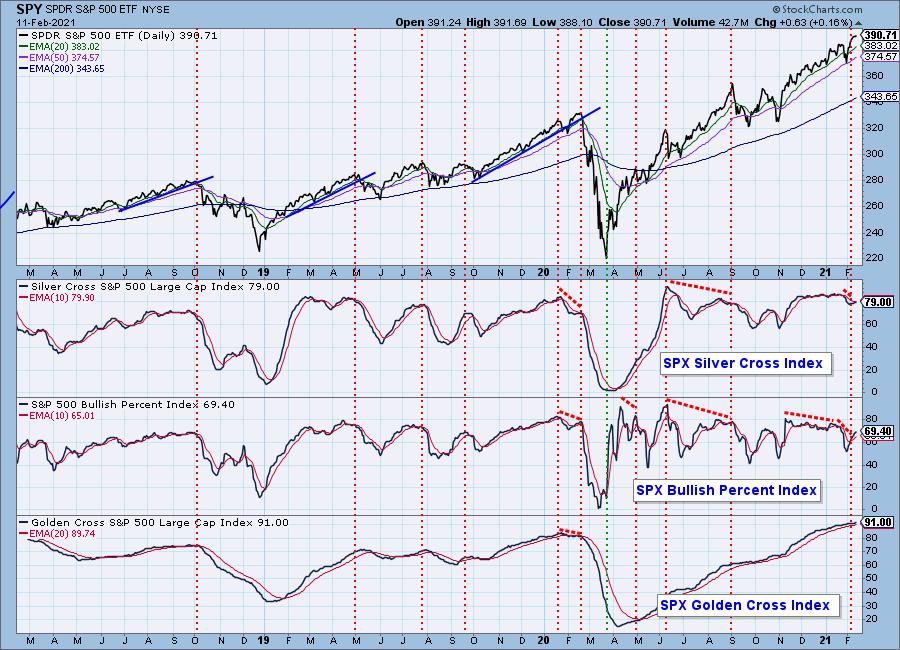

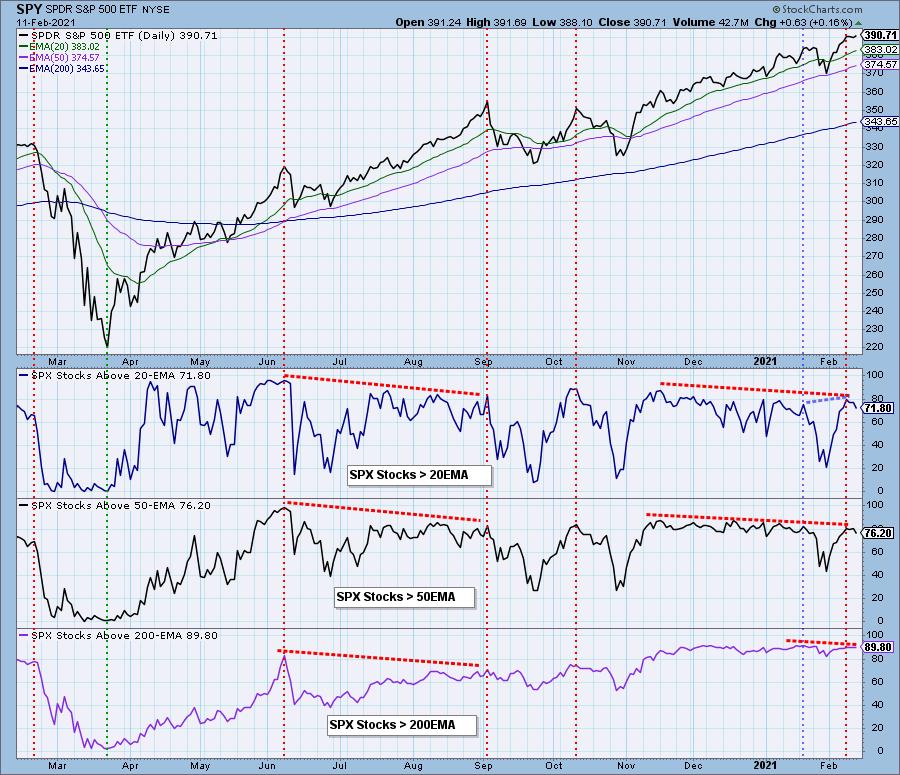

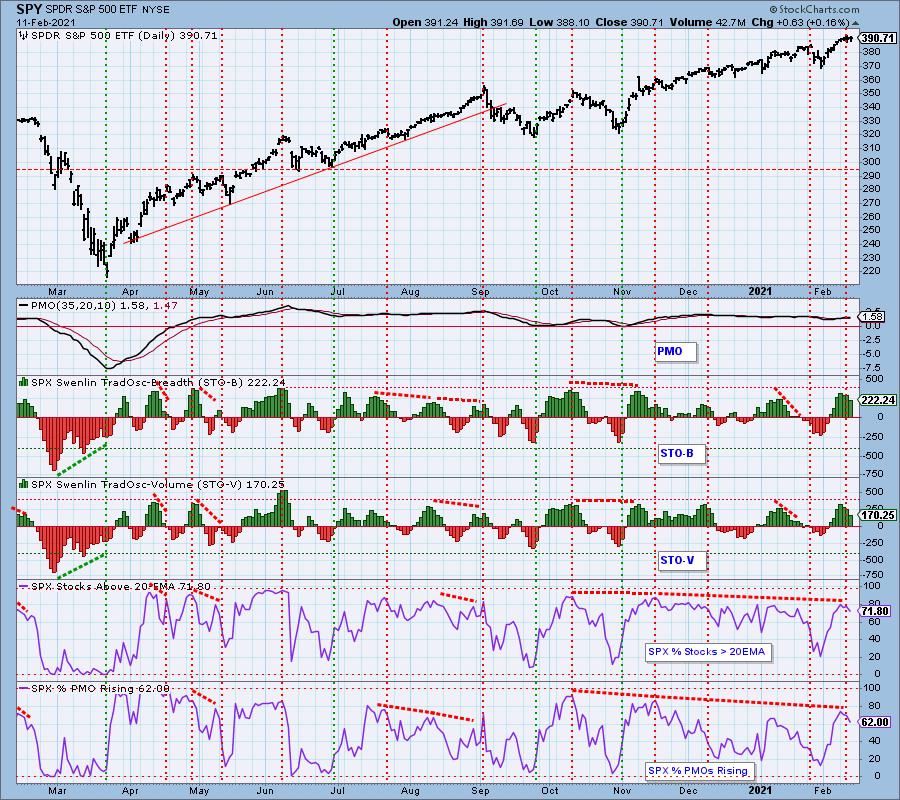

Participation: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

The negative divergences remain, but we did see all of these indicators rise, including the GCI which is now at an extremely high reading of 91.

We closed higher on the day, but more members of the SPX lost support at their 20/50/200-EMAs.

Climactic Market Indicators: No climaxes today. We did see New Highs pare back on a rally day which isn't encouraging.

Short-Term Market Indicators: The short-term market trend is UP and the condition is OVERBOUGHT.

STOs are still overbought and they are declining. This suggests a decline, but so far we haven't seen much damage.

Intermediate-Term Market Indicators: The intermediate-term market trend is UP and the condition is SOMEWHAT OVERBOUGHT. The intermediate-term market bias is BULLISH.

Unlike the STOs the ITBM/ITVM did what you would expect on a rally, they continued higher. They are overbought, but still look healthy. I liked seeing an increase in %Stocks with Crossover BUY signals on the rally.

CONCLUSION: The market continues to look toppy as it pushes up against the top of the rising trend channel. STOs continue to decline from overbought territory which is bearish in the short term. However in the very short-term, the hammer candlestick suggests we should finish higher tomorrow. Remember candlesticks are one-day patterns. The VIX is very overbought and is also looking toppy on the inverted scale. We should see a decline very soon, but until then tighten the stops (or make them "hard" not "mental") and eke out the gains that the market is currently giving us.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

BITCOIN

Bitcoin is breaking out again after forming a short-term bull flag. The PMO is rising and suggests price could continue higher. The RSI is overbought, but we've seen that doesn't mean much.

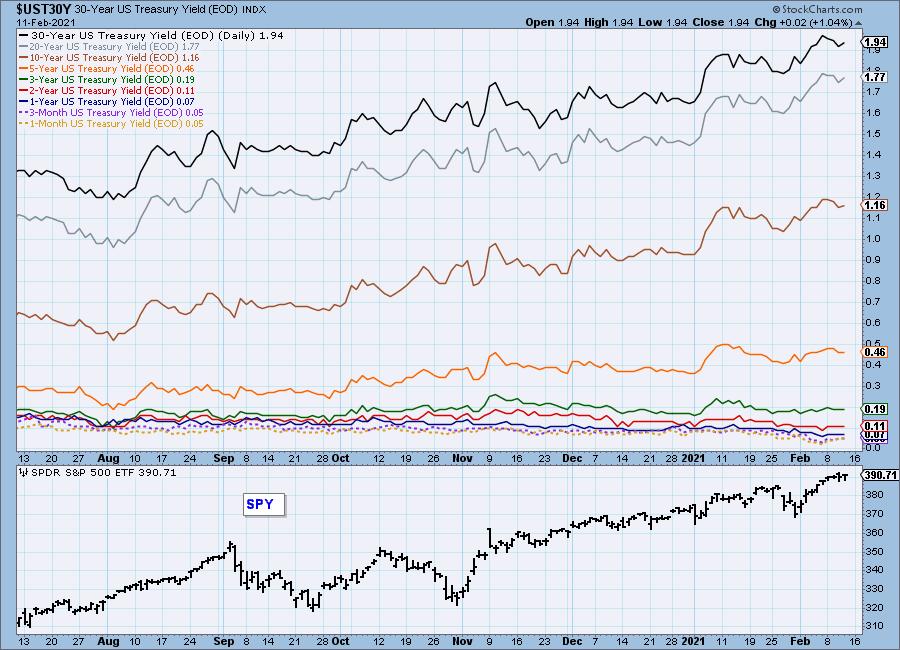

INTEREST RATES

This chart is included so we can monitor rate inversions. In normal circumstances the longer money is borrowed the higher the interest rate that must be paid. When rates are inverted, the reverse is true.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 5/28/2020

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: UUP looks like it may bottom, but the RSI and PMO tell me not to hold my breath. UUP came up as a scan result from my "Diamond Dog" bearish scan. There were only two results and one was UUP. I wouldn't count on this as a solid bottom.

The reverse flag is quite ugly. Support is possible at 24.25, but more likely it will test the January low.

GOLD

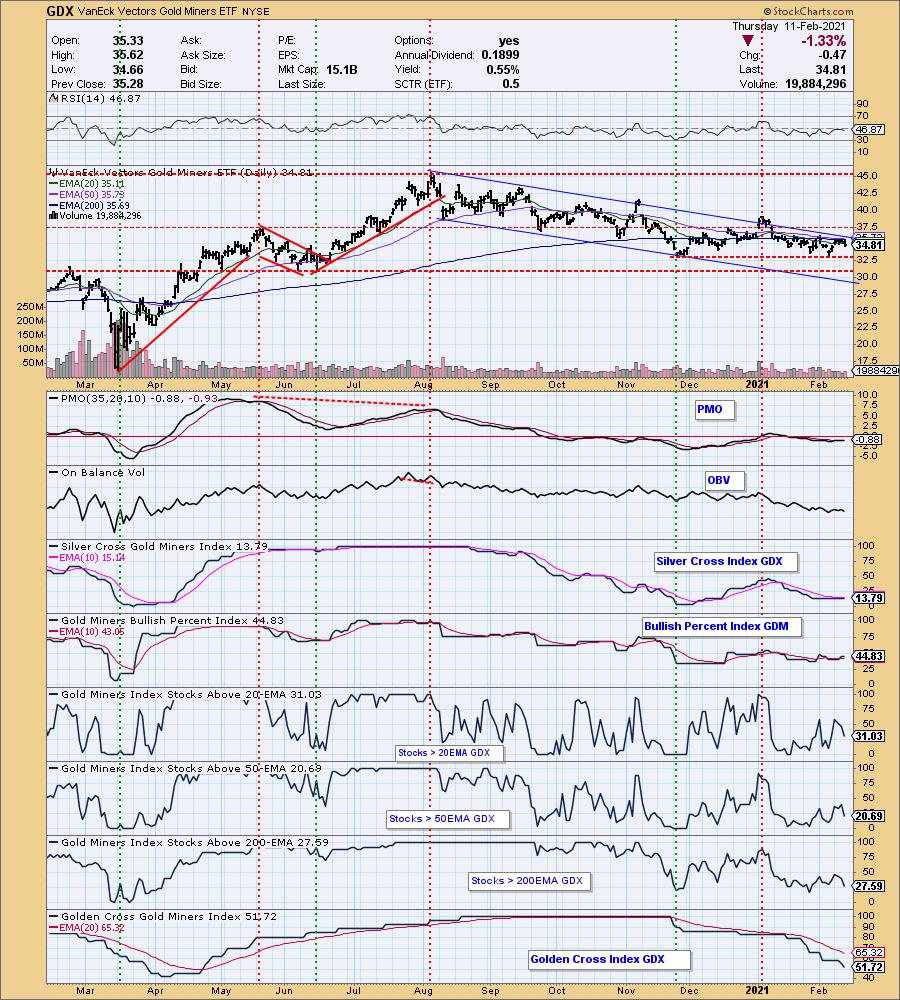

IT Trend Model: NEUTRAL as of 1/14/2021

LT Trend Model: BUY as of 1/8/2019

GLD Daily Chart: Despite a lower close on the Dollar, GLD dropped like a rock. Support is holding at the 200-EMA and the bottom of the trading channel, but seeing the RSI top in negative territory and the PMO topping below its signal line. I wouldn't expect much from Gold.

Full disclosure: I own GLD.

On $GOLD chart we can see the long wick that pushed price above resistance, but once again it closed below.

GOLD MINERS Golden and Silver Cross Indexes: I've been saying that I don't trust Miners and today I was proved correct. Price is still hung up at the 20/50-EMAs and the declining tops trendline. The PMO is on a BUY signal, but you can see the drastic drop in participation.

CRUDE OIL (USO)

IT Trend Model: BUY as of 10/20/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: The rising trend continues for Crude. It is highly overbought and could use a pause. Currently it remains above the prior bearish rising wedge. The PMO was damaged slightly, but overall, I'd look for a pause.

BONDS (TLT)

IT Trend Model: NEUTRAL as of 8/27/2020

LT Trend Model: SELL as of 1/8/2021

TLT Daily Chart: Yesterday's comments proved prescient.

"TLT is looking good, but overhead resistance at $150 is nearing. The RSI is positive and rising. The PMO hasn't really gotten on board this rally. It looks like a healthy and sustainable bottom, but yields may not cooperate much longer as they are in a rising trend, annotated on the second chart."

Additionally you can see that yields are still in a rising trend which will continue to put pressure on TLT. Volume by price bars suggest this could hold as support. If not it will be a long way down to the next support level at $143.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs, trading rooms or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.