Periodically we examine the DecisionPoint "Rydex Ratio" to determine market sentiment. It's measures market sentiment based on actual money rather than "finger in the wind" polling. Guggenheim now manages these funds, but we have kept the Rydex name for our ratio. The Ratio is calculated by taking the assets from bear and money market funds and dividing them by the assets in the bull funds. We use an inverted scale for the Ratio so that overbought readings are at the top.

What is overbought? That is when there are far more assets in the bull funds than bear and money market funds. As you can see in the chart below, when this Ratio gets extremely overbought, it generally precedes major market declines. Right now we have Ratio readings that are at multiyear highs on the inverted scale. As with most indicators in a bull market, they can remain overbought for some time, but it appears the ratio is beginning to top and that doesn't bode well for the market.

The DecisionPoint Alert Weekly Wrap presents an end-of-week assessment of the trend and condition of the Stock Market, the U.S. Dollar, Gold, Crude Oil, and Bonds. The DecisionPoint Alert daily report (Monday through Thursday) is abbreviated and gives updates on the Weekly Wrap assessments.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

MAJOR MARKET INDEXES

TODAY'S RESULTS:

THIS WEEK'S RESULTS:

S&P 500 SECTORS

TODAY'S RESULTS:

THIS WEEK'S RESULTS:

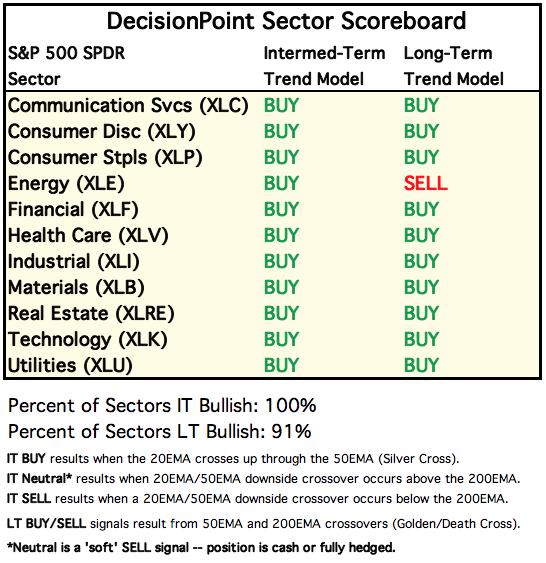

SIGNAL SUMMARY:

Each S&P 500 Index component stock is assigned to one, and only one, of 11 major sectors. This is a snapshot of the Intermediate-Term (Silver Cross) and Long-Term (Golden Cross) Trend Model signal status for those sectors.

CLICK HERE for Carl's annotated Sector charts.

THE MARKET (S&P 500)

IT Trend Model: BUY as of 5/8/2020

LT Trend Model: BUY as of 6/8/2020

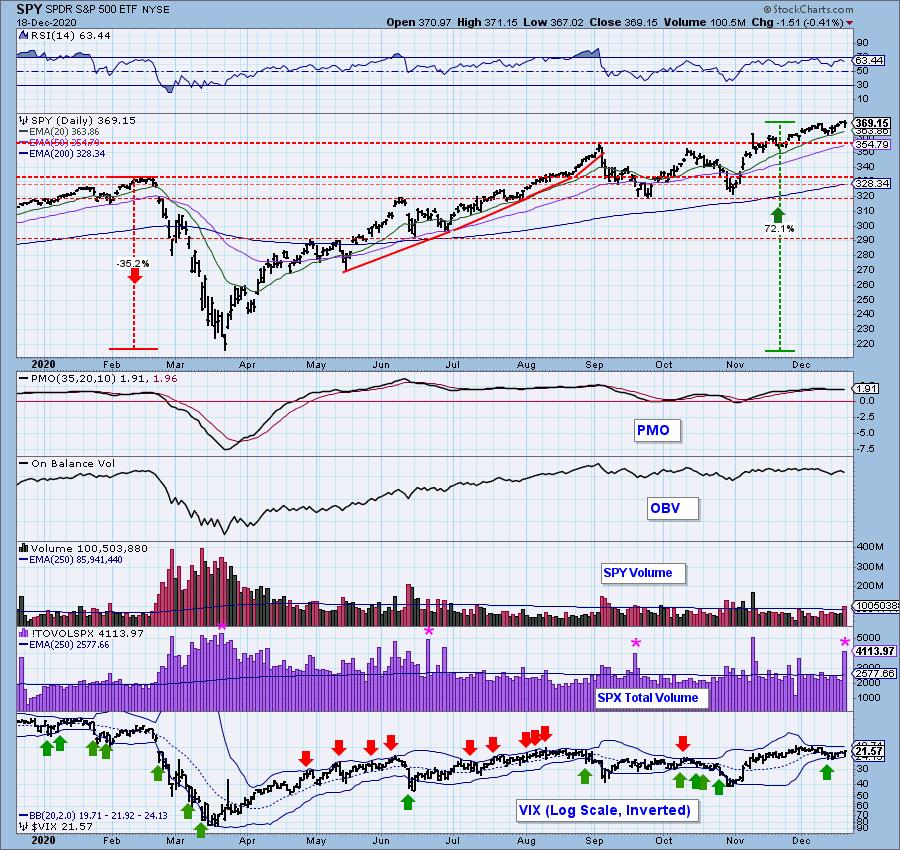

SPY Daily Chart: There is a new rising wedge in town and it should resolve downward based on the textbooks. The PMO turned down today below its signal line which is especially bearish. The RSI remains positive, but notice we have a very clear OBV negative divergence in play as well.

Total volume was very high today, but that is due to options expiration so we can't read too much into that.

SPY Weekly Chart: Price is now extending past the upper boundaries of the bearish megaphone pattern. Just another indication of how overbought the market currently is. The weekly PMO is extremely overbought as well.

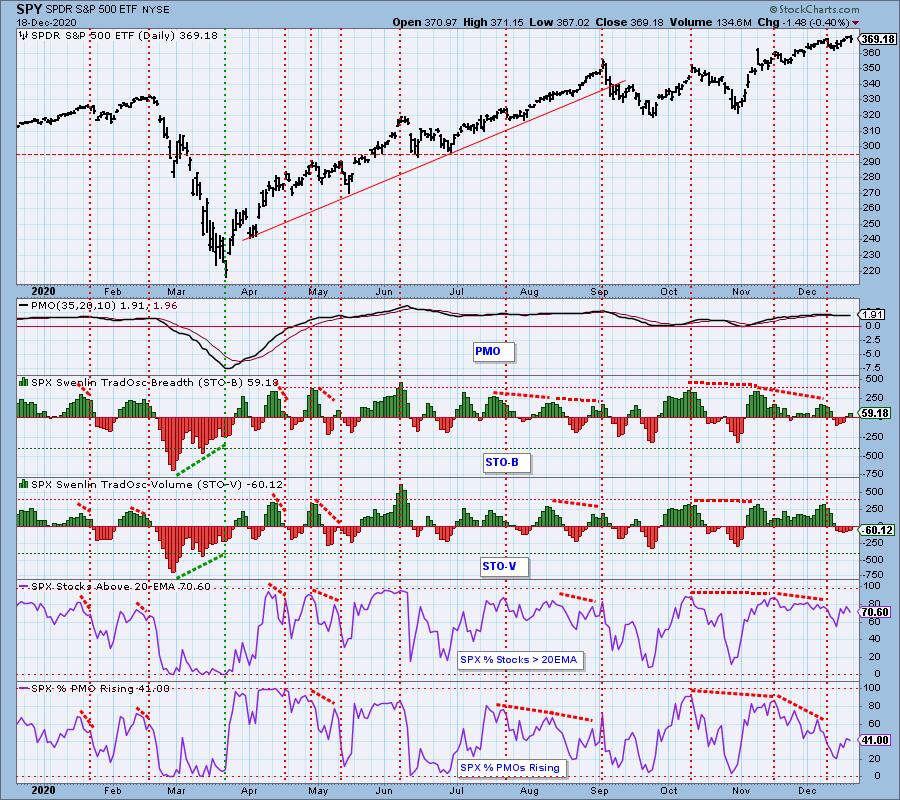

Participation: The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA).

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA).

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

The SCI is rising, but is very overbought. The BPI had a negative crossover, but overall it is in a declining trend and appears ready to turnover completely. The GCI continues to get further and further overbought reaching multiyear highs.

Another objective measure of participation across three time frames is the percentage of stocks above their 20-, 50-, and 200-EMAs. In the short term we have a negative divergence, and in all time frames the market is overbought.

Climactic Market Indicators: Interestingly we saw an increase in New Highs despite the decline today. The Net A-D Volume reading came close to having a climax, but we didn't see any corroborating evidence of a selling initiation climax. The extremely high volume readings would normally be considered climactic, but it is due to options expiration, not climax frenzy.

NYSE Up/Down and Down/Up volume ratios can also be used as climax detectors. We use the 9:1 ratio suggested by the late Dr. Martin Zweig in his book, Winning on Wall Street. These climaxes happen less frequently than those on the chart above, and they can be used to clarify a particular event. We have an NYSE and S&P 500 version of the ratios, and normally they will only be published when there is a climax ratio.

This week there were no climaxes on either NYSE or SPX Volume Ratio chart.

The S&P 500 version can get different results than the NYSE version because: (a) there are only 500 stocks versus a few thousand; and (b) those 500 stocks are all large-cap stocks that tend to move with more uniformity.

Short-Term Market Indicators: The short-term market trend is UP and the condition is NEUTRAL to somewhat OVERSOLD. The short-term market bias is NEUTRAL.

It is bullish when these indicators rise out of oversold territory and tells us to look for a higher prices in the short term. With Santa Claus arriving in the next two weeks that makes sense. However, the market is trying to turnover so we may have to settle for a pause.

Intermediate-Term Market Indicators: The intermediate-term market trend is UP and the condition is OVERBOUGHT. The market bias in this time frame is BULLISH, but we can see significant deterioration in that bias over the last few months. With readings falling and prices rising, there is a negative divergence.

OPTIONS EXPIRATION: End-of-quarter options expiration went as expected -- low volatility and very high SPX Total Volume. The price range for the week was only about 2.25% and less than one percent on Thursday and Friday. Why is low volatility the usual case? We think it is because significant numbers of hedges are being rolled from old positions into new positions, and those guys don't want any excess turbulence to complicate with the process.

CONCLUSION: Even though the Technology Sector has been taking a break, the rally has continued because other sectors have come alive. And the rally is not only focused on large-cap stocks, the small- and mid-cap stocks are participating as well.

Friday's pullback makes perfect sense as traders positioned for two weeks of holiday trading. As for the market direction for those two weeks, our intermediate-term indicators are overbought, which favors some corrective action; however, we may have to wait until the new year for serious movement to take place.

Note: On Monday Tesla (TSLA) will be replacing Apartment Investment and Management Co. (AIV) in the S&P 500 Index, and some major re-balancing will take place because of TSLA's monster market cap. We don't know how this will affect trading that day, but be forewarned that some turbulence is possible.

Have you subscribed the DecisionPoint Diamonds yet? DP does the work for you by providing handpicked stocks/ETFs from exclusive DP scans! Add it with a discount! Contact support@decisionpoint.com for more information!

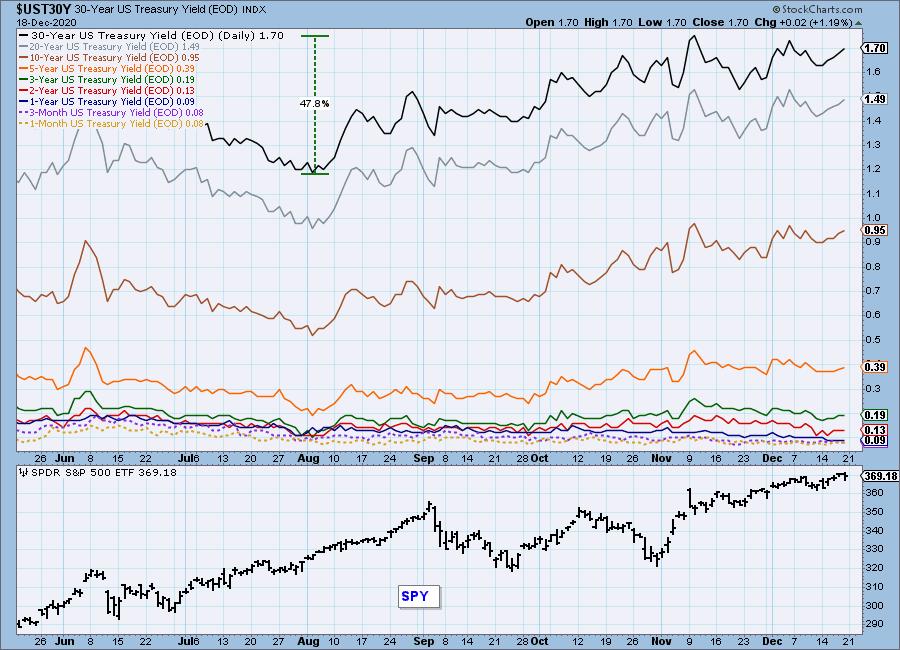

INTEREST RATES

This chart is included so we can monitor rate inversions. In normal circumstances the longer money is borrowed the higher the interest rate that must be paid. When rates are inverted, the reverse is true.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 5/28/2020

LT Trend Model: SELL as of 7/10/2020

UUP Daily Chart: The Dollar rebounded slightly today but overall the declining trend and negative PMO suggest this isn't likely a solid foundation for a bottom.

UUP Weekly Chart: There is some support available at $24 based on the late 2017 top and mid-2018 pullback. However, on the weekly chart the RSI is negative and not oversold. The weekly PMO is picking up speed. It's not likely that this support level will hold.

GOLD

IT Trend Model: NEUTRAL as of 10/14/2020

LT Trend Model: BUY as of 1/8/2019

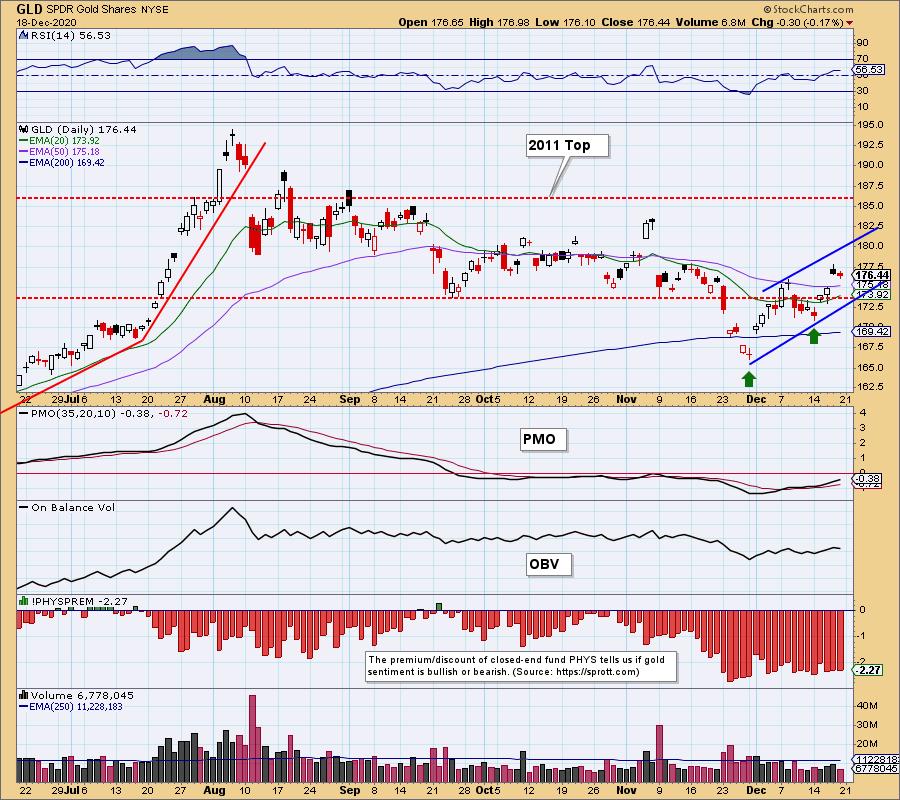

GLD Daily Chart: On our Monday StockCharts TV show, Carl speculated that GLD needed to set a bottom above the late-November bottom, which would be the next step in starting a new up trend. Once that bottom was in, we needed a top above the prior week's top to officially establish the up trend. As luck would have it, Monday's low was the bottom we were looking for, and on Thursday the prior week's top was exceeded. Now we need to see price reach the top of the new rising trend channel.

GOLD Daily Chart: There is a significant amount of resistance above and below the line drawn across the 2011 price top. Note that the top of the rising trend channel intersects with that horizontal resistance at about the same point where price will likely attempt to penetrate.

GOLD Weekly Chart: The parabolic advance has been corrected by the falling flag. This is a bullish setup. We continue to see very high discounts on PHYS which suggests very bearish sentiment. Sentiment being contrarian, this should be good for Gold.

GOLD MINERS Golden and Silver Cross Indexes: With the outlook for Gold favorable, Miners will likely breakout. The indicators look excellent with the SCI moving higher out of oversold territory. The BPI is trending higher and we can see plenty of participation and support among the components of GDX as the %Stocks > 50/200-EMA are rising and not overbought. %Stocks > 20-EMA is somewhat overbought.

CRUDE OIL (USO)

IT Trend Model: BUY as of 10/20/2020

LT Trend Model: SELL as of 2/3/2020

USO Daily Chart: Oil continued rallied the entire week which has put the RSI on USO firmly into overbought territory. The PMO is rising and is overbought. Oil has been beat down and interest has returned. It is due for a pullback or pause.

USO/$WTIC Weekly Chart: The small breakout above the 17-week EMA is holding with overhead resistance not arriving until price reaches the 43-week EMA. The weekly PMO is rising out of oversold territory and is heading to positive territory above the zero line.

BONDS (TLT)

IT Trend Model: NEUTRAL as of 8/27/2020

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: Yields are trending upward again and that has put pressure on Bonds. The RSI is negative and the PMO has topped and should trigger a crossover SELL signal next week. We have a descending triangle which is a bearish chart pattern. Expect a breakdown.

TLT Weekly Chart: The weekly chart doesn't inspire confidence. Yields are about to breakout. The PMO is falling. The RSI is negative and falling. Support at the June low is available but given the negativity of this chart, there's a high likelihood that it will not hold.

Technical Analysis is a windsock, not a crystal ball.

-- Carl Swenlin

___________

Our job is not to see the future, it is to see the present very clearly.

-- Jawad Mian, stray-reflections.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.