Both the SPY and "Diamonds in the Rough" finished lower on the week, but at least "Diamonds in the Rough" didn't lose as much ground as the SPY. I'm still thoroughly unimpressed by results these past weeks. The market appears to be in a bear market configuration and it is not helping picks. While we don't have the requisite 20% drop to name it a bear market, it is acting like one.

The best position, or Darling for the week was our only short, Applied Materials (AMAT). That is saying something if the best position was a short. The market is weak so we need to concentrate on the short side for now. Tariffs come next week and that is likely to shake the market, but we've also seen rhetoric from the president shifting markets higher like on Monday so we can't rule that out. Best to stay defensive, by avoiding opening short-term positions that aren't shorts.

The Dud this week was United Airlines (UAL) which took a terrible turn after being picked. We'll explore the chart and see if there was anything that could've suggested this could happen.

The Sector to Watch is Utilities again this week with Consumer Staples coming in as a close second. With the market weak, these defensive sectors are likely to see some gains or at least not lose as quickly as the aggressive sectors.

The Industry Group to Watch is Water. All of the groups look favorable within Utilities, but I thought the new rally in Water was the way to go. I found the following symbols within the group: MSEX, AWK, YORW, AWR, SJW and CWT.

I had an opportunity to run the Diamond Dog Scan to find some shorting opportunities and came up with: SSTK, UCTT, ONTO, MKSI and NVT.

I'm sorry about the link being incorrect this morning for the Diamond Mine Trading Room, but the regulars seemed to have found their way in. The one-hour recording is available for viewing or download below.

Have a wonderful weekend!

Good Luck & Good Trading,

Erin

Diamond Mine Trading Room:

RECORDING & DOWNLOAD LINK (3/28/2025):

Topic: DecisionPoint Diamond Mine (3/28/2025) LIVE Trading Room

Recording & Download Link

Passcode: March#28

REGISTRATION for 4/4/2025:

When: April 4, 2025 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording from 3/24. You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscribe HERE.

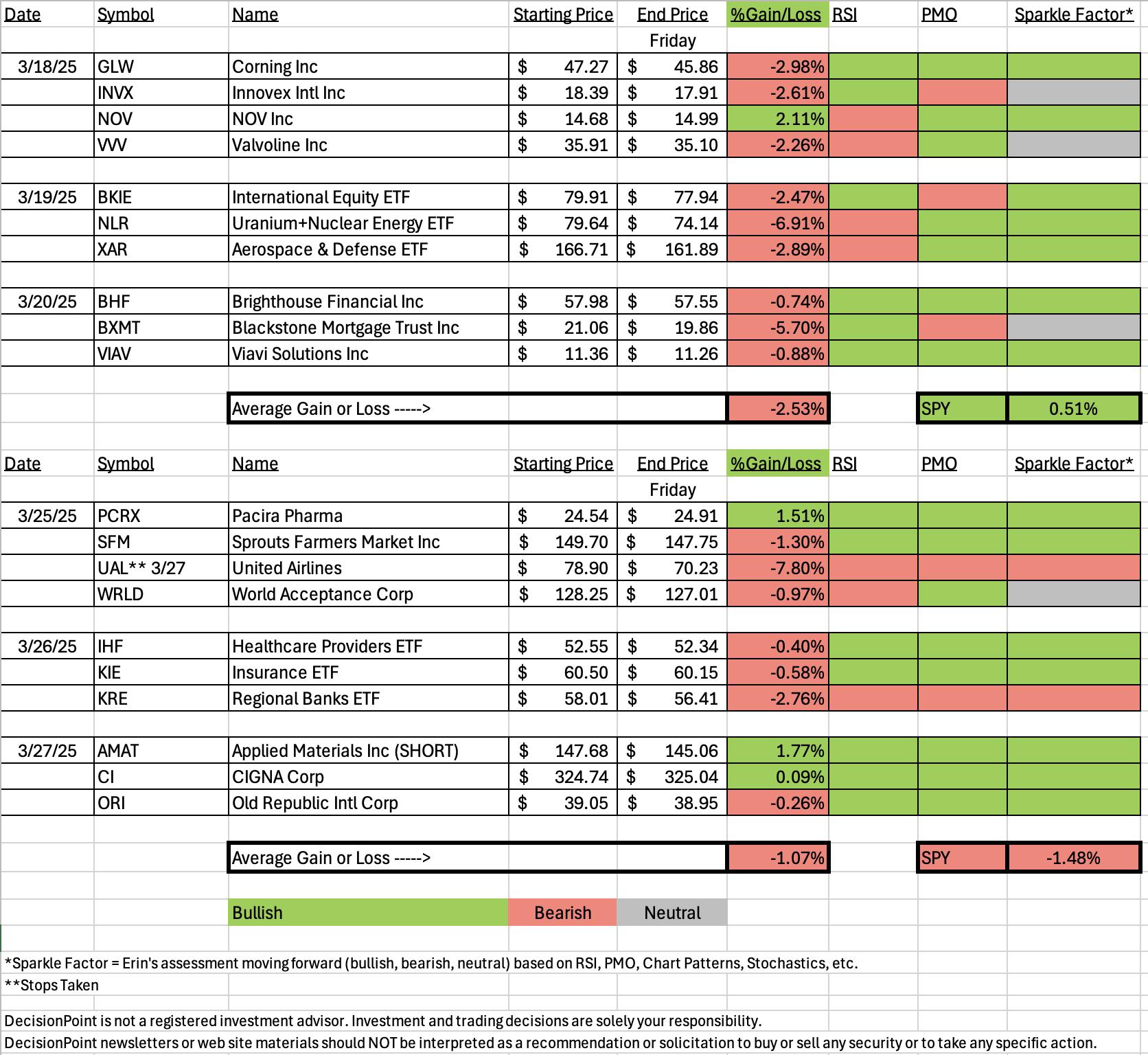

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Applied Materials, Inc. (AMAT) - SHORT

EARNINGS: 2025-05-15 (AMC)

Applied Materials, Inc. provides manufacturing equipment, services and software to the semiconductor, display and related industries. It operates through the following segments: Semiconductor Systems, Applied Global Services, and Display & Adjacent Markets. The Semiconductor Systems segment includes semiconductor capital equipment for etch, rapid thermal processing, deposition, chemical mechanical planarization, metrology and inspection, wafer packaging, and ion implantation. The Applied Global Services segment provides solutions to optimize equipment, performance, and productivity. The Display & Adjacent Markets segment offers products for manufacturing liquid crystal displays, organic light-emitting diodes, equipment upgrades, and other display technologies for TVs, monitors, laptops, personal computers, smart phones, and other consumer-oriented devices. The company was founded on November 10, 1967 and is headquartered in Santa Clara, CA.

Predefined Scans Triggered: P&F Double Bottom Breakdown, New CCI Sell Signals and Parabolic SAR Sell Signals.

Below are the commentary and chart from Thursday, 3/27:

"AMAT is down -0.33% in after hours trading. Price hit overhead resistance at the December low and 20-day EMA and turned down. It hasn't broken support yet, but it appears destined to given the poor indicators. The RSI is in negative territory and is not oversold yet. The PMO topped well below the zero line and is nearing a Crossover SELL Signal. Stochastics are dropping vertically in negative territory. You can see the group is seriously underperforming the market. AMAT is underperforming as well, although it is traveling inline with the group. That's fine given the group is doing so terribly. The upside stop is set above resistance at 7.7% or $159.05."

Here is today's chart:

This short did exactly what it was meant to, break down below support at the prior low. The PMO has now given us a Crossover SELL Signal and Stochastics are still diving lower. I really don't like the Semiconductors right now so you could consider shorting others or use the inverse ETF SOXS to hedge this group in particular.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

United Airlines Holdings Inc. (UAL)

EARNINGS: 2025-04-15 (AMC)

United Airlines Holdings, Inc. is a holding company, which engages in the provision of transportation services. It operates through the following geographical segments: Domestic, Atlantic, Pacific, and Latin America. The company was founded on December 30, 1968 and is headquartered in Chicago, IL.

Predefined Scans Triggered: P&F Ascending Triple Top Breakout and P&F Double Top Breakout.

Below are the commentary and chart from Tuesday, 3/25:

"UAL is up +0.25% in after hours trading. I liked the small rally above the 200-day EMA. I like the airline group right now as you can see it is beginning to outperform the market. The RSI is not yet in positive territory, but it is headed that direction. The PMO is nearing a Crossover BUY Signal. This is a reversal candidate simply because the PMO is deeply negative right now. I think it is worth a try on new group strength. Stochastics are rising, but haven't reached positive territory yet. This is an early pick. UAL is outperforming the group and the SPY. I've set the stop as close to support as I could at 7.8% or $72.74."

Here is today's chart:

So where did this one go bad? There wasn't an indication that a deep decline was on the way, but we could point to the negative RSI as telling us this may have trouble, but again, nothing to suggest we'd get this kind of a decline. The chart has gone south with indicators turning down and relative strength fading away. This looks pretty good for a short right now.

THIS WEEK's Performance:

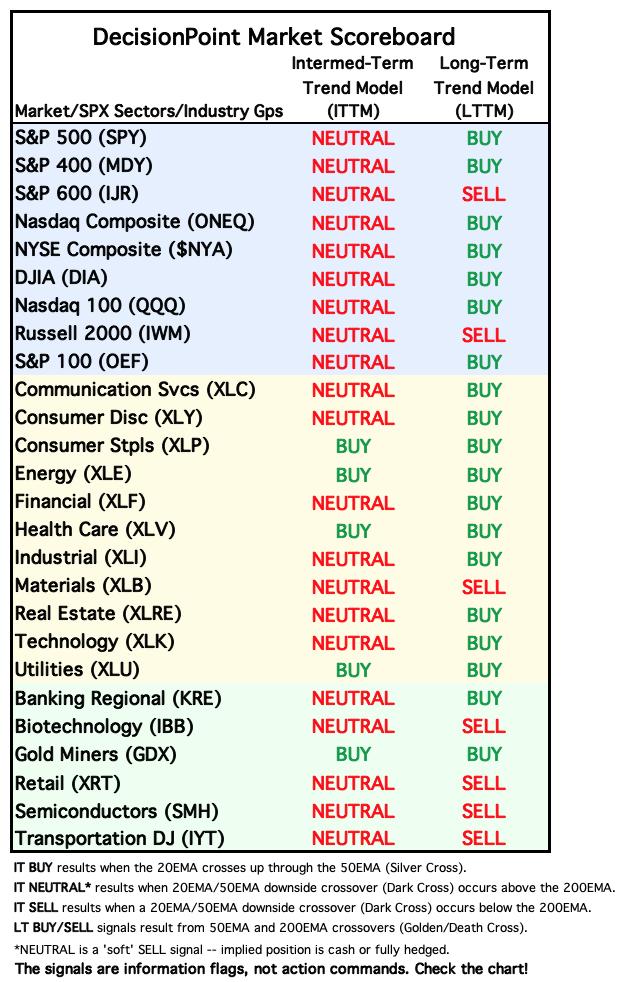

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Friday signal changes are outlined in purple.

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Utilities (XLU)

As I noted last week, XLU is in a sideways trading range that doesn't look particularly interesting, but under the hood this sector really suggests we could see a breakout or at least some more upside to resistance at the November top. The RSI is now positive and the PMO has reversed just above the zero line. The Silver Cross Index suggests that 68% of stocks hold a bullish bias or Silver Cross. The Golden Cross Index is healthy at 81%. Participation is extremely healthy and not overbought yet. Stochastics have turned back up and relative strength is picking up. We should see some more upside here, but a severe decline would likely take this sector down with it so tread carefully.

Industry Group to Watch: Water ($DJUSWU)

The large bull flag is what attracted me to this industry group this morning. Notice that the flag was a bullish falling wedge. Price is rallying strongly out of the pattern suggesting it could set up another flagpole. The RSI is positive and rising. The PMO has turned back up well above the zero line and Stochastics are rising. You'll note the group is also outperforming the SPY. I found the following symbols of interest here: MSEX, AWK, YORW, AWR, SJW and CWT.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 15% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin HERE!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2025 DecisionPoint.com