The market sure looked a whole lot better in this morning's trading room versus how it finished the day. We saw a price reversal as it was announced that tariffs begin on Saturday against Canada, Mexico and China. The market doesn't like tariffs as it makes it cost more to do business abroad and that can put downside pressure on stocks, particularly global companies.

Despite the turnaround, "Diamonds in the Rough" still had a positive finish to the week while the SPY lost -1.01% on the week. Today's reversal was the culprit. Tuesday's Diamonds didn't polish up this week, but most still have merit moving forward so the pullbacks may've just offered better entries.

This week's "Darling" was the UltraShort on Natural Gas (KOLD). It is leveraged so it did have an advantage. I think this ETF will continue to pay off.

This week's "Dud" was Service Corp (SCI) which was down -3.35%. It may be offering an opportunity for entry, but the chart did go south. We'll talk about it further down.

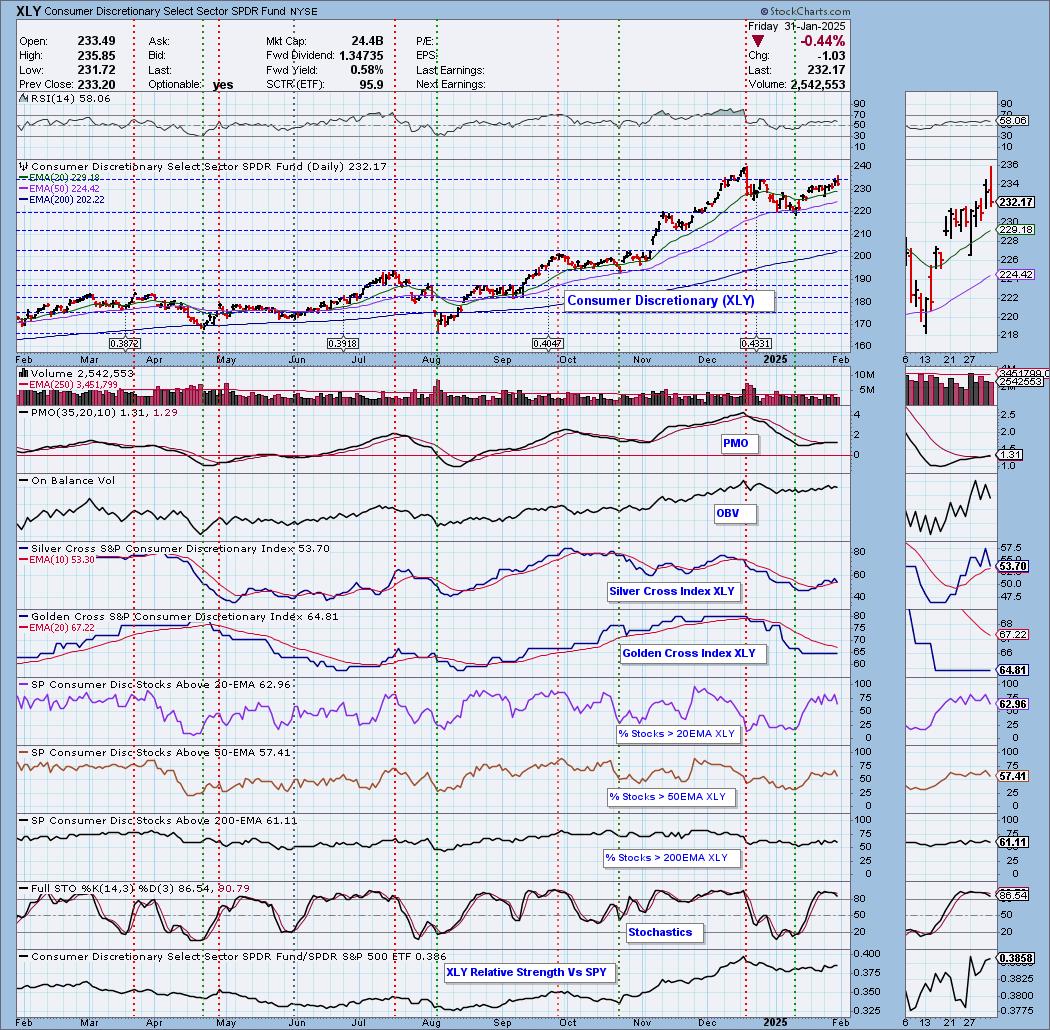

The Sector to Watch was Consumer Discretionary, although I do have some misgivings given today's reversal on tariffs. Tariffs could pose a problem for this sector. Autos are already being hit. Still, the chart is bullish.

The Industry Group to Watch is Specialized Consumer Services. It is set up very well and we found quite a few candidates within the group: CART, FTDR, APEI, PRDO, EBAY and MELI.

I had time to run two scans at the end of the trading room and actually found many symbols that I liked. They'll need to be reviewed because today's reversal may've damaged some of the charts. Here they are: AFRM, KC, BROS, DOCU, WEAV, EDN and BMI.

Have a wonderful weekend!

Good Luck & Good Trading,

Erin

Diamond Mine Trading Room:

RECORDING & DOWNLOAD LINK (1/31/2025):

Topic: DecisionPoint Diamond Mine (1/31/2025) LIVE Trading Room

Download & Recording Link

Passcode: January#31

REGISTRATION for 2/7/2025:

When: February 7, 2025 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording from 1/27. You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscribe HERE.

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

ProShares UltraShort Bloomberg Natural Gas (KOLD)

EARNINGS: N/A

KOLD provides daily -2x exposure to an index that tracks natural gas by holding one second month futures contract at a time. Click HERE for more information.

Predefined Scans Triggered: P&F Double Top Breakout.

Below are the commentary and chart from Wednesday, 1/29:

"KOLD is up +0.16% in after hours trading. Natural Gas had an excellent rally, but it does appear ready to come back down, at least to support. In the case of KOLD, we want it to get to overhead resistance. The RSI is not yet positive due to today's big loss, but the PMO does seem to suggest we will see prices move higher on KOLD. Stochastics are also very positive despite today's decline. The ETF has been outperforming the SPY of late and if Nat Gas really starts to decline, it will fare even better. The stop has to be set deeply (today's action is a good example as to why) so I've opted to set it at 9.9% or $33.97."

Here is today's chart:

Natural Gas is pulling back and I believe it will continue to so this inverse ETF should continue to perform well. At this point the RSI is in negative territory, but if the rally continues as I believe it will, that will fix itself quickly. The PMO is rising nicely and Stochastics have popped above 80. Look for a move to test resistance at $50.00.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Service Corp. (SCI)

EARNINGS: 2025-02-12 (AMC)

Service Corp. International engages in the provision of funeral goods and services. It operates through the Funeral and Cemetery segments. The Funeral segment offers services related to cremations, including the use of home facilities and motor vehicles, arranging and directing services, removal, preparation, embalming, memorialization, and catering. The Cemetery segment provides property interment rights, including lawn crypts, mausoleum spaces, niches, and interment options. The company was founded by Robert L. Waltrip in July 1962 and is headquartered in Houston, TX.

Predefined Scans Triggered: New CCI Buy Signals.

Below are the commentary and chart from Tuesday, 1/28:

"SCI is unchanged in after hours trading. This is another rounded bottom reversal. I like that it occurred well above support and on the 200-day EMA which is providing strong support. Price broke out briefly today, but looks good for followthrough. The RSI is positive and not overbought. The PMO is on a new Crossover BUY Signal. Stochastics are above 80 and relative strength studies show rising trends across the board. The stop is set beneath support at 7.2% or $75.01."

Here is today's chart:

Price had not broken out yet and that could be part of the problem with this pick. I haven't given it a bearish Sparkle Factor, I left it Neutral. Why? We now have a bullish cup with handle. Support is arriving at the 200-day EMA. While I'm not thrilled with the chart, it isn't bad enough to take it completely off the list. The PMO is technically rising still so there is an opportunity for price to reverse higher. I wouldn't pick this one now, but if I owned it, I would probably give it a bit more time.

THIS WEEK's Performance:

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Friday signal changes are outlined in purple.

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Consumer Discretionary (XLY)

This sector looked a bit more healthy this morning. It is a bit suspect right now as we didn't see much in the way of participation. It was hit not improved. Still, we have a new PMO Crossover BUY Signal and a positive not overbought RSI. Stochastics are also holding above 80. The Silver Cross Index is above its signal line so there is still a BULLISH IT Bias and it is outperforming the SPY currently. Stochastics are also above 80 still. I'm less excited about it than I was this AM, but it still deserves to be watched next week.

Industry Group to Watch: Specialized Consumer Services ($DJUSCS)

We have a nice reverse head and shoulders pattern that has been confirmed with the breakout above the neckline this week. The RSI is positive and not overbought. The PMO just hit positive territory and Stochastics look very comfortable above 80. We did see a bearish engulfing candlestick today so we could get a hiccup next week, but ultimately it looks bullish. Symbols of interest in this group are: CART, FTDR, APEI, PRDO, EBAY and MELI.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 50% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin HERE!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2025 DecisionPoint.com