I don't like weeks like this one. All but one of our "Diamonds in the Rough" were down since being picked. I went out on a limb for the Consumer Goods ETF with the thought that defensive sectors like Consumer Staples would start to find favor. The market is taking most stocks down with it and "Diamonds in the Rough" were included this week. Next week I'll likely be looking at shorts unless some pretty bullish charts cross my screen.

Expanding your portfolio isn't really wise at this time as many stocks are losing rising momentum and support at key moving averages. It is time to start closely monitoring already open positions with an eye toward stop levels.

The Sector to Watch is Utilities (XLU). I've been expecting this defensive group to wake up with the market showing weakness. Energy (XLE) was a close second, but I like to find new momentum. XLU has brand new momentum as the PMO managed to turn up today as the sector had a really good day.

I have essentially two Industry Groups to Watch, but I'll only be presenting the chart for Multiutilities. The other group to keep an eye on is Gas Distribution. From Multiutilities I have: AEE, PEG and WEC looking bullish. For Gas Distribution I liked: NI and CPK.

I was able to run a few scans at the end of the trading room. I wasn't impressed with the results, but I did find: SABR, ANF, SBH and TPH as possible stocks to watch next week.

Have a great weekend! I'll see you in the trading room Monday!

Good Luck & Good Trading,

Erin

Diamond Mine Trading Room:

RECORDING & DOWNLOAD LINK (11/15/2024):

Topic: DecisionPoint Diamond Mine (11/15/2024) LIVE Trading Room

Recording & Download Link

Passcode: November#15

REGISTRATION for 11/22/2024:

When: November 22, 2024 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording from 11/11. You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscribe HERE.

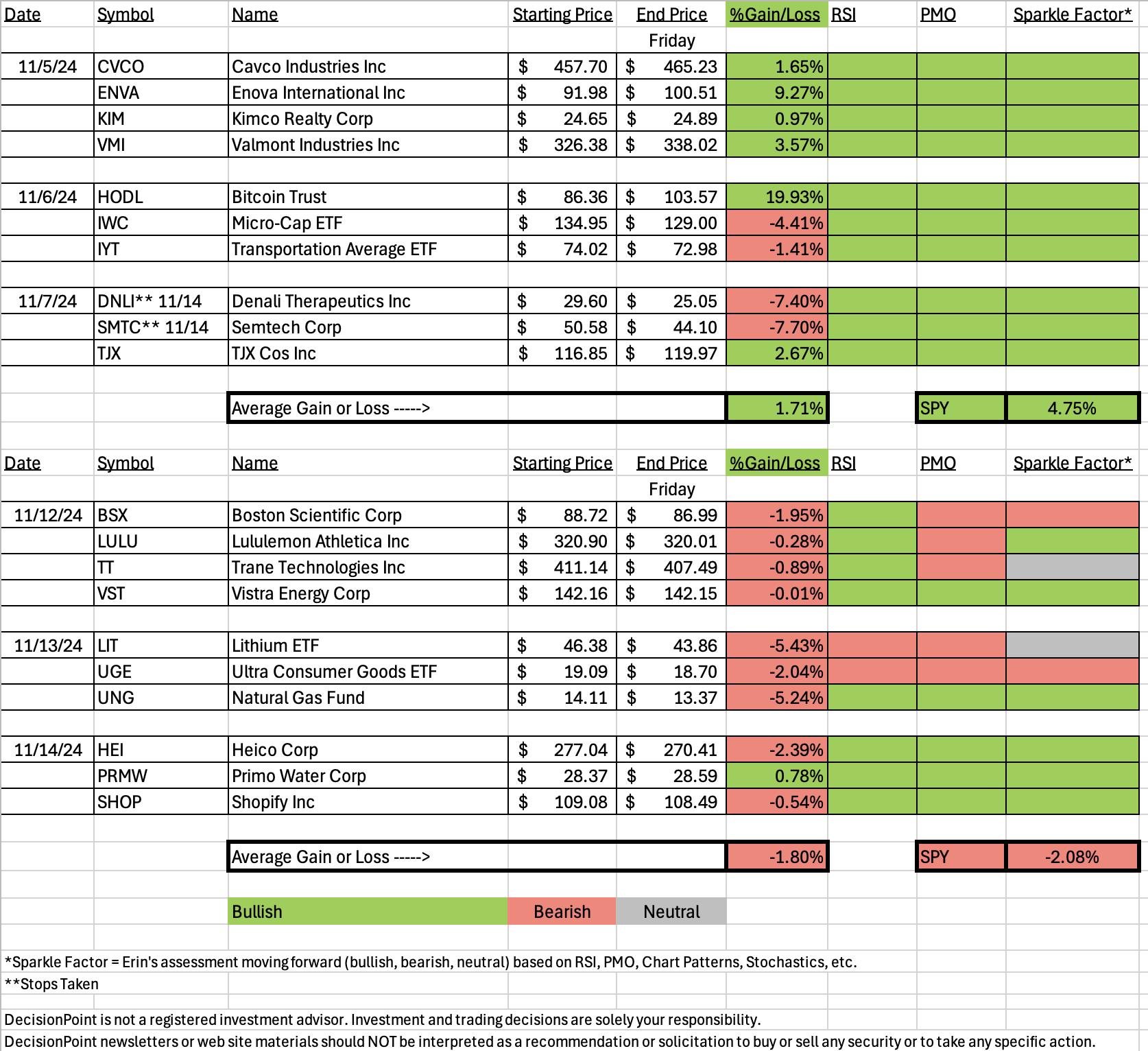

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Primo Water Corporation (PRMW)

EARNINGS: 2025-02-26 (BMO)

Primo Brands Corp. is a branded beverage company. It focuses on healthy hydration, delivering sustainably and domestically sourced diversified offerings across products, formats, channels, price points and consumer occasions, distributed in every state and Canada. The company was founded on June 16, 2024 and is headquartered in Tampa FL.

Predefined Scans Triggered: New 52-week Highs, P&F Ascending Triple Top Breakout and P&F Double Top Breakout.

Below are the commentary and chart from Thursday, 11/14:

"PRMW is unchanged in after hours trading. Here we have a strong upward thrust and breakout. This has brought the RSI into overbought territory, but this stock's personality shows it isn't afraid of overbought conditions. The PMO is on a new Crossover BUY Signal. I'd prefer to see the OBV making new highs of its own, but it is showing strong volume on this rally. Stochastics are rising strongly. The group is struggling, but I am looking for Consumer Staples to improve on this market downturn as it is defensive. This stock could benefit. This rally has set it up for excellent outperformance against the group and the SPY. The stop is set near the 20-day EMA at 7.4% or $26.27."

Here is today's chart:

Well our one stock that was up today formed a bearish filled black candlestick. It could be in for a pullback toward support. The indicators still look good, as they should considering this was picked yesterday. The group isn't doing well and that could apply downward pressure. Maybe Consumer Staples will reverse higher and bring this industry group with it. In the meantime, it could be an interesting entry on a pullback.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Global X Lithium ETF (LIT)

EARNINGS: N/A

LIT tracks a market-cap-weighted index of global lithium miners and battery producers. Click HERE for more information.

Predefined Scans Triggered: Stocks in a New Uptrend (Aroon) and Filled Black Candles.

Below are the commentary and chart from Wednesday, 11/13:

"LIT is up +0.91% in after hours trading. LIT has been on a nice rally and has now broken out above overhead resistance. The 50-day EMA is coming up to the 200-day EMA for a nearing Golden Cross. We do have a filled black candlestick so we could see a small decline tomorrow, although after hours trading has it up right now. The RSI is positive and not overbought. There is a new PMO Crossover BUY Signal and Stochastics are above 80. It's actually been outperforming the SPY for some time. I set the stop below the 200-day EMA at 7.3% or $42.99."

Here is today's chart:

What went wrong here? I'm honestly not sure given it was set up quite nicely with the indicators. That has since been abandoned with the PMO now moving lower and the RSI moving into negative territory. Stochastics are also flying lower. I liked the rising trend, but it has been broken. It did form a bullish hollow red candlestick today which is why I left this one with a "neutral" Sparkle Factor on the spreadsheet. It could be held in anticipation of a possible gain on the bullish candlestick and that could lead to more upside. I wouldn't enter it at this point given the declining PMO.

THIS WEEK's Performance:

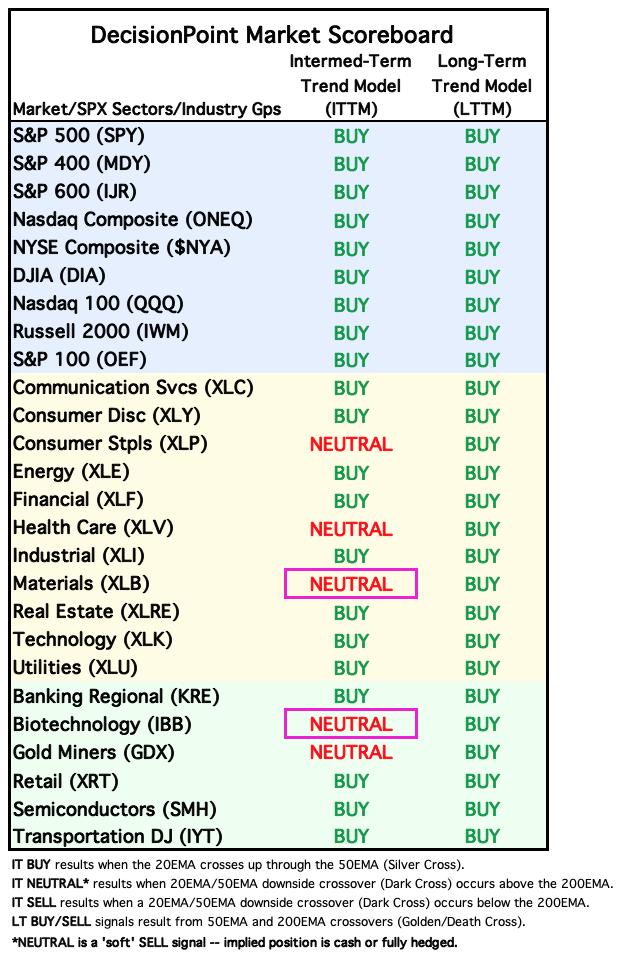

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Friday signal changes are outlined in purple.

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Utilities (XLU)

XLU saw a nice rally today. It has formed a new rising trend in the short term. The formation does look a bit toppy with the double top, but I am looking for a resurgence based on market weakness. Participation is still rather low with less than 50% holding above their 20-day EMA. Yet we do see that participation of stocks above their 20/50-day EMAs are in rising trends. The PMO turned up today as did Stochastics. We are seeing new outperformance. The Silver Cross Index is still vulnerable to more decline and is below its signal line, but this is early for this move. Definitely watch this sector (and Energy) closely next week.

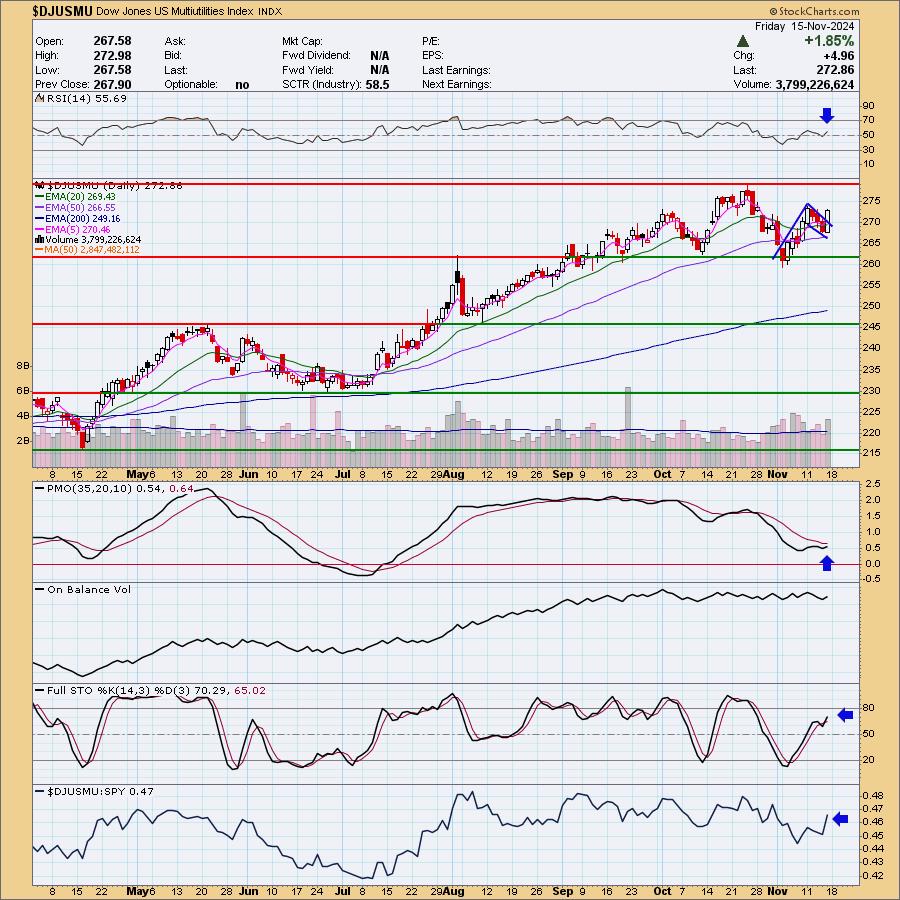

Industry Group to Watch: Multiutilities ($DJUSMU)

I will admit that this does look like a possible head and shoulders top developing, but I am concentrating on the mini flag and the subsequent breakout. The RSI is positive, rising and is not overbought. The PMO has turned up again and is headed for a Crossover BUY Signal. Stochastics are rising in positive territory. Relative strength has also improved. The stocks I found within that interested me were: AEE, PEG and WEC.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 70% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin HERE!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2024 DecisionPoint.com