We're finally starting to see the hangover from the election rally as much of the market pulled back today. Diamond Scans were not plentiful, but I did find some candidates that have promise despite the market pullback that may be on tap right now. Adding exposure is somewhat risky right now given the market is in need of a pause.

One of today's selections is a Utility. While they haven't been doing that well, I'm expecting defensive areas like Utilities and maybe Healthcare will see some action if the market gets toppy. I also have a Healthcare stock today keeping this defensive posture in mind.

I also have a reversal candidate for you. I think they are a bit dangerous right now, but this stock is really inching higher and has gotten above the 200-day EMA.

Good Luck & Good Trading,

Erin

Today's "Diamonds in the Rough": BSX, LULU, TT and VST.

Runner-ups: J, KMT, SLM and SLGN.

Diamond Mine Trading Room:

RECORDING & DOWNLOAD LINK (11/8/2024):

Topic: DecisionPoint Diamond Mine (11/8/2024) LIVE Trading Room

Recording & Download Link

Passcode: November#8

REGISTRATION for 11/15/2024:

When: November 15, 2024 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording from 11/11. You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscribe HERE.

Welcome to DecisionPoint Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Stop levels are all rounded down.

Boston Scientific Corp. (BSX)

EARNINGS: 2025-01-29 (BMO)

Boston Scientific Corp. engages in the development, manufacture, and marketing of medical devices that are used in interventional medical procedures. It operates through the MedSurg and Cardiovascular segments. The MedSurg segment includes Endoscopy, Urology, and Neuromodulation. The Cardiovascular segment consists of Cardiology and Peripheral Interventions. The company was founded by John E. Abele and Pete Michael Nicholas on June 29, 1979 and is headquartered in Marlborough, MA.

Predefined Scans Triggered: P&F Triple Top Breakout, New 52-week Highs and P&F Double Top Breakout.

BSX is down -0.51% in after hours trading. We don't have the breakout yet and we could see price consolidate a bit longer beneath support since it has been seven straight days of rally. The OBV shows us that volume is coming in on this rally so the excitement is there. The RSI is not yet overbought and there is a new PMO Crossover BUY Signal. Stochastics are holding above 80. Relative strength is beginning to pick up for this group. BSX is already outperforming both the group and the SPY. It is a clear leader in the group given the length of that rising relative strength line. I opted to set the stop beneath the prior bottom at 7.1% or $82.42.

Price just keeps climbing on a nice rising trend that is not parabolic. This looks like a winner that can keep on winning. The weekly RSI is in overbought territory, but we can see that this condition doesn't bother it while in its strong bull market move. The weekly PMO is rising and should give us a positive Crossover BUY Signal soon. The StockCharts Technical Rank (SCTR) is not in the hot zone* yet, but it is very close and rising. Consider a 17% upside target to around $103.80.

*If a stock is in the "hot zone" above 70, it implies that it is stronger than 70% of its universe (large-, mid-, small-caps and ETFs) primarily in the intermediate to long terms.

Lululemon Athletica Inc. (LULU)

EARNINGS: 2024-12-05 (AMC)

Lululemon Athletica, Inc. engages in the business of designing, distributing, and retailing technical athletic apparel, footwear, and accessories. It operates through the following segments: Company-Operated Stores, Direct to Consumer, and Other. The company was founded by Dennis James Wilson in 1998 and is headquartered in Vancouver, Canada.

Predefined Scans Triggered: P&F Ascending Triple Top Breakout, New CCI Buy Signals and P&F Double Top Breakout.

LULU is up +0.17% in after hours trading. I like this bottoming base that is building a foundation for more upside. It has moved back above the 200-day EMA. It is near overhead resistance, but I'm looking for a breakout to occur after some possible consolidation. The RSI is positive and not overbought. The PMO has surged above the signal line. Stochastics are rising toward 80 again. The group is seeing some outperformance and overall LULU is outperforming the group and the SPY. The stop is set between the 20/50-day EMAs at 7.2% or $297.79.

This rally looks credible on the weekly chart as price makes its way back up to the top of its trading range. The weekly RSI is positive and not at all overbought. The weekly PMO is rising on a Crossover BUY Signal. The SCTR is not inside the hot zone unfortunately, but it is rising again. A 22% upside target looks reasonable.

Trane Technologies Inc (TT)

EARNINGS: 2025-01-30 (BMO)

Trane Technologies Plc engages in providing solutions to buildings, homes, and transportation. It operates through the following business segments: Americas, EMEA, and Asia Pacific. The Americas segment encompasses commercial heating and cooling systems, building controls, and energy services and solutions, residential heating and cooling, and transport refrigeration systems, and solutions in North America and Latin America regions. The EMEA segment includes heating and cooling systems, services and solutions for commercial buildings, and transport refrigeration systems and solutions in Europe, Middle East, and Africa regions. The Asia Pacific segment is involved in heating and cooling systems, services and solutions for commercial buildings and transport refrigeration systems and solutions in Asia Pacific region. The company was founded in 1871 and is headquartered in Swords, Ireland.

Predefined Scans Triggered: P&F Ascending Triple Top Breakout and P&F Double Top Breakout.

TT is down -0.64% in after hours trading. I liked the breakout with today's mechanical pullback. The RSI is positive and not overbought. The PMO is on a new Crossover BUY Signal. Stochastics are rising above 80. All of this sets it up for higher prices. Relative strength is improving for the group and TT is outperforming the group, consequently it is outperforming the SPY. I set the stop beneath the 50-day EMA at 7.6% or $379.89.

This is a nice breakout to new all-time highs on the weekly chart. We have a steady rising trend with price essentially holding above the 17-week EMA. The weekly RSI is not overbought yet. The weekly PMO is bottoming above the signal line well above the zero line. The SCTR is in the hot zone. Notice also that volume has been steadily increasing, confirming the rising trend with the OBV. Consider a 17% upside target to about $481.03.

Vistra Energy Corp. (VST)

EARNINGS: 2025-02-26 (BMO)

Vistra Corp. is a holding company, which engages in the provision of electricity and power generation. It operates through the following segments: Retail, Texas, East, West, Sunset, and Asset Closure. The Retail segment sells electricity and natural gas to residential, commercial, and industrial customers. The Texas and East segments are involved in electricity generation, wholesale energy sales and purchases, commodity risk management activities, fuel production and fuel logistics management. The West segment represents the company's electricity generation operations in CAISO. The Sunset segment includes generation plants with announced retirement plans. The Asset Closure segment refers to the decommissioning and reclamation of retired plants and mines. The company was founded in 1882 and is headquartered in Irving, TX.

Predefined Scans Triggered: Evening Star.

VST is down -0.02% in after hours trading. I liked the breakout. I'm not completely happy that the pullback took it back below new support, but given the setup of the indicators and my vision that Utilities will prosper soon, I'm looking for another breakout. The RSI is no longer overbought. The PMO is nearing a Crossover BUY Signal above the zero line. Stochastics are still rising above 80 despite today's decline. Another problem is that the group isn't performing well, but as I said earlier, I'm looking for that to change. Despite the group struggling, VST is still outperforming the SPY by a lot. The stop is set near the 20-day EMA at 7.5% or $131.49.

This is a nice breakout this week, we just need to get price back above resistance. The weekly RSI is positive and not yet overbought. The weekly PMO has surged above the signal line and the SCTR is at the top of the hot zone. We should see follow through here. Consider a 17% upside target to about $166.33.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

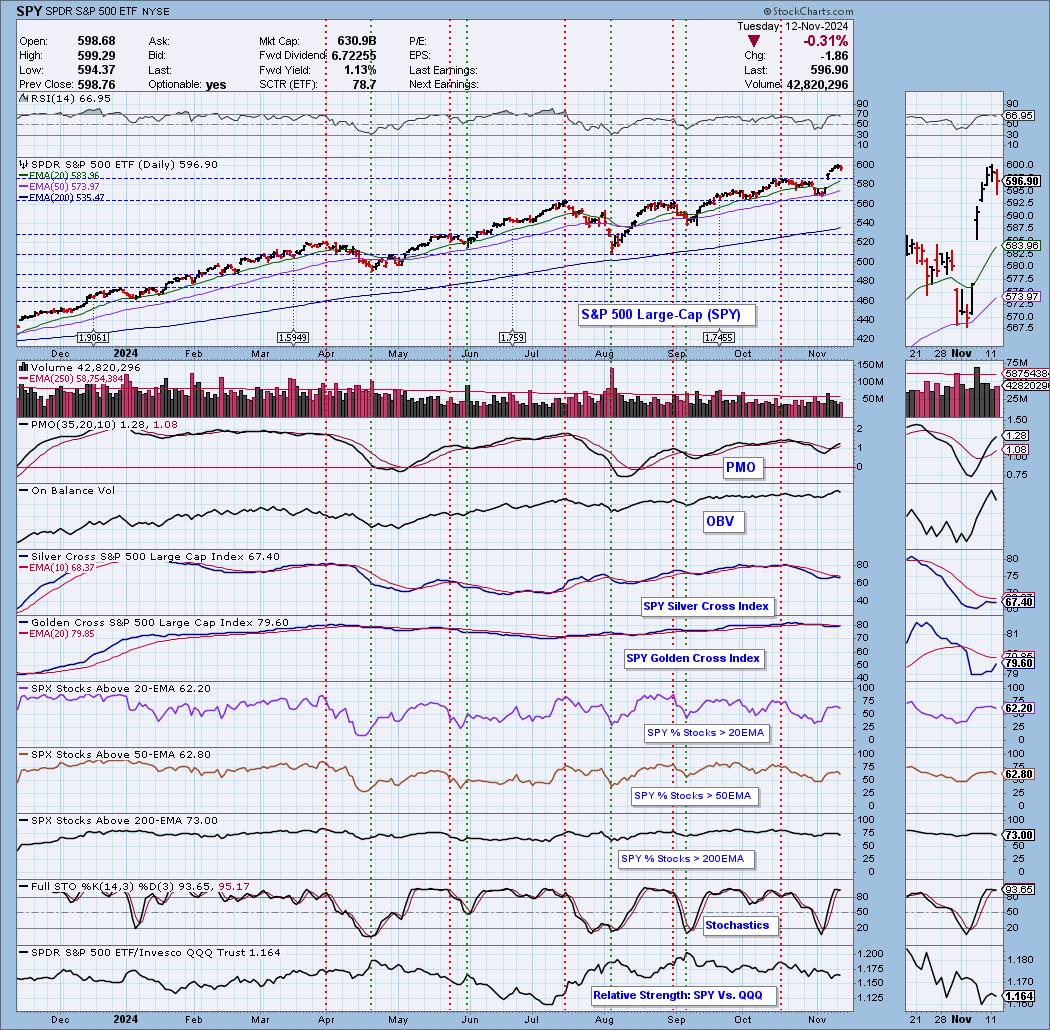

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our "Under the Hood" curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 70% long, 0% short.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Watch the latest episode of DecisionPoint Trading Room with Carl & Erin Swenlin Mondays on the DecisionPoint YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com