This week's spreadsheet looks very good with one real blemish and that was one of the shorts I gave you last week. Last week's ETFs also saw problems as we had three hedge positions. I like to present hedges when needed, but they do take the spreadsheet down when the market reverses.

CrowdStrike (CRWD) was a terrible short this week as the rebound in the market was mostly attributed to Technology stocks. I don't know that I'd want to hold onto this short as the market does look like it will hold onto this rally going into next week.

This week's Darling was reader requested Annexon (ANNX) which had a terrific trading day. It took out the "Diamond in the Rough", Duolingo (DUOL) which would've been the winner for the week.

The Sector to Watch was Consumer Discretionary with Materials running a close second. It won out Under the Hood compared to Materials.

Within the Sector to Watch, I found the Industry Group to Watch. There were plenty of good choices in this area, Autos and Home Builders look good as well as Clothing and Accessories, but I decided to go with Restaurants and Bars. We found four symbols of interest: PTLO, SHAK, BJRI and LOCO. BJRI came through on one of the scans today.

I ran scans at the end of the trading room and was able to find six symbols for your watch list next week: ISRG, AA, GFF, ALGN, OC and VVV.

See you in the Monday trading room!

Good Luck & Good Trading,

Erin

Diamond Mine Trading Room:

RECORDING & DOWNLOAD LINK (9/13/2024):

Topic: DecisionPoint Diamond Mine (9/13/2024) LIVE Trading Room

Recording & Download LINK

Passcode: September#13

REGISTRATION for 9/20/2024:

When: September 20, 2024 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording from 9/9. You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscribe HERE.

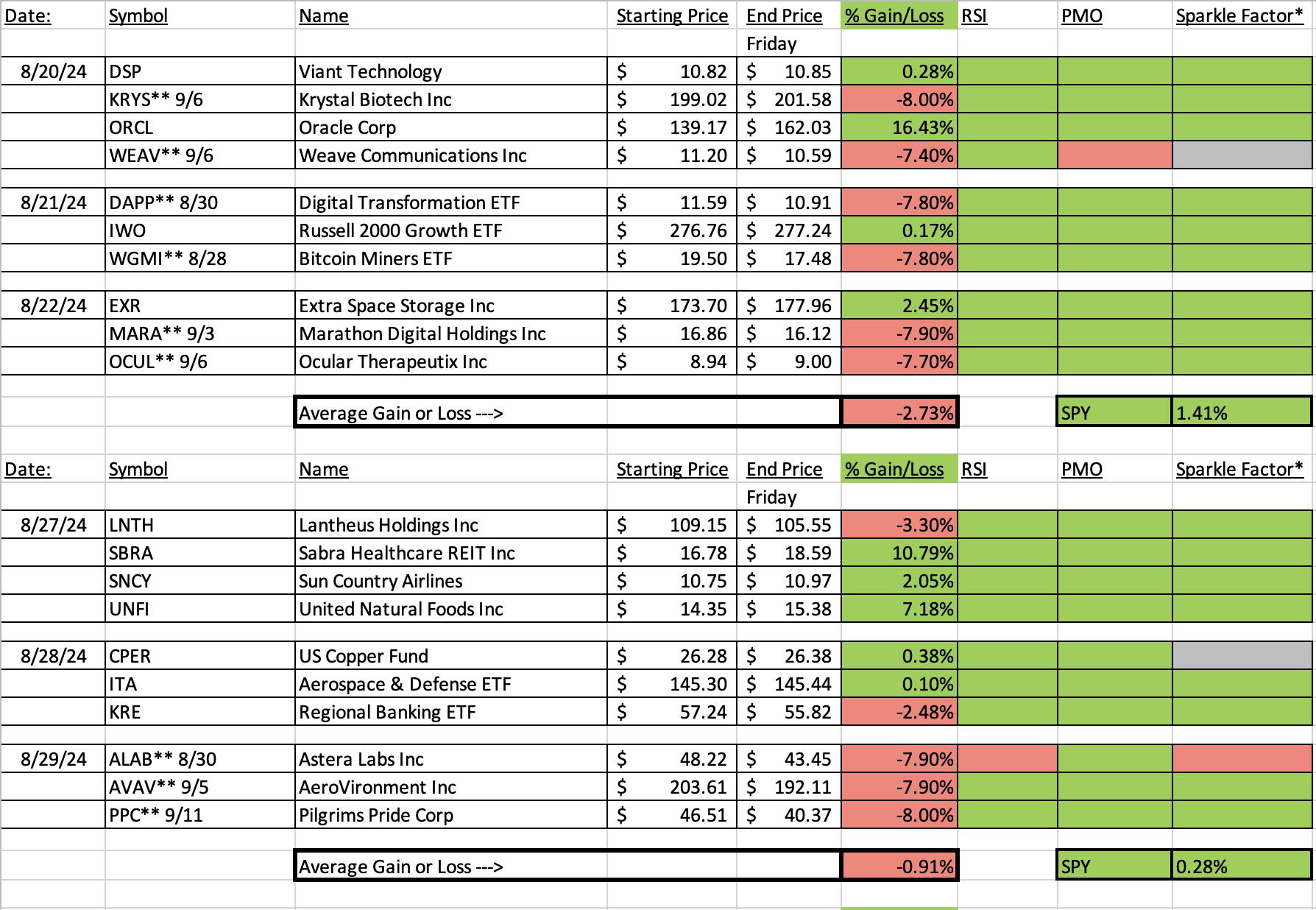

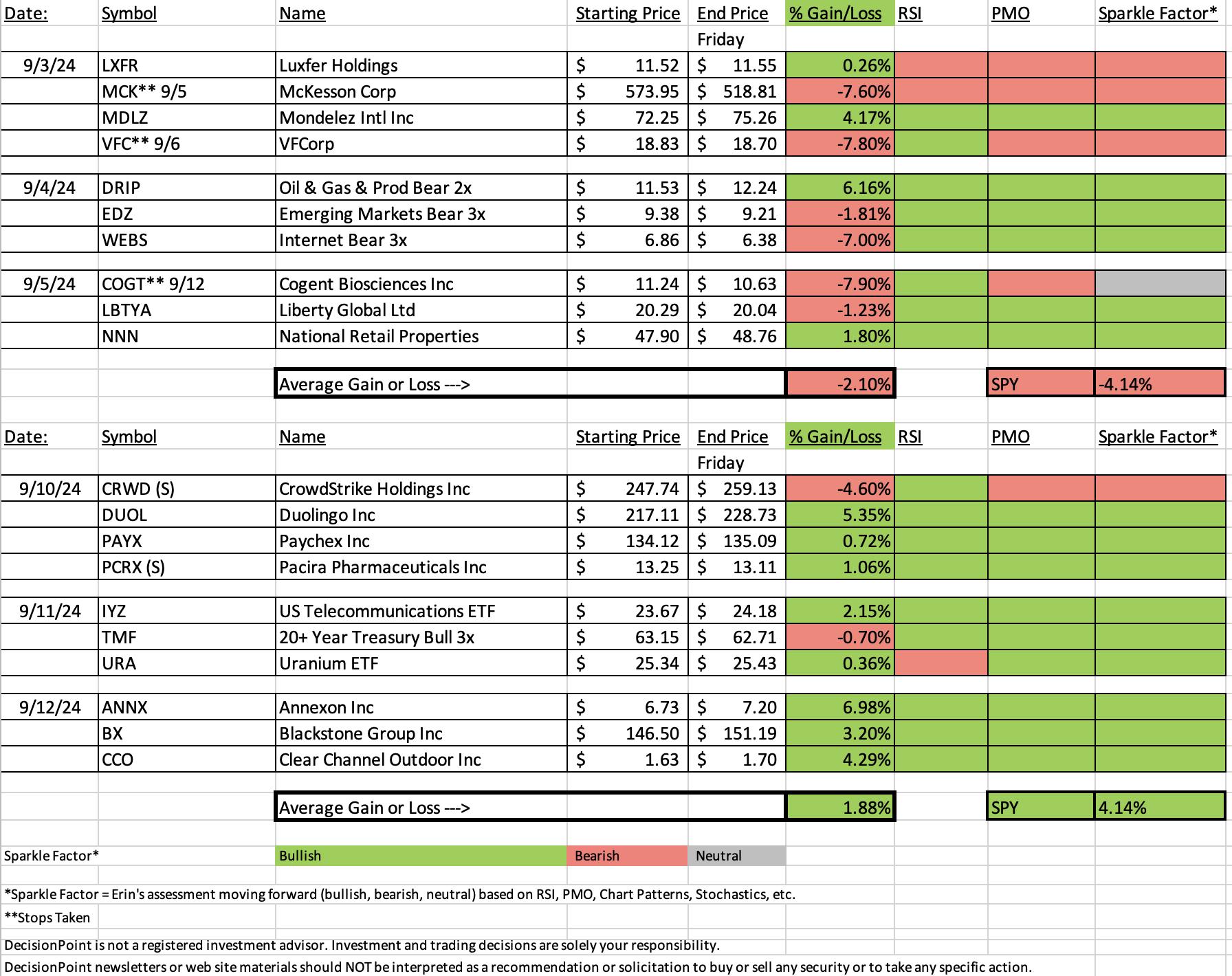

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Annexon Inc. (ANNX)

EARNINGS: 2024-11-14 (BMO)

Annexon, Inc. is a clinical-stage biopharmaceutical company, which develops a pipeline of novel therapies for patients with classical complement-mediated disorders of the body, eye and brain. It offers drugs that control or target huntington's and alzheimer's disease, multiple sclerosis, glaucoma, parkinson's disease, and spinal muscular atrophy. The company was founded by Ben Barres and Arnon Rosenthal on March 3, 2011 and is headquartered in Brisbane, CA.

Predefined Scans Triggered: Moved Above Upper Bollinger Band and Moved Above Upper Price Channel.

Below are commentary and chart from Thursday, 9/12:

"ANNX is up +1.49% in after hours trading. It hasn't quite broken out of the trading range, but it did close above the July high. It was a strong performance today. The chart is set up for follow through. The RSI is rising and is not overbought. There is a new PMO BUY Signal above the zero line that implies strength. Stochastics show internal strength as they are above 80. The Pharma group isn't performing well, but that didn't stop ANNX from rallying strongly out of the last low. It is a clearly outperforming both the group and the SPY. It was tough to set the stop given today's big move, but I opted to set it at 7.8% or $6.20. It is a low-priced stock so position size wisely."

Here is today's chart:

Today's strong rally was a nice breakout above the July top. It is now hitting resistance at the June top. This may be a spot where it pauses. I'm looking for a pause because the RSI is already overbought now. The PMO is accelerating so we should get the breakout. The industry group is still suffering but it doesn't seem to be a problem for ANNX.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

CrowdStrike Holdings, Inc. (CRWD) - SHORT

EARNINGS: 2024-11-26 (AMC)

CrowdStrike Holdings, Inc. provides cybersecurity products and services to stop breaches. It offers cloud-delivered protection across endpoints, cloud workloads, identity and data, and threat intelligence, managed security services, IT operations management, threat hunting, Zero Trust identity protection, and log management. CrowdStrike serves customers worldwide. The company was founded by George P. Kurtz, Gregg Marston, and Dmitri Alperovitch on November 7, 2011, and is headquartered in Austin, TX.

Predefined Scans Triggered: P&F Double Bottom Breakdown and Filled Black Candles.

Below are the commentary and chart from Tuesday, 9/10:

"CRWD is down -0.04% in after hours trading. We a sixth bearish candlestick formation with today's being filled black. That portends a decline tomorrow. Price went right up against overhead resistance and was turned away. It appears it will move down and test support again. The RSI is negative. The PMO has topped below the zero line and is nearing a Crossover SELL Signal. Stochastics are holding below 20, also a sign of weakness. Admittedly the industry group does look like it is getting ready to outperform the SPY, but CRWD is displaying weakness against both the SPY and the group. The upside stop on this short is set at 7.8% or $267.06."

Here is today's chart:

What went wrong here? The market saw a nice upside reversal and CRWD reaped the benefits being in Technology. I would still look for a decline, but it may not occur again until we hit overhead resistance. That will bust this short. The chart overall has moved bullish with a PMO bottom above the signal line and reversing Stochastics. I don't like this as a short any longer.

THIS WEEK's Performance:

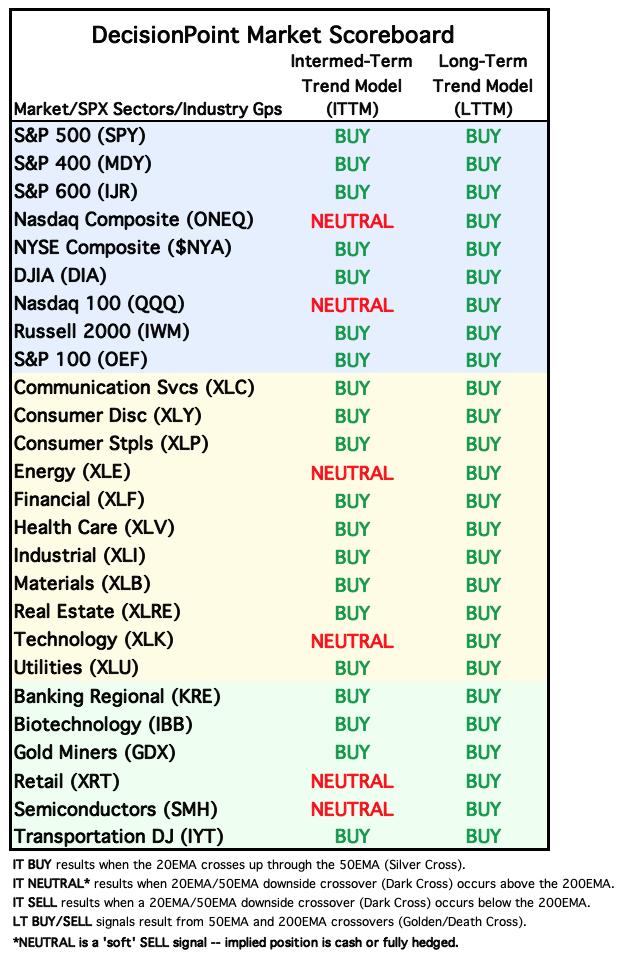

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Friday signal changes are outlined in purple.

Click Here to view Carl's annotated "Under the Hood" ChartList!

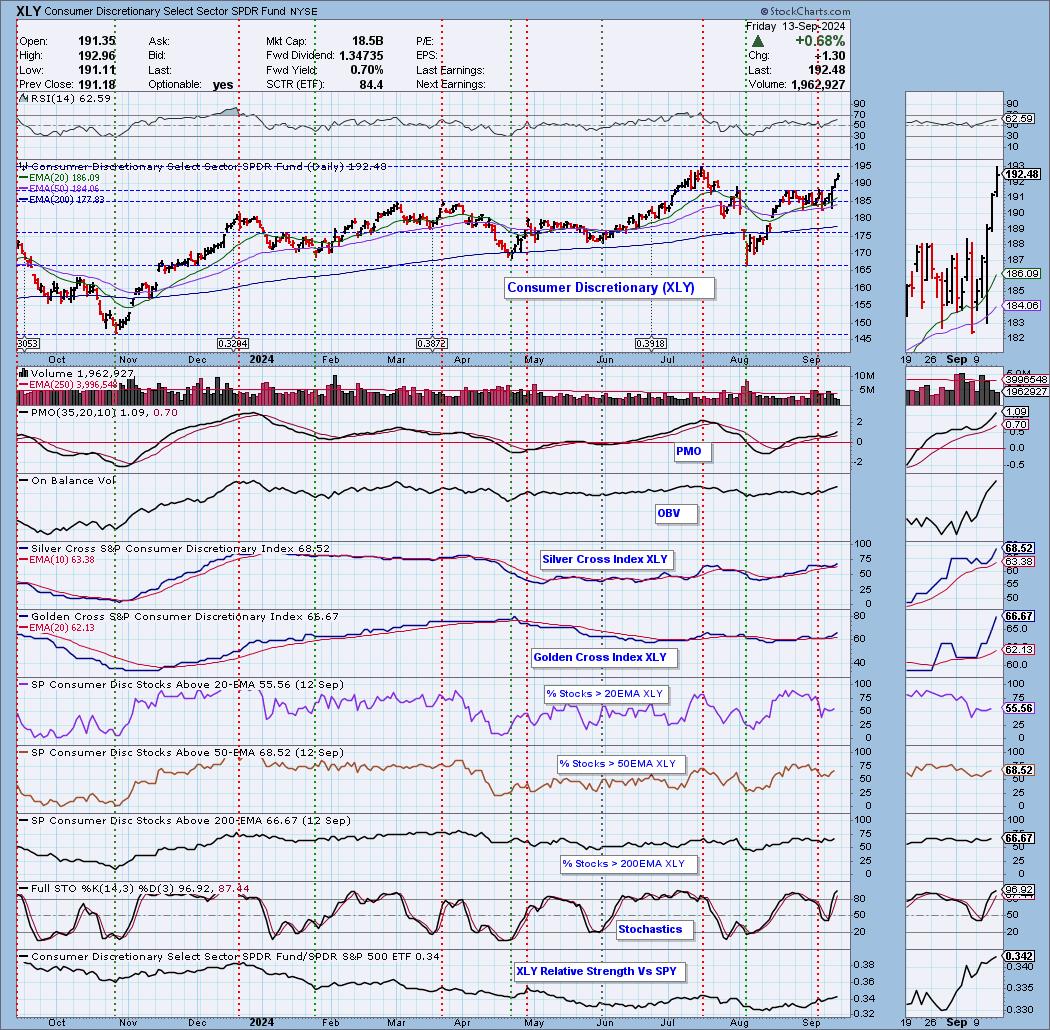

Sector to Watch: Consumer Staples (XLP)

I really liked this week's breakout from the trading range. XLY didn't lose that much ground on last week's decline, it was mostly range bound. We have good numbers under the hood. What primarily sold me on XLY was the way the Silver Cross Index is rising after bottoming above the signal line. Participation is healthy and not overbought so there is room for expansion. The Golden Cross Index also looks very bullish on its rise. Stochastics are above 80 and relative strength is gaining. We'll see if this sector can keep the winning going next week.

Industry Group to Watch: Restaurants & Bars ($DJUSVN)

I liked the breakout here coming off a bull flag formation that suggests far more upside ahead. The PMO is quite elevated which was another reason I liked it. We have a whipsaw PMO BUY Signal as well. Stochastics are well above 80 and relative strength is improving. There were quite a few choices within this group to find stocks. The symbols you might want to review are PTLO, SHAK, BJRI and LOCO.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 30% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin HERE!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2024 DecisionPoint.com