This week "Diamonds in the Rough" significantly outperformed the SPY. "Diamonds in the Rough" were up +2.37% while the SPY was up %1.41%. Nine out of the ten stocks/ETFs finished the week higher. Let's keep this rolling.

The market is looking toppy and likely will see more churn ahead, but after that I'm expecting it to begin rising again. This should work for most of our positions, but we may have some turbulence to deal with first.

This week's Darling was up +10.85%. This was only one day of action! I'd like to take credit (well I did pick it from the short list), but this was a reader request. A very good one.

The Dud of the week was of course the only position that I picked for my own portfolio and the only position that was down on the week. We'll look at what might have gone wrong here.

The Sector to Watch was not that difficult to pick this week. It is Financials (XLF) but I will say that Real Estate (XLRE) looked very good as well. Both had breakouts today.

The Industry Group to Watch is Mortgage Finance ($DJUSMF). The symbols we found in this area were TREE, NMIH, EFC, ESNT and PFSI.

We ran the Diamond PMO Scan and Momentum Sleepers Scan at the end of the program. They had quite a few symbols that are worth a look going into next week: ENSG, FULT, HNI, MHO, UE and BAX.

Have a great weekend! See you in the Monday trading room!

Good Luck & Good Trading,

Erin

Diamond Mine Trading Room:

RECORDING & DOWNLOAD LINK (8/23/2024):

Topic: DecisionPoint Diamond Mine (8/23/2024) LIVE Trading Room

Recording & Download Link

Passcode: August#23

REGISTRATION for 8/30/2024:

When: August 30, 2024 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording from 8/19. You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscribe HERE.

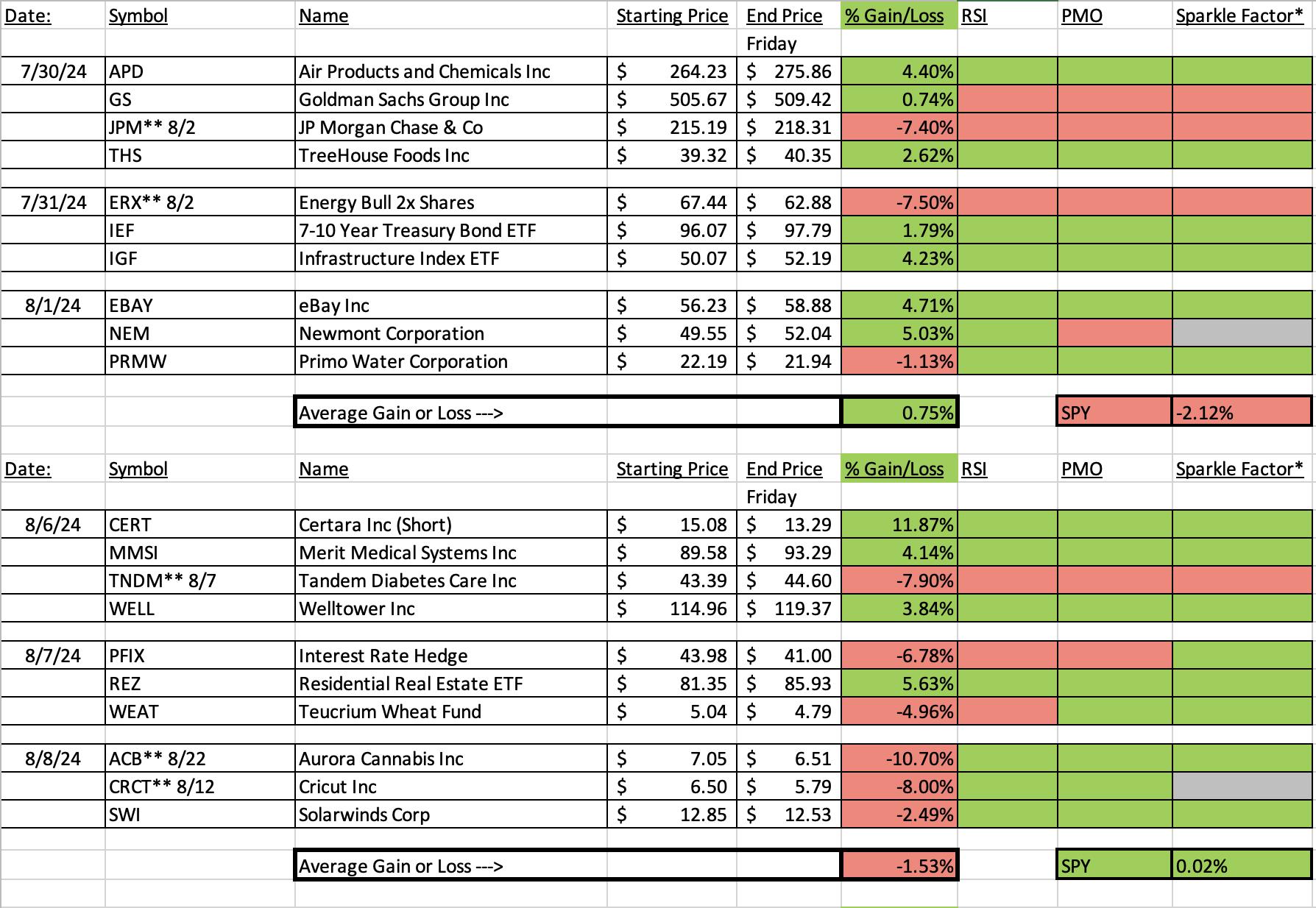

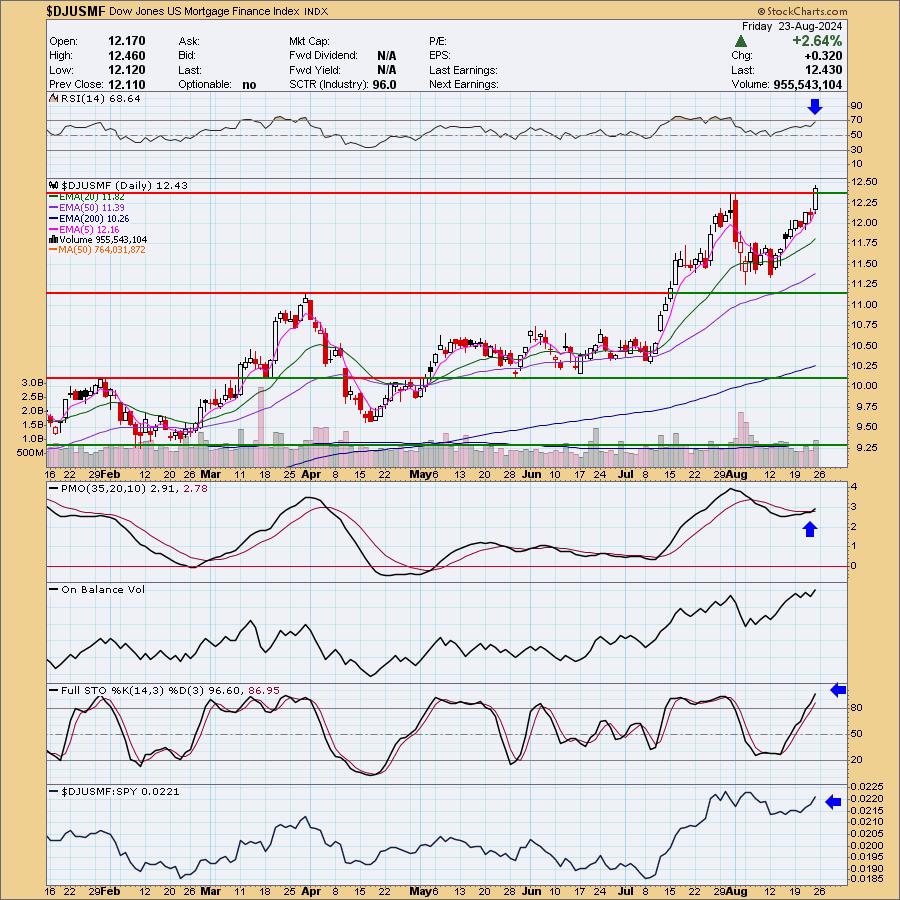

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Marathon Digital Holdings Inc (MARA)

EARNINGS: 2024-11-07 (AMC)

Marathon Digital Holdings, Inc. is a digital asset technology company, which engages in mining cryptocurrencies with a focus on the blockchain ecosystem and the generation of digital assets. The company was founded on February 23, 2010 and is headquartered in Las Vegas, NV.

Predefined Scans Triggered: Elder Bar Turned Blue.

Below are the commentary and chart from Thursday, 8/22:

"MARA is up +0.94% in after hours trading. This is a nice rally off strong support. This trade also takes advantage of what I see as new strength for Bitcoin coming in. This is also the giant 'boom or bust' stock I have for you today. Today's big decline is just a taste of what you may have to endure with a stock like this. Get out the Tums. Price is holding below resistance currently, but the chart is beginning to shape up. The RSI is negative, but that means it isn't overbought. The PMO is nearing a Crossover BUY Signal despite today's decline. Stochastics are also rising strongly in spite of the decline as well. Relative strength is picking up for the group near-term and MARA is performing well against the group and SPY. The stop has to be set deep and even then it isn't that close to support. I've set it at 7.9% or $15.52."

Here is today's chart:

The big gain happened in one day and it is poised to see even more upside. This is a boom or bust type of stock so as I mentioned in the write up above, you'll need a strong stomach, but boy days like this make it worth it. Look for more followthrough on this rally.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Weave Communications Inc. (WEAV)

EARNINGS: 2024-10-30 (AMC)

Weave Communications, Inc. develops a customer communication platform for service-based businesses. It offers voice, short message service, email and marketing services to dental, optometry, medical, and veterinary offices. The company was founded by Clint Berry, Brandon Rodman, and Jared Rodman in September 2008 and is headquartered in Lehi, UT.

Predefined Scans Triggered: None.

Below are the commentary and chart from Tuesday, 8/20:

"WEAV is up +1.29% in after hours trading. I like this steady sort of rounded bottom look on price. It looks like it is coming off a good base. The RSI is not yet overbought. The PMO is rising above the signal line and zero line. The OBV has been rising steadily. The group is not doing well at all but WEAV is outperforming both the group and the SPY right now. There is also a 'golden cross' of the 50/200-day EMAs. I've set the stop beneath support and the 20-day EMA at 7.4% or $10.37."

Here is today's chart:

I'm not giving up on this stock just yet, but you'll note I did give it a "Neutral" Sparkle Factor, meaning the choice is yours. The big problem is the declining PMO but today's rally is encouraging and Stochastics are still rising. I'm not sure what actually went wrong here, I believe it is simply a function of being a boom or bust type of stock and those declines can be somewhat painful. (Full disclosure: I own WEAV.)

THIS WEEK's Performance:

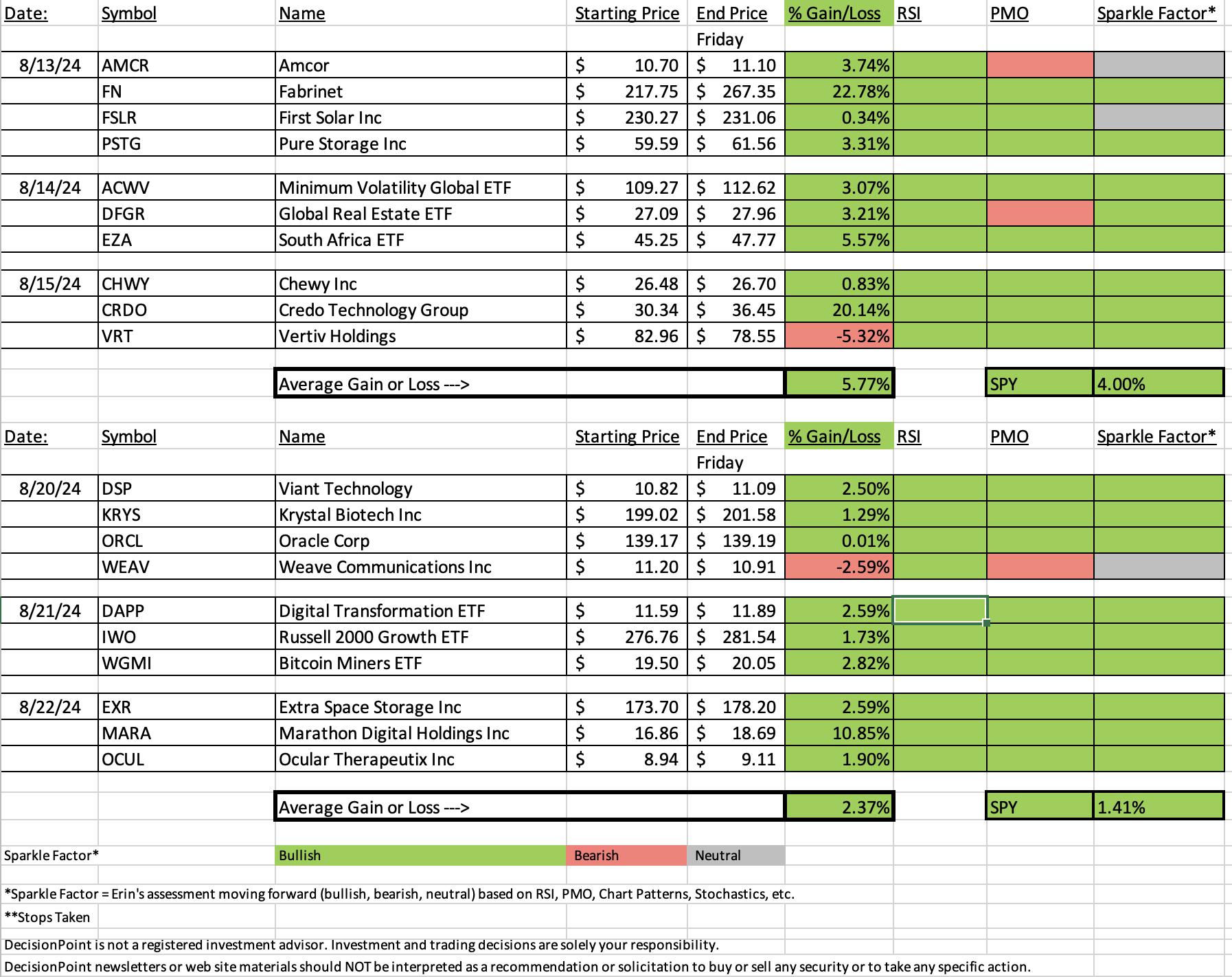

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Friday signal changes are outlined in purple.

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Consumer Discretionary (XLY)

The breakout sold me on this sector as did the fact that the RSI is not overbought like it was on Real Estate (XLRE). We don't have outperformance just yet. Participation is through the roof which is good in that it provides a good foundation, but is bad in that things will be as good as they're going to get before they start getting as bad as they can get. Basically, participation is overbought. The Silver Cross Index is rising above its signal line and Stochastics are fixed above 80. The PMO is rising. I'm looking for a continuation rally for XLF next week.

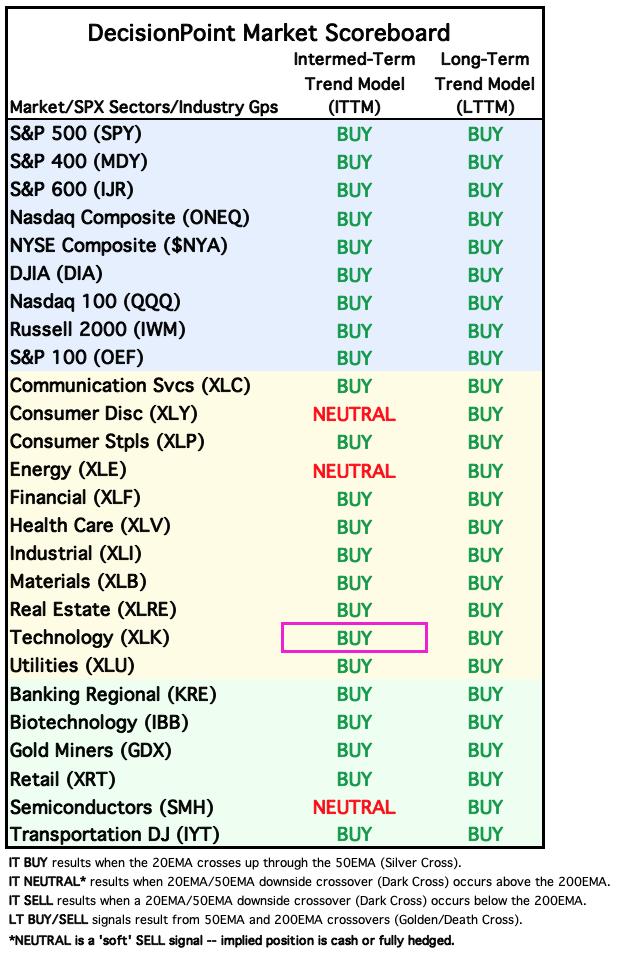

Industry Group to Watch: Mortgage Finance ($DJUSMF)

This looks a lot like XLF which is why I like it. We have a breakout above the prior top that looks very bullish. The RSI is not overbought and there is a new PMO Crossover BUY Signal. Stochastics look very strong above 80. We even have some outperformance coming in. I found five symbols of interest for next week: TREE, NMIH, EFC, ESNT and PFSI.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 45% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin HERE!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2024 DecisionPoint.com