The market has enjoyed quite a rally, but now it is time for some digestion. The picks today are from more aggressive areas of the market as I do see the rally likely resuming after a period of pause.

I don't usually pick favorites, but today I ran one of my off the beaten path scans and it came up with an interesting setup with lots of upside potential. WEAV is on my radar.

I also noticed that Alphabet (GOOGL) was in my scan results today and I do like the set up there. I didn't present it mainly because this is likely a chart you look at yourself often and I figured I could just tell you to go look at it again.

Good Luck & Good Trading,

Erin

Today's "Diamonds in the Rough": DSP, KRYS, ORCL and WEAV.

Runner-ups: GEO, GOOGL, BCO, HPE, MGM and BLMN.

Diamond Mine Trading Room:

RECORDING & DOWNLOAD LINK (8/16/2024):

Topic: DecisionPoint Diamond Mine (8/16/2024) LIVE Trading Room

Download & Recording Link

Passcode: August#16

REGISTRATION for 8/23/2024:

When: August 23, 2024 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording from 8/19. You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscribe HERE.

Welcome to DecisionPoint Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Stop levels are all rounded down.

Viant Technology Inc. (DSP)

EARNINGS: 2024-11-11 (AMC)

Viant Technology, Inc. is an advertising software company, which develops and manages an enterprise software platform. Its solutions include Viant Household ID, Viant's Identity Graph, Viant Data Lake, and Potens. The firm also offers Adelphic, an omnichannel demand-side platform which enables marketers to execute programmatic advertising campaigns. The company was founded by Timothy C. Vanderhook, Christopher John Vanderhook, and Russell T. Vanderhook on October 9, 2020 and is headquartered in Irvine, CA.

Predefined Scans Triggered: Bullish MACD Crossovers.

DSP is unchanged in after hours trading. This is a price pattern that I saw on the majority of stocks I looked at today. What I liked about this one was the bounce off strong support and the 200-day EMA as well as price getting above both the 20/50-day EMAs. Upside potential to the July top is over 14% which was also something I liked. The RSI is not overbought and the PMO is going in for a Crossover BUY Signal. Stochastics are rising nicely in positive territory. Relative strength is improving for both the stock and the group to some degree. The stop is set below the 50-day EMA at 7.7% or $9.98.

I like the broad basing pattern on the weekly chart. The weekly RSI is positive and not overbought and the StockCharts Technical Rank (SCTR) is inside the hot zone* above 70. The weekly PMO doesn't look so good, but it is decelerating its decline. If price can return to the prior tops it would be an over 20% gain.

*If a stock is in the "hot zone" above 70, it implies that it is stronger than 70% of its universe (large-, mid-, small-caps and ETFs) primarily in the intermediate to long terms.

Krystal Biotech, Inc. (KRYS)

EARNINGS: 2024-11-04 (BMO)

Krystal Biotech, Inc. engages in developing and commercializing pharmaceutical products. It offers the product, VYJUVEK. The company was founded by Krish S. Krishnan and Suma M. Krishnan on April 15, 2016 and is headquartered in Pittsburgh, PA.

Predefined Scans Triggered: P&F Double Top Breakout.

KRYS is unchanged in after hours trading. Here we have a consistent rally after a corrective move. Price is above all key moving averages. It has a "V" Bottom appearance that would suggest we'll see a breakout. The RSI is positive and the PMO is going in for a Crossover BUY Signal above the zero line. Stochastics are rising. The group has been underperforming of late, but in the intermediate term it is outperforming. The stock itself is showing leadership against the group and the SPY. The stop is set at support at 8% or $183.09.

This breakout looks nice on the weekly chart. The weekly RSI is positive and not overbought. The weekly PMO doesn't look very healthy right now, but that is mainly a function of the prior deep decline. The SCTR is at the top of the hot zone so we should see a breakout ahead. Consider a 17% upside target to about $232.85.

Oracle Corp. (ORCL)

EARNINGS: 2024-09-09 (AMC)

Oracle Corp. engages in the provision of products and services that address aspects of corporate information technology environments, including applications and infrastructure technologies. It operates through the following business segments: Cloud and License, Hardware, and Services. The Cloud and License segment markets, sells, and delivers enterprise applications and infrastructure technologies through cloud and on-premise deployment models including cloud services and license support offerings. The Hardware segment provides infrastructure technologies including Oracle Engineered Systems, servers, storage, industry-specific hardware, operating systems, virtualization, management, and other hardware-related software. The Services segment offers consulting, advanced support, and education services. The company was founded by Lawrence Joseph Ellison, Robert Nimrod Miner, and Edward A. Oates on June 16, 1977 and is headquartered in Austin, TX.

Predefined Scans Triggered: P&F Low Pole.

ORCL is down -0.28% in after hours trading. It has rallied nicely above the 20/50-day EMAs and above the prior lows from the prior trading range. It is due for a pause but that might offer a better entry. The RSI is not at all overbought despite this relentless rally higher. The PMO is on a new Crossover BUY Signal above the zero line. Stochastics just moved above 80. Relative strength is about even for the group, but it is angling upward for ORCL. I've set the stop somewhat toward the prior low at 7.7% or $128.45.

I like the weekly chart minus the nearing weekly PMO negative crossover. It is flattening so it could possibly avoid it. Price bounced off very strong support. The SCTR is within the hot zone above 70. Consider a 17% upside target to about $162.83.

Weave Communications Inc. (WEAV)

EARNINGS: 2024-10-30 (AMC)

Weave Communications, Inc. develops a customer communication platform for service-based businesses. It offers voice, short message service, email and marketing services to dental, optometry, medical, and veterinary offices. The company was founded by Clint Berry, Brandon Rodman, and Jared Rodman in September 2008 and is headquartered in Lehi, UT.

Predefined Scans Triggered: None.

WEAV is up +1.29% in after hours trading. I like this steady sort of rounded bottom look on price. It looks like it is coming off a good base. The RSI is not yet overbought. The PMO is rising above the signal line and zero line. The OBV has been rising steadily. The group is not doing well at all but WEAV is outperforming both the group and the SPY right now. There is also a 'golden cross' of the 50/200-day EMAs. I've set the stop beneath support and the 20-day EMA at 7.4% or $10.37.

I really like upside potential here and that is part of the reason I selected it. The weekly RSI is positive and not overbought. The weekly PMO is on a new Crossover BUY Signal. The SCTR is just about in the hot zone.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

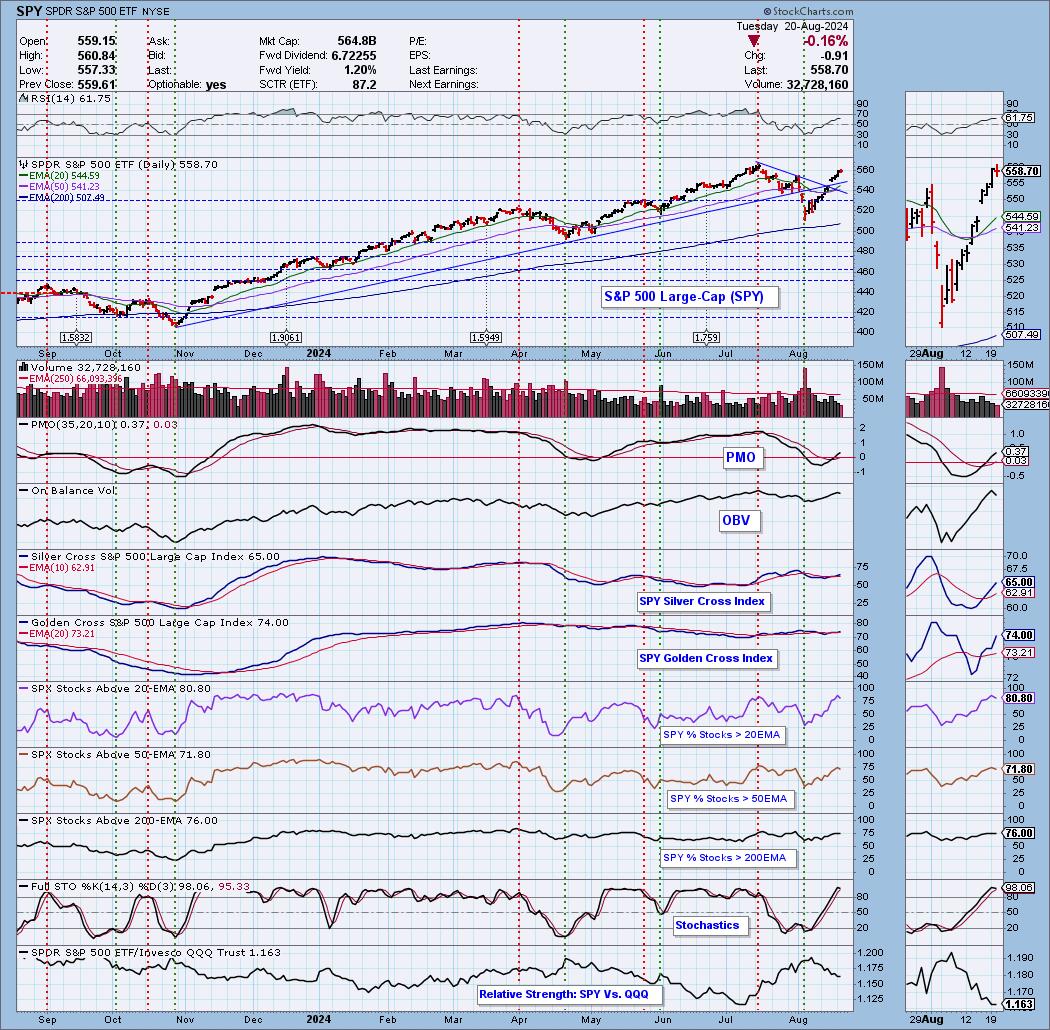

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our "Under the Hood" curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 45% long, 0% short.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Watch the latest episode of DecisionPoint Trading Room with Carl & Erin Swenlin Mondays on the DecisionPoint YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com