Today is Reader Request Day but I only had one taker this week. Hence I ran the scans on my own and decided to include one of those results. I've also listed my runner-ups as there were some nice charts coming out of the scans today.

At the end of the month we are FINALLY going to launch the new Scan Alert System where you get the raw results from my scans. If Diamonds doesn't provide you with enough choices, you can add choices through the Scan Alert System. It will be $39/mo, but we will be running a special when we launch for $29/mo. Very exciting!

Don't forget that you can send me symbols to review either on Reader Request Day or in the Friday subscriber-only Diamond Mine trading room. Send them all week long if you'd like.

Good Luck & Good Trading,

Erin

Today's "Diamonds in the Rough": IP, MDU and UNFI.

Other requests: GM and NR.

Runner-ups: APD, AVB, AVY and GD.

Diamond Mine Trading Room:

RECORDING & DOWNLOAD LINK (7/12/2024):

Topic: DecisionPoint Diamond Mine (7/12/2024) LIVE Trading Room

Download & Recording LINK

Passcode: July#12th

REGISTRATION for 7/19/2024:

When: July 19, 2024 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE.

After registering, you will receive a confirmation email containing information about joining the webinar.

Below is the latest free DecisionPoint Trading Room recording from 7/15. You'll find these recordings posted on Mondays to our DP YouTube Channel. Be sure and subscribe HERE.

Welcome to DecisionPoint Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Stop levels are all rounded down.

International Paper Co. (IP)

EARNINGS: 2024-07-24 (BMO)

International Paper Co. engages in the business of producing renewable fiber-based packaging and pulp products with manufacturing operations. It operates through the following segments: Industrial Packaging, Global Cellulose Fibers, and Corporate and Intersegment. The Industrial Packaging segment is involved in creating fiber-based packaging that protects and promotes goods, enables worldwide commerce, and helps keep consumers safe. The Global Cellulose Fibers segment offers a wide range of applications like diapers, towel and tissue products, feminine care, incontinence, and other personal care products that promote health and wellness. The company was founded by Hugh J. Chisholm in 1898 and is headquartered in Memphis, TN.

Predefined Scans Triggered: None.

IP is down -0.01% in after hours trading. It is on its way to covering the prior gap down and should see a continuation after coverage. The RSI is positive and not overbought. I like that the PMO hasn't quite given us the Crossover BUY Signal, but it is headed there and is above the zero line. The OBV is confirming the rally as volume is coming in on this rally. Stochastics are above 80 and relative strength is rising for both the group and IP. I've set the stop as close to support as I could at 7.9% or $42.25.

The weekly chart shows a nice rising trend coming out of the prior trading range from 2023 to early 2024. It is struggling a bit at overhead resistance, but ultimately I see a breakout ahead as the indicators are very positive. The weekly RSI is not overbought and the weekly PMO is surging above the signal line. On top of that, we have a StockCharts Technical Rank (SCTR) inside the hot zone*. There is good upside potential should it reach prior highs.

*If a stock is in the "hot zone" above 70, it implies that it is stronger than 70% of its universe (large-, mid-, small-caps and ETFs) primarily in the intermediate to long terms.

MDU Resources Group, Inc. (MDU)

EARNINGS: 2024-08-08 (BMO)

MDU Resources Group, Inc. engages in the provision of natural resource products and related services to energy and transportation infrastructure. It operates through the following business segments: Electric, Natural Gas Distribution, Pipeline and Midstream, Construction Materials and Contracting, Construction Services, and others. The Electric segment generates, transmits and distributes electricity in Montana, North Dakota, South Dakota, and Wyoming. The Natural Gas Distribution segment distributes natural gas in Montana, North Dakota, South Dakota, Wyoming, Idaho, Minnesota, Oregon, and Washington. The Pipeline and Midstream segment offers natural gas transportation, underground storage, processing and gathering services, as well as oil gathering, through regulated and non-regulated pipeline systems and processing facilities. The Construction Materials and Contracting segment mines aggregates and markets crushed stone, sand, gravel and related construction materials, including ready-mixed concrete, cement, asphalt, liquid asphalt and other value-added products. The Construction Services segment refers to the inside and outside specialty contracting services. The company was founded by C. C. Yawkey, R.M. Heskett and Walter Alexander on March 14,1924, and is headquartered in Bismarck, ND.

Predefined Scans Triggered: Moved Above Upper Keltner Channel, Moved Above Upper Bollinger Band and P&F Double Top Breakout.

MDU is unchanged in after hours trading. I really like the breakout from the bullish ascending triangle (flat top, rising bottoms). The RSI is positive and not yet overbought. The PMO is on a Crossover BUY Signal above the zero line. The OBV is rising to confirm the rally and Stochastics are holding above 80. Relative strength looks excellent for both the group and MDU. It is now showing leadership against the group. I set the stop below support at 7.4% or $24.26.

Nice breakout to new all-time highs. After rallying strongly it consolidated into the ascending triangle and has now broken out. The weekly PMO is surging above the signal line (bottoming above the signal line) and we have a strong SCTR percentage. Consider a 17% upside target to $30.65.

United Natural Foods, Inc. (UNFI)

EARNINGS: 2024-09-24 (BMO)

United Natural Foods, Inc. engages in the distribution of natural, organic, and specialty foods and non-food products. The firm operates through the Wholesale and Retail segments. The Wholesale segment is engaged in the national distribution of natural, organic, specialty, produce, and conventional grocery and non-food products, and providing retail services in the United States and Canada. The Retail segment derives revenues from the sale of groceries and other products at retail locations operated by company. It offers food and non food, frozen, perishables, bulk, body care products, and supplements. The company was founded by Michael S. Funk and Norman A. Cloutier in July 1976 and is headquartered in Providence, RI.

Predefined Scans Triggered: Moved Above Upper Bollinger Band.

UNFI is up +0.28% in after hours trading. This is my pick. My only wish is that I found this one sooner as it has run pretty hot. It looks good for a continuation on this giant cup with handle pattern. The expectation of that pattern is a breakout above the February high. Considering the length of the rally, the RSI isn't really overbought yet. The PMO just triggered a Crossover BUY Signal above the zero line. Stochastics are rising above 80 and relative strength is picking up for UNFI and its industry group. I picked XLP yesterday and this is part of that sector. The stop is set around the 20-day EMA at 7.7% or $13.00.

It has been in a difficult decline for over a year, but it has bottomed with a cup and handle. The weekly RSI is now in positive territory and the weekly PMO is accelerating higher. We do see the SCTR outside the hot zone so keep this in the short-term timeframe for now. Upside potential is huge, but I'd take even half of that if it gets above the 2024 high.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

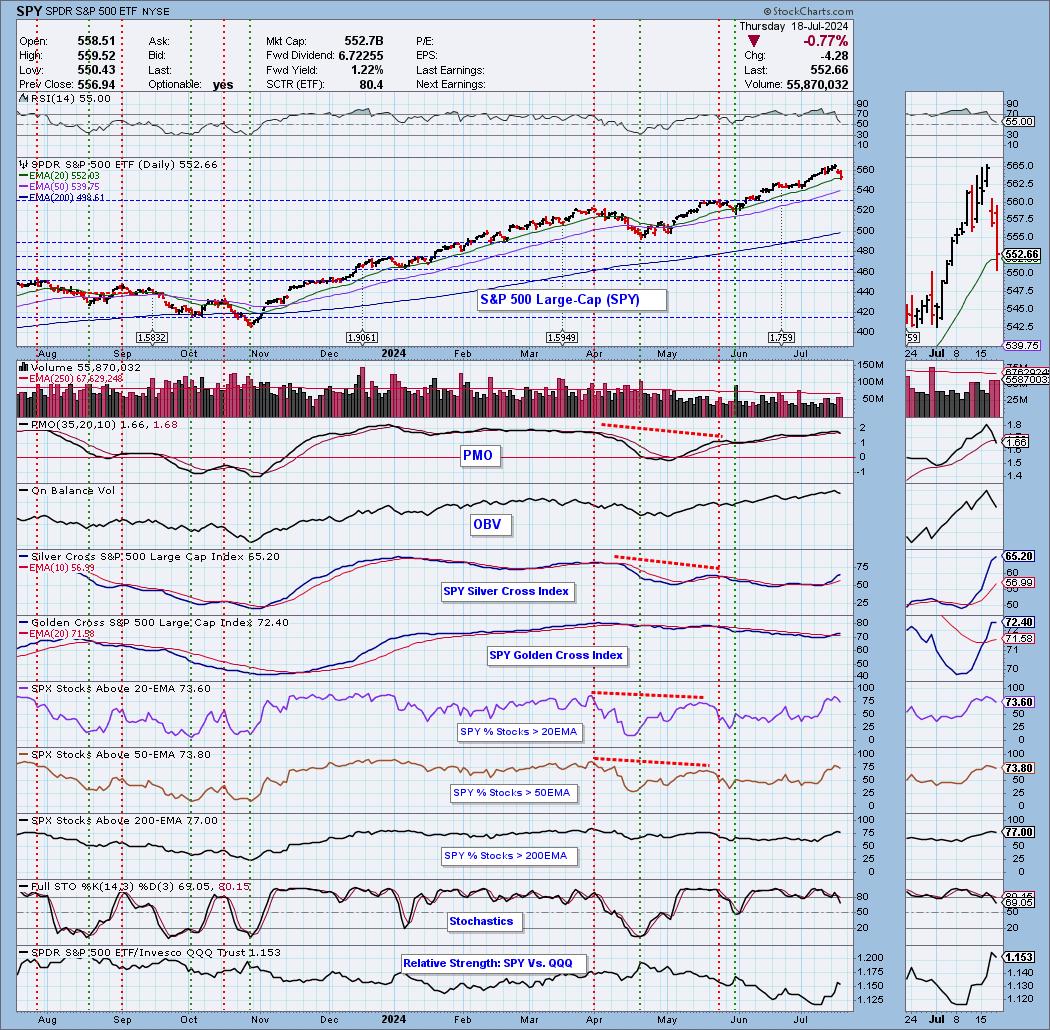

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our "Under the Hood" curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 45% long, 0% short. Contemplating UNFI and MDU for an add.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Watch the latest episode of DecisionPoint Trading Room with Carl & Erin Swenlin Mondays on the DecisionPoint YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com